Decoding Decisions

Making sense of the messy middle

Authors

Jonny leads Google’s insights team in the UK. Prior to his 10years of

marketing research at Google, he plied his trade in the media agency

world. He is a regular speaker on evolving consumer behaviour, cross-

media measurement, and marketing effectiveness. He represents

Google in a range of forums in the UK marketing and research industries.

Jonny Protheroe

Head of Market Insights UK, Google

Ali began his career researching ad effectiveness in agency before

moving client-side to build and lead a team with an expanding remit

ranging from marketing and proposition development to innovation

and business strategy. Over the past 20 years he has developed a

highly strategic approach to insight development which he now uses to

explore consumer behaviour and decision-making at Google, where he

is a regular speaker on these topics.

Alistair Rennie

Research Lead, Market Insights UK, Google

Claire began her career on the agency side at 360i and relocated

to London ve years ago to head up the insights team at 360i’s

new European outpost. Upon joining Google, Claire specialised in

emerging and innovative research methodologies, from neuro and

physiological response research to trend identication through

text analytics. In2017, she was named one of Management Today’s

35 Women Under35. She is now working as a Product Manager in

Google’sworkshop forexperimental products.

Claire Charron

Product Manager, Google

Gerald’s team works with UK clients, bringing together Google data

analysis and research to help address their challenges. Before joining

Google almost 10 years ago, he worked on some of the UK’s biggest

brands at well-known creative agencies. He sits on the Institute Of

Practitioners in Advertising (IPA) Effectiveness Advisor y Board and is a

regular speaker on marketing effectiveness and strategy.

Gerald Breatnach

Head of Strategic Insights UK, Google

Chapter

Chapter

Chapter

Chapter

Chapter

Chapter

Contents

1

4

3

2

5

6

Introducing the messy middle ...............................04

Taking a walk down internet street .................................04

What does the consumer journey look like? ..........................06

Charting undiscovered territory ...................................07

Marketing in the messy middle ....................................09

Identifying the messy middle ................................10

Cheap, or best? .................................................10

Enter behavioural science ........................................12

Riders and elephants ............................................13

A brief histor y of the evolution of marketing models ...................14

Observed shopping behaviour ..................................... 15

Exploring and evaluating .......................................... 16

The science behind explore and evaluate ............................ 17

Show... me... the... model! ......................................... 18

E is for... .......................................................19

Investigating the messy middle .............................26

Searching for clues in Google Trends ...............................26

Are you not entertained? The slow demise of ‘free’ ....................28

OK Google, let’s go shopping ......................................31

‘Best’ and ‘cheap’ around the world ................................45

Influencing the messy middle ...............................47

Homo-not-so-economicus .......................................47

A summary of six biases ..........................................49

Testing the six biases ............................................51

The simulation .................................................55

The power of showing up .........................................56

Social proof: people respond to people .............................. 60

The low-hanging fruit of behavioural science ........................61

Cross-functional implementations .................................65

Supercharging the second-choice brand ............................68

Starting from nothing ............................................75

Simulation summary ............................................. 81

Implications of the messy middle .............................. 84

Implications for brands ..........................................84

Ensuring brand presence .........................................86

Intelligently (and responsibly) employing behavioural science ..........88

Closing the gap between trigger and purchase .......................91

The importance of measurement ..................................92

Organisational implications .......................................92

Inhabiting the messy middle ................................94

1

Taking a walk down internet street

Let’s take a walk down internet street. You might know it, and since the

coronavirus pandemic you might have spent more time there than usual. It’s

open 24 hours a day, seven days a week. It’s probably the biggest shopping

district you’ve ever seen, but somehow you can get to any part of it you want

in the time it takes to blink.

Whenever you’re ready, you can tell someone what you’re looking for and,

in addition to the brands that are already in your mind, you’ll immediately be

shown every possible option and variation.

Every shop that sells that item is somehow just a step away, whether it’s a

huge department store or a tiny boutique. And the shops you don’t need will

magically disappear from view until you want to see them again.

Maybe you don’t know what you want. If that’s the case, there are places you

can go that will show you every product available in every store. They’ll let

you rank and compare them in every imaginable way, sorting and ltering

until you see something you like.

And if you still can’t decide, you can ask a friend for advice. Or an expert. Or a

famous celebrity. They’re all here too, some of them hanging out at their own

places, while others will come and meet you at the store. In fact, there are

millions upon millions of people here, most of whom are only too happy to talk

to you about the things they decided to buy, and how that experience turned out.

Introducing

the messy middle

CHAPTER 15

INTRODUCING THE MESSY MIDDLE

There’s a lot happening here on internet street. Because it’s all so easy, you

might wind up making several visits before you get around to actually buying

anything, moving in and out of multiple stores, going back for a second and

then a third look, making full use of everything internet street has to offer.

That’s the reality of shopping on the internet today, but it hasn’t always been

like this. Before the internet, we shopped on a physical street, where we had

less choice and less information. What we ended up buying was restricted by

availability and proximity, and we relied on brands to reassure us that we were

making the right decisions. We even had to carry our own shopping baskets.

Our behaviour has fundamentally changed, but for the most part we revel in

it, as instincts formed by thousands of years of scarcity are supercharged

with a sudden wealth of options and opportunity. So much choice, so many

shops to visit and products to view. So much complexity that we’ve turned to

a range of coping mechanisms – mental shortcuts and techniques that help

us cut through to what matters.

Marketing has also evolved and developed new ways of cutting through.

Marketers have embraced new platforms, new technology, new data, and

new formats. And lately, innovations like machine learning and articial

intelligence are pushing all of this further and faster into the future.

Most of these developments have been good things. The expansive reach

ofdigital marketing has allowed new businesses to emerge and grow.

Butwhile this is ultimately a report about marketing, it is not a report about

that side of the equation.

Instincts formed by thousands of years of

scarcity are supercharged with a sudden

wealth of options and oppounity.

CHAPTER 16

INTRODUCING THE MESSY MIDDLE

1 ONS Retail Sales Index time series (DRSI), UK, May. 2020

Instead, this report is about the mental processes that have been activated

by the abundance of the web. It’s about how consumers deal with scale and

complexity using cognitive biases encoded deep in our pre-digital history.

If behaviour has evolved, as we believe it has, then it is crucial that marketers

understand how consumer decision-making has changed so that they can

continue to uncover new growth opportunities and defend existing brand share.

What does the consumer journey look like?

This is among the questions most frequently asked of Google’s insights

team. There are a couple of variations involving phrases like “purchase

funnel” and “path to purchase” but, for the most part, they’re all asking the

same thing. There’s a lot of value in questions like these, but we’ve come to

realise that there is another aspect of what shoppers are doing that needs

to be considered. The other question we need to answer is this: how do

consumers decide what they want to buy and who they want to buy it from?

It isn’t surprising that businesses are keen to outsource this question. It’s

probably the most important in all of advertising, but also the hardest to

answer. Often, research in this area will focus on the journey, resulting in a list

of touchpoints that people hit along the path to purchase. But while such lists

offer valuable insight into the places people go during their online journey,

they can’t address the equally important question of why a shopper ended up

making the decision they did.

We know more about advertising performance than ever before, and can

measure outcomes with amazing granularity. And yet, understanding

consumer decision-making is more difcult than it’s ever been. In 2020,

following the outbreak of coronavirus and subsequent restrictions on

physical retail, the proportion of purchases happening online has risen to

record levels. And while the majority of purchases are still made offline, the

media and information that inform those purchases are increasingly online,

and the complexity of potential decision-making pathways has grown

considerably. If we don’t update our thinking about consumer behaviour to

account for this huge expansion in choice and attendant complexity, we’ll be

trying to account for 21st century behaviour with 20th century models.

CHAPTER 17

INTRODUCING THE MESSY MIDDLE

2 We shared an early draft of the project with the well-known advertising strategist Vicki Holgate, and she played it back to us as “a kind of messy-middle”.

We tried various titles and names for presentations, but this was the phrase that stuck.

Charting undiscovered territory

So, over the course of the past two years, our team has embarked

on a multi-pronged project with the goal of trying to understand

how consumers on internet street interpret and manage increased information

and choice while buying online and offline. This research has led us to

identify a specic territory within the labyrinth of searches, ads, links, and

clicks involved in making a purchase. We call it the “messy middle”, a space

of abundant information and unlimited choice that shoppers have learned to

manage using a range of cognitive shortcuts.

2

Successfully learning how to

navigate its switchbacks, hairpin bends, and dead ends is going to be as crucial

to future marketing success as any investment in technology or platforms.

The ‘messy middle’, a space of abundant

information and unlimited choice that

shoppers have learned to manage using a

range of cognitive shocuts.

Once we discovered this territory, we set out to map it. In doing so, we

devised an updated model for how we believe people behave in this sphere of

abundance and uncertainty.

With the help of behavioural science expert The Behavioural Architects, we

recruited people to complete shopping tasks, captured their behaviour, and

listened in real time as they told us what they were thinking and doing, and

why they were doing it. As we watched, we began to notice how seamlessly

consumers switch between complementary states of “exploration” and

“evaluation”. We then applied behavioural science to help us cut through

the participants’ explanations and post-rationalisation to understand the

underlying cognitive processes at work.

CHAPTER 18

INTRODUCING THE MESSY MIDDLE

Unsurprisingly, it turns out that faced with all this complexity, people try to

keep things simple – an effort that in itself turns out to be quite complex.

To validate the existence of the exploratory and evaluative states, we also

looked through Google’s historic search data for clues. In several cases, we

found examples of changes in the way people search over time that illustrate

how these behaviours manifest in the real world.

Alongside this, we also undertook a thorough literature review to try and

isolate the specic cognitive processes at work while people are caught up

in the exploratory and evaluative whirl. We identied six of the most critical

biases, and then devised a large-scale experiment to test the effectiveness of

these shortcuts and heuristics in guiding shoppers out of the messy middle

and towards purchase.

Over the following chapters, we’ll explain why we started looking for the

messy middle, the tools we used to identify and codify it, and the discoveries

we made while exploring it. We’ll share some of the most surprising insights

from the process, including:

The power of showing up – how simply being present in

moments of deliberation can be enough to win or retain

consumer preference.

Several of the most powerful behavioural biases we

investigated can be easily addressed by marketers surfacing

and modifying existing assets.

Why addressing some of the most powerful behavioural

biases requires cross-functional cooperation from marketing, user

experience, product development, and nance.

Finally, we’ll wrap up with specic ideas for how marketers from both

established and challenger brands can adapt to this rich and complex space.

CHAPTER 19

INTRODUCING THE MESSY MIDDLE

Marketing in the messy middle

Access to media and information has led to the growth of important

influences that don’t necessarily t into traditional brand marketing or

performance marketing buckets. This has some big implications for

marketers from brands both large and small. If you don’t truly understand

why consumers make the purchase decisions that they do, you may not

achieve the full return on your brand investments, and could nd yourself

vulnerable to nimble competitors.

It seems then that “messy middle” might also be a good way to describe how

marketing has evolved over the past decade or two, with the polarisation

between branding and direct response creating a gap into which all sorts

of valuable consumer behaviour goes unrecognised and underserved.

Getting comfortable with the messy middle could ultimately help bridge

organisational divides that our research suggests mean more to marketing

departments than they do to consumers.

Of course, guring out what consumers think and how they behave is not a

new idea. It’s an aspiration that’s always been at the very heart of marketing.

But, as we’re about to nd out, the context within which marketers are trying

to achieve this goal has changed dramatically.

Geing comfoable with the messy

middle could ultimately help bridge

organisational divides that our research

suggests mean more to marketing

depaments than they do to consumers.

3 Source: https://www.blog.google/products/search/search-language-understanding-bert/

2

Cheap, or best?

The research project behind this report began with a hunch that there was

more to say about the evolution of choice, information, and decision-making

on the internet. The next step was to look for clues to support and expand our

initial hypothesis.

To kick off the investigation, we turned to one of our biggest resources

as researchers at Google: our search trends data. Google sees billions of

searches every day, and 15% of those queries are ones we haven’t seen

before.

3

Our freely accessible search query exploration tool, Google Trends,

represents a detailed history of how our curiosity and thirst for knowledge

has evolved throughout the digital age. Using Google Trends data you can

chart the fortunes of celebrities, politicians, and reality TV stars, observe the

rise and fall of a decade’s worth of memes and fads, and watch the iPhone

and Android create and dene a category.

But the names of people and objects aren’t the only data points in our Google

Trends dataset. When consumers search, they often modify the query with one

or more adjectives or other descriptors. You aren’t just looking for any laptop,

but for the right laptop – however you dene it. We call these additional words

modiers, and they describe what the user wants to know about the thing they

are searching for, or add precision to their search. Modiers provide a cognitive

and emotional snapshot, allowing researchers to see how our feelings and

needs have evolved through the lens of the things we all search for.

Identifying

the messy middle

CHAPTER 211

IDENTIFYING THE MESSY MIDDLE

4 UK Ofce for National Statistics – Living Costs and Food Survey

Data source: Google Trends, United Kingdom, 1st January 2004 - 1st January 2020, All categories, Web Search

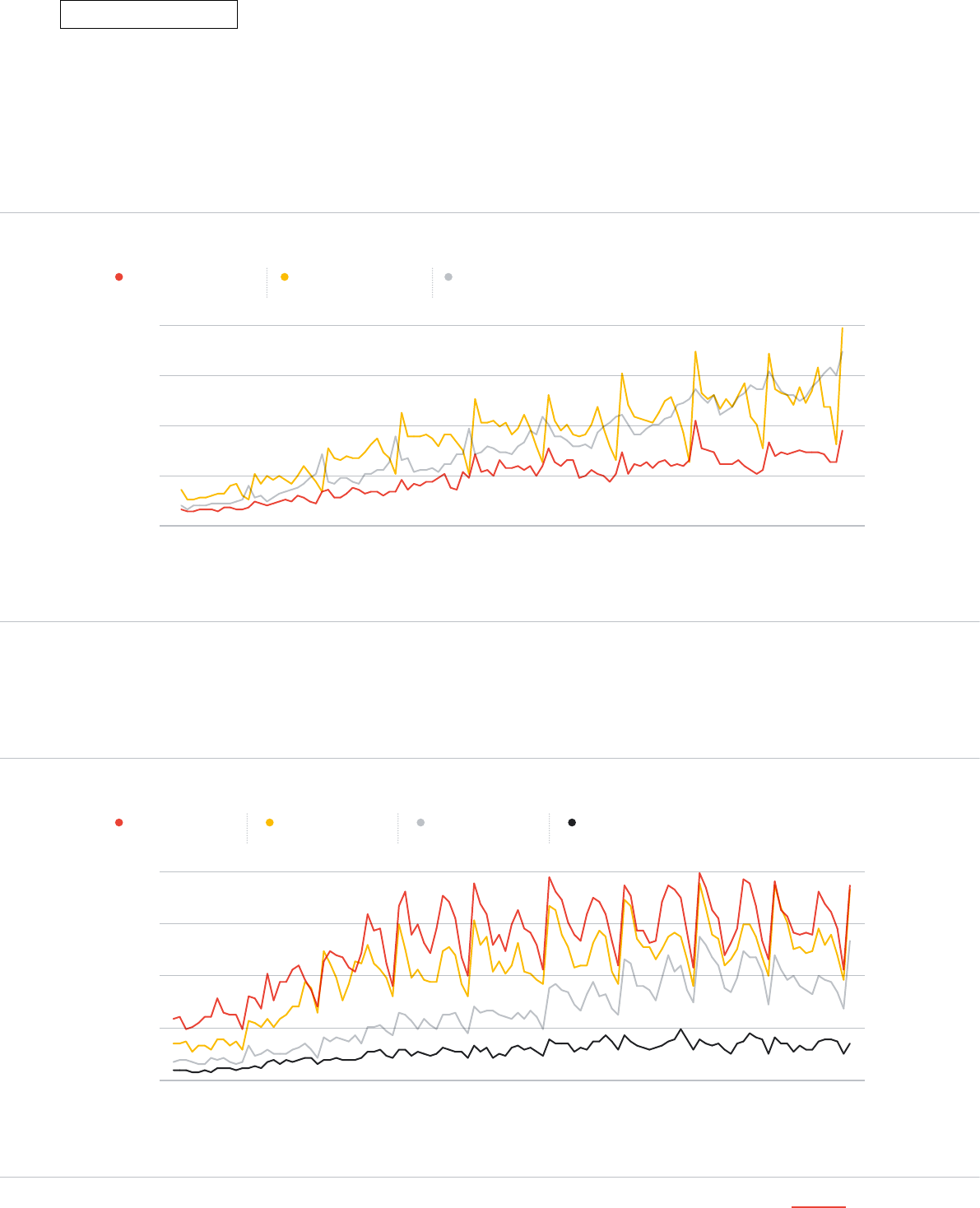

Turning to our trends data, we immediately began to nd some tantalising

clues. Take the terms “cheap” and “best”. In the UK, interest in search queries

containing the word “cheap” has steadily declined over the past 15 years,

while interest in “best” has increased with an impressive degree of negative

correlation (gure 1).

Figure 1

2004 2006 2008 2010 2012 2014 2016 2018 2020

0

25

50

SEARCH INTEREST

75

100

cheap

Search term

best

Search term

This data suggests that at some point around 2009, consumer interest in

nding the cheapest item online was eclipsed by a desire to nd the best. One

hypothesis to explain this might be that as average incomes increase over

time, an appetite for signiers of wealth, such as having the “best”, might

increase too. However, when these two trends crossed over in 2009, the

world was in the grip of the worst nancial crisis since the Wall Street Crash

– following which median household incomes in the UK actually fell.

4

Looking more closely at “cheap” and “best”, it quickly becomes apparent that

these two modiers are very different in scope and application. “Cheap” is

quantiable and rational, “best” is more subjective and emotional. The precise

value of “cheap” may vary between individuals, but it still carries a singular

meaning. “Best”, on the other hand, can have a wide range of meanings, being

applicable to value, quality, performance, popularity, and more.

The trends for UK searches containing “cheap” and “best” have been in opposite directions.

CHAPTER 212

IDENTIFYING THE MESSY MIDDLE

As the internet has grown, ithas

transformed from a tool for

comparing prices to a tool for

comparing everything.

It is this transition from simple to complex modiers that offers the rst

signicant clue to how consumer behaviour and decision-making have

changed. As the internet has grown, it has transformed from a tool for

comparing prices to a tool for comparing everything.

Enter behavioural science

To go beyond describing what consumers are doing on the internet to

understanding why that behaviour has changed, we needed to take a

different approach, grounded in cognitive science. Our partner from the

beginning of this project has been The Behavioural Architects, a global

consultancy specialising in the application of behavioural science to

marketing challenges.

We’re certainly not claiming to be the rst to apply behavioural science to

marketing. Influential marketers have long emphasised the importance

of using mental shortcuts to build brand salience and create messages

that generate a response, so the use of behavioural insights will not be a

new concept for advanced practitioners. However, with the help of The

Behavioural Architects we’ve been able to comprehensively review a

signicant proportion of the available scientic and marketing-related

literature, and to use it as the foundation of a series of large-scale

experiments exploring the impact of behavioural biases that we’ll review in

Chapter Four.

CHAPTER 213

IDENTIFYING THE MESSY MIDDLE

Riders and elephants

There’s a famous analogy used to describe how reason and emotion interact

when we’re making decisions. Jonathan Haidt, psychologist and Professor

of Ethical Leadership at New York University, likens the relationship to that

between an elephant and its rider. The rider is notionally in charge of where

the pair are going, but as soon as some stimulus or other catches the

elephant’s attention, the rider quickly nds out how little control they really

have. The signal of the reins is soon drowned out by the noise of a trumpeting

giant charging towards the fullment of one of its primal needs.

Inevitably, the elephant’s motives are something of a mystery to the rider. If

you ask them to explain what happened, they’ll be able to tell you where they

wanted to go, but not why they ended up where they did. Answers about the

elephant will be mostly guesswork and post-rationalisation. The mechanism

that often causes emotion to overhaul reason remains hidden to us.

Many attempts have been made over the years to isolate the signals and

cues most likely to make the elephant take control and, in a sense, the project

we embarked upon had a similar goal. After all, anywhere that has recently

been visited by an elephant tends to end up a little messy.

The mechanism that oen

causes emotion to overhaul

reason remains hidden to us.

CHAPTER 214

IDENTIFYING THE MESSY MIDDLE

The Behavioural Architects eventually proposed the above list as representative of the way

thinking in this space has evolved. It isn’t exhaustive – we chose not to include any model that

seemed more focused on organisational concerns than consumer perspectives – but what

this list does show is a general direction of travel and a tendency towards increasing detail.

1898 1997

1924

2005

1961

2009

1986

2011

1. AIDA

Elmo Lewis’ theoretical customer

journey from the moment a brand or

product attracts consumer attention

to the point of action or purchase.

2. The Funnel

William Townsend’s adaptation

of AIDA. Introduced the funnel

concept.

3. DAGMAR

Not intended as a decision-making

model, but Russell Colley adds an

important pre-awareness stage to

the funnel.

4. Moment of Truth

Jan Carlzon’s model, captured in

his claim that: “Any time a customer

comes into contact with a business,

however remote, they have an

opportunity to form an impression”.

5. ATR-N

Ehrenberg’s model emphasises

the importance of post-purchase

experience and interaction (nudges).

6. First and Second

Moments of Truth

A.G. Lafley builds on Carlzon’s moment

of truth, distinguishing between looking

at the product and then using it with the

rst and second moments of truth.

7. The McKinsey consumer

decision journey

McKinsey’s “active evaluation” stage

updates decision-making to reflect

a less linear, active process and

introduces the “loyalty loop”.

8. ZMOT

Google extends Carlzon’s and Lafley’s

moments of truth with the “zero moment

of truth” - when you start to learn about a

product or service for the rst time.

A brief history of the evolution of marketing models

One of the ways that marketers have tried to describe (and to some extent prescribe) the

paths elephant and rider take towards purchase is to map them in marketing models.

To give us some historical context, The Behavioural Architects kicked things off with

an extensive investigation of marketing model white papers, starting with Elmo Lewis’

famous AIDA, and covering several of the influential models that have emerged over the

intervening century and a bit.

CHAPTER 215

IDENTIFYING THE MESSY MIDDLE

Observed shopping behaviour

Google started out as a postgraduate research project, so we have a healthy

respect for the perspectives of academics and experts. However, our

ultimate source of truth is always the consumer, and we knew we wanted to

nd a way to get back to their perspective.

Our method for doing this was to observe several hundred hours of shopping

tasks, covering 310 different journeys across 31 categories. In these tasks,

shoppers were asked to research a product for which they were currently

in-market. Journeys were recorded using screen capture audio and video,

while the shoppers talked us through what they were doing. The Behavioural

Architects then analysed the journeys through the lens of behavioural

science, annotating the video playback with the different cognitive biases

they observed.

After watching the recordings, we made an initial attempt at describing what

we’d seen. On a Post-It Note we drew the purchase trigger at the top and the

purchase itself at the bottom, and in the middle we drew this (below).

CHAPTER 216

IDENTIFYING THE MESSY MIDDLE

search engines, review sites, video sharing sites, portals,

social media, comparison sites, forums, interest groups /

clubs, retailer sites, aggregators, blogging sites, voucher /

coupon sites, branded sites, publishers, noticeboards

Shopping touchpoints observed

Figure 2

Having arrived at these sites, of which there are multiple to choose from,

many of the shoppers spent signicant amounts of time navigating back

and forth, switching between sites across multiple browser tabs and apps. In

fact, in some of the sessions we observed, the product under consideration

actually changed mid-search, as a new option became preferred.

Exploring and evaluating

Taken together, the literature reviews and observed shopping tasks started

to reveal some of the core characteristics of the new reality of consumer

decision-making.

We began the rst chapter as shoppers browsing an innite high street,

moving effortlessly between vendors until something catches our eye. If we

like what we see on closer inspection, we can check out immediately, but if not

it hardly matters – there are plenty of other stores to visit on internet street.

In between those two points there is a winding, scrawled squiggle, which

seemed a reasonable way to represent our rst signicant discovery: there

are no typical journeys. Instead there is a confusing web of touchpoints that

we likened to spaghetti, not least because it was clear that this would be a

real mess to clean up.

The different sites and touchpoints visited by the shoppers who took part in

the shopping observations included, but weren’t limited to, the items listed in

gure 2.

CHAPTER 217

IDENTIFYING THE MESSY MIDDLE

5 McKinsey (2009), https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/the-consumer-decision-journey#

6 Pirolli, P., & Card, S. (1999). Information foraging. Psychological Review, 106(4), 643–675. https://doi.org/10.1037/0033-295X.106.4.643

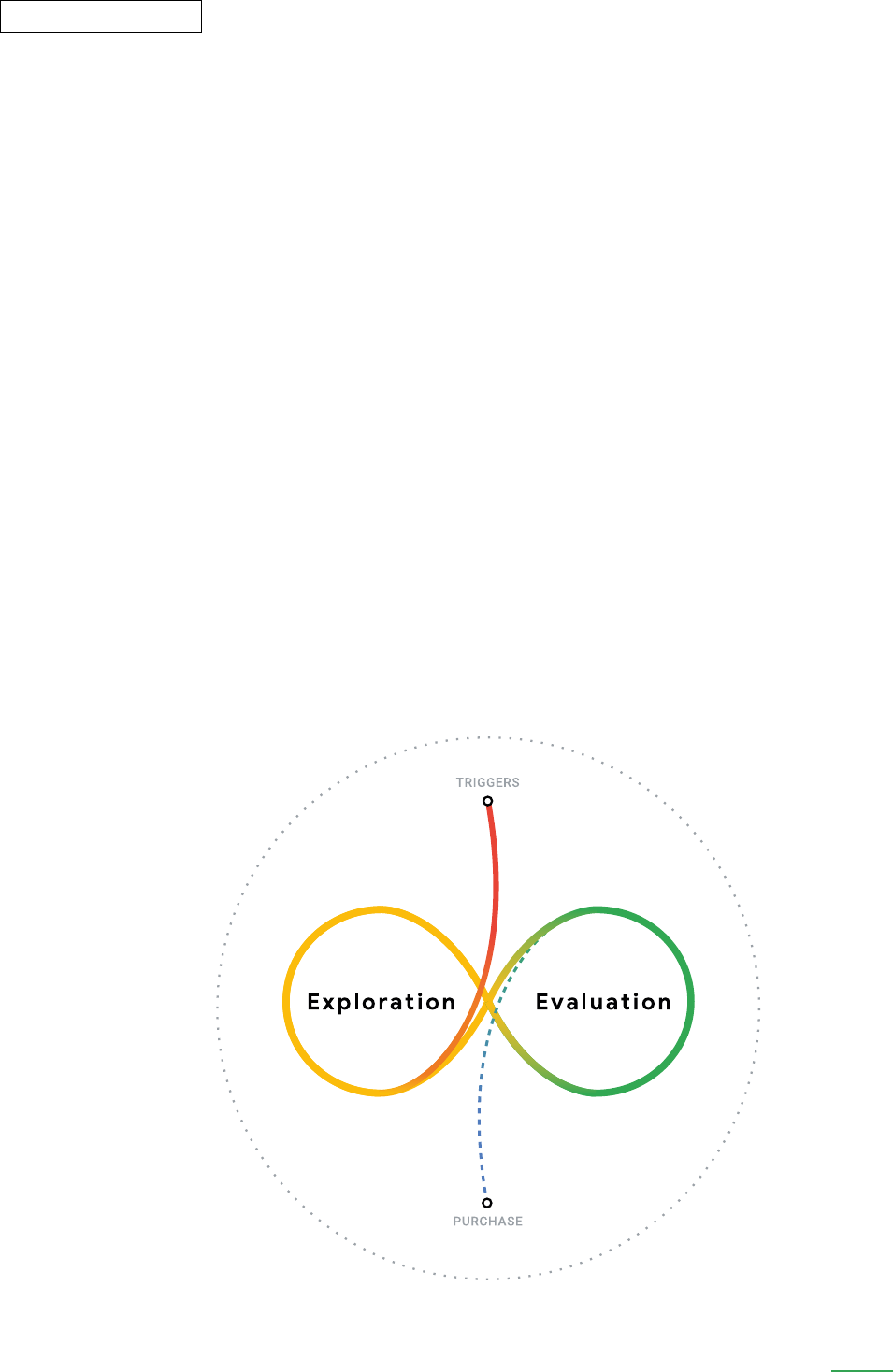

This sequence of looking for products and then weighing options equates

to two different mental modes: exploration and evaluation. And, as it turns

out, they are the key to understanding the messy middle. Exploration is an

expansive activity, while evaluation is inherently reductive. When exploring,

we add brands, products, and category information to mental portfolios or

“consideration sets”. When evaluating, we narrow down those options.

In McKinsey’s consumer decision-making model

5

(one of our favourite recent

models), these modes are combined into a single “active evaluation” phase.

However, our research suggests that they are cognitively distinct with different

reward systems and, as such, different tactics are required to connect with

consumers depending on whether they are exploring or evaluating.

The difference between giving a consumer information about a category or

product and actively closing a sale is subtle but important. In any transaction

choice is power, and consumers are now more powerful than ever before.

Sending the wrong signal at the wrong moment could be highly disruptive,

with the result that the offending brand is jettisoned from the shopper’s

consideration set.

The science behind explore and evaluate

Next we wanted to validate that explore and evaluate t within the existing

body of behavioural science. So, we went back to our stack of books and

periodicals to see if anyone else had identied a similar pattern of behaviour.

One theory that closely matched our hypothesis is “information foraging”,

6

which describes behaviours humans exhibit to reduce energy expenditure

whilst maximising gain. Historically, this theory was derived from a food

foraging theory which helped biologists understand animals’ feeding

strategies – in the case of a predator: how much energy is required to hunt

prey versus the energy that will be gained from eating it? Applying these

theories to online behaviour could explain how we explore and evaluate: how

easy is it to nd the information we need and how useful will that information

be? If it’s useful, we tend to exhaust the information at that location before

proceeding to the next. If not, we rapidly switch sources before we expend

too much energy.

CHAPTER 218

IDENTIFYING THE MESSY MIDDLE

Show... me... the… model!

We didn’t set out to build a new marketing model, but after sifting through

hundreds of white papers and spending as many hours observing online

shopping journeys, we realised that only a new structure would allow us to

piece together everything we’d learned.

Between the twin poles of trigger and

purchase sits the messy middle.

CHAPTER 219

IDENTIFYING THE MESSY MIDDLE

7 Binet, L., & Field, P. (2013). The Long and the Short of It: Balancing Short and Long-Term Marketing Strategies. IPA

If you recognise a few of the marketing models mentioned earlier, there’s a

chance that our model will feel familiar, sharing common elements with the

McKinsey model and others. This is intentional – our brief history shows how

each generation builds on the models that came before, stretching all the

way back to AIDA. However, we do believe that we’ve identied several novel

elements that reflect nuances of decision-making that previous models don’t

fully capture.

In our model, between the twin poles of trigger and purchase, sits the messy

middle, in which consumers loop between exploring and evaluating the

options available to them until they are ready to purchase. This process takes

place against an ever-present backdrop of exposure – effectively a substrate

representing all of the thoughts, feelings, and perceptions the shopper has

about the categories, brands, products, and retailers. After purchase comes

experience with both brand and product, all of which feeds back into the sum

total of exposure.

That’s the simple version – over the rest of this chapter we’ll look at each

component of the model in more detail.

E is for...

Alliteration is a good aide-memoire and, in a happy coincidence, all of the

novel components in our model beyond trigger and purchase begin with the

same letter.

Exposure

Describing the effect of brand advertising in a marketing model is tricky.

Brands can inspire powerful emotional responses and, as Binet and Field

have shown,

7

their impact can be felt throughout the decision-making

process. Moreover, their power doesn’t only derive from advertising. Brands

have a presence beyond marketing: our associations with them may

be life-long in some cases and everything we know about them, from a

newspaper article to a conversation overheard on the street, can influence

our perceptions.

CHAPTER 220

IDENTIFYING THE MESSY MIDDLE

To capture this broad spectrum of interaction and influence, we propose

“exposure”. Exposure is your awareness of the brands and products in a

category. Exposure is the sum total of all the advertising emanating from a

category that you’ve seen or heard. It’s the things you’ve learned through

word of mouth, the things you’ve read in the press and online. It can be

passively assimilated prior to a purchase trigger, part of the trigger itself,

actively sought or experienced post-trigger, and it can be a deciding factor in

the nal purchase.

But crucially, exposure is not a stage, or a phase, or a step. It’s an always-on,

constantly changing backdrop that remains present throughout the duration

of the decision-making process.

And it’s not just made up of branding and brand perceptions. Broader

category exposure and related category exposure are also components of

the backdrop. This too is a vast territory, but these types of exposure are

often complicit in triggering a purchase.

CHAPTER 221

IDENTIFYING THE MESSY MIDDLE

The exploration and evaluation loop

This seemingly innite construct is the dening characteristic of the messy

middle (the design we’ve chosen for the loop isn’t an accident). Consumers

explore their options and expand their knowledge and consideration sets,

then – either sequentially or simultaneously – they evaluate the options

and narrow down their choices. For certain categories, only a brief time

might be required moving between these modes, while habitual and impulse

purchases may bypass the loop altogether. But other purchases, typically

more complex, encourage or even oblige us to engage in lengthy exploration,

generating a healthy number of options to evaluate.

CHAPTER 222

IDENTIFYING THE MESSY MIDDLE

The loop is our best attempt at describing the non-linear nature of the messy

middle, with its back and forth between destination sites and mental modes

until one lucky brand emerges victorious. For marketers the challenge

is simple: how do you ensure that when the shopper stops flip-flopping

between states, it’s your product or service that wins? In other words, how

do you persuade someone to stop shopping around and actually buy what

you’re selling?

But while the endless circulation of the exploration/evaluation loop might

frustrate advertisers, it’s important to remember that it often delights

consumers. The goal is not to stymie the customer or force them out of the

activity they have chosen to pursue, but to provide them with everything they

need to feel comfortable making a decision.

Consumers explore their options and

expand their knowledge and consideration

sets, then – either sequentially or

simultaneously – they evaluate the options

and narrow down their choices.

CHAPTER 223

IDENTIFYING THE MESSY MIDDLE

Experience

This last component of our model occurs outside of the messy middle, so

we’ll only touch on it briefly. The experience a customer has with the product

or service they’ve purchased feeds directly into their background exposure.

A brand that provides a good experience has a head start here, and a brand

that delivers an amazing experience might even become a trigger itself,

potentially increasing the frequency of purchases.

But with so much choice available in the messy middle, a brand that delivers

a poor experience will probably have to work extremely hard to do business

with that customer again. If it’s a complete disaster, that experience might

push that customer out of the category entirely, and risks their dissatisfaction

being discoverable to other potential customers in the form of negative

reviews or comments on social media.

CHAPTER 224

IDENTIFYING THE MESSY MIDDLE

Triggers and purchase

It might seem odd to cover these critical points in our model as an

afterthought, but as they strictly occur beyond the boundaries of the messy

middle, our research doesn’t touch on them directly.

Sufce to say that triggers are responsible for moving consumers from a

passive state into an active purchase state. We’ve made them plural in our

model to account for the fact that it is often not just one inciting factor that

prompts the desire to purchase. In many cases an interconnected set of

internal and external factors – feelings and memories, ads, and reminders –

are responsible for triggering an active purchase state.

CHAPTER 225

IDENTIFYING THE MESSY MIDDLE

The messy middle identified

In this chapter, we’ve gone from a vague hunch to an updated model of

consumer decision-making, via some intriguing hints from Google Trends

and a long reading list of behavioural science. In the next, we’re going to

nd out what else search data can tell us about the evolution of behaviour

on the internet.

Q: What exactly is the purpose of the model?

A: It labels the specic cognitive inputs and mental modes that consumers

engage when processing vast amounts of information and managing choice.

It also illustrates the relationship between those inputs and modes. In short, it

helps to make sense of what’s going on in the messy middle.

Q: How is this model new?

A: Given that it brings together various elements of previous models and

theories, it isn’t entirely new. But it does effectively illustrate the non-linear reality of

decision-making – such as the constant backdrop of exposure and the innitely

looping relationship between explore and evaluate.

Q: Do the older models still have value?

A: Not all models are built with the same purpose in mind. We wanted to focus

specically on delineating consumer behaviour, while other models give greater

focus to branding, loyalty, and the role of habit and impulse.

Q: Is the funnel dead?

A: Our model is designed to reflect the complex way that people make decisions.

As such, it is tightly focused on the consumer, rather than on marketing or sales

processes. As a tool for formulating marketing objectives, the funnel is still very much

alive. In fact, at 120 years old and counting, the funnel is quite possibly immortal.

Model FAQs

3

Searching for clues in Google Trends

With a hypothesis now in place, our next step was to return to the Google

Trends data to see if we could nd real-world evidence of behaviour changing

over time on the web.

At a high level, people use search to look for information about a particular

subject or object. But because the amount of available information is so vast,

searches are often modied with an additional word or phrase that describes

what it is the searcher wants to know about the thing they’re searching for. In

our search data, fads, trends, and memes blip in and out of popularity, but the

way people use search has slowly increased in range and complexity over time.

If you’re looking for a laptop, you might prefer to narrow down your search by

modifying it to “best laptop” or “cheap laptop”, or even “laptops near me”. The

modiers people use can’t always be neatly broken down into exploration or

evaluation, but if we trend the use of these sorts of terms, we can nd clues

that illuminate how behaviour has changed.

For those not familiar with Google Trends, here’s a quick primer on how it works,

and a few clarifying notes on what the charts used in this chapter represent.

Investigating the

messy middle

CHAPTER 327

INVESTIGATING THE MESSY MIDDLE

All charts in this chapter have been generated in Google Trends and,

because it is a publicly available tool, all the charts can be easily recreated.

To make comparisons between terms easier, Google Trends normalises

search data by time period, location, and topic. It therefore displays the

relative popularity of a term over time, not absolute.

Numbers represent search interest relative to the highest point on the

chart for the given region and time. A value of 100 is the peak popularity for

the term.

Due to a change in the methodology of Google Trends on 1st January 2011,

relating to improved geographical assignment, the majority of the charts

we feature in this chapter begin on this date.

By using double quotation marks around search terms, for example

“giftideas”, the results include the exact phrase, possibly with words

before or after, like “birthday gift ideas”.

Search Tips for Trends is a must-visit for anyone wanting to have a play

around in Google Trends.

The way people use search has

slowly increased in range and

complexity over time.

Google Trends

CHAPTER 328

INVESTIGATING THE MESSY MIDDLE

Are you not enteained? The slow demise of ‘free’

In the last chapter, we discussed the strange intersection of “best”and

“cheap” in our search data. But these two modiers weren’t all we

were searching for back then. For the rst decade and a half of the new

millennium, it seems that we were keen to get something for nothing.

Evenmore than “best” and “cheap”, in the 2000s “free” was king (gure 1).

Figure 1

0

25

50

75

100

2004 2006 2008 2010 2012 2014 2016 2018 2020

SEARCH INTEREST

cheap

Search term

best

Search term

free

Search term

Data source: Google Trends, United Kingdom, 1st January 2004–1st January 2020, All categories, Web Search

The proportion of UK searches containing “free” or “cheap” has been in decline, but the proportion containing “best”

has been increasing.

CHAPTER 329

INVESTIGATING THE MESSY MIDDLE

As we fast forward through the past 16 years, the relative volume of

entertainment searches containing “free” gradually diminishes and today,

in2020, the frequency of these expressions is far lower in relative terms.

The demise of “free” is partly a story about our changing search behaviour

but, of course, we can’t forget that it’s also a reflection of how new platforms

and streaming services have changed the entertainment industry. In 2004

there was no YouTube (founded 2005), no Spotify (founded 2006), Netflix was

still a DVD sales and rentals business (it didn’t offer streaming until 2007),

and there was no App Store (launched 2008).

Figure 2

0

25

50

75

100

2004 2006 2008 2010 2012 2014 2016 2018 2020

SEARCH INTEREST

free games

Search term

free music

Search term

free movies

Search term

However, appearances can be deceiving. When we look at the kinds of

queries that contain these modiers, we begin to see some revealing

patterns. In the 2000s we didn’t search for free everything. For the most part,

we wanted free entertainment: games, music, and movies (gure 2).

Data source: Google Trends, United Kingdom, 1st January 2004–1st January 2020, All categories, Web Search

Declining UK search interest for entertainment queries containing “free”.

CHAPTER 330

INVESTIGATING THE MESSY MIDDLE

The demise of “free” and the category-specic details that add nuance to

that narrative, serve as a cautionary tale for the rest of this chapter. As we

look at other search modiers, in each case we have to bear in mind that the

same word can have different meanings in different categories, countries,

and languages.

Figure 3

0

25

50

75

100

2004 2006 2008 2010 2012 2014 2016 2018 2020

SEARCH INTEREST

free

Search term

gluten free

Search term

sugar free

Search term

dairy free

Search term

meat free

Search term

The lesson of ‘free’ – a warning to the curious

This isn’t to say that “free” no longer features in searches today. It still

represents signicant volume, but the types of free things we are looking

for have evolved, and the composition of search queries containing “free”

helps us to understand that evolution. For example, if we limit our analysis

to the food and drink category, we see that when people use the word “free”

in a search they tend to be looking for items that are “free from” a specic

ingredient or allergen (gure 3).

Data source: Google Trends, United Kingdom, 1st January 2004–1st January 2020, Food & Drink category, Web Search

Rising UK search interest for the term “free” in the food and drink category.

CHAPTER 331

INVESTIGATING THE MESSY MIDDLE

OK Google, let’s go shopping

Now let’s take a look at modiers and categories within a more

commercialcontext.

We’ll look at seven main search modiers: “ideas”, “best”, “difference

between”, “cheap”, “deals”, “reviews”, and “discount codes”.

The order in which these seven modiers are listed is intentional. While it

might not be possible to strictly classify a search query as either exploratory

or evaluative, we can at least hypothesise that some searches have a more

expansive, information-gathering intention, and others are more reductive

and clarifying.

best

ideas reviews

deals

cheap

difference between

discount codes

CHAPTER 332

INVESTIGATING THE MESSY MIDDLE

OK Google, inspire me with ideas

We begin with the modier “ideas”, which has been gradually increasing its

share of UK search over time (gure 4).

“Ideas” is arguably the most expansive of the seven modiers on our list. Located

rmly within exploration territory, searchers employ this term when seeking new

information, inspiration, and brands to add to their consideration sets.

Figure 4

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

ideas

Search term

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, All categories, Web Search

An upward trend in UK searches containing “ideas”, spiking each year at Halloween.

CHAPTER 333

INVESTIGATING THE MESSY MIDDLE

It is likely that searches containing “ideas” will often follow on quickly from

one or more triggers, such as a pressing need to identify and buy a gift for

somebody. While “Christmas gift ideas” is the largest phrase by volume, as

seen in gure 5, we also turn to Google to help us with birthday gift ideas

(afairly flat pattern given birthdays occur all year round) and anniversary gift

ideas (on close inspection peaking in May-September each year, aligned with

the fact more couples in the UK marry in summer months than in winter).

8

Figure 5

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

christmas gift ideas

Search term

birthday gift ideas

Search term

anniversary gift ideas

Search term

8 UK Ofce of National Statistics, https://www.ons.gov.uk/visualisations/dvc360/index.html

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, All categories, Web Search

Popular UK search queries containing “gift ideas”.

CHAPTER 334

INVESTIGATING THE MESSY MIDDLE

Figure 7

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

bedroom ideas

Search term

bathroom ideas

Search term

kitchen ideas

Search term

living room ideas

Search term

When it comes to our homes, there isn’t a room in the house where we’re not

seeking ideas, inspiration, and new additions (gure 7).

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, Food & Drink category, Web Search

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, Home & Garden category, Web Search

Figure 6

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

breakfast ideas

Search term

lunch ideas

Search term

dinner ideas

Search term

We also increasingly turn to Google to give us ideas of what to rustle up for our

next meal (gure 6).

Rising mealtime “ideas” searches in the food and drink category in the UK.

Rising popularity of “ideas” searches in the home and garden category in the UK.

CHAPTER 335

INVESTIGATING THE MESSY MIDDLE

OK Google, what’s best?

Of all our seven modiers, “best” has the widest footprint across categories.

People use “best” as a modier in searches for everything from ironing

boards to insurance, from TV sets to travel destinations.

Since we’ve already spent some time thinking about “best” in earlier sections,

we won’t repeat those lessons here. However, there’s one further insight

worth bearing in mind: it can be challenging to denitively label “best” as a

signier of exploration or evaluation. At rst we might assume it to be strictly

evaluative – after all, to ask what’s “best” implies a side-by-side comparison.

But on closer inspection, it turns out that “best” is also being used to explore

categories in conjunction with more generic search terms.

People use ‘best’ as a modier

in searches for everything from

ironing boards to insurance, from

TV sets to travel destinations.

An interesting feature of searches containing “ideas” is that, compared with

other modiers, the term they appear alongside is rarely the name of a brand

or retailer. In 2019, less than 5% of UK searches for gift ideas, meal ideas, and

room ideas also contained the name of a brand or retailer.

9

This supports the

hypothesis that “ideas” searches are associated with an exploration mindset

– people are adding information, products, and brands into their thinking, not

evaluating between a shortlist of known products, brands, and retailers.

‘Ideas’ searches are associated

with an exploration mindset.

9 Google internal data, UK, 2019

CHAPTER 336

INVESTIGATING THE MESSY MIDDLE

For example, when we look at overall searches for the “best” restaurants and

places to eat, as well as the best bars and pubs, we can see that these are all

consistently growing over time (gure 8).

And in the example from the travel and tourism category, all of these “best”

searches are recognisably exploratory in nature (gure 9).

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, All categories, Web Search

Data source: Google Trends, United Kingdom, 1st January 2011 - 1st January 2020, Travel category, Web Search

Figure 9

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

best places

Search term

best beaches

Search term

best hotels in

Search term

best things to do

Search term

Rising UK search interest in the travel category for the “best” places to visit.

Figure 8

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

best places to eat

Search term

best restaurants

Search term

best bars

Search term

best pubs

Search term

Rising UK search interest in the “best” places to eat and drink.

CHAPTER 337

INVESTIGATING THE MESSY MIDDLE

OK Google, what’s the difference?

Food – and new food trends in particular – can often be a source of

confusion for consumers. So it’s not surprising that we often ask Google to

explain the “difference between” two products (gure 10).

For example, we ask for help understanding the differences between pairs

of related items: cappuccino and latte, lager and beer, gelato and ice cream,

baking powder and baking soda, sultanas and raisins, fromage frais and

creme fraiche, whisky and bourbon, vegetarian and vegan, champagne and

prosecco, cacao and cocoa, paella and risotto.

This trend in particular is suggestive of both expanding choice in the messy

middle, and of consumer desire for information that claries and reassures.

We oen ask Google to explain the

‘dierence between’ two products.

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, Food & Drink category, Web Search

Figure 10

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

difference between

Search term

Rising UK search interest in the food and drink category to understand the “difference between” two items.

CHAPTER 338

INVESTIGATING THE MESSY MIDDLE

OK Google, I want the best trip, but I want it cheap too

The story of “cheap” is largely a story about travel and tourism, even in 2020

when these categories were severely disrupted by the coronavirus pandemic.

Of the top 10 UK search queries since 2011 including or related to “cheap”,

seven were denitively from the travel and tourism category (gure 11).

Top 10 searches related to the term ‘cheap’

cheap ights, ights, cheap holidays, cheap hotels, cheap

tickets, cheap holiday, cheap insurance, cheap ight, cheap

train tickets, cheap cars

Figure 11

Looking at “best” and “cheap” travel searches side by side, they mirror the

same pattern visible at the aggregate level (gure 12).

Data source: Google Trends, United Kingdom, 1st January 2011 - 1st January 2020, All categories, Web Search

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, Travel Category, Web Search

Figure 12

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

cheap

Search term

best

Search term

Travel category searches in the UK more often contain “cheap” than “best” but these trends have been converging.

cheap

CHAPTER 339

INVESTIGATING THE MESSY MIDDLE

And as we saw earlier, with “best” sometimes occupying an exploratory

function when used alongside a generic search term, these two modiers

capture both sides of the exploration and evaluation loop.

On the one hand, we perform exploratory searches to determine the most

appealing destinations, eateries, and activities. For example, the upward

trends we noted for “best places”, “best beaches”, “best hotels in”, and “best

things to do”.

On the other hand, we appear determined to pay as little as possible for our

transport to get there and our accommodation once we arrive, frequently

modifying our travel searches with “cheap” (albeit with “cheap” featuring in a

decreasing proportion of travel searches over time, gure 13).

Figure 13

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

cheap flights

Search term

cheap holidays

Search term

cheap hotels

Search term

cheap train tickets

Search term

cheap all inclusive

Search term

It’s notable that travel searches including “cheap” rarely contain the names

of brands. While it might be tempting to assume that “cheap” searches are

purely evaluative, the absence of brands shows us that these might often

also be exploratory.

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, Travel category, Web Search

The term “cheap” appears in a range of popular searches in the travel category in the UK.

CHAPTER 340

INVESTIGATING THE MESSY MIDDLE

OK Google, show me the bargains

Three modiers used in similar categories and for similar purposes are

“deals”, “offers”, and “sale”.

“Deals” is especially common in the internet and telecom sector. We use this

modier to seek value when both exploring and evaluating broadband, phone

contracts, and TV subscriptions (gure 14).

Figure 14

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

broadband deals

Search term

sim only deals

Search term

tv deals

Search term

It’s much harder to broadly characterise searches containing “deals” as

explore or evaluate based on the presence of brands. Both are commonly

used with and without brand names, implying that people are looking

expansively for information and new brands, as well as critically evaluating

the deals on offer from the brands they are considering.

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, Internet & Telecom category, Web Search

A rising proportion of UK searches in the internet and telecoms category contains the term “deals”.

CHAPTER 341

INVESTIGATING THE MESSY MIDDLE

Our other modiers of this nature exhibit similar trends over time, albeit

with different category afnities. As “deals” is to telecoms, “offers” is to

grocery retail, especially with relatively high unit price purchases, such as

alcohol. Conversely, the word “sale” tends to be more associated with retail

categories such as clothing and furniture.

10

OK Google, does it have good reviews?

We’ve seen how the search modier “best” can help people nd out what

others consider to be worth doing or buying. An even more explicit way of

expressing a wish to investigate the views of others – be they peers, previous

buyers, vloggers, or category experts – is to include the modier “reviews”

in a search. However, there’s an interesting distinction between searches

containing “best” and “reviews”, with searches containing “best” rarely

containing the name of a brand, while searches containing “reviews” often do.

Top 15 searches related to ‘sim only deals’

ee sim only deals, ee sim only, sim only vodafone, vodafone

sim only deals, o2 sim only, o2 sim only deals, sim only deals

virgin, virgin sim only, tesco sim only, sim only deals tesco,

best sim only deals uk, phone sim only deals, sim only deals

uk, mobile sim only deals, best sim only deals

Figure 15

For example, the top 15 “sim only deals” searches in the UK in 2019

comprised 11 with a brand name (in red) and 4 without (in pink, gure 15).

10 Note that “sale” and “for sale” are search modiers with very different meaning and usage. The term “sale” is associated with discounts

and price reductions offered by a business, whereas “for sale” typically denotes second-hand or private sales.

Data source: Top 15 queries related to “sim only deals”, Google Trends, United Kingdom, 2019, All categories, Web Search. Excludes related

queries not containing “sim only”

sim only deals

CHAPTER 342

INVESTIGATING THE MESSY MIDDLE

Reviews are also a prevalent feature of the automotive category, with a

similar trend visible in the combination of modiers and brands (along with a

few authoritative websites and magazines). The modier “review” provides

us with a clear example of shoppers actively seeking out authoritative

viewpoints to boost condence during decision-making.

Unlike “best”, the fact that “review” searches typically contain the names of

specic brands and products hints that review searches on the whole are

more evaluative than exploratory. In many cases it appears that people have

one or more potential brands and models in mind, and are looking for further

information to help evaluate which would be the better choice.

As these and similar examples from this chapter show, the presence of

brands is often evaluative, especially in conjunction with a specic product

name. However, it is important to note that by itself, the presence of a brand

term in a query is insufcient to signal the shopper’s mental mode.

Top 10 queries related to ‘review’

laptop review, headphones

review, ipad review, ps4 review,

kindlereview, kindle re review,

lenovo yoga review, galaxy note

review, microsoft surface review,

kindle re hd review

Top 10 queries related to ‘best’

best apps, best camera,

bestlaptop, best tv, best pc,

bestheadphones, besttablet,

bestipad, best laptops,

bestspeakers

Figure 16

For example, if we look at the top UK search queries of the past 10 years in

the computers and electronics category, of the top 10 related to “best”, only

one contains the name of a manufacturer or product brand (“best ipad”). In

contrast, all but two of the top 10 search queries related to “review” contain

the name of a company or product brand, with the exceptions being the top

two results (“laptop review” and “headphones review”, gure 16).

Data source: Google Trends, United Kingdom, 1st January 2011–1st January 2020, Computers & Electronics category, Web Search.

Negative keyword “-buy” applied to searches containing “best”.

review best

CHAPTER 343

INVESTIGATING THE MESSY MIDDLE

OK Google, can I get any money off?

Our nal search modier is “discount code”, although we’ll group this

together with its sibling, “promo code”.

These modiers have grown as a proportion of search over the past 10 years,

spiking in November and December (gure 17).

Figure 17

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

25

50

75

100

SEARCH INTEREST

discount code

Search term

promo code

Search term

Data source: Google Trends, United Kingdom, 1st January 2011 - 1st January 2020, All categories, Web Search

A rising proportion of UK searches contains “discount code” or “promo code”.

CHAPTER 344

INVESTIGATING THE MESSY MIDDLE

The majority of searches containing “discount code” also contain the name

of a retailer. For example, of the top 15 related queries for these terms in the

UK in 2019, 11 (inred) contained the name of a retailer (gure 18).

Data source: Top 15 queries related to “discount code”, Google Trends, United Kingdom, 2019, All categories, Web Search

Top 15 queries related to ‘discount code’

asos discount code, argos discount code, amazon discount

code, jd discount code, debenhams discount code, boots

discount code, boohoo discount code, currys discount

code, ebay discount code, john lewis discount code, next

discountcode, just eat discount code, tui discount code,

travelodge discount code, nike discount code

Figure 18

The presence of a named retailer in these searches implies that little

exploration is happening here, and that the evaluative phase may be nearing

an end too. As such, these modiers place us as close as search gets to the

moment of purchase.

Modifying the messy middle

As these examples show, our relationship with the things we search for is

complex and mutable. But the search modiers people use are a rich source

of insight into how our thinking and behaviour have evolved over time, and

can even offer clues about the underlying cognitive biases at work. In the

next chapter, we’ll take some of these insights and attempt to quantify the

impact that specic biases can have on decision-making.

discount code

CHAPTER 345

INVESTIGATING THE MESSY MIDDLE

‘Best’ and ‘cheap’ around the world

Although we need to account for how the meaning of words can differ

between categories, many of the trends we identied in UK data are also

visible in other geographies and languages.

This is how the pattern of “best”, “cheap”, and “free” looks for all searches

globally in English (below).

Figure 19

2004 2006 2008 2010 2012 2014 2016 2018 2020

0

25

50

75

100

SEARCH INTEREST

cheap

Search term

best

Search term

free

Search term

Data sources: Google Trends, Worldwide, 1st January 2004–1st January 2020, All categories, Web Search

Similar long-term trends for “best” and “cheap” are also visible when we

translate those terms into the native languages of many other countries:

The proportion of worldwide searches containing “free” or “cheap” has been in decline, but the proportion containing

“best” has been increasing.

CHAPTER 346

INVESTIGATING THE MESSY MIDDLE

The lines for “best” and “cheap” don’t always cross as they do in the UK: for

example in the US, searches including “best” have been more frequent from the

beginning. However “best” has still seen a steady rise in the US, and “cheap” a very

gradual decline, making it broadly consistent with the UK and other countries.

cheap

Search term

best

Search term

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

2004 2012 2020

0

25

50

75

100

SEARCH INTEREST

SEARCH INTEREST

SEARCH INTEREST

India Germany Spain

France Italy Brazil

United Kingdom United States Australia

Data source: Google Trends, various countries, 1st January 2004–1st January 2020, All categories, Web Search

Figure 20

Search trends for “cheap” and “best” around the world, translated into local languages.

4

The next stage of our research involved taking what we’d learned from our

literature reviews, Google Trends data, and shopping observations, and applying

it in an experimental setting. Over the course of 310,000 simulated purchase

scenarios, we tested the impact that various behavioural biases can have on

shoppers’ brand preferences.

Homo-not-so-economicus

As theories about “economic man” have given way to metaphors about ridersand

elephants, it would seem that most behavioural scientists now agree that, in

reality, our decision-making apparatus comprises both reason and emotion.

Inuencing the

messy middle

Even a seemingly functional, low‑cost

purchase like buying a favourite

shampoo can be prompted by emotional

or rational considerations.

CHAPTER 448

INFLUENCING THE MESSY MIDDLE

In the context of shopping decisions, we might be tempted to propose that

the degree of rationality increases with the size and importance of the

purchase. But as anyone who has ever bought a car, a house, or an expensive

holiday knows, the moment the deal closes can still be fraught with complex

emotion. And at the other end of the scale, even a seemingly functional,

low-cost purchase like buying a favourite shampoo can be prompted by

emotional or rational considerations, depending on the individual.

And of course, muddying the water of reason and emotion further is

advertising – particularly branding. Brands often seek to cultivate an emotional

connection with consumers – in fact, many people will openly describe

themselves as loving or hating a particular brand. These associations, often

bound up in our sense of ourselves and our aspirations for who we want to be,

are a powerful source of behavioural change in themselves.

To design an experiment looking at how behaviour is influenced during the

crucial explore and evaluate phases of our model, we needed to draw up a

list of behavioural science biases to test. For this, The Behavioural Architects

returned to the literature of academic behavioural science. Over the course of

more than 50 years, the discipline has codied some 300 principles that explain

the conscious and unconscious workings of the human mind. Of course, not all

of the 300 are relevant to the kind of decision-making we’re exploring here, so

during a thorough review, the team whittled down the list to six biases that are

closely associated with the explore and evaluate phases of our model.

CHAPTER 449

INFLUENCING THE MESSY MIDDLE

A summary of six biases

The names we’re using for these biases may or may not be familiar to you,

but the underlying denitions are congruent with those used in academic

behavioural science. Of course, you may well have used some of them in

your own campaigns, or recognise them at work in the ads of one of your

competitors or favourite brands.

Category heuristics are shortcuts or rules of thumb that aid us in making a

quick and satisfactory decision within a given category. An example would be

focusing on how many megapixels (MP) the camera has when purchasing

a smartphone or how many gigabytes (GB) of data are included in a mobile

phone contract.

Princeton psychologists, Shah and Oppenheimer,

11

found heuristics reduce

cognitive effort through the following impacts on decision-making:

Examining fewer pieces of information

Relying on easy-to-access pieces of information

Simplifying the weighting of information

Integrating less information in a decision process

Considering fewer alternatives overall

Authority bias describes the tendency to alter our opinions or behaviours to

match those of someone we consider to be an authority on a subject. When

we’re unsure, we tend to follow the lead of people we believe to be credible

and knowledgeable experts, and therefore may use an authority view as a

mental shortcut. In one experiment, the brains of 24 college students were

scanned while making nancial decisions. If students received advice from

a renowned economist, the scans showed that the decision-making parts of

students’ brains showed less activity as the students “offloaded” the burden

of the decision process to the expert.

12

2.

11

Shah, A. K., & Oppenheimer, D. M. (2008). Heuristics Made Easy: An Effort-Reduction Framework. Psychological Bulletin, 134(2), 207–222

12 Engelmann J. B., Capra C. M., Noussair, C., & Berns G. S. (2009). Expert Financial Advice Neurobiologically “Offloads” Financial Decision-

Making under Risk. PLoS ONE 4(3): e4957. https://doi.org/10.1371/journal.pone.0004957

1.

CHAPTER 450

INFLUENCING THE MESSY MIDDLE

Social proof posited by psychologist Robert Cialdini

13

describes the tendency

to copy the behaviour and actions of other people in situations of ambiguity

or uncertainty. The internet has digitised word-of-mouth reviews and

recommendations, making it much easier for people to rely on social proof

as a shortcut for decision-making. Sometimes we’re conscious of this, for

example if we take the time to read consumer reviews, but often we’re influenced

unconsciously. For example, without thinking, we might click on an ad that

includes a four- or ve-star rating, drawn to what appears to be a popular choice.

Power of now describes the fact that we tend to want things now rather

than later. Humans are wired to live in the present – our evolutionary survival

hinged on our ability to deal with the problems of the here and now rather

than our ability to plan for the future. This explains why people often nd it a

challenge to save for their future.

14

“Power of now” also explains the success of

instant downloads or 24-hour delivery versus having to wait to get a product.

15

Scarcity bias is based on the economic principle that rare or limited resources

are more desirable. As Robert Cialdini states: “The scarcity principle trades on

our weakness for shortcuts”.

16

Scarcity typically takes one of three forms:

Time limited: when there is a time limit to a product’s

availability, it creates a deadline that makes people act

before the time is up.

Quantity limited: limited or rare supplies are perceived by

people as a threat to their freedom of choice, triggering a

reaction to ght the threat and maintain their access to the

resource.

Access limited: meaning limited access to features like

information, groups, or spaces. Censorship makes people

place a higher value on restricted features because

exclusivity makes them feel special.

4.

5.

13 Caldini, R. B. (1984). Influence – The Psychology of Persuasion. Collins. 14 Thaler, R. T. (1991). “Some Empirical Evidence on Dynamic Inconsistency” in Richard H. Thaler,

ed.. Quasi Rational Economics. New York: Russell Sage Foundation, 127–33. 15 The scientic name for “power of now” is discounting the future, which the economist Richard

Strotz explored in 1955 with his work on hyperbolic discounting and time inconsistent preferences. 16 Caldini, R. B. (1984). Influence – The Psychology of Persuasion. Collins.

3.

CHAPTER 451

INFLUENCING THE MESSY MIDDLE

Power of free describes the fact that there is something special about the

price of zero. The demand for a product or service is signicantly greater at

a price of exactly zero compared to a price even slightly greater than zero.

In his book “Predictably Irrational”, behavioural economist Dan Ariely writes

about a study in which people were given the option to choose between two

offers. One was a free $10 Amazon gift card, the other a $20 gift card that

could be bought for only $7. More people chose the $10 gift card, despite the

other option offering superior value.

17

The power of free can be thought of

as an emotional hot button – a source of irrational excitement that can be

critical in persuading a consumer to make a purchase decision.

While certainly not a denitive list of every bias in play, our set of six

represents several of the most powerful principles identied in the literature,

all of which are suitable for testing at scale. It also has the advantage of

covering implementations that range from simple copy changes to more

complex merchandising and logistical decisions.

Testing the six biases

The biases identied by The Behavioural Architects have been thoroughly

examined in an academic context, but to gauge their importance to

marketers we knew we would have to place them within a purchase-making

context to see how they affect the emotional weight of competing brands.

The previous experimental results we reviewed were often from relatively

small samples, without a purchase or brand aspect, and not systematically