A COMMISSIONER’S GUIDE TO PROBABILITY

SAMPLING FOR SURVEYS AT USAID

by: Julie Uwimana and Jennifer Kuzara

This document was produced for review by the United States Agency for International Development. It was prepared by Social Solutions

International, Inc. under contract number AID-OAA-M-14-00014.

A Commissioner’s Guide to Probability

Sampling for Surveys at USAID

By: Julie Uwimana and Jennifer Kuzara

Submitted to:

Virginia Lamprecht, Contracting Officer’s Representative (COR)

USAID/Policy, Planning and Learning

Submitted by:

Social Solutions International, Inc.

Contract AID-OAA-M-14-00014

April 24, 2020

DISCLAIMER:

The views expressed in this publication do not necessarily reflect the views of the United States Agency for

International Development or the United States Government.

COVER PHOTO CREDITS:

Left: Unsplash Photo, Ryoji Iwata, 2019

Right: Original Graphic, Jul

ie Uwimana and Jennifer Kuzara, 2020

MECap Knowledge Product

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

By Julie Uwimana and Jennifer Kuzara

This publication was produced at the request of the United States Agency for International Development (USAID). It was prepared under the

Expanding Monitoring and Evaluation Capacities (MECap) task order, contract number AID-OAA-M-14-00014, managed by Social Solutions

International. The views expressed in this publication are solely of the authors and do not reflect the views of USAID.

Contents

Document Purpose and Audience........................... 1

Surveys at USAID ..................................................... 2

Descriptive and Inferential Statistics ...................... 3

Sampling Basics ......................................................... 5

Probabilistic vs. Non-probabilistic ...................................... 5

Probability Sampling ............................................................... 6

How Do I Choose a Sample Frame?........................ 9

Sample Frames and Sampling Bias....................................... 9

Making Generalizations .......................................................10

How Do I Review Sample-Size Calculations? ....... 10

Common Parameters ..........................................................10

Design Effect.......................................................................... 11

Effect Size ...............................................................................12

Statistical Power ...................................................................12

Confidence Level, Margin of Error, and Confidence

Interval ....................................................................................12

Significance and Alpha.......................................................... 13

Non-Response....................................................................... 13

Attrition ..................................................................................13

Other Considerations ............................................. 14

Population Estimates............................................................ 14

Proportional Allocation of the Sample ............................ 15

Sensitivity Analysis................................................................ 16

What Does Sampling Look Like in Practice? ....... 17

Why is My Input in These Decisions Important? . 19

Annex A: Sampling Design Review Checklist....... 22

Annex B: Examples of Statistical Tests for Variable

Combinations .......................................................... 24

Annex C: Sampling Approaches ............................ 27

Annex D: Common Sample Size Parameters...... 28

Annex E: Timeframe............................................... 29

Annex F: Terms....................................................... 31

Resources ................................................................. 33

Document Purpose and Audience

Sampling is the process of studying a subset of a

population for the purposes of describing or

testing questions about a whole population. At

USAID, sampling may be used to collect data for

baselines, evaluations (both impact evaluations and

performance evaluations), assessments that require

survey data, and in some cases in indicator

reporting.

This document includes answers to common

questions that the authors have been asked by

USAID staff and is based on experience, best

practice, and existing agency guidance. Some

USAID bureaus have specific guidance for

population-based surveys, like the

Feed the

Future’s Population Based-Survey Sampling Guide,

which is guidance targeted at practitioners. This

guide reviews similar content at a simplified level

to support commissioners of surveys.

The purpose of this document is to provide a

foundational understanding of probability sampling

to USAID staff to equip them as well-informed

commissioners and consumers of surveys,

evaluations, and other products (hereafter

referred to as studies) that require probability

sampling. We hope that it will serve as a resource

for commissioners to make informed decisions

about surveys and to use monitoring, evaluation,

and learning (MEL) resources effectively. The main

audience for this document includes monitoring, evaluation, and learning specialists, Contracting Officer’s

Repr

esentative (CORs), and Agreement Officer’s Representative (AORs).

This d

ocument is intended to provide a general overview of sampling and r

elated concepts of representative

survey design. It is not official guidance. Rather, it represents good practices in the survey design field. It is

not specific to any USAID initiative or requirement, nor is it exhaustive. When pursuing a representative

April 2020 | 1

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

survey for USAID or in collaboration with other organizations, remember that there are guidelines and

requirements associated with the purpose of the survey, which depends heavily on the stakeholders

involved. The first step to a successful survey is to understand the data needs, existing requirements, and

policies of all stakeholders. As the commissioner, if you are unsure about the information provided by the

external survey team, or the team is unable to answer your questions directly or transparently, seek the

assistance of a survey design expert.

Survey design is a specialized skill set, even among monitoring and evaluation experts. As a commissioner of

a survey, consider the composition of an evaluation or assessment team conducting a survey to ensure the

team has the right mix of skills and equipped to identify potential issues in a survey you are overseeing.

Surveys at USAID

Surveys provide information for decision-making throughout the Program Cycle, answering USAID’s

information needs in annual reporting, assessments, impact evaluations, and performance evaluations.

Surveys can be administered specifically to program participants or the general population of the

communities being served. They can be administered internally by implementing partners as part of their

regular monitoring and evaluation, or they can be administered by USAID or by a party contracted by

USAID specifically for that purpose, such as a monitoring, evaluation, and learning (MEL) platform.

Reporting might include surveys of participants. For example, indicator performance levels are frequently

collected through participant-based surveys and included in annual reports. This kind of survey is typically

administered by implementing partners and reviewed by USAID as part of the regular Data Quality

Assessments conducted on indicator data as required by ADS 201.

Surveys might also be included in assessments. Assessments are forward-looking and may be designed to

examine a country or sector context or to characterize the specific set of problems to be addressed by an

activity, project, or strategy. Assessments may be used to inform strategic planning and both activity and

project design. An assessment is distinct from an evaluation. Assessments, like gender assessments or

household economic analyses (HEAs), are often conducted in advance of or as part of the design process.

Not all assessments use surveys, but when they do, it is because the findings are intended to be

representative of a certain geographic area. Assessments may be used to provide baseline values for key

indicators, and in these cases, it is critical that they represent the intended geographic programming area

and population.

Impact evaluations

usu

ally include surveys to provide quantitative data for an outcome of interest. Impact

evaluations measure the change in a development outcome for program beneficiaries that is attributable to a

defined intervention. Impact evaluations are based on models o f cause and effect and require a credible and

rigorously defined counterfactual to control for factors other than the intervention that might account for

the observed change. In these studies, the measurable change attributed to the intervention is called the

“effect size.” Impact evaluations can have either experimental or quasi-experimental designs. In experimental

designs, conditions are randomly assigned to participants; one condition is the intervention being tested, and

the control group may receive no interventions, or they may receive the current standard of care or some

variant of it. Quasi-experimental designs also use comparison groups, but they are not randomly assigned,

April 2020

| 2

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

which means they require specialized statistical techniques to address the potential for bias in their

comparison groups. These designs include propensity score matching, regression discontinuity, and using

before and after measures from a non-equivalent comparison group.

Surveys are also frequently used in performance evaluations. Performance evaluations encompass a broad

range of evaluation purposes and approaches. They may incorporate before-after comparisons but lack a

rigorously defined counterfactual. More often, performance evaluations provide cross-sectional data (a

snapshot of a single point in time) at mid-term or end-line. When surveys are used in performance

evaluations, it is generally as part of a mixed-methods design, whereby both qualitative and quantitative

measures are utilized in answering the evaluation questions. Surveys of participants are a common feature of

performance evaluations; population-based surveys (those administered among a whole population) are less

common. Because population-based surveys can be more resource-intensive than other approaches to

collecting quantitative data, commissioners of performance evaluations should only elect to use them when

they are appropriate to the evaluation purpose, such as when outcomes need to be measured at the

population level or when interventions are administered at the level of a whole community or catchment

area, making identification of specific beneficiaries impossible.

The specific circumstances of a given survey, as laid out above, will guide the decisions that follow with

respect to sampling, sample size, and the appropriate statistical tests to use, which will also be influenced by

the specific evaluation or study questions underlying the report, assessment, or evaluation.

Descriptive and Inferential Statistics

There are two types of statistics: descriptive and inferential. Descriptive statistics provide a concise

summary of data, numerically or graphically – such as a mean traffic light wait time of four minutes among

those surveyed (or a range of three to five minutes). Inferential statistics use a random sample of data

taken from a population to make inferences or test hypotheses about the whole population. For example,

“the median age of Senegal is 18.4 years old (+/- 2.5 %) based on a sample of 5,000 of its citizens”, or

“Senegalese women who marry after 16 years of age are 6.7 % less likely to experience under-five mortality

in their children (p = 0.038) than women who marry at 16 or younger.”

A study population is needed when using both descriptive and inferential statistics. A study population is

the group of people of which survey questions are being asked. Descriptive statistics only summarize those

from whom data was collected, while inferential statistics require a representative sample of the study

population.

Relying on a sample rather than the overall population may lead to bias. A representative sample is a

sample that reflects the characteristics of a study population and minimizes bias. Random selection does not

ensure that a sample is perfectly representative, but it does help to ensure that any differences between the

sample and the overall population are random rather than systematic. Differences that are systematic can

skew results in a specific direction if the over- or under-represented characteristic is related to an outcome

being measured. There are many types of bias. In this document, bias refers to sampling bias. Sampling bias

results when the traits of the units within the sample frame are different from those in the population that

you are trying to study. In Figure 1, the sample frame (blue) is very similar to the black ring (the target

April 2020 | 3

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

population), but not exactly the same. This is because no sampling frame is ever perfect. The key is knowing

where the sample frame and target population do not align, and if or how it may result in potential bias. For

example, in your study, you may want to draw conclusions about all of the participants in a program, but

you select them based on records that only include the participants who regularly came to meetings. This

sample might include more of the people who had an easier time engaging with the program or who were

more interested in it, and fewer of the people who had a harder time coming to meetings or who were less

engaged.

Figure 1: Population, Sample Frame, and Sample

The central role of inferential statistics is that they can be used to test assumptions or hypotheses about a

parameter (a parameter is defined as either a numerical characteristic of a population, as estimated by a

study variable, or a quantitative variable whose value is chosen for a specific set of circumstance).

Hypothesis tests use statistical analysis to compare a hypothesis that there was an effect (or difference,

relationship, change, etc.) with the “null hypothesis” or default assumption of no effect (or difference,

relationship, change, etc.). In evaluation, the hypotheses being compared are usually that the intervention

had an effect versus the null hypothesis that it did not. When the finding is significant, it means that the

intervention probably had an effect. A result that is not significant means you cannot reject the null

hypothesis that the intervention had no effect.

Study questions often pertain to the relationship between characteristics or aspects of an experience. In

evaluations, this is most often of interest to study the relationship between an intervention and an outcome.

The outcome is called the “dependent variable” because it responds to (is dependent on) the intervention

(e.g., reading skills). In such relationships, the effects of factors other than the intervention that may also

affect the outcome of interest are accounted for, in order to isolate the effect of the intervention. The other

factors, called control variables, together with exposure to the intervention, are known as “independent

variables” (e.g., student age). In addition to establishing relationships, a study may further test these

relationships. The kind of test that is most appropriate for a given situation depends on the nature of the

variables, for example, whether they are numerical variables like height or nominal variables like marital

status.

April 2020 | 4

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

It is essential to know whether descriptive or inferential statistics are planned for your study because it

influences the types of survey data that is needed and the type of statistical tests that can be conducted. To

better understand the options for statistical tests, refer to Annex B: Examples of Statistical Tests for

Variable Combinations.

Descriptive and Inferential Statistics

Questions to ask yourself:

What is y

our study population? What population do you

want to be able to test hypotheses about, make

statements about, and generalize findings to?

Knowing your study population will help the

survey team identify a sound sampling frame.

Questions to ask your survey team:

What kinds of statistics are you planning to use? Are you

planning to test relationships? Do you intend to make

claims about a whole population? Are you only interested

in describing the people you have surveyed?

The type of questions you are interested in

dictate the statistical tests

you may use.

Sampling Basics

Perfect measurement of a characteristic is rarely, if ever, practical, which is why we use sampling to

approximate the (unknowable) true value within a certain tolerance for precision.

Statistical error is the unknown difference between an estimated value from a sample and the “true”

value based on the whole population. In the most basic sense, it is noise in the data resulting from random

chance. A true value is a value that would result from ideal measurement.

For example, if you could locate and collect a perfectly precise measure of the height of every single

American adult and then calculate sex-disaggregated means, you would have “true” values for the average

height of American men and women.

There are many methods of approximating a true value through sampling. The following section

provides a foundational overview of approaches.

Probabilistic vs. Non-probabilistic

There are two main types of sampling approaches: probabilistic and non-probabilistic. In a probabilistic

sampling, every sampling unit (e.g., person or household or school) within the sample frame has some

probability of being selected. A sample frame is a group of units from which a subset is drawn (e.g., all

beneficiaries of a program or all schools covered by an intervention or all schools in a country). The sample

frame defines the units eligible to be sampled but does not imply that each unit within the sample frame will

be selected for data collection. Recall that the study population is the group of people of which survey

questions are being asked. More explicitly, the study population are the units that the sample is expected to

represent. If random selection is performed by choosing tickets out of a hat, the sample frame is all the

tickets in the hat.

Probabilistic methods are used when it is important to ensure that the sampling units selected represent the

larger population. A representative sample is achieved through probabilistic sampling approaches. This form

April 2020 | 5

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

of sampling minimizes the potential for sampling bias resulting from the over- or under-representation of

people in the final sample relative to the population, because of the way sampling was designed. The

objective in developing a good sample frame is to make the probability of being selected as equal as possible

among the units of the study population, given the constraints of the sampling approach. However, the

probability of being selected for a sample will never be exactly equivalent for all units in the study

population. This is because sample frames are imperfect.

Non-probabilistic meth

ods use purposeful selection and judgment factors to choose sampling units. Non-

probabilistic methods are used when studying a specific issue, event, or group of people who does not need

to be representative (e.g., collecting data from success stories). Non-probabilistic sampling designs limit the

kind of statistical analyses that can be done on resulting data. In general, descriptive statistics (which should

not be generalized beyond the sample) are best suited to non-probabilistic samples. Inferential statistics are

frequently inappropriate for these designs.

1

A convenience sample is one example of non-probabilistic

sampling when selection is based on convenience of contact. For example, the findings from a convenience

sample to determine the median age of women visiting a specific village clinic should not be used to

extrapolate the age of women nationally visiting clinics.

An exc

eption to this rule is known as a census, which is when you are able to get information from all or

nearly all members of the population to which you want to generalize. This is not considered sampling

because you are not selecting a part to represent the whole. Rather, you are trying to capture the whole

directly. There is no probability involved (because there is no sampling), but you are able to conduct

statistical analyses. If you interview every student enrolled in a given school, you have a census for it, and any

claims you make will be accurate for that school (though not for others).

Probability Sampling

As mentioned above, probabilistic or probability sampling is a selection method whereby every sampling unit

within the sample frame has a specific probability of being selected, and that probability can be estimated.

There are five types of probability sampling: simple random, systematic random sampling, stratified, multi-

stage, and cluster. This section briefly explains each type. It is possible to have multiple sampling approaches

present in one design.

Simple Random Sampling

Simple random sampling is an approach where every unit in the sample frame has roughly the same probability

of being selected. An example of simple random sampling is randomly selecting beneficiaries from a

complete beneficiary list. In this case, the sample frame is the complete beneficiary list. Because all of the

sampling units or beneficiaries are known, each has an equal probability of being selected. Simple random

sampling is most common in scenarios where the sample frame is small and defined. The larger the sample

frame, the more difficult and costly it is to use simple random sampling.

Systematic Random Sampling

In systematic random sampling, sampling units are selected according to a random starting point and a fixed,

periodic interval. Selection begins with an ordered or randomized list, and every r-th sampling unit are

1

In some cases, a specialized parameter might be appropriate (for example, if snowball sampling is used for a social network analysis, specialized

statistics can be used that are not dependent on the representativeness of the sample), but this needs to be determined on a case-by-case basis.

April 2020 | 6

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

selected. In the beneficiary list example, systematic random sampling of beneficiaries in a defined list would

be accomplished by either using a spreadsheet or statistical program function to randomize the list and then

selecting every fifth beneficiary in the list, for example. The interval is usually selected based on the

proportion of the list that will be sampled. If there are 1,000 beneficiaries, and 250 of them are to be

sampled, you would randomly order the list and then select every fourth person.

Stratified Sampling

Stratified sampling splits an entire population into homogeneous groups or strata before sampling. The

sample is then selected randomly from each stratum. Examples of strata are geographic regions, age groups,

grades, or any other classification which: 1) includes the entire population of interest (collectively

exhaustive); and 2) defines categories so that each sampling unit is only assigned to one stratum, (mutually

exclusive).

Stratified sampling is most commonly used in the following cases: 1) y

our outcome variable is strongly

related to your stratification variable; in these cases, stratification reduces error; 2) to ensure that you can

conduct sub-population analyses, either because you guarantee having the minimum sample size allowed

through normal stratification or because you have introduced oversampling into your stratification

scheme; and 3) in cases where your sample frame already stratifies in some way - so stratification is just

easier.

2

Oversampling is a special type of stratified sampling in which disproportional numbers of sampling units

are selected from specific strata. This is designed to ensure that there are enough members of a particular

group displaying a specific, usually low-prevalence, characteristic to conduct sub-analyses on that group. For

example, USAID is often interested in the well-being of marginalized populations, which are usually in the

minority of a population. To conduct analyses at this level, more minority individuals need to be included in

the overall sample size than the proportion of the population they actually represent, effectively increasing

the sub-sample of the marginalized group.

3

Multistage Sampling

Multi-stage sampling starts with the primary sampling unit (PSU), or the units selected in the first stage

of a multi-stage sampling design. It divides the population into smaller and smaller configurations before

sampling. The sample is drawn from the smallest unit of analysis. Multi-stage sampling is often preferred for

its functionality and cost-effectiveness compared to simple random sampling. Multistage sampling will

commonly use multiple approaches to sampling within the various stages.

For example, if you want to randomly select individuals from a household beneficiary list, but you only need

one respondent per household, you may start by randomly selecting households from the list (first stage),

then ask the members of the household to give you a complete list of household members who meet the

2

This is potentially problematic and is often used incorrectly in cluster sampling, e.g., "we pre-selected this district purposively and then took 26% of

our sample from there because they have 26% of the total population," when actually a PPS approach is what is needed to choose the district.

3

Note that oversampling is done to facilitate the analysis of specific sub-populations. For analyses of the overall population, any over-sampling that

was done will need to be accounted for through weighting to ensure that the minority population is not over-represented in point estimates for the

larger population.

April 2020 | 7

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

inclusion criteria (e.g., women in reproductive age, elderly visiting health clinics, working men), and choose

randomly from that list (second stage).

Cluster Sampling

A cluster sample is a special kind of multistage sample.

4

In cluster sampling, you divide the population into

clusters, select a subset of those clusters, and then select a sample from within each of the selected clusters.

A cluster is the smallest area unit selected for a survey. An example of a multistage cluster sample is

choosing 20 schools randomly from a list of 300 schools, and then selecting 40 students from each selected

school from a total sample of 800 students. An enumeration area is a special kind of cluster and the

result of having a census. Enumeration areas (EAs) are small geographic units specifically designed for census

data collection and often designed to be equal in size.

Clusters may be selected randomly or purposively, and the selection of the sample within the individual

cluster is generally probabilistic. When clusters are selected probabilistically, so long as the right weighting is

applied at selection and analysis, generalizability is feasible. However, it is important to remember that when

choosing clusters purposively, findings should not be extrapolated more broadly than that specific cluster.

For example, if an intervention is designed to improve the health status of women in a rural district in the

northeast of a country, findings from that sample should not be ascribed to the entire region, only the

specific district purposively selected for the cluster. Similarly, when an entire region is probabilistically

sampled, the findings from that sample would be representative of the whole region, not only the selected

clusters.

The approach to sampling will vary based on the design and the sample frames, but systematic and stratified

ap

proaches are both common. In cluster sampling, it is assumed that clusters are naturally defined (e.g.,

households, schools, clinics, counties) so that the sampling units within are similar in nature (e.g., the

individuals within a cluster share many characteristics). Otherwise, sub-populations may be over- or under-

represented, depending on which clusters are selected. Later, we will discuss strategies survey designers use

to address this challenge.

4

Not all multistage samples are cluster samples, but all cluster samples are selected in stages.

April 2020 | 8

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

Sampling Basics

Questions to ask yourself:

What is the primary use of the findings from

this study? Have you communicated them

with the survey team?

Understa

nding the intended use of the findings will better

equip the survey team to create a strong sampling design.

Are any of

your study questions designed to

result in quantitative findings about a

subpopulation that is 10 percent or less of

the total population?

If so, the s

urvey design might need oversampling. Consult

with the des

ign team to decide whether oversampling is

necessary. **Recall that oversampling

is

a special type of

stratified sampling that intentionally includes more sampling

units into the sample size than would be included through a

randomized sa

mple. This is designed to

ensure that there

are enough

members of a particular group

displaying a

specific, usually low-prevalence, characteristic to conduct

sub-analyses

on that group.

5

Question to ask your survey team:

Is your survey team planning on making

claims about an entire population based on a

sample?

If so, conf

irm that they are also using a probabilistic

sampling

method. The most common probabilistic design

used at USAID is a multi-stage cluster design, in which case

confirm that each stage of sampling is clearly defined.

How Do I Choose a Sample Frame?

Sample Frames and Sampling Bias

Recall that a sample frame is a group of units from which a sample is drawn; it will be roughly but not

exactly the same as the group of units that the sample is expected to represent, the study population. It

defines the units eligible to be sampled. In multi-stage sampling, each stage has a defined sample frame or a

selection rule (remember that in multi-stage designs, some stages may be probabilistic while others are not).

A sample frame can include households within a political-administrative division, like a county or region, or a

list of identifications for people in a specific area, like a local registry or a program participant list. In each

case, the sample frame has the potential to introduce sampling bias because the sample frame may differ in

small or large ways from the intended study population.

A sampling bias occurs when the traits of the units within the sample frame (e.g., spotty list of program

participants or records on the participants who are most interested in the services and come more regularly

to meetings) are different from those in the population that you are trying to study (e.g., all program

participants). The differences may be slight, based on a trend in behavior, or more extreme, for example,

when the choice of sample frame has the effect of entirely excluding a specific sub-group of the population

from the sample frame. For example, if all the people who own a cell phone in a specified town are used as a

sample frame to randomly select community members for a community-based public health survey, then

those without phones would be systematically excluded. This is not to say that using the telephone numbers

as a sample frame is wrong. However, excluding those who do not own a phone may introduce bias (Are

they older? Less wealthy? Less comfortable with technology?) and should be addressed in the clarification of

the study limitations and in the interpretation of its results.

5

Kish, L.: Survey Sampling. John Wiley & Sons, Inc., New York, London 1965, IX + 643 S., 31 Abb., 56 Tab., Preis 83 s.

April 2020 | 9

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

Sampling limitations are often addressed in specific sections of both survey design proposals and survey

reports. What qualifies as a limitation depends uniquely on each survey design and its associated questions.

A limitation can be any significant weakness in the design by which the findings could be influenced. In the

example given above, a limitation might be that cell phone ownership is correlated with socioeconomic

status, and therefore the poorest people in the study population are systematically under-represented.

How Do I Choose a Sample Frame?

Question to ask yourself:

Who are the people your study questions are asking

about, and how well does the sample frame matches

that study population?

Knowing the primary subject of your study

questions will help determine an appropriate sample

frame.

Question to ask your survey team:

What is the sample frame for each stage of

sampling?

Most population-based surveys at USAID are multi-

stage, cluster designs. The survey team should be

clear about how selection is approached at each

stage.

How is the sample frame being constructed? What

are its limitations in generalizing to the study

population?

Most sample frames in population surveys are

proxies for the total population, and each choice of

frame will come with limitations.

Making Generalizations

Sample frames are important. They sometimes limit the extent to which the findings of a study can be

generalized. This is a separate issue from the issue of sampling bias; it refers to the ability to make inferences

about the overall study population on the basis of a sample. Almost all samples have some degree of bias;

but too much bias can impede the ability of researchers to apply findings from within the sample to findings

outside the sample. In the same cell phone example, the sample frame is imperfect, but results can be

inferred to represent the whole community, albeit with some degree of bias. Findings based on this sample

would not be appropriate to generalize outside the community from which the cell phone registry was taken,

because the sample frame was only selected to represent that one community.

How Do I Review Sample-Size Calculations?

This section gives a basic overview of common parameters and

considerations involved in calculating a sample size. Parameters are

values that need to be set to complete a sample size calculation. It also

provides a checklist for reviewing sample size calculations.

Common Parameters

Sample size is the number of respondents needed to estimate the

statistics of the population of interest with sufficient precision for the

inferences you want to make. Different formulas are used to estimate

the necessary sample size depending on the sampling methodology and

the type of analysis planned. However, all formulas use a common set of

parameters. Recall that parameters are values that need to be set to

complete a sample size calculation.

Sample Size Formulas:

The

formula used to calculate sample size

depends in part on the nature of the

desired statistical test,

which, in turn,

is partly determined by the nature of

the variables being measured.

Annex B

of this document provides

a quick guide to the most common

inferential statistical tests that are

used for different combinations of

variables.

April 2020 | 10

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

This section explains the most common parameters used in sample size calculations: design effect, effect

size, statistical power, confidence level, margin of error, significance, non-response, and attrition. For an

example of a sample size calculator, refer to USAID’s Feed the Future Sample Size Calculator.

Design Effect

For a cluster design or other multi-stage design, it is necessary to factor in a design effect (DEFF) in the

sample size calculation. The design effect is an additional error that is introduced by the sampling design.

Multi-stage designs have less precision and greater potential for error than simple random sampling. DEFF is

the difference between the error the survey has because of its design, and the error it would have had

under a simple random sample.

The DEFF makes

the adjustment needed to find the survey sample size when using sampling methods

different from simple random sample. Effective sample size is equal to the actual sample size divided by

DEFF.

Actual DEFF ca

n only be calculated after data

have been collected and analyzed for variance,

but design effects can also be estimated before

data collection to more accurately estimate the

sample size needed in complex designs. For

example, to calculate sample size in a cluster

design, a survey team needs to know the

number of clusters that will be sampled and the

size of each cluster. This will ultimately be used

to calculate an intraclass correlation coefficient

(ICC), which is necessary to calculate DEFF

after all data have been collected. The ICC

measures the amount of total variation in an

outcome that can be attributed to differences

between clusters. It uses measures of variation

within clusters and variation between clusters.

Predicting what this coefficient will be is the

most challenging part of estimating DEFF. If

there are no existing data (from other surveys

in the area, for example), then a range of values

should be tested to see how the effective

sample size changes in response to different

possible DEFFs. The higher the intraclass

correlation coefficient, the larger the sample

size needed.

Table 1: Sample Size and Design Effect

Examples of sample size calculations for three common Margin of errors: M1 =

.05; M2 = .07; M3 = .10.

A. Sample Size Calculation: Design Effect 2.0

M1

M2

M3

Estimated Proportion

0.500

0.500

0.500

Alpha

0.050

0.050

0.050

Confidence Level

0.975

0.975

0.975

Margin of Error

0.050

0.070

0.100

Design Effect

2.0

2.0

2.0

Initial Sample Size 769 392 193

Plus 5% N on-response 807 412 203

B. S

ample Size Calculation: Desig

n Effect 4.0

M1

M2

M3

Estimated Proportion

0.500

0.500

0.500

Alpha

0.050

0.050

0.050

Confidence Level

0.975

0.975

0.975

Margin of Error

0.050

0.070

0.100

Design Effect

4.0

4.0

4.0

Initial Sample Size

1,537

784

385

5% Non-response

1,614

823

40

The two examples above show how the design effect and margin of error

influence the sample size needed to be able to accurately estimate the

proportion of a variable in a population. The more precision desired, as

illustrated by the smaller margin of error, the larger a sample size needed.

Similarly, the larger the design effect or possible error introduced by the

sampling design, the larger the sample size needed.

DEFFs are always ≥1, where 1 represents

simple random sampling, and therefore, there is

April 2020 | 11

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

no design effect. The higher the design effect, the smaller the effective sample size. A DEFF of 1.5 means that

the actual sample needs to be 150 percent higher than what it would be if there was no design effect. Refer

to Table 1. Note that with the exact same parameters, only different DEFF’s, the first example uses a DEFF

of 2 and the second 4- doubling the sample size.

Scenarios that would increase DEFF include when clusters are few and large or when clusters are very

different from one another, or the number of PSU’s per cluster is high. When existing DEFF data are not

possible to find, a common DEFF is 2. A DEFF can be naturally lowered by sampling from a larger number of

smaller clusters, rather than only a few larger clusters, to achieve a comparable sample size. The larger or

fewer clusters being sampled from, the greater the potential for over-representing the traits of that cluster

in the total sample.

Effect Size

The effect size is the strength or magnitude of the difference between the sets of data. Often, the sets of

data represent before and after values for a group that received an intervention and for a control or

comparison group, to measure the size of the difference in the effect of that intervention relative to the

control. The smaller the effect size, the larger the sample required to detect it. Effect sizes are seen in

impact evaluations more often than performance evaluations.

The formula used to calculate sample size depends on the specific hypothesis test planned for the data.

Sample sizes should be calculated for all outcomes to be measured, and the largest (most conservative) of

the sample sizes used. Often, survey teams will measure more than one outcome, and in these cases, they

should use the outcome with the smallest estimated effect size for their sample size calculation (which will

require the largest sample size to detect). A review of background literature can provide a sense of what the

effect sizes might be. It is often wise to calculate sample sizes from a few different effect sizes within a range

(e.g., five percent, ten percent, and 20 percent). This is called a sensitivity analysis.

Remember that the effect size you use to calculate sample size is an estimate of the effect size you want to

achieve (your target). Use the estimate that is the minimum you wish to be able to detect.

Statistical Power

Statistical power, used for inferential statistics, is the probability that if a real effect exists (for example, the

difference between the two groups before and after an intervention), the sample selected will be sufficient

to detect it. To calculate a sample size for inferential analysis, the survey team will need to decide on a

statistical power. The higher the power, the more likely the study will detect an effect, but it also requires a

larger sample. The value for this parameter most often used in social sciences is .80.

Confidence Level, Margin of Error, and Confidence Interval

Methods to calculate sample size require you to decide on a confidence level and a margin of error. The

confidence level is one measure of the validity of your results, and the margin of error is a measure of

their precision. The more precision you want (i.e. the smaller the margin of error), the larger the sample

size you will need. Likewise, the higher the level of confidence you want to have in the validity of your

results, the larger the sample size you will need.

April 2020 | 12

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

When calculating a value from data, such as a point estimate or an effect size, statistical techniques are used

to determine a range within which the “real” value is likely to fall, with a specified level of confidence. If the

confidence level is 95 percent, for example, then if a study could be repeated 100 times, in 95 of them the

identified range of values would include the “real” value. The higher the level of confidence you want to have

in your result, the larger the sample size needed. Commonly used confidence levels are 90 percent, 95

percent, and 99 percent, but 95 percent is the most common.

The margin of error refers to the amount of error due to random factors you wish to allow in your results;

in other words, it determines the amount of precision you will have for your result. Survey teams choose a

specific margin of error they want to aim for. Increasing the sample size reduces the amount of error, so

reducing the margin of error requires increasing the sample size.

The margin of error is related to the confidence interval; it is half the width of the confidence interval. The

confidence interval is the range within which your result falls, at your desired confidence level. You might

see a confidence interval expressed as: “Mean = 15.6 (CI 14.8; 16.40)” or “Mean = 15.6 ± 0.8.”

Significance and Alpha

Significance is a feature of the results of hypothesis tests. A finding is called statistically significant when

there is a low probability that it is due to chance alone. When a statistic is significant, it simply means that

the survey team is very sure that the finding is real and not due to chance. It doesn't definitively mean the

finding is valuable or that it has specific decision-making utility. Significance is related to confidence level and

Alpha. At a confidence level of 95 percent, a significant result is one the survey team can be 95 percent sure

is due to an actual difference between the samples and not to random chance. On the other hand, Alpha is

the probability of rejecting the null hypothesis when the null hypothesis is true or the probability of being

incorrect. Therefore, if the confidence level is 95 percent, Alpha is 0.05.

Non-Response

When calculating sample size, include a factor of non-response. This means accounting for selected

respondents who will choose not to participate or not to answer questions about the outcomes you wish to

measure, effectively adding to the needed sample size. The estimated percentage of non-response can be

drawn from comparable studies in similar locations. A common non-response rate estimate for sample size

calculation is 5-10 percent.

Attrition

Attrition is particularly relevant for longitudinal studies (studies that takes place over a pre-determined time

period, using repeated observations of the same subjects). Selected respondents at the beginning of a study

may move or decline to participate before it has been completed. In these cases, attrition may also be

accounted for but is distinct from non-response.

Attrition and non-respo

nse may each introduce bias into your findings, particularly if certain kinds of people

are more likely to drop out because of their characteristics. For example, younger and lower-income people

are more likely to move and may move away from the study area at higher rates than other people. If the

outcome is related to age or wealth, then the loss of these individuals may result in over- or under-

estimating the outcome.

April 2020

| 13

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

Attrition as a limitation should be acknowledged by survey teams, mitigated where possible by weighting the

data in the analysis stage to account for missing data, and considered in the interpretation or generalization

of findings.

How Do I Review Sample-Size Calculations?

Question to ask yourself:

How much precision do you need around a

point estimate? This means, in order for the

findings to be useful for the purpose of the

intended audience, how close do you need to

be to the measurement of interest if it were

to be measured perfectly?

Not all measurement purposes require high precision. For

exam

ple, measuring the average number of children per

family for the purpose of describing national demographics

might require less precision than knowing how many

children in a specific district are undernourished and

therefore intended targets of a nutrition intervention.

Recall that higher precision requires larger samples sizes.

Higher sample sizes require larger budgets. Therefore, it is

prudent to understand the degree to which your

measurements need to be precise.

Question to ask your survey team:

What parameters are being used to calculate

sample size, and how were they selected?

Your s

urvey team should be able to justify the parameters

they have selected, including those based upon common

practice, and those based on reasonable, data-driven

estimates. Review the estimates, especially for parameters

relating to your outcomes, to be sure they match your

expectations and the degree of precision needed. See

Annex D for Common Sample Size Parameters

Other Considerations

Population Estimates

Population data are required for sample size calculations for a representative survey, as well as for

probability-proportional-to-size selections. In scenarios where quality census data exist, population data can

be provided at the enumeration area level. As previously mentioned, enumeration areas (EAs) are small

geographic units specifically designed for census data collection and often designed to be equal in size,

making sampling from them much more straightforward. To be clear, an EA is not a generic term and is only

the direct result of having a census.

If there are no quality census data, as in countries with failures of governance or a history of conflict, and

widespread population movements, designers of a sampling frame will need to compensate by including an

alternative for population estimates that sufficiently representative of the population being studied if they

wish for their survey to be representative at the population level. In most cases where EAs are available,

they are likely to be preferred for use as clusters, because they have already defined geographic boundaries

and associated population data.

April 2020 | 14

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

Proportional Allocation of the Sample

In cluster designs (and some other cases where people are selected in groups, as when sampling schools or

the catchment area of a clinic or service provider), there is a risk of over- or under-representing specific

characteristics or traits in the results, because they are more or less prevalent in that cluster or group than

in the total population. This can be particularly important when there are differences in characteristics

between rural and urban populations.

Consider a situation in which ten towns

are eligible for selection, and the population of the towns’ ranges

from 542 at the low end to 251,724 at the high end, with a total population across the ten of 588,766. If a

simple random sample is used to select towns, each with a one-in-ten chance of being selected, then the 542

people in the smallest town will have a one-in-ten chance of selection even while making up <1 percent of

the total population. The characteristics of residents of that town will be over-represented relative to the

total population. This can be addressed through weighting at analysis (in which analysts “count” some

respondents less than others by specific percentages), but another popular approach is to use probability-

proportional-to-size (PPS) selection.

In PPS s

ampling approaches, random selection is still used, but a cluster is assigned a probability of selection

that is equal to the proportion of the overall population made up by the residents of that cluster. In our

example from above, the smallest town would have 542 chances out of 588,766 of being selected (that is, if

tickets were being drawn from a hat to select the town, it would have 542 tickets in the hat, while the

largest town would have 251,724 tickets, and so on).

Usually, PPS sampling is achieved using a sta

tistical software program, which requires reasonably reliable

population estimates for each cluster. This could be a list of towns within a geographic area, but it may also

be a list of EAs or some other geographic unit. In either case, the population estimates used for PPS

sampling should be confirmed by survey teams on the ground. This is usually accomplished by conferring

with local officials when they arrive in town. The updated population estimates will be used to apply a

weight at the analysis stage to correct for any errors in the estimates used and to ensure that the resulting

statistics are as representative as possible.

6

In most countries, relatively current pop

ulation estimates are readily available, but in some countries where

USAID works, particularly those affected by disruptions to governance or on-going conflict, population data

may be unavailable or too outdated to use, complicating the use of PPS. In such cases, it is recommended

that survey commissioners or implementers consult with implementing partners, other donors, and UN

agencies operating in the area, who may have collected population data from towns in which they work. In

cases where population estimates are suspected to be of low quality, they may still be used for PPS selection

of clusters, but surveyors should confirm population figures for clusters they visit; usually, this information

can be obtained from local authorities. If estimates are found to be substantially different from those used

for PPS selection, weighting can be applied at analysis to correct for this difference. Such a practice can be

beneficial, even when surveyors are reasonably confident in the estimates used for PPS, but is essential when

6

An alternative to PPS is to define clusters so that they have equal sub-populations, and then the clusters can be selected with a simple, unweighted,

random sample. This is the practice behind EAs, which are often determined so as to have a common range of households and equal sub-

populations.

April 2020 | 15

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

data are suspect. See Box 1 for some alternative sources of population data when census data are not

available.

Box 1: Population Data Sources: Census data is the most straightforward way of estimating population size.

However, not every country where USAID works has an up-to-date, quality census. Census data that are old can still

be used in many cases, but not if: 1) they are very old (if a census has not been done in several decades, for example),

or 2) there have been large-scale population movements due to conflict, natural disaster, or urban migration since the

time of the last census. And in some rare cases, there is simply no census at all. Alternative approaches to identifying

population data for use in PPS sampling include:

• Tapping into implementing partner (IP) population estimates. IP’s usually keep up-to-date population counts

for the areas in which they work, or have relationships with local authorities who can provide the data.

• Examining whether there are any USG-supported surveys occurring in the country. The US government

supports a wide range of studies in different sectors (for example, the Demographic and Health Surveys and

various rounds and regions of the global barometer surveys). If a representative survey is being conducted,

you can inquire about the source of the population data they are using.

• Reaching out to UN agencies operating in-country. The United Nations Population Fund (UNFPA) and other

UN organizations sometimes conduct population estimation exercises when there is no available census data.

If conflict has caused population movements, the International Organization for Migration (IOM) may have

data to share.

• Check the availability of estimates derived from satellite imagery, such as LandScan from the Oakridge

National Laboratory, which is free to USG. LandScan is developed using best available demographic (Census)

and geographic data and remote-sensing imagery analysis techniques to disaggregate and impute census counts

to small geographic units within any given administrative boundary.

Other Considerations

Questions to ask yourself:

Did the survey team include a design effect, and if

not, do they have a good reason for not including

it?

In simple random sampling, which is often possible

within beneficiary groups, there is no additional

error introduced with design. However, with any

multistage cluster design, there should be a listed

DEFF within the design document.

Questions to ask your survey team:

How was the DEFF determined?

If a survey design estimates too low a DEFF as a

way of keeping sample size and costs low, it risks

resulting in an underpowered survey. All multistage

surveys should include a design effect that is > 1,

and if there is no design effect included in the

sample size calculations or the design effect = 1,

you should be asking your survey team why.

Sensitivity Analysis

When various sampling designs are being considered, survey teams may conduct a sensitivity analysis to

determine reasonable levels for effect size and design effect. Recall that effect size and design effect, as used

in a sample size calculation, are (ideally) based on existing, comparable studies or based on knowledge of the

field, and the estimates are ultimately chosen by the survey team. The design effect can only be estimated at

this stage and is not definitively calculated until the data analysis stage. Effect size is an estimation of change

to be detected. Therefore, the effect size and design effect used in the sample size calculations are informed

estimations for empirical parameters that will be calculated later. To conduct a sensitivity analysis, survey

April 2020 | 16

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

teams first review comparable studies to note the DEFF and effect size. The effect size estimated by other

studies can suggest a reasonable effect to assume, given a particular sector or study purpose. Existing studies

with similar sampling designs in the location of interest will also provide insight into what one can expect the

DEFF to be at the analysis stage. Second, the survey team would use estimated values for the DEFF and

effect size, based on these resources, to run sample size calculations at different DEFF and effect size levels,

using different sampling designs (e.g., number of clusters). Ultimately, survey teams choose one of the sets of

parameters (and the associated sample size) as the one that best meets their (sometimes competing) needs.

By having done sensitivity testing, survey teams can have more confidence in the DEFF and effect size

estimations selected as they relate to the purpose of the survey and existing limitations, like time frame and

budget.

What Does Sampling Look Like in Practice?

This section gives a basic overview of sampling stages in a cluster design using enumeration areas (EAs) and

without EAs. When EAs are available, they should be used. If EAs are not available, aspects of the

environment will determine your options, including whether there are independent population estimates

available (see Box 1 for sources).

Sampling with EAs

Prior to sampling, survey teams should know the geographic boundaries they wish to focus on. These

boundaries will determine the sample frame for the initial stage of sampling. Geographic boundaries are

typically at the district, regional, or country level.

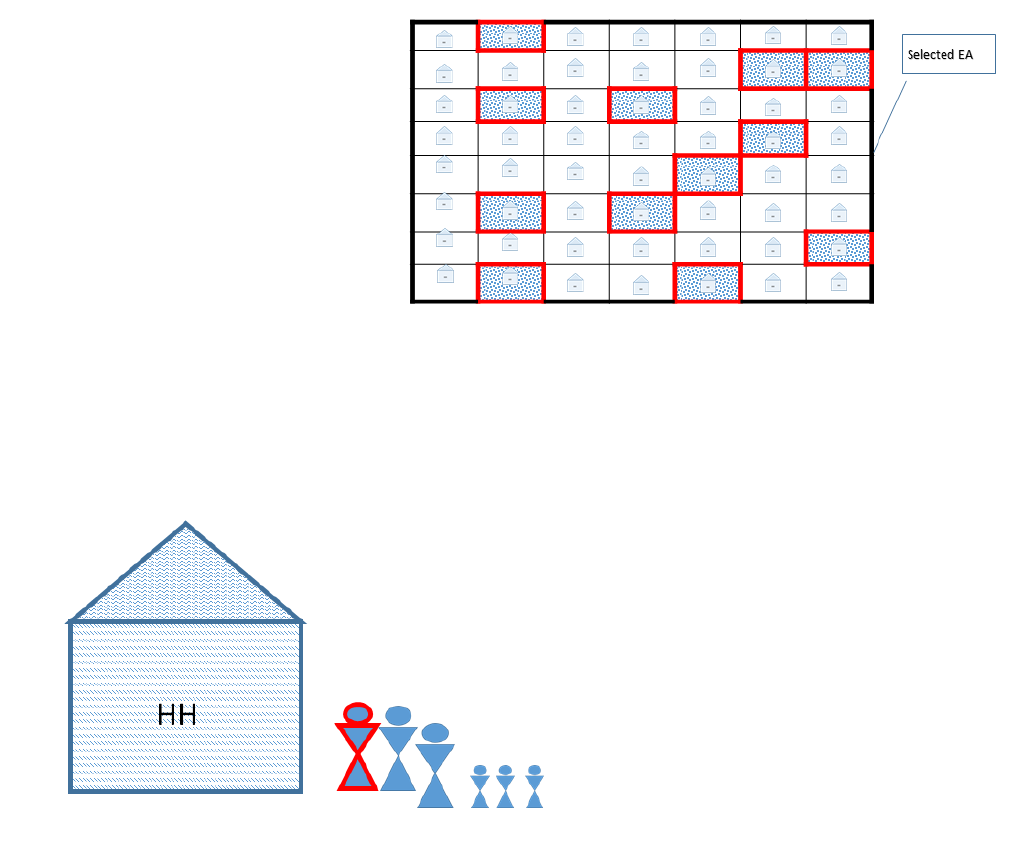

Figure 2: Randomly Selected EAs within the Sample Frame

Stage 1: Selection of EAs (these will be

the PSU). Once the sample frame is set, the

sample EAs can be selected. Because lists of

EAs are sometimes available (often with

number IDs, along with population sizes and

GPS coordinates), EAs can be selected

through either simple or systematic random

sampling. They may also be selected using a

PPS approach, particularly if they vary

considerably in their population size. In either

case, data should be weighted at analysis to

account for population size. As an illustration,

in Figure 2, the ce

lls in red represent the selected EA’s from the sample frame. Note, some EA’s are inside the

sample frame, but not selected for data collection.

April 2020 | 17

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

Figure 3: Randomly Selected Households within the Selected EA

Stage 2: Selection of HH. If household

numbers are available within EAs, then

HHs can be selected randomly from an

existing list (see Figure 3). If household

numbers are not available, a household

list can be constructed manually, usually

by consulting with local authorities and

completing a community map. An

alternative approach to household

selection is a transect walk. In a transect

walk, each member of the survey team

starts from a specific point within an

enumeration area an

d walks in a randomly selected direction, interviewing every n-th household. If transect

walks are used, the rules for selection should be clearly specified and consistent across all EAs in the survey.

While not strictly a probabilistic approach to household selection, this kind of approach is commonly used

wherever it is impractical for a survey team to list households.

Figure 4: Household Respondent Selection

Stage 3: Ru

les for selection of HH

members. Once a household is selected,

HH members may be selected according

to pre-identified selection criteria, or else

randomly (the person outlined in red in

Figure 4). Some surveys are designed to

include all eligible household members in

the survey; more commonly, a specific

type of respondent is desired (e.g.,

household heads, women who gave birth

in the last six months, or adults between

the ages of 18 and 65). If only one

respondent is desired per household, and

that person has not been pre-identified

by role, enumerators should list all eligible household members (if there are more than one), and select

randomly among them using a random number chart. Survey designs should be clear and specific about how

household members will be selected.

To summa

rize, the proceeding sampling steps, the household in Figure 4 was inside the sample frame and

geographically located within one of the selected EAs within the sample frame. Among all of the households

in the selected EA in which this household live, it was again selected to be part of the data collection. Once

the household was selected, a rule was applied whereby only one person, the one highlighted in red in

Figure 4, was selected to respond for that household.

April 2020 | 18

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

Sampling without EAs

Sampling without EAs is different than sampling with EAs - but only in the first stage of sampling. When EAs

are not available for an area, survey teams will usually use a locally relevant administrative unit instead – like

a county or village. It is essential that the unit be locally relevant because survey teams will likely depend on

local authorities for confirmation of population estimates. The choice of administrative units will depend on

a number of factors, including availability of population estimates, logistical constraints, and the number of

clusters to be visited.

What Does Sampling Look Like in Practice?

Question to ask your survey team:

Does your country have EAs? If so, what

year was the census? Have there been large

population movements since the census was

conducted?

When quality EAs are available, they are the best option.

However, if large population movements took place after

the census or data quality is questionable, the data may not

be usable as a reference for population data. Recall that EAs

are small geographic units specifically designed for census

data collection and often designed to be equal in size, making

sampling from them much more straightforward. To be

clear, an EA is not a generic term and is only the direct

result of having a census.

Questions to ask your survey team:

If using PPS, what approach does the survey

team intend to take to confirm estimates

used in PPS allocation in the field?

The population estimates used to calculate the sample size

should be confirmed in the field. The data is then weighted

based on the confirmed population numbers, not the

estimated numbers used to calculate sample size. Weighting

means counting a respondent’s value as slightly more or less

than one, based on the portion of the population their

cluster represents. This is done because the population

numbers gathered during data collection will always be the

most recent compared to other available data.

Why is My Input in These Decisions Important?

Survey design teams will make dozens of decisions over the course of a survey design. In most cases, these

decisions do not necessarily have a right or wrong answer but do entail a set of trade-offs with respect to

your study questions and how you will be able to interpret findings. The intended utilization of the data will

inform which trade-offs are tolerable and which are not. Without your input, survey teams may find

themselves making judgment calls based on their assumptions about how you will use the data; even

experienced survey designers may make the wrong choice if they do not know your priorities.

Reasons you want to be involved in survey design: Decisions made during design will

impose permanent, irreversible constraints on how data can be used.

• You may be tempted to think that even if you cannot get the sample size you need for the analyses

you desire; a small survey will be better than nothing. This is not true. There is likely to be a

better use for your resources, because an underpowered survey will not give you the information

you want.

April 2020 | 19

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

• If your survey is underpowered, you probably won’t be able to answer the questions you want to

answer about your data, but you also won’t know why your findings are weak. You won’t be able to

tell if they’re weak because there’s no finding to detect, or if they’re weak because your survey was

simply too underpowered to detect it.

• The sample size you need depends on the statistics you plan to use. Survey teams need a very clear

idea of your data needs and the intended use of the findings to know what statistical analyses are

likely to be needed. Discuss the kind of statistics that meet your use needs with the survey team

before they finalize the sampling design.

• Sampling determines who is represented by the data; if you want all voices represented in your

survey, you have to be confident in your sampling design and your ability to generalize. Discuss the

issue of generalizability directly with your survey team, and know the selection rules at each stage of

sampling.

April 2020 | 20

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

About the Authors

The authors are staff from MECap*.

Julie Uwimana has been with MECap since 2016, previously serving as an M&E Fellow with the Bureau for Policy,

Planning and Learning (PPL), and the Monitoring, Evaluation, and Learning team in the Bureau for Food Security (BFS).

While at BFS, she supported the Feed the Future Zone of Influence representative surveys in Mali and Ethiopia. Before

joining USAID, she spent seven years working on monitoring, evaluation, and learning with USAID implementing

partners, as well as the Department of State. She holds a Master’s Degree in International Development from the

Graduate School of Public and International Affairs at the University of Pittsburgh.

Jennifer Kuzara has been with MECap since 2015, serving as an M&E Fellow with USAID Somalia and the Middle East

Bureau before joining MECap's core team as a Senior M&E Specialist. Prior to joining USAID, she worked with CARE

in Atlanta for seven years, where she led and supported population-based surveys and contributed to the development

and piloting of a socio-psychological tool to measure women's empowerment. She also held a fellowship at the

Centers for Disease Control and Prevention (CDC), where she supported the Community Guide for Preventive

Services in conducting systematic reviews and meta-analyses of public health program evaluations. She holds a Ph.D. in

Anthropology and a Masters of Public Health in Epidemiology from the Rollins School of Public Health, both earned at

Emory University. In addition, she holds a certificate in Global Mental Health from the Harvard Program for Refugee

Trauma and has received supplemental training in Formal Demographic Methods from Stanford University, in

transcultural psychiatry from McGill University, with a focus on the development and validation of conflict-sensitive,

culturally-aware psychometric tools, and in research design and field methods from the National Science Foundation.

*Expanding Monitoring and Evaluation Capacities is an institutional support contract managed by the Bureau for Policy, Planning

and Learning, Office of Learning, Evaluation and Research. MECap collaborates with Mission and Washington offices to deliver specialized

technical assistance that improves planning, design, monitoring, evaluation, and learning practices.

Acknowledgements

The authors would like to thank the colleagues who spent valuable time on reviewing and providing feedback to the

authors on the content and format of this document. The final resource is no doubt stronger for their efforts.

Acknowledgements are due to Jerome Gallagher, Lesley Perlman, and Anne Swindale for early input on the direction

of this resource; to Tonya Giannoni and Virginia Lamprecht for careful review and feedback on the framing and

audience, to Erica Schmidt for assistance with editing and layout; and to Daniel Handel and Joe Amick for volunteering

to review the final product. A special thanks is due to Michaela Gulemetova, who carefully reviewed the statistical

content for accuracy and clarity.

This document is one from a series of MECap Knowledge Products. MECap Knowledge Products include guidance,

templates, training materials, and conceptual frameworks to strengthen Agency processes of planning, commissioning,

and using monitoring data and evaluation findings for strategic learning and planning.

This publication was produced at the request of the United States Agency for International Development (USAID). It

was prepared under the MECap task order, contract number AID-OAA-M-14-00014, managed by Social Solutions

International. The views expressed in this publication do not necessarily reflect the views of USAID.

April 2020 | 21

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

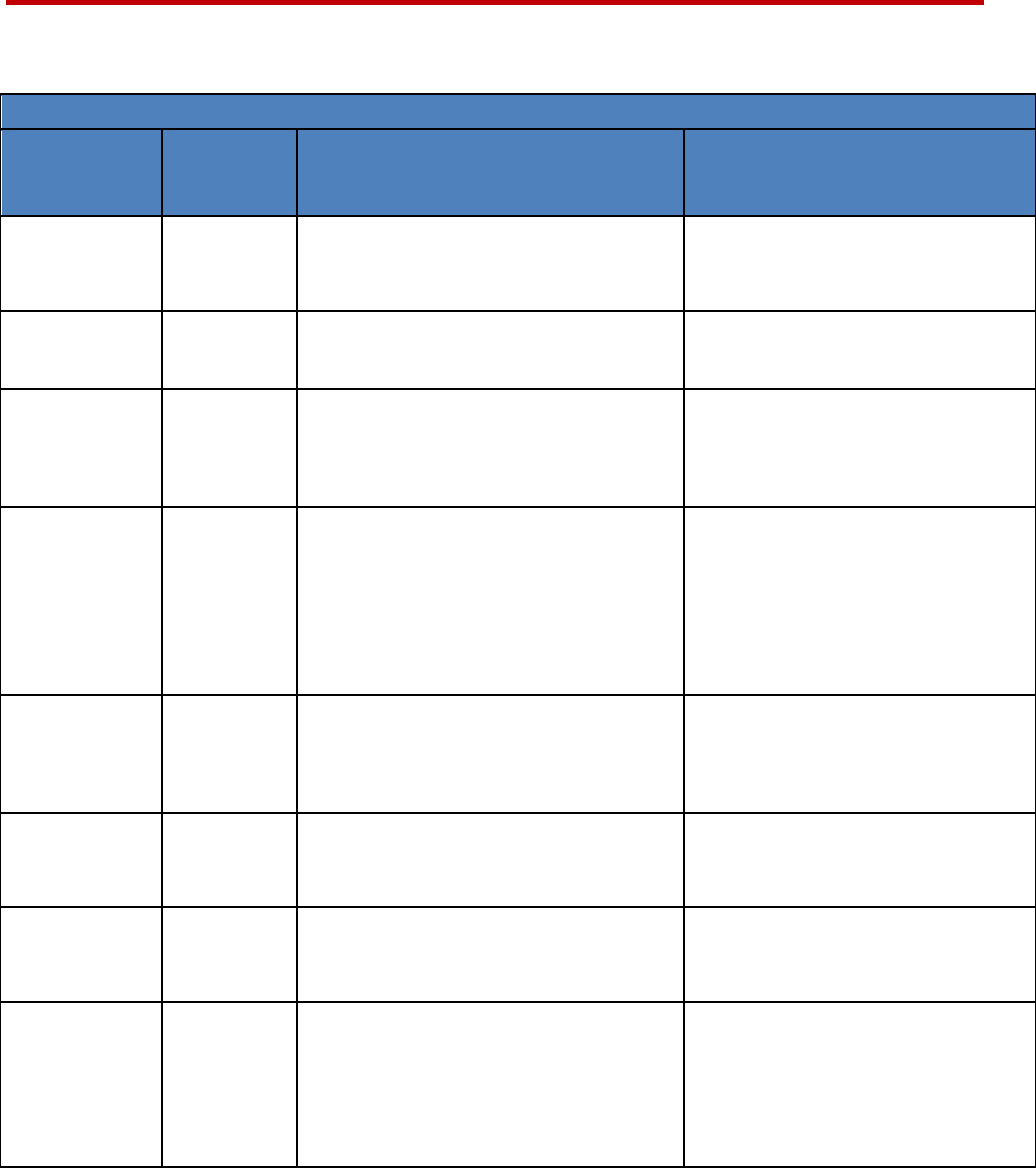

Annex A: Sampling Design Review Checklist

Sampling Review Checklist

A population-based survey is

needed

Population-based surveys sho uld not be chosen lightly. They are

more complicated than some other kinds of surveys because they

typically require multistage sampling, which can be more expensive

and time-consuming than other approaches. They should only be

used when it is essential to characterize the whole population of an

entire geographic area. In many cases, study questions focused on

project beneficiaries can be answered using simpler sampling

approaches that are representative of the beneficiary group (but not

necessarily the larger population).

Use of the findings are clear How does the information gathered align with the project for

activity theories of change? What are the programmatic implications

of the findings? Use should be at the forefront of decision-making

when determining the variables for the analysis.

What are the ‘need to know’ and ‘good to know’ characteristics to

be collected? The more variables and characteristics being collected

in the survey, the more costly it will be. Using a shorter survey may

allow for a larger sample within the same budget.

What sub-populations might be of interest in the analysis? If a sub-

analysis is planned on a minority group, over-sampling may be

needed to attain adequate representation.

An intentional sampling

design exists

If a design document mentions sampling, it should also explain how

the sampling will be conducted. The design should include step-by-

step processes for sampling unit selection. For example, is it simple

random sampling from a beneficiary list or multistage-stage cluster

sampling? If the latter, have they explained sampling at each stage,

including how clusters will be selected? This information should be

clear.

Randomness is clearly

identified

Confirm that each stage of sampling for which generalizability is

desired has an element of randomness. What is important is that

each stage of sampling should be clearly explained with respect to

why and how randomization is being introduced or not. If selection

is purposive - particularly in the first stage of sampling - it affects

generalizability.

Appropriate sample frame Compare the sample frame identified in the design to the subject of

the study question being investigated. In an effort to cut time and

cost, a survey team may propose a sample frame smaller than what

is needed for the desired generalizability. This is problematic. The

data from a representative study can only be generalized to the

population included in the sample frame. For example, if your frame

includes only adults aged 25-60, you cannot generalize to those

outside this age range.

Limitations are clearly

addressed

Sample frames are imperfect. Limitations that exist with the

selection of a sample frame should be recorded in detail.

April 2020 | 22

Sampling Review Checklist

A Commissioner’s Guide to Probability Sampling for Surveys at USAID

Design effect is justified If your survey includes a cluster design, then the sample size

calculation includes a design effect estimate. Design effects can be

naturally lowered without increasing the sample size by visiting and

sampling fewer respondents, each from a larger number of clusters.

However, a sampling design that includes a large number of clusters

is more expensive than a sampling design that uses fewer because of

the increased need for travel, logistics planning, and time.

Although lowering a design effect estimate is tempting because it

lowers the sample size calculated, the design effect itself will be

based on the actual nature of your data; underestimating it will