Knights of Columbus

Enrollment Guide for

Medicare-eligible individuals

LOOK INSIDE TO LEARN MORE ABOUT:

• Connecting with a benefits counselor

• Exploring your new healthcare coverage options

• Enrolling in a plan that meets your needs and budget

This Enrollment Guide contains important information on how your current Knights of Columbus-sponsored retiree

healthcare coverage for you and any eligible dependents will be changing. It is important that you read through all

pages carefully. You must take action by enrolling in your new healthcare plan — with a benefits counselor — in order

to have the coverage you need.

Mercer Marketplace 365+

SM*

Retiree

P.O. Box 14401, Des Moines, IA 50306-3401

Online: retiree.mercermarketplace.com/kofc

Toll-Free: 855.254.1187

For deaf or hard of hearing: Dial 711 for

Telecommunications Relay Service

Fax: 857.362.2999

* Services provided by Mercer Health &

Benefits Administration LLC.

2

SUCCESSFUL ENROLLMENT USING A STEP-BY-STEP PROCESS — Following these steps will help you

understand what to expect, what is needed, and how to get ready for a smooth transition. Page 2

PREPARING FOR YOUR CONSULTATION — Using this guideline will help you get the most out of your

appointment with your benefits counselor. Page 4

COVERAGE AND PLAN TYPES — Utilize these pages for understanding which plan options may best fit

your needs and budget. Page 6

OTHER INSURANCE OPTIONS — Understand how you can build complete coverage with Dental and

Vision insurance. Page 7

HRA INFORMATION — Understand important facts about the Health Reimbursement Arrangement

(HRA) account your former employer will be providing. Page 8

ASSISTANCE BEYOND ENROLLMENT — Our team is available year-round to answer any questions or

concerns you may have regarding any healthcare plan related matter. Page 9

ADDITIONAL MEDICARE RESOURCES — The Centers for Medicare and Medicaid Services provides a

variety of learning opportunities you may wish to explore. Page 10

FREQUENTLY ASKED QUESTIONS — Review these FAQs to help guide the transition to your new

healthcare plan. Page 11

HEALTHCARE PROVIDER AND PRESCRIPTION DRUG INFORMATION — Record this important

information and send to us as soon as possible, but at least 10 days before your consultation. Page 15

This guide has

been organized to

provide you with a

clear roadmap for

your upcoming

healthcare plan

change.

Medicare Enrollment Guide | 1

Having the right healthcare coverage to meet your

needs and budget during retirement is important.

That's why Knights of Columbus has engaged Mercer

Marketplace 365+ Retiree to help you evaluate your

options and enroll in a new healthcare plan. You

will need to enroll in a new medical plan if you want

to continue to have medical coverage (other than

Medicare Part A and Part B). The enclosed letter

discusses the upcoming changes to your retiree

health coverage benefits.

This change is intended to provide retirees and

eligible Medicare dependents (if applicable) with

more flexibility and assistance with:

• Spending your healthcare dollars.

• Providing access to a greater variety of plans in

the marketplace.

• Connecting you with an experienced, licensed

benefits counselor who will assist you in making

a new healthcare plan election.

You will shop for and enroll in your new

healthcare coverage through Mercer

Marketplace 365+ Retiree. You now have several

options to choose from to meet your healthcare

and prescription drug needs. Mercer Marketplace

365+ Retiree and its benefits counselors are ready

to support you before, during, and long after your

health plan changes. They will help you understand

the dierent individual plans oered to you, assist

you in determining which plans provide the coverage

you need, and complete your enrollment when ready.

When you enroll in new medical coverage

through Mercer Marketplace 365+ Retiree,

Knights of Columbus will provide an HRA

(Health Reimbursement Arrangement) account

to oset the cost of your healthcare plan. This

HRA is a special, tax-free account that you may use

to reimburse yourself for eligible healthcare plan

expenses as defined by your employer and the IRS.

For a retiree and any applicable dependent(s) to

be eligible for the HRA, you must enroll in medical

coverage through Mercer Marketplace 365+ Retiree.

To continue to be eligible for the HRA, you must

maintain your medical plan enrollment though

Mercer Marketplace 365+ Retiree. A Reimbursement

Instructional Guide will be provided in a separate

mailing upon your enrollment in medical coverage

through Mercer.

You will have assistance from a benefits

counselor at every step. A counselor will help

you compare your health and prescription drug

coverage options, and complete your enrollment when

you are ready. You may also visit our website

to learn more about the dierent plans and

compare your coverage options. Refer to page 4

for more information about connecting with a benefits

counselor.

In the meantime, review this Enrollment Guide.

It contains tools and exercises to help you start

learning about your new healthcare plan options.

Completing the information requested in this guide

will make it easy for you and a benefits counselor to

evaluate your options and help you enroll on time.

Our team is excited to serve you in this new

program. Benefits counselors are available to

support you during your enrollment period. You

may reach Mercer Marketplace 365+ Retiree:

• Online at retiree.mercermarketplace.com/kofc

at your convenience, 24 hours a day, seven days a

week.

• Any business day, from 8:00 a.m. to

5:30 p.m. ET at 1-855-254-1187 toll-free (deaf or

hard of hearing individuals should dial 711) to set

up a consultation.

For additional information about Mercer Marketplace

365+ Retiree, including our compensation and privacy

practices, please see the enclosed document.

We look forward to working with you.

Mercer Marketplace 365+ Retiree

Welcome to Mercer Marketplace 365+

Retiree

2

This transition will be an easy one if you review the

steps below and gather the requested information

prior to your consultation. Doing so ensures you will

be accurately and eciently enrolled in the plan that

best fits your needs and budget.

STEP 1: Upon receipt

• Review this Enrollment Guide.

• Because you are 65 and older or Medicare

eligible, be sure you have enrolled in coverage

for Medicare Parts A and B. You must

have already enrolled in both in order to

enroll in healthcare coverage with Mercer

Marketplace 365+ Retiree. Contact the Social

Security Administration at www.ssa.gov or by

calling 1-800-772-1213 (TTY 1-800-325-0778) if

you have not yet enrolled in Medicare Part B.

STEP 2: Schedule your consultation

Consult with a licensed benefits counselor

Go online at retiree.mercermarketplace.com/

kofc to schedule a one-on-one consultation with

a licensed benefits counselor. From the navigation

bar at the top of the page, click “Schedule a

Consultation.” If you prefer, you may also call to

schedule. It is important to act NOW to select your

date and time. Don’t wait until the end of your

enrollment period approaches before making this

appointment; doing so may leave you with a short

amount of time in which to make a decision. If you

have signed up for text messages or email updates,

you will receive a text/email confirmation once your

have scheduled your consultation.

STEP 3: Prepare now

Preparing for your consultation

Start by keeping track of your individual healthcare

coverage needs. Providing correct and complete

information will help your benefits counselor analyze

your health plan coverage specifics:

• Use the worksheet on page 15 to list your

important healthcare providers and prescription

drugs; you may enter your prescription drugs

online by visiting retiree.mercermarketplace.

com/kofc

• Think about plan features that are important to you.

• Prepare any questions you may have for your

benefits counselor.

• Have your Medicare insurance card handy, but do

not mail or fax this information.

• Gather any documentation that pertains to a

Power of Attorney, if applicable to you.

• Go online to visit our website: retiree.

mercermarketplace.com/kofc. Our online

tools are easy to use, and utilizing them can help

you feel more comfortable with this process and

also reduce the amount of time you spend on the

phone with your benefits counselor.

• If you have signed up for text messages or email

updates, you will receive a text/email 24 hours

before your consultation with a reminder of the

steps listed above.

STEP 4: The consultation

Explore your new plan options when you

consult with your benefits counselor

Please take this opportunity to utilize your benefits

counselor and his or her health insurance expertise.

He or she will present you with all of your options

so you can feel confident about the decision you

are making.

What steps do I have to take to successfully

enroll in my new plan?

Medicare Enrollment Guide | 3

STEP 5: Avoid a gap in coverage

Enroll in your new plan with your benefits

counselor

When you are ready to enroll in your new plan(s),

you will:

• Have your benefits counselor complete your

enrollment over the phone; online self-

enrollment is available only with certain

carriers and not all plans are available to be

viewed on the website.

• Provide information to set up payment for

your premium.

• Be sent any forms that are required; please review,

sign, date, and return promptly.

STEP 6: After enrolling in your new plan(s)

After your eective date, you:

• May be contacted by your new insurance carrier

in order to verify your enrollment; please do not

ignore this request, as doing so could delay or

nullify your coverage.

• Will receive your new insurance cards by mail from

your insurance carrier(s) after your enrollment has

been processed; please review them for accuracy.

• Will receive a confirmation of enrollment with

helpful next steps and FAQs if you have signed up

for text message/email updates.

STEP 7: Preparing to use your subsidy

Set up your HRA

You will receive additional information in a future

mailing outlining how to set up and utilize your HRA.

STEP 8: Ongoing

Please retain this Enrollment Guide as it will serve

as on ongoing reference for your health insurance

transition.

Open your camera on

your smartphone or

tablet and place your

camera over this code.

You will be directed

to our website where

you can schedule a

consultation, chat

with our experts, or

research your plan

options.

4

Follow these steps to ensure that you are prepared for your phone consultation with your Mercer

Marketplace 365+ Retiree benefits counselor.

GO ONLINE AT RETIREE.MERCERMARKETPLACE.COM/KOFC TO SCHEDULE A CONSULTATION

WITH A BENEFITS COUNSELOR. From the navigation bar at the top of the page, click “Schedule a

Consultation.” If you prefer, you may call 1-855-254-1187 (Monday through Friday, 8:00 a.m. to 5:30

p.m. ET) to schedule your consultation. If your spouse is also eligible to enroll, we recommend calling to

schedule your consultations so they can be scheduled close to one another. Jot down the date and time

for this appointment below:

Consultation Date: ________________________________________________________

Time: ___________________________________________________________________

COMPLETE THE HEALTHCARE PROVIDER AND PRESCRIPTION DRUG INFORMATION FORM

included in this guide on page 15 and mail, fax, or email the following information as soon as possible,

but at least 10 days before your consultation.

Address: Mercer Marketplace 365+ Retiree

P.O. Box 14401

Des Moines, IA 50306-3401

Secure fax: 857-362-2999

Email: rx.tracker@mercer.com

OR, YOU CAN SAVE TIME BY GOING ONLINE!

You can shorten the amount of time you spend on the consultation call by submitting

your prescription drug information and healthcare providers through the website by

following these steps:

• Start by visiting the homepage at retiree.mercermarketplace.com/kofc

• At the top of the page, click on ‘Shop & Compare’, then in the pull-down menu, click on ‘Shop

for Medicare plans.’

• When you are ready to begin reviewing plan options, scroll to the bottom and click

'GET STARTED.' When you follow the step-by-step instructions, you will be

directed to a location where you will enter prescription drug information.

• Your prescription drug information will be pre-loaded to your profile and available

to your benefits counselor prior to your consultation.

1

2

How do I schedule an appointment with a

benets counselor and how should I prepare

for my consultation?

Medicare Enrollment Guide | 5

CONSIDER YOUR ANSWERS TO THE FOLLOWING QUESTIONS PRIOR TO YOUR CONSULTATION:

• Do you have end stage renal disease (ESRD)?

• Do you currently reside in a Nursing Home or Assisted Living Facility?

• Do you anticipate spending considerable time away from your primary residence during which you

would seek non-emergency medical care?

• Are you comfortable with an HMO/PPO network which may include some, but not all, of your

providers and may not provide care outside your area without additional higher fees?

• Do you use healthcare providers that do not accept Medicare? (You can call your providers and ask

the billing department.)

• Are you entitled to TRICARE For Life, other prescription drug/health benefits through the VA, or any

other health or prescription drug benefits not listed here?

• Has Medicare or the Social Security Administration notified you that you are eligible for assistance

with paying for Medicare prescription drug plan costs?

• Are you currently receiving Medicaid benefits?

BE READY ON THE DATE AND TIME YOU SELECTED FOR YOUR CONSULTATION, AND:

• Have your Medicare (red, white, and blue) ID card available for your

consultation. You will need to provide both your Part A and Part B eective

dates. Please do not email or fax this card or Medicare number.

• Allow enough time for the consultation, approximately 60-90 minutes.

• Make certain any family member or caregiver is available for the call if desired.

• If you do not receive your consultation call within 30 minutes of the scheduled time,

please contact Mercer Marketplace 365+ Retiree.

• Promptly reschedule the consultation if you find you cannot keep the appointment you originally

scheduled by going online at retiree.mercermarketplace.com/kofc or by calling

1-855-254-1187; those who are deaf or hard of hearing should dial 711 for Telecommunications Relay

Service.

3

4

Your benefits counselor will ask you the following questions during your

consultation, but it helps to have them in front of you and be better prepared

for your call. Your answers to these questions will help your benefits counselor

discuss healthcare insurance plans that best fit your needs.

How do I schedule an appointment with a

benets counselor and how should I prepare

for my consultation?

6

In most cases, when a person enrolls, they will choose between these options.

Use this chart to help you decide which option is right for you.

Step 1: Decide if you want

Original Medicare

WITH MEDICARE SUPPLEMENT

Medicare Advantage Plan

LIKE AN HMO OR PPO NETWORK

PART A (HOSPITAL INSURANCE)

PART B (MEDICAL INSURANCE)

PART C: INCLUDES BOTH PART A (HOSPITAL

INSURANCE) & PART B (MEDICAL

INSURANCE)

Medicare provides this coverage.

You have your choice of doctors, hospitals, and

other providers that accept Medicare.

Most people pay a monthly premium for Part

B. In addition, you will pay deductibles for

services covered under Parts A and B and pay

co-insurance for all Medicare-covered services.

IN ADDITION, YOU MAY ADD A MEDICARE

SUPPLEMENT POLICY TO YOUR PART A AND B

MEDICARE COVERAGE.

These plans are oered by private insurance

companies that pay all or part of the

deductibles and co-insurance with predictable

out-of-pocket expenses.

Note: You can enroll in either a Medicare

Advantage Plan that oers prescription drug

coverage as part of the plan, or a Medicare

Supplement policy and a free-standing

prescription drug plan.

No network restrictions, as long as the provider

accepts Medicare.

Private insurance companies approved by

Medicare provide this coverage.

In most plans, you need to use approved

network doctors, hospitals, and other providers

or you will pay more.

You pay a monthly premium (depending upon

the plan), your Part B premium, and

co-payments for covered services.

Costs, rules, and coverage beyond what’s

covered in Medicare Parts A and B will vary by

plan.

Note: If you join a Medicare Advantage Plan,

you cannot have a Medicare Supplement

policy or enroll in a free-standing prescription

drug plan.

Normally you will see lower monthly premium

costs, but higher out-of-pocket expenses

when services are rendered.

Step 2: Decide if you want Prescription Drug Coverage (Part D)

If you want this coverage, you must choose a

Medicare Prescription Drug Plan.

These plans are run by private insurance

companies approved by Medicare.

You must pay the monthly plan premium and

drug co-payments.

Most Medicare Advantage Plans include

prescription drug coverage (Part D).

The prescription drug premium is included in

your monthly Medicare Advantage premium.

You will be responsible for co-payments and

any other plan costs.

How can I learn more about my Medicare

options?

Medicare Enrollment Guide | 7

During your consultation with your benefits counselor, he or she will review all of your benefits options with

you, discuss your personal situation, and answer any questions you may have. Your benefits counselor will

help educate you about additional insurance options available that you may wish to consider in order to make

the best possible decision for you and your family.

DENTAL INSURANCE THROUGH

MERCER MARKETPLACE 365+ RETIREE:

Enrolling in dental insurance can be

a cost-eective way to address the

costs of annual exams and related

services such as fillings and extractions.

Dental insurance can play an important role in

your health. Since people with dental insurance

are more likely to visit the dentist, a solid

insurance plan can help you maintain good oral

health, which promotes your overall health.

VISION INSURANCE THROUGH

MERCER MARKETPLACE 365+ RETIREE:

Vision insurance is a type of supplemental

insurance that can help pay for yearly

eyesight exams, glasses and/or contact

lenses. With vision insurance, you will

also have access to eye doctors who are focused

on keeping your eyes healthy by detecting

conditions such as glaucoma or cataracts.

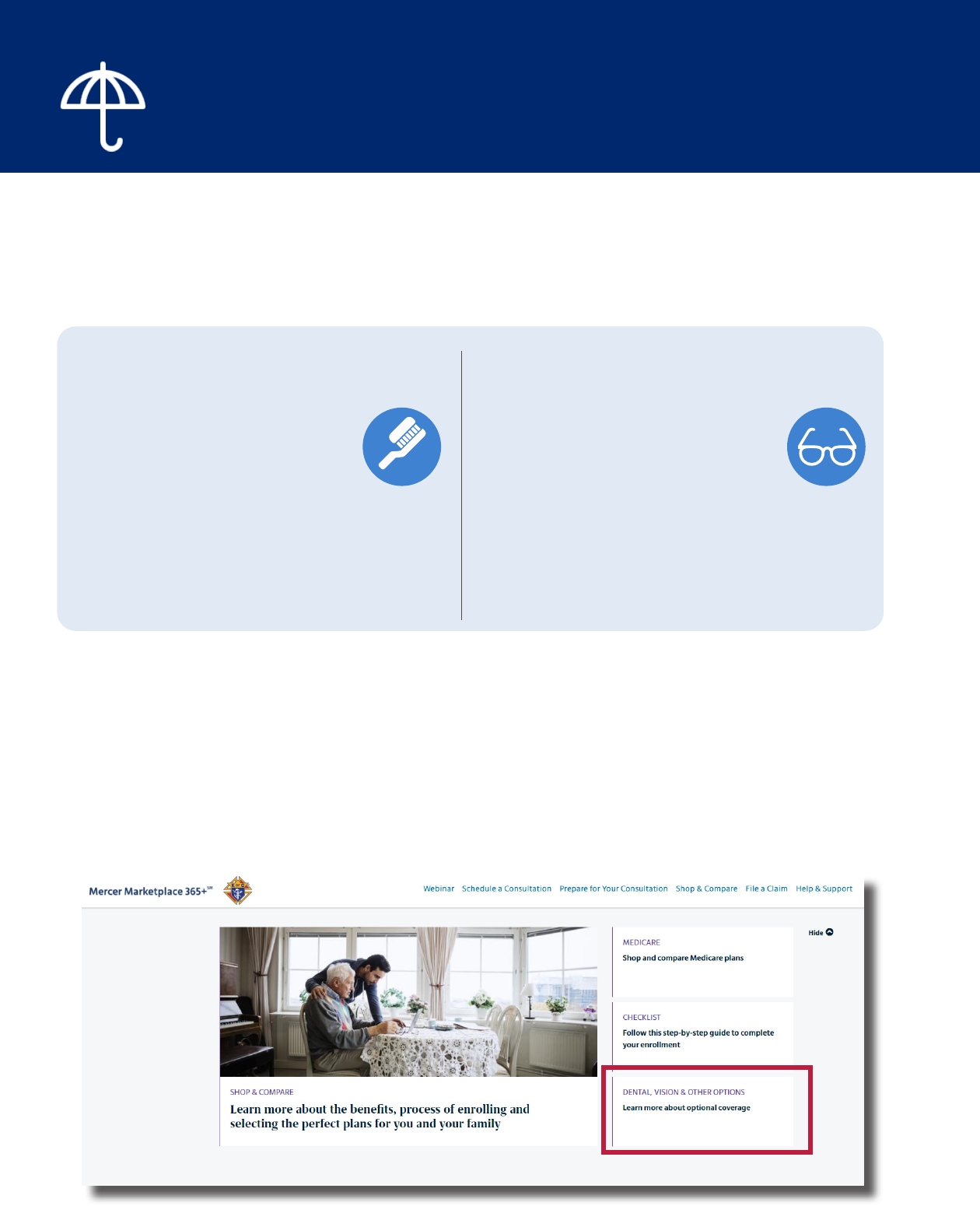

You may go online to view your additional insurance options and enroll in a plan of your choice.

• Start by visiting the homepage at retiree.mercermarketplace.com/kofc

• In the ‘Shop & Compare’ section, click on the box to the far right titled ‘DENTAL, VISION, & OTHER

OPTIONS ’ (Please see the area in red box below.) You may explore other insurance options such as Dental

and Vision.

• Enroll in the Dental and/or Vision plan(s) of your choice online or with the assistance of your benefits

counselor.

What other insurance options should I be

considering to round out my coverage?

8

Your former employer is providing a Health Reimbursement Arrangement (HRA) account for their eligible

retirees. This HRA may be used for reimbursement of healthcare premiums and eligible out-of-pocket

healthcare expenses as defined by your former employer.

You pay your premium(s) or out-of-pocket expenses directly to your insurance carrier(s) or provider(s), then

you will be reimbursed with available funds from your HRA account.

You will receive additional information in a future mailing outlining how to set up and utilize your HRA.

How does my HRA work and how will I be

reimbursed?

Medicare Enrollment Guide | 9

We are here to help beyond your initial enrollment

Once you have enrolled in your medical plan(s) through Mercer Marketplace 365+ Retiree team, your benefits

counselor is available to provide assistance with any healthcare plan related matter. If you have questions

about your plan or problems resolving an issue with a carrier, help is just a click online or a phone call away.

What to expect in the years to come

Typically, if you like your healthcare plan(s), and the carrier continues to oer the plan(s), you do not need to

re-enroll each year. However, there are a few things you will need to consider each fall:

• We will send you a reminder that the Open Enrollment Period is approaching. If you do wish to make a

new healthcare plan election, keep in mind the Medicare Open Enrollment Period is typically October 15–

December 7.

• By law, your insurance carrier is required to send you information about plan or pricing changes. Please be

certain to open, review, and save all of this documentation.

• If you are considering making a change to your healthcare plan, please be certain to contact a Mercer

Marketplace 365+ Retiree benefits counselor BEFORE making any changes on your own. There are

implications you will need to consider, and our benefits counselors are trained at making sure you

understand these prior to enrolling in a new plan.

How you can reach us

• Go online for 24/7 assistance: retiree.mercermarketplace.com/kofc

• Call: 1-855-254-1187; those who are deaf or hard of hearing should dial 711 for Telecommunications Relay

Service.

• Fax: 857-362-2999

• Mailing address: P.O. Box 14401, Des Moines, IA 50306-3401

Make sure your email, phone number and mailing addresses are

up-to-date with us, as we may send you dierent communications

throughout the year and want to have the most accurate way of

reaching you.

What type of assistance is available to me

after I enroll?

10

If you are new to Medicare, or just want to better understand the Medicare program and dierent benefits,

you may visit CMS (The Centers for Medicare and Medicaid Services) at https://www.cms.gov.

CMS produces a comprehensive publication each year that discusses the Medicare program in its entirety.

You may request a printed copy of this book by calling 1-800-MEDICARE (1-800-633-4227); TTY users should

call 1-877-486-2048. You may also access this publication online by visiting https://www.medicare.gov/

pubs/pdf/10050-Medicare-and-You.pdf.

MEDICARE

• Go online www.medicare.gov

• Call 1-800-MEDICARE (1-800-633-4227; TTY 1-877-486-2048), available 24 hours a day, 7 days a week

SOCIAL SECURITY

• Visit your local Social Security oce

• Go online www.ssa.gov

• Call 1-800-772-1213 (TTY 1-800-325-0778)

Where can I nd out more information about

the Medicare program?

Medicare Enrollment Guide | 11

We recognize your health plan choices and costs are important to you. If you have questions, we encourage

you to speak to your benefits counselor. Below you will find answers to many questions frequently asked by

retirees and their dependents.

HOW IS MY HEALTH INSURANCE CHANGING?

You will soon turn 65 and become eligible to enroll in

Medicare, OR you are already enrolled in Medicare and

will soon be retiring from the company where you are

currently employed. As such, your current health

plan coverage will end and you will need to choose a

new plan to ensure you have the coverage you need

going forward.

HOW WILL I OBTAIN MY NEW

HEALTH INSURANCE?

In order to help you find the plan that best fits

your needs and budget, your company has

partnered with Mercer Marketplace 365+ Retiree to

guide you through the process from beginning to

end. Mercer Marketplace 365+ Retiree will be your

single point of contact for healthcare insurance

issues — before, during and after the transition to

your new healthcare plan.

HOW WILL I PAY FOR MY NEW

HEALTH INSURANCE?

You will now pay your premiums directly to the

insurance carrier for your retiree healthcare

coverage and you will be reimbursed from your HRA.

You can be reimbursed for your premiums via direct

deposit into your bank account or a paper check.

For additional details about your HRA, you may refer to the Reimbursement Instructional Guide you will receive

after enrolling in medical coverage through Mercer.

WILL I BE REQUIRED TO CHOOSE A NEW DOCTOR?

It depends on the health insurance strategy that you choose. Medicare Supplement plans allow you to choose

any doctor that accepts Medicare, while Medicare Advantage uses networks of doctors who accept only certain

plans. Your Mercer Marketplace 365+ Retiree benefits counselor will help you find a plan that works with your

doctor.

Where can I nd answers to additional

questions I may have?

12

HOW LONG WILL THE APPOINTMENT WITH MY BENEFITS COUNSELOR LAST?

In general, you’ll spend about 60 to 90 minutes on the phone speaking with your benefits counselor. The length of

the call will depend on whether you enroll that day or want to include a family member or caregiver, or a power of

attorney on the call. The length of your appointment will also depend on how much preparation you wish to do in

advance.

Remember, your benefits counselor is an excellent resource and will take as much time on the phone or in a future

conversation as you need to feel comfortable with your enrollment decision.

If you go online to the Mercer Marketplace 365+ Retiree website prior to your consultation to enter your

prescription drugs, your appointment could be much shorter. See the checklist in this Enrollment Guide for

details on how to prepare for your call.

IF I NEED ASSISTANCE WITH ENROLLING, CAN SOMEONE SPEAK WITH MY BENEFITS COUNSELOR

ON MY BEHALF?

If you complete and sign a Personal Information Authorization form, anyone listed on the form can assist you with

your plan information and/or selections. However, a durable Power of Attorney (POA) document must be

on file at Mercer Marketplace 365+ Retiree for anyone but the retiree to enroll in healthcare coverage.

Anyone who is listed on the durable POA can act on behalf of the retiree in all insurance capacities, including HRA

paperwork.

Where can I nd answers to additional

questions I may have?

continued

Medicare Enrollment Guide | 13

IF I LIKE THE BENEFITS COUNSELOR

I HAVE MY CONSULTATION WITH, CAN

I REQUEST THAT SAME PERSON AGAIN?

The person you enjoyed dealing with

before may not be available due to other

scheduled appointments when you call.

Every benefits counselor must, by law,

be licensed, certified, and appointed to

talk with you about the plans in your

specific geographic area.

Please be assured that if you can’t reach

the benefits counselor you request, all of

your information is available in our secure

system, and another benefits counselor

will be able to assist you.

DO I NEED TO ENROLL IN MEDICARE

PART B?

Yes, in order to qualify for a Medicare

Supplement or Medicare Advantage

plan, you must be enrolled in both

Medicare Part A and Part B, and continue

to pay for those premiums.

DO I NEED TO ENROLL IN A MEDICARE

PART D PLAN?

Medicare recommends that you enroll

in a plan when you are first eligible,

both to gain access to discounted

prescriptions and to avoid Medicare’s

permanent late enrollment penalty.

Where can I nd answers to additional

questions I may have?

continued

WILL MY NEW COVERAGE COVER ME IF I TRAVEL?

When traveling domestically, as long as a hospital, clinic, or doctor accepts Original Medicare, Part A, and Part B,

healthcare providers will accept your Medicare supplement plan. For Medicare Advantage plans such as HMOs

and PPOs, there will be network restrictions when traveling outside of your plan’s area. Your licensed benefits

counselor can provide additional details on healthcare benefits while traveling during your consultation or at any

point throughout the year.

IF I DON’T LIKE THE PLAN I’M ENROLLED IN, WHEN CAN I CHANGE?

Medicare Supplement plans can be changed at any point during the course of the year, but may require

underwriting to do so. Underwriting is when an insurance carrier collects your medical history to determine

whether or not to accept your application for insurance and how much to charge you. There is a one-time window

of guaranteed insurability after your initial enrollment into Medicare or after you leave a terminating group plan.

After that window closes, carriers may ask you underwriting questions if you are changing your plan. Each carrier

has its own rules, so it is important to discuss any changes you may wish to make with your licensed

benefits counselor. There is no medical underwriting for changing Medicare Advantage plans, however, Medicare

Advantage and Medicare Advantage Prescription Drug plans only accept enrollments during the Annual Enrollment

Period (October 15th–December 7th) for a January 1st eective date. Additionally, Part D prescription drug plans

can only be changed during the same Annual Enrollment Period for a January 1st eective date.

14

Where can I nd answers to additional

questions I may have?

continued

Medicare Enrollment Guide | 15

HEALTHCARE PROVIDER INFORMATION

YOUR NAME___________________________________________ PHONE__________________

Please list your current healthcare providers below. Some healthcare plans like HMOs and PPOs use networks.

Gathering your healthcare providers’ information here will help your benefits counselor compare access to

your current providers. You may also contact your providers and ask them which plans they accept.

CURRENT HEALTHCARE PROVIDERS PRIMARY CARE, SPECIALISTS, ETC.

Name Address Phone Number

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

PRESCRIPTION DRUG INFORMATION

In order to construct an accurate cost analysis, we will need your complete and correct drug information. For

example, it is important to indicate the name of the drug that you are taking, and whether you are taking a

BRAND or GENERIC version. Please note, over-the-counter medications, vitamins, and supplements are not

covered by prescription drug plans and therefore are not required on this form.

CURRENT PRESCRIPTIONS, DOSAGES, FREQUENCY AND WHERE/HOW YOU OBTAIN THE MEDICATION

Medication Dosage Frequency Pharmacy or Mail Order

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

Please complete one form per person. If you have additional healthcare providers or prescription drugs to

share with your benefits counselor, please make a copy of this page (prior to completing) and use it to record

your additional entries.

What information do I need to provide?

16

[ The remainder of this page is intentionally left blank so that if you

submit this information by mail, you won’t be mailing

anything important that you may need later.]

REMEMBER! You may go online to enter your prescription drug information as soon as possible, but at least

10 days prior to your consultation; doing so will shorten the amount of time you spend on the consultation call.

Follow the step-by-step instructions listed in the blue box on page 4.

If you are unable to go online, please mail, fax, or email this worksheet as soon as possible, but at least 10 days

prior to your scheduled appointment to:

Mercer Marketplace 365+ Retiree

P.O. Box 14401, Des Moines, IA 50306-3401

Fax: 857-362-2999

Email: rx.tracker@mercer.com

Medicare Enrollment Guide | 17

Questions for my benets counselor

The insurers whose policies you may enroll in are separate and independent from Mercer Marketplace 365+ Retiree.

Mercer Marketplace 365+ Retiree is not responsible for any insurer’s or service provider’s failure to provide coverage or

service, including but not limited to any failure resulting from the insurer’s or service provider’s current or future financial

condition or solvency. From time to time, insurance companies may become insolvent and fall into receivership with the

state’s insurance regulatory authority. In addition to potential access to state guarantee funds, these state departments

also may provide financial information. See your state’s department of insurance website for any information they may

provide. While each state does impose its own minimum capital and surplus requirements on insurers, Mercer

Marketplace 365+ Retiree also advises that you consider the ratings of an independent agency. Independent agencies,

such as A.M. Best (www.ambest.com), may also issue ratings describing their evaluation of an insurer’s financial ability to

honor its insuring obligations. Insurers receive dierent ratings. Some insurers available to you fail to achieve the agency’s

rating for superior or excellent. Mercer Marketplace 365+ Retiree recommends that you carefully consider financial

information provided by both state insurance regulators and independent rating agencies when purchasing insurance

coverage.

KOFC-AGE-MED-HRA