Wells Fargo & Company Annual Report 2005

How Do We Picture the

Next Stage of Success?

3 To Our Owners

For 20 years,Wells Fargo has achieved

double-digit growth in almost every

economic environment.Chairman/CEO

Dick Kovacevich explains how our

team did it.

11 How Do We Picture the

Next Stage of Success?

We believe—and many industry

observers agree—that we have the

strongest management team in all

of financial services. Here’s how they

picture success for their customers,

their businesses and their teams.

24 Picturing the Next Stage of Success

for Our Communities

We’re one of corporate America’s top

10 givers—but it’s the time, talent

and creativity of our team member

volunteers that really sets us apart.

31 Board of Directors, Senior Management

33 Financial Review

58 Controls, Procedures

60 Financial Statements

112 Report of Independent Registered

Public Accounting Firm

116 Stockholder Information

Which Measures Really Matter?

2005 Update (inside back cover)

Wells Fargo & Company

Wells Fargo & Company (NYSE:WFC)

is a diversified financial services company

providing banking, insurance,investments,

mortgage loans and consumer finance. Our

corporate headquarters is in San Francisco,

but we’re decentralized so all Wells Fargo

“convenience points”—including stores,

regional commercial banking centers,

ATMs, Wells Fargo Phone Bank

SM

centers,

internet—are headquarters for satisfying

all our customers’financial needs and

helping them succeed financially.

“Aaa”

Wells Fargo Bank, N.A. is the only U.S. bank to

receive the highest possible credit rating from

Moody’s Investors Service.

Assets: $482 billion (5th among U.S. peers)

Market value of stock: $105 billion

(4th among U.S. peers)

Fortune 500: Profit, 17th; Market Cap,18th

Team members: 153,500

(one of U.S.’s 40 largest private employers)

Customers: 23+ million

Stores: 6,250

Reputation

Barron’s

World’s most admired financial

services company

Business Ethics

Ranked top 10 corporate citizen

BusinessWeek

Among corporate America’s top 10

corporate givers

Fortune

“Most Admired Megabank”

52nd in revenue among all U.S.

companies in all industries

World’s 29th most profitable company

Mergent,Inc.

“Dividend Achiever”*

Moody’s Investors Service

Only U.S. bank rated “Aaa,”

highest possible credit rating

Watchfire GomezPro

#1 internet bank

Our Market Leadership

#1, 2 or 3 in deposit market share in 15 of

our 23 banking states; #4 nationally

(6/30/05)

#1 retail mortgage originator;

#2 mortgage servicer

#2 in mortgages to low-to-moderate income

home buyers

#1 home equity lender

#1 small business lender

#1 small business lender in low-to-moderate

income neighborhoods

#1 insurance broker owned by bank

holding company (world’s 5th largest

insurance brokerage)

#1 agricultural lender

#1 financial services provider to

middle-market businesses in

our banking states

#2 debit card issuer

#2 bank auto lender

#3 ATM network

One of U.S.’s leading commercial

real estate lenders

One of North America’s premier

consumer finance companies

Our Earnings Diversity

Earnings based on historical averages and near future year expectations

Banking, insurance, investments,

mortgage loans,and consumer finance—

we span North America and beyond.

Community Banking . . . . . . . . . . . . . 34%

Home Mortgage/Home Equity . . . 20%

Investments & Insurance . . . . . . . . . 15%

Specialized Lending . . . . . . . . . . . . . . 15%

Wholesale Banking/

Commercial Real Estate . . . 9%

Consumer Finance . . . . . . . . 7%

* Publicly traded companies that increased dividends for last

10+ consecutive years;Wells Fargo has increased dividends

for 18 consecutive years, 23 increases since 1988.

Our vision—as it has been for 20 years—is to satisfy all our customers’ financial needs and

help them succeed financially. A vision by itself, however, is not enough.You must have a

plan to achieve that vision and a time-tested business model that can perform successfully

in any economic cycle.You have to execute against that plan efficiently and effectively.

In fact, it’s all about execution.To be successful, you need leaders who can establish,

share and communicate that vision, motivate others to embrace, believe in and follow

that vision, and execute in a superior fashion each day, every day, one customer at a time.

How Do We Picture the Next Stage of Success?

3

This year’s outstanding results prove it once again.We have

the most talented, professional, caring, committed, ethical,

“customer first”team in all of financial services. Guided by

our vision, values, our time-tested business model,our

diversity of businesses and our conservative risk management

—all in place for 20 years—our team once again produced

outstanding, industry-leading results.That included double-

digit growth in revenue and earnings per share—which we

achieved not just this year, but also for the past 20, 15, 10 and

five years. Over all these periods, our total stockholder return

was about double the S&P 500

®

.Amazing!

To Our Owners,

It’s all the more amazing because our team achieved these

record results the past 20 years, while dealing with almost

every economic cycle and every economic condition a financial

institution can experience. High and low interest rates. Bubbles

and recessions. All types of yield curves (steep, flat and inverted).

High and low unemployment. No one can accurately predict

how the economy will perform in 2006 or in any year but for

Wells Fargo to achieve double-digit growth we must continue to

focus on our primary strategy, consistent for 20 years, which is

to satisfy all our customers’ financial needs, help them succeed

financially, and through cross-selling, gain wallet share and earn

100 percent of their business.

Among our 2005 achievements:

• Revenue growth of 10 percent—double-digits once again—

the most important measure of success in our industry—

outpacing our single-digit expense growth.

• Diluted earnings per share—a record $4.50, up 10 percent—

despite the $0.07 per share cost for increased bankruptcy

filings before the October change in federal bankruptcy laws.

• Net income—a record $7.7 billion, up 9 percent.

• Our stock price reached a record high close of $64.34 on

November 25, 2005.

4

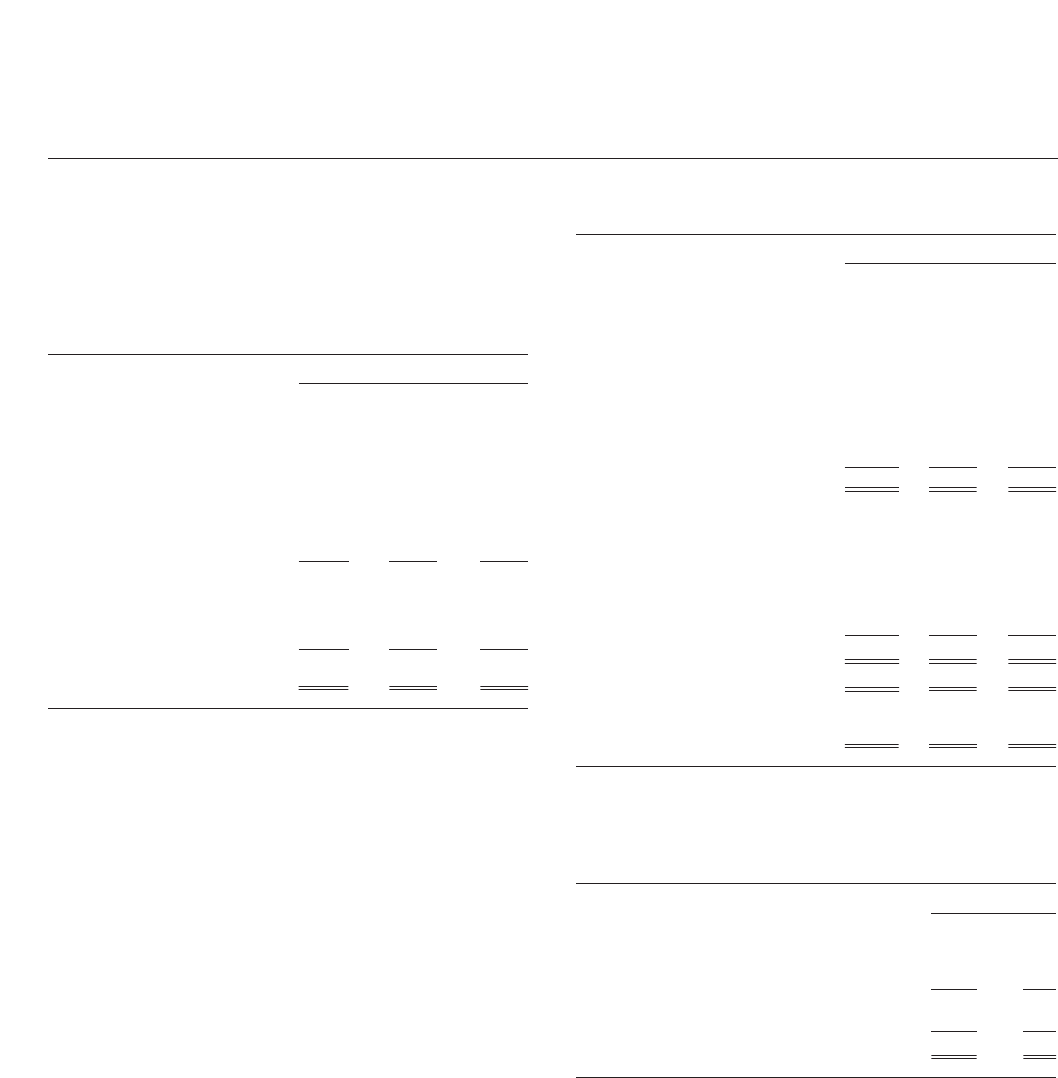

Our Performance

Double-digit growth: earnings per share, revenue,loans and retail core deposits

$ in millions, except per share amounts 2005 2004 Change

FOR THE YEAR

Net income $ 7,671 $ 7,014 9%

Diluted earnings per common share 4.50 4.09 10

Profitability ratios

Net income to average total assets (ROA) 1.72% 1.71% 1

Net income applicable to common stock to

average common stockholders’equity (ROE) 19.57 19.56 —

Efficiency ratio

1

57.7 58.5 (1)

Total revenue $ 32,949 $ 30,059 10

Dividends declared per common share 2.00 1.86 8

Average common shares outstanding 1,686.3 1,692.2 —

Diluted average common shares outstanding 1,705.5 1,713.4 —

Average loans $296,106 $269,570 10

Average assets 445,790 410,579 9

Average core deposits

2

242,754 223,359 9

Average retail core deposits

3

201,867 183,716 10

Net interest margin 4.86% 4.89% (1)

AT YEAR END

Securities available for sale $ 41,834 $ 33,717 24

Loans 310,837 287,586 8

Allowance for loan losses 3,871 3,762 3

Goodwill 10,787 10,681 1

Assets 481,741 427,849 13

Core deposits

2

253,341 229,703 10

Stockholders’ equity 40,660 37,866 7

Tier 1 capital 31,724 29,060 9

Total capital 44,687 41,706 7

Capital ratios

Stockholders’ equity to assets 8.44% 8.85% (5)

Risk-based capital

Tier 1 capital 8.26 8.41 (2)

Total capital 11.64 12.07 (4)

Tier 1 leverage 6.99 7.08 (1)

Book value per common share $ 24.25 $ 22.36 8

Team members (active, full-time equivalent) 153,500 145,500 5

1 The efficiency ratio is noninterest expense divided by total revenue (net interest income and noninterest income).

2 Core deposits are noninterest-bearing deposits, interest-bearing checking, savings certificates and market rate and other savings.

3 Retail core deposits are total core deposits excluding Wholesale Banking core deposits and retail mortgage escrow deposits.

5

• At year-end, the total value of our stock was $105 billion—

again making us one of the nation’s 20 most valuable companies.

• Return on equity, 19.57 percent; return on assets, 1.72 percent.

• Our credit quality remained excellent. Nonperforming loans

were at or near historic lows.

• Fortune ranked Wells Fargo “Most Admired Megabank”;

Barron’s ranked us the world’s most admired financial services

company and we continue to be the only U.S. bank with the

highest possible credit rating, “Aaa.”

• Community Banking achieved record profit of $5.53 billion,

up 13 percent with revenue increasing nine percent.

• In consumer banking, we sold almost 16 million products

(or “solutions”)—checking, savings, debit cards, loans, etc.—

to our customers, up 15 percent.

• Our loans to small businesses, primarily less than $100,000,

grew 18 percent. For the third consecutive year, we were the

nation’s #1 small business lender in total dollars. In the past

10 years, we’ve loaned more than $26 billion to small

businesses owned by African-Americans, Asian-Americans,

Latinos and women, exceeding our publicly-stated goals.

• For the seventh consecutive year, our cross-sell reached record

highs—4.8 products per retail banking household, 5.7 products

per Wholesale Banking customer. Our average middle-market,

commercial banking customer now has almost 7.0 products

with us—up from almost five just two years ago. In fact, more

than one of every five of our commercial banking offices

nationwide averaged eight products per customer.

• For the seventh consecutive year, Wholesale Banking achieved

record net income of $1.73 billion—with double-digit loan

growth this year across its businesses.

• Our Wholesale Banking business now is truly coast-to-coast,

with more than 600 offices nationwide. Across the Eastern

U.S., we have 175 offices for commercial banking, commercial

real estate, corporate banking, asset-based lending and

equipment finance. We’re attracting new commercial

customers in markets such as Atlanta, Boston, Cleveland,

Hartford (Conn.), Indianapolis, New York and Tampa.

Our primary strategy, consistent for 20 years,

is to satisfy all our customers’financial needs,

help them succeed financially, and through

cross-selling earn 100 percent of their business.

• We funded $366 billion in mortgages—our second highest

annual total ever—and continued to be the nation’s #1 retail

mortgage originator. Our owned mortgage servicing portfolio,

the nation’s second largest, rose 23 percent to $989 billion. The

housing market remained strong because new home construction

continued to lag the pace of new household formation.

• Our National Home Equity Group’s loans were $72 billion at

year-end with continued very strong credit quality—ranking

us the nation’s #1 home equity lender for the fourth consec-

utive year.

• Wells Fargo Financial—our consumer finance business—

grew average receivables 25 percent.

• Watchfire GomezPro ranked Wells Fargo internet banking

#1 among all U.S. banks. Global Finance magazine named

wellsfargo.com best in the U.S. in six categories including

“best corporate/institutional internet bank.” Information

technology magazine CIO named Wells Fargo one of its

100 Bold winners for our innovative Commercial Electronic

Office

®

(CEO

®

) portal, now used by almost three-fourths of

our commercial customers for everything from loan payments

to foreign exchange.

Top 10 Consumer Internet Banks

1. Wells Fargo 6. First National Bank of Omaha

2. Citibank 7. HSBC

3. Bank of America 8. U.S. Bank

4. E*Trade Bank 9. Chase

5. Huntington 10. Wachovia

Source: Watchfire GomezPro,3Q05

• To be the financial services company of choice for remittance

customers, we expanded that service beyond Mexico, India

and the Philippines into El Salvador and Guatemala. The

number of accounts we opened for Mexican Nationals using

the Matricula Consular card as a form of identification

surpassed 600,000. We were the first financial institution

in the nation to promote the use of this card as a form of

6

identification to help these customers move from the risky,

cash economy to secure, reliable financial services.

• In Los Angeles and Orange counties, we launched a pilot

program to offer mortgage loans to employed, taxpaying cus-

tomers who have an individual taxpayer identification number

(ITIN) issued by the IRS but do not have a Social Security

number.

1

If successful, we hope to roll this mortgage product

out across all 23 of our community banking states.

• We increased the Company’s quarterly dividend more than

8 percent to 52 cents a share, the 18th consecutive year we’ve

increased our dividend, our 23rd dividend increase since 1988.

We’re the nation’s 13th largest dividend payer and one of less

than 3 percent of more than 10,000 North American-listed,

dividend-paying common stocks classified as a “Dividend

Achiever”—a publicly-traded company that has increased its

dividends for the last 10 or more consecutive years.

2

If you

had invested $10,000 in 1986 in our predecessor company,

Norwest Corporation, it would have been worth $435,000

at year-end 2005 with dividends reinvested.

• Our total managed and administered assets rose 6 percent

to $880 billion. The new Wells Fargo Advantage Funds

SM

—

the result of the merger of Wells Fargo Funds

®

and Strong

Funds

®

—is the nation’s 18th-largest mutual fund company,

managing $108 billion in assets, with 120 funds spanning

almost all asset classes and investment styles.

• We announced a 10-point commitment to integrate

environmental responsibility into our business practices.

This includes a pledge to provide more than $1 billion in the

next five years, in lending, investments and other financial

commitments to environmentally-beneficial business oppor-

tunities including sustainable forestry, renewable energy,

water-resource management, waste management, “green

home” construction and development, and energy efficiency.

1 Qualified individuals must have been customers of Wells Fargo Bank for six months, paid U.S. taxes

for two years,must be able to prove two years of California residence.

2 Mergent,Inc.

Double-Digit Annual Compound

Growth – for 20 Years

Total Stockholder Return

Years EPS Revenue Wells Fargo S&P 500

®

5 14% 10% 5% 0.5%

10 11 13 17 9

15 12 12 21 11

20 14 12 21 12

Impressive results, indeed. We’re very proud of them. But, believe

it or not, we can do even better. In recent annual reports, we told

you that we’ve not been growing our business banking and

investment businesses at a rate consistent with their potential.

I’m pleased to report we’re making significant progress.

Business Banking

Just two years ago, our average Business Banking customer—

businesses with annual revenue up to $20 million—had only

about 2.7 products with us—dead last in cross-sell among all

our businesses. Also, less than one of every four of our Business

Banking customers did their personal banking with Wells Fargo.

Less than one of every 10 gave us their investment business.

Two years ago we said that by 2008 we wanted to double rev-

enue and cross-sell and dramatically increase our market share

for both deposits and loans from our small business customers.

I’m pleased to report that our Business Banking cross-sell grew

11 percent for the year. Our Business Banking team surpassed

an average of 3.0 products (or “solutions”) per customer.

The number of business customers actively using online banking

grew 24 percent. Our Business Banking deposits—which grew

10 percent in 2004—rose another 9 percent in 2005. During

those same years our loans and lines of credit—primarily less

than $100,000, sold to our small business customers through

our banking stores, online, direct mail, teleconsulting and

in-bound calls—rose 17 percent and 18 percent, respectively.

Our business customers are buying their financial products

from someone. Since we believe we can offer them a superior

value, there’s no reason we shouldn’t earn all their financial

services business—business, personal and investments. In 2004

Wells Fargo was #1 for the third year in a row in loans under

$100,000 to small businesses, with 15 percent market share

nationally. We also were the #1 lender to small businesses in

low-to-moderate income neighborhoods, with almost 16 percent

market share, nationwide.

7

commission discounts with a linked WellsTrade

®

account. In

just five months, balances across all our deposit and brokerage

accounts increased over $4 billion.

Our Investment Management and Trust businesses are growing,

too. In addition to more basic wealth planning services—such as

trust and estate services —we’ve added alternative asset classes

and we’re offering “best of class” outside money managers for

our high net worth clients. They, in turn, have given us more

of their business. As a result, we’ve achieved five consecutive

quarters of record sales, a 40 percent increase in revenue year

over year from wealth planning and insurance.

Good progress but, here again, we can and must do better,

faster. Our market share of our customers’ investment business

should be two to three times higher than it is. There’s no reason

why we can’t attract many more new customers. More of our

Private Banking and Personal Trust customers should want to give

us their investment management and brokerage business. We also

should be satisfying more of the investment needs of our small

business customers and the executives of our middle-market, real

estate, and large corporate customers. We should be their first

choice for personal investment and banking business.

Preparing for more growth

We continue to invest in new stores and operation centers to

help satisfy all our customers’ financial needs. During 2005,

we opened 92 banking stores, remodeled another 485 banking

stores to improve customer service, and opened 47 mortgage

stores, 20 consumer finance stores, seven regional commercial

banking offices and two commercial real estate offices. We also

completed four major operations facilities (and are about to

complete a fifth):

• West Des Moines, Iowa Our mortgage and consumer credit

group opened a 281,000 square foot center for about 1,500

team members. Two more buildings are scheduled to open

in mid-2006 and in 2007—for a total of almost one million

square feet—on a 160-acre campus, large enough to accom-

modate even more expansion.

Top 10 U.S. Full-Service Online Brokers

1. Smith Barney 6. Piper Jaffray

2. Wells Fargo 7. DB Alex Brown

3. UBS 8. A.G. Edwards

4. Wachovia 9. McDonald Investments

5. Merrill Lynch 10. Edward Jones

Source: Watchfire GomezPro 10/31/05

Private Client Services

Our private banking and investment business—Private Client

Services—also is growing. It ended 2005 with double-digit

revenue growth in the fourth quarter. We built the foundation for

this growth by integrating all banking, investment and insurance

services to serve all of our clients’ wealth management needs.

We’ve significantly increased the number of investment

professionals serving clients. We now have more than 700 private

bankers in our banking stores and wealth management offices,

up 150 percent the past two years—and 2,500 licensed bankers

and financial consultants, up more than 85 percent in three years.

In 2005, we were the first in our industry to announce low- and

no-cost online stock and mutual fund trades to benefit our most

loyal customers. Watchfire GomezPro ranked us the nation’s

second best, full-service on-line brokerage.

As a result, we’re earning more of our clients’ business. Our

loans to Private Banking customers grew 15 to 20 percent each

of the last five years. The last two years, deposits rose 38 percent,

and brokerage assets 14 percent. More than one million of our

customers now have a Wells Fargo Portfolio Management

Account

®

, or PMA

®

account—which combines all a customer’s

relationships with Wells Fargo, including checking, savings,

mortgage, personal loans, trust and brokerage. This relationship

product offers rewards, discounts, competitive money market

rates, bonus interest rates on linked savings accounts and CDs,

no monthly service fees on linked accounts, a Wells Fargo Visa

®

Credit Card with waived fee for the Retention Rewards

®

program,

no annual fees on select line of credit accounts, free checks, and

Wells Fargo has achieved double-digit,

annual compound growth in revenue and

earnings per share, with total stockholder

return about double the S&P 500 for the

past five, 10, 15 and 20 years.

8

• Des Moines,Iowa Later in 2006 Wells Fargo Financial is

scheduled to complete a 360,000 square foot, nine-story

building for 1,500 team members, connected via skyway

to its downtown headquarters;

• Minneapolis,Minnesota A $175 million conversion and

expansion of the former Honeywell Campus near downtown

Minneapolis. It consolidates a dozen Twin Cities area

mortgage operations centers and is expected to accommodate

about 4,600 team members by year-end 2006;

• Shoreview, Minnesota A new 160,000 square foot data

center in a northern Twin Cities suburb;

• Chandler, Arizona A new operations, technology and

call center campus near Phoenix has two, 200,000 square

foot, four-story buildings, now home to about 2,100 team

members in operations and technology. This site is large

enough to accommodate four more buildings totaling

800,000 square feet.

The quality of our leadership

Our vision—as it has been for 20 years—is to satisfy all our

customers’ financial needs and help them succeed financially.

A vision by itself, however, is not enough. You must have a plan

to achieve that vision and a time-tested business model that can

perform successfully in any economic cycle. You have to execute

against that plan efficiently and effectively. In fact, it’s all about

execution. To be successful, you need leaders who can establish,

share and communicate the vision, motivate others to embrace,

believe in and follow that vision, and execute in a superior

fashion each day, every day, one customer at a time.

At Wells Fargo, we’re fortunate to have what I believe—

and many industry observers agree—is the best team of senior

leaders in the entire financial services and banking industry.

They’re the CEOs of our diverse businesses—spanning virtually

every segment of our industry. They’re responsible. They’re

accountable. They and their teams have produced outstanding

results you’ve come to expect from Wells Fargo year after year

after year. They partner together unselfishly. Each and every one

is a great coach. They realize, as every great coach does, that

“At Wells Fargo, we’re fortunate to have what

I believe—and many industry observers

agree—is the best team of senior leaders in

the entire financial services and banking

industry.They lead with integrity.They know

how to build high-performing teams.They

all own the customer experience—together.”

success is not about their own self-interest. It’s about what’s

best for their teams, their customers and their partners in other

Wells Fargo businesses. They give their teams the tools, training

and resources they need to achieve our goal of industry-leading,

double-digit growth in revenue, profit and earnings per share.

They help create our vision and values. They help us achieve our

vision every day with every customer. They cause our success to

happen. They drive our business results. They influence, direct

and inspire their teams. They make sure our 153,000 team

members understand, support and live that vision and those

values. They’re role models for leadership. They lead with

integrity. When they make a mistake, they accept responsibility

and learn from it. They’re big picture thinkers with a broad

perspective—company-wide and industry-wide. They’re open

to new ideas, know how to learn and they learn from each other

and share best practices. They’re mentors for emerging, diverse

management talent across the company. They’re collaborators.

They know how to build high-performing teams. They and their

teams have fun together. They thrive on change. They care about

their people. They value diversity. They all own the customer

experience—together.

They’re not just good leaders, they’re great leaders. What’s

the difference? A good leader inspires a team to have confidence

in her or him. A great leader inspires a team to have confidence

in themselves. They teach and coach others to lead. Most of all,

they believe in our most important value: people as a competitive

advantage. They make every business decision with that value

in mind. They know that somewhere on their teams is the answer

to every problem, challenge and opportunity. Their job is to

find the people on their teams who have the answers, regardless

of rank or stripes, and help translate those answers into action.

The people with the answers most often are those closest

to our customers.

How do we picture the next stage of success?

Therefore, in our report to you this year, we want you to get to

know this great team of senior business leaders better. We want

you to fully appreciate, as I do, their outstanding talent, skill,

experience, integrity, ethics, innovation, insight and caring—

9

and how they picture success for their businesses in the coming

years. Beginning on page 11, our leaders describe their vision

of success for their businesses, how they and their talented teams

intend to partner to grow market share and wallet share, and

earn all of our customers’ business. I’m very fortunate to be

playing with the best team in financial services. I’m very proud

to share their stories with you in this report.

The National Bank Act—the law of the land

Mobility is a way of life for most of our more than 23 million

customers. They commute, do business, relocate, travel and

vacation, often coast to coast. Many have a second home in

different states. They buy goods and services globally. When it

comes to commerce, state boundaries are meaningless for them.

They assume that anywhere they go in the United States (or the

world) they can access their money, make financial transactions

and get information about their accounts through their national

bank governed by uniform, consistent federal oversight. Thanks

to this national oversight, they can receive credit decisions almost

instantly, a mortgage in just a few days.

They take this national freedom of financial access for

granted. But it’s not a birthright. It’s the result of a series of laws

and court decisions going back almost a century and a half.

The most important of those laws, by far, is the National Bank

Act of 1864. This visionary law—enacted just 12 years after our

company was founded—brought economic order out of a costly,

chaotic patchwork of state laws. It created uniform national

standards for safety and soundness governing an association of

national banks with national charters. When the telegraph was

the internet of its day, this law encouraged the free flow of capital

and labor across state lines in an increasingly mobile society. It

created the federal Office of the Comptroller of the Currency

and gave it exclusive powers to examine national banks such as

today’s Wells Fargo Bank, N.A. States could still regulate state

banks. The federal government would regulate national banks.

Unfortunately, the last few years several states have tried to

turn back the clock and challenge the authority of the Comptroller

to set uniform federal law for national banking and to supervise,

exclusively, national banks and their operating subsidiaries.

One Nation. One Economy.

Consistent National Standards.

Here are just six recent rulings that each upheld the principle that

the National Bank Act preempts state attempts to regulate national

banks—whether a state does this by restricting their banking

activities or through regulatory supervision:

January 2006 The U.S. Supreme Court, in an 8-0 ruling, holds that relevant

federal banking laws do not deny national banks the right to have cases

heard in federal court merely because the bank does business in a partic-

ular state.Justice Ruth Bader Ginsburg wrote in the ruling that a lower court

ruling was wrong because national banks would be “singularly disfavored”

in their access to federal courts.

October 2005 Federal District Court rules in favor of a financial services

trade association. It blocks the New York Attorney General’s Office from

demanding information from national banks and investigating their lending

practices.The Court rules that the National Bank Act preempts state

investigations of this type over a national bank such as Wells Fargo Bank, N.A.,

leaving such oversight to national regulators such as the Office of the

Comptroller of the Currency and the Federal Reserve Board.

August 2005 Federal Ninth Circuit Court of Appeals rules in favor of

Wells Fargo. It holds that the National Bank Act preempts state licensing

requirements and state supervisory authority over national bank subsidiaries.

The California Department of Corporations had tried to exercise authority

over Wells Fargo Home Mortgage,Inc., part of Wells Fargo Bank, N.A.

July 2005 A Federal Circuit Court of Appeals holds that the National Bank

Act preempts state regulation of a national bank’s operating subsidiary.

The case arose when a national bank and its mortgage subsidiary sued

the State of Connecticut to avoid having to obtain a state license and

follow certain state laws.

February 2003 Federal Fifth Circuit Court of Appeals rules in favor of

Wells Fargo and other national banks.It holds that the National Bank Act

preempts state laws that ban certain check-cashing fees to non-customers.

October 2002 Federal Ninth Circuit Court of Appeals rules in favor of

Wells Fargo and other national banks.It holds that the National Bank Act

preempts local ordinances that try to stop national banks from charging

non-customers a convenience fee for using their ATMs. San Francisco

and Santa Monica had ordinances to prohibit these fees.

10

Fortunately for our customers, every single one of these misguided

attempts has failed. When states and local governments announce

these lawsuits, they often attract significant media coverage.

But when they’re adjudicated in the courts—which have

consistently ruled in favor of national banks on these issues—

the stories are buried or not reported at all.

2006: The Economy

This coming year will be challenging for the banking industry.

Asset yields do not seem to account for risk. Credit quality

can’t get much better. The yield curve—the difference between

short-term and long-term interest rates—is likely to be flat, even

inverted. Banking competitors are, once again, relaxing loan

terms while not fully pricing for this risk. However, Wells Fargo’s

business model, now in place for nearly 20 years, focuses on

selling more products to existing customers and, therefore,

gaining both market share and wallet share. Perhaps that’s why

Wells Fargo produced consistent double-digit increases in both

revenue and earnings per share over the past 20, 15, 10 and

five years, which included almost every economic condition

a financial institution can face, not unlike those that may exist

in 2006.

The Next Stage

Once again, we thank our 153,000 talented team members

for their outstanding accomplishments and record results not

just for this year but for the past 20 years. We thank our

customers for entrusting us with more of their business and for

returning to us for their next financial services product. We thank

our communities—thousands of them across North America—

that we partner with to make them better places to live and

work. And we thank you, our owners, for your confidence in

Wells Fargo as we begin our 155th year (March 1852).

A special thank you

Two members of our Board will retire this April after a total of

three decades of service to our company.

Dr. Reatha Clark King, retired president

and board chair of the General Mills

Foundation, Minneapolis, Minnesota,

joined the Board 20 years ago when the

former Norwest Corporation had assets

of just over $21 billion. Most recently she

served on the audit and examination, and

the finance committees.

Gus Blanchard, chairman of ADC

Telecommunications, Inc., Eden Prairie,

Minnesota, joined our Board 10 years

ago, when we had assets of just over

$80 billion. Most recently, he served on

the audit and examination, credit, and

governance and nominating committees.

Their wise counsel and thoughtful guidance has helped our

company achieve remarkable growth during their tenures while

we built a reputation as one of the world’s most admired financial

services companies. Thank you, Reatha and Gus!

The “Next Stage” of success is just down the road—for our team

members, our customers, our communities and our stockholders.

It’s going to be a great ride!

Richard M. Kovacevich, Chairman and CEO

11

How Do We Picture the

Next Stage of Success?

Each of our senior leaders has a vision for the

future success of their businesses—how they

and their talented teams intend to partner to

grow market share and earn all of their customers’

business.As you can see on the following pages,

they’re unanimous on one key point—people

as a competitive advantage.

(l to r): Howard Atkins, Senior EVP,Chief

Financial Officer; Dave Hoyt,Senior EVP,

Wholesale Banking; John Stumpf, President

and Chief Operating Officer; Mark Oman,

Senior EVP, Home and Consumer Finance

12

“The way our team partners together, cares about each other, cares

about customers and solves their financial needs is rare in any

company.‘Culture’makes it happen. It’s instinctive. It’s knowing the

right thing to do without having to be told.Financial services is very

complex. Our company has more than 80 businesses,so winning

all our customers’business is a team sport.The star of our team…

is the team!

We’re a circle not a hierarchy. At the center of the circle—our

customers.Alongside them—our customer-contact team members.

Farther out in the circle are our managers.At the outside of the circle

are senior managers like me.All of us partner together to do the

best job we can for our customers.

If we grow the top line—revenue—the bottom line takes care

of itself.We’re not just expanding our franchise, we’re expanding our

thinking.We’re not just adding new stores,we’re adding more team

members to serve and sell our customers and offer them the best

solutions. Our success is the result of habits and focused execution,

not random acts. Our people are our competitive advantage.Our

product is service.Our value-added is advice.Our customers come

to us because of what we know, so they can learn how to save time

and money. If we think like a customer and focus our team on

serving customers, then everyone benefits.”

John Stumpf, President and Chief Operating Officer

Years in financial services: 30

Star of Our Team: The Team!

(l to r): Patti Hoversen,Technology

Information Group,Minneapolis,

Minnesota; Lori LoCascio,Wells Fargo

Phone Bank,Lubbock,Texas;

John Stumpf

13

“Our picture of success begins with talented people.Our customers

think of them first when they think of Wells Fargo.Diverse, seasoned

leaders who make decisions locally, close to the customer. Our

relationship managers make sure we completely understand the

customer’s needs before we offer any products to satisfy their

financial needs.The scope of our group is amazing—55 national

businesses,coast to coast,revenue the equal of a Fortune 350

company, as impressive an array of products and services as you’ll

find anywhere.

We know how to serve and sell—we lead the company in

products per customer. For example, we deliver credit products

many different ways—a straight commercial loan,an asset-based

loan, a commercial mortgage loan, a franchisee loan, a loan for

equipment-finance or equipment-leasing, or a private placement

or a syndicated credit.Almost three of every four of our customers

now use our internet portal—Commercial Electronic Office—to

run their business more efficiently. It continues to be the best in

the industry.Customers sign on just once to access more than

40 products. Our new Desktop Deposit

SM

service lets customers

make deposits electronically from their own office,no more

hauling paper to our banking stores.“

Dave Hoyt, Senior EVP,Wholesale Banking

Years in financial services: 28

Knowing How to Serve and Sell

Team members: 15,000

Customers: 78,000

Locations: 600

Products per customer: 5.7

(l to r): Dave Hoyt; Patti Rosenthal,

Wholesale Services,San Francisco,

California; Ray Orquiola,Wholesale

University, San Francisco, California

14

“Our team serves virtually all the credit needs of individual

customers—mortgage loans,home equity loans, personal credit,

and consumer finance.So, success for us is satisfying all these needs

smoothly for our customers whether it’s through our stores, on the

phone or via the internet.We span all 50 states,Canada and parts of

the Caribbean, and we’re #1 nationally in many products, but our

market share is still relatively small.That gives us lots of opportunity

for future growth.

A mortgage is the largest, most complex financial transaction

most of our customers ever make.It’s also a core product—

customers value it so much they’re more likely to give us even

more of their financial services business—not just home equity

loans and banking products but their investments and insurance.

We’ve proven this works:cross-sell among our mortgage customers

has grown about 30 percent a year for the last several years.Our

mortgage business is the Company’s second largest source of

checking accounts and new credit card customers.Our group

accounts for almost two of every three of Wells Fargo’s new

customers.We’ll be even more successful when we can earn

more business from our consumer finance customers.

We service the mortgage and home equity loans of more than

five million households.That’s a monthly relationship that positions

us to be there when they need their next financial product.We also

have to be best at managing risk.We can’t avoid all risk and still

make a profit. It’s how well we manage interest-rate risk, credit risk,

operations risk and compliance risk that makes the difference.”

Mark Oman, Senior EVP, Home and Consumer Finance

Years in financial services: 26

Turning Vision into Reality

Team members: 52,000

Customers: 12.3 million

Stores: 2,388

(l to r): Mark Oman; Phil Hall,

Home and Consumer Finance,

Des Moines,Iowa; Michael Levine,

Wells Fargo Home Mortgage,

Minneapolis,Minnesota

15

“Our financial success begins with our time-tested business model.

More than 80 businesses.We cover virtually every facet of financial

services.This diversity gives us 80 different ways to grow, helps us

manage the risk of unforeseen changes in the economy or financial

markets, and helps us earn more business from our customers

wherever they are in their financial life cycle. Success for us also

means excelling at managing risk in asset quality, interest rates,

accounting and operations,and capital.

Our credit ratings are very high. Our approach to risk has always

been very disciplined.We don’t take unacceptable risks even if

some competitors are willing to do so.We’re consistent—with our

customers and with Wall Street.As good as our business model and

track record is, however, our strong and consistent financial results

cannot happen without…great people! I believe we have the best

in the industry.”

Howard Atkins, Senior EVP, Chief Financial Officer

Years in financial services: 31

Consistency

Team members: 1,200

Finance, Corporate Development,

Investor Relations,Treasury,

Corporate Properties, Investment

Portfolio, Controllers

(l to r): Howard Atkins; Nancy Lee,

Investor Relations,San Francisco,

California; Cindy Garcia, Corporate

Properties,Phoenix, Arizona

16

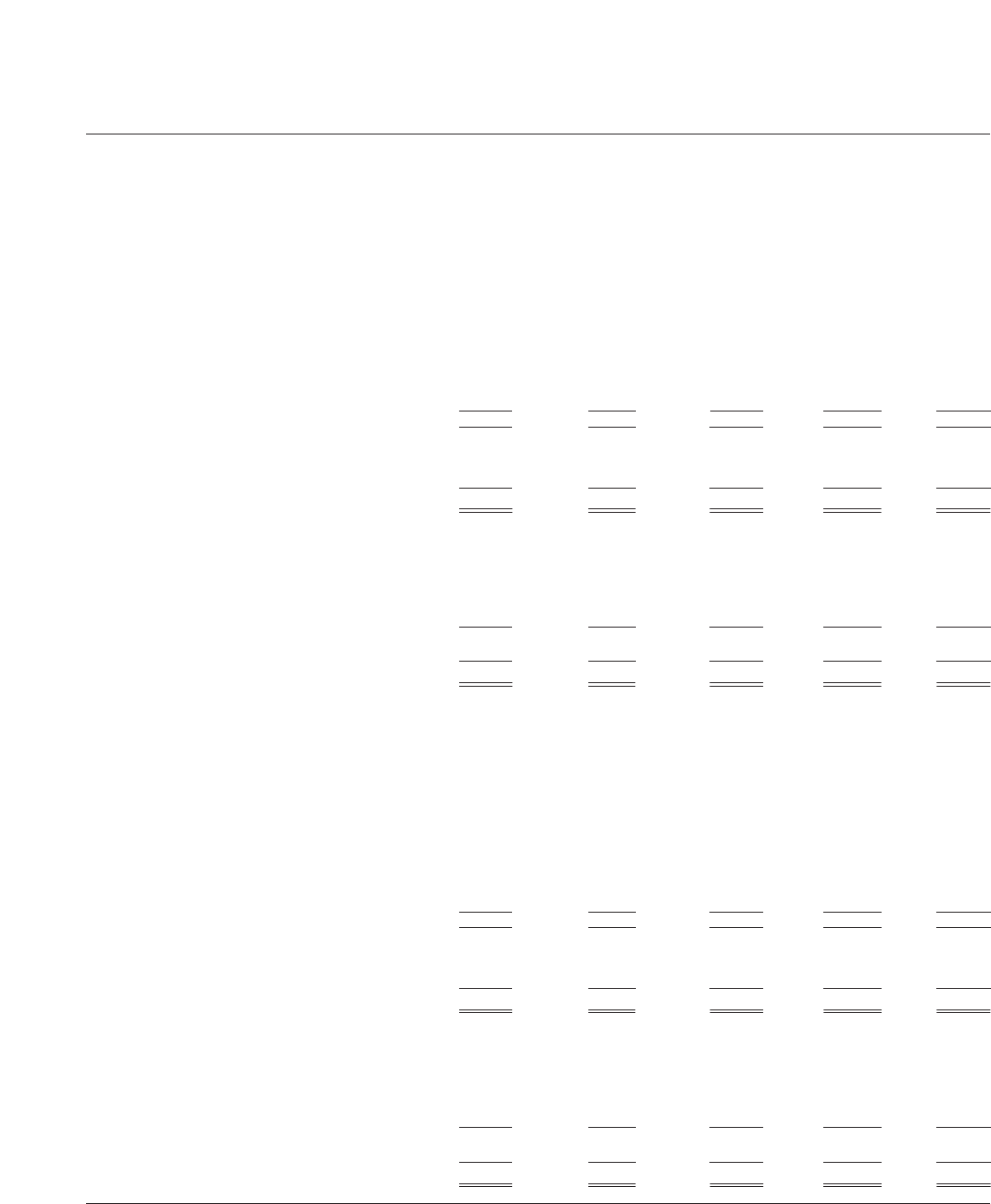

Carrie Tolstedt, Regional Banking

Years in financial services: 20

Energized, Diverse, Caring

Clyde Ostler, Private Client Services (PCS), Internet Services

Years in financial services: 35

Great Service Every Time

Team members: 51,000

Households: 10.3 million

Stores: 3,120 (92 opened in ’05)

Products per customer: 4.8

(l to r): Carrie Tolstedt; Joey Davis,

Regional Banking,Omaha,

Nebraska; Laurie Doretti, Regional

Banking,Scottsdale, Arizona

Team members: 8,000

PCS clients: 820,000

Active online consumers: 7.1 million

#1 consumer internet bank

(l to r): Katie Kellen, PCS,

Denver, Colorado; Clyde Ostler;

Lisa Robinson, Internet Services,

San Francisco,California

“Our success begins with our great team.When our diverse and

caring team is doing what they do best, they connect with our

customers to create a special relationship that lasts a lifetime. Our

engaged team is the link between our vision and the customer

experience.Supported by talented leaders in our local markets,

our team responds quickly to their customers,on the spot, doing

what’s right for them.They know their stores, their customers and

communities better than anyone.

We develop tools centrally to support our team—training,

measurement, marketing, reporting,products and systems.We want

to earn 100 percent of our customers’ business by partnering with

other teams,such as Home Mortgage, Private Client Services and

Wells Fargo Financial.Our customers are at the center of everything

we do. Our team is our competitive advantage.”

“Our picture of success for Private Client Services is very simple—

exceptional service for each client every time.We start with the

client’s aspirations, goals, and the legacy they want to leave for future

generations.Our value-added is our financial advice.

Our team of professionals should understand our clients’ financial

needs so well—and deliver such great service—that they will want

to bring all their business to Wells Fargo. Partnering with our banking

store teams, we provide investment and insurance services by

putting our customers’needs first, and giving them great, individual

service and advice that distinguishes us from our competitors.

We’re rated America’s best internet bank, but we measure

internet success by what our customers tell us—and they tell us

they appreciate the convenience and benefits of wellsfargo.com

by giving us more of their business.”

17

“We’re a diverse group of businesses that share one vision

for success—to help our team members and customers

achieve their goals.

For team members,this means knowing how their work

connects to the Wells Fargo vision,knowing they have the tools,

work environment and partnering spirit to go as far as their talent

and skill can take them. For customers, it means helping them

achieve financial success.

Having the right products and services is important, but

to satisfy all our customers’financial needs we have to build

relationships with them, as trusted advisors, so they’ll want to

give us all their business.”

Mike James, Diversified Products

Years in financial services: 33

Trusted Advisors

“To succeed as an insurance provider we must be consistently

superior in helping customers identify their specific risks,

understand their insurance choices, select cost-effective protection,

and be comfortable with their choice.Success in all of these helps

them, and us, be financially successful.

Like checking, investments and a mortgage, insurance is a core

Wells Fargo product: when customers buy it from us they’re more

likely to buy more products from us.That’s why we’re a full-service

provider of insurance solutions through our insurance agencies,

banking stores, phone, mail and internet.

We’re the world’s fifth largest insurance brokerage company,

and America’s largest crop insurance provider—but we have

unlimited potential for growth and more success.Only four percent

of our banking customers buy their insurance through us!”

Pete Wissinger, Insurance

Years in financial services: 30

Insurance: Core Product

Team members: 5,000

#1 U.S. small business lender

#2 U.S. debit card issuer

Student loan customers: 1 million

(l to r): Ciony Catangui, Education

Finance Services,Sioux Falls,

South Dakota; Danny Ayala,Global

Remittances,Concord, California;

Mike James

Team members: 2,000

Customers: 300,000

World’s 5th largest insurance broker

#1 U.S. crop insurer

#1 bank-owned insurance agency

(l to r): Pete Wissinger; John Tebbs,

Rural Community Insurance Services,

Winchester, Kentucky; Paul Gauro,

Wells Fargo Insurance, Minneapolis,

Minnesota

18

“Our business is all about relationships.If we earn our customers’ trust

then they’ll rely on us as their financial institution and we can earn all

their business.We offer valued advice to deepen every relationship, to

help every customer be financially successful. Relationship managers

are key in building successful partnerships. Our talented team of

bankers is trained and equipped with extensive product knowledge.

We know our customers well.We listen and respond by

customizing specific solutions tailored to each customer’s financial

needs.We anticipate challenges and design solutions they may not

have even thought about.The more they value our relationship, the

more resources we can provide them—credit for their operations,

a term loan for capital expenditures or acquisitions, investment

alternatives, insurance solutions, or treasury management.When

our customers succeed, we succeed.”

Iris Chan, Commercial Banking

Years in financial services: 30

Growing with Customers

“We’re a diverse, complex group—22 businesses and 150 locations

nationwide.Our team members do everything from making loans

and leases to investing in securities and providing capital markets

advice.Our customers range from tribal governments and local school

districts to real estate developers and Fortune 1000 companies.

Our picture of success: understand our customers’businesses

better than anyone else and offer them great ideas and sophisticated

solutions so they can be more successful.We ring the bell when we

help create value for them.”

Tim Sloan, Specialized Financial Services

Years in financial services: 21

Ringing the Bell

Team members: 1,100

Customers: 8,200

#1 financial services provider

to middle-market companies in

western U.S.

(l to r): Richard Gan, Commercial

Banking,Austin,Texas; Iris Chan;

Gary Dyshaw,Commercial Banking,

St. Paul,Minnesota

Team members: 1,800

Customers: 33,000

Assets: $30 billion

(l to r): Alex Idichandy,Corporate

Banking,Atlanta, Georgia;

Kristine Netjes,Media Finance,

Minneapolis,Minnesota;

Tim Sloan

19

“Success happens when we deliver terrific results for our clients

and help them meet their investment goals.When we do that, they

entrust us with even more of their money.The more high quality

investment choices we offer—such as more funds that carry 4-star

or 5-star ratings from Morningstar and those top-ranked by Lipper

—the more successful we are.

For us,great service is a given. Successful investment management

is the result of our talented team delivering superior performance.”

Mike Niedermeyer, Asset Management

Years in financial services: 22

Results

“In our group, definitions of success are as varied as the wide

range of business customers we serve.They look to us to give

them alternatives to cash flow loans that help them achieve their

objectives, and the financial flexibility they need to move from

one phase to the next in the life cycle of their business.

Success for us is providing this flexibility but balancing the

common sense of a lender with the innovative spirit of an

entrepreneur.”

Peter Schwab, Asset-Based Lending

Years in financial services: 30

Staying Flexible

Team members: 3,300

Customers: 32,000

Assets managed: $219 billion

17th largest U.S.mutual fund

company

(l to r): Mike Niedermeyer;

Tom Hooley, Institutional Trust,

Minneapolis,Minnesota; James

Alexander, Institutional Brokerage

and Sales,Chicago, Illinois

Team members: 1,100

Customers: 1,200

Among top U.S. asset-based lenders

(l to r): Peter Schwab; Eileen

Quinn,Wells Fargo Foothill,Boston,

Massachusetts; Paz Hernandez,

Wells Fargo Foothill,Los Angeles,

California

20

“Success means helping our domestic customers succeed wherever

they do business in the world—to grow their earnings,seize global

opportunities, and be their one-stop shop through our internet

portal, Commercial Electronic Office.

We can open bank accounts for them in 66 countries, facilitate

trade in 80 countries,and help reduce currency risk, payment

processing risk, regulatory risk, and cultural risk.We succeed when

We Make the Complex Simple®!”

Dave Zuercher, International, Correspondent Banking, Insurance

Years in financial services: 36

Making the Complex Simple

“For our team—even before real estate and credit—people come

first.That’s what creates success for our customers, our communities,

Wells Fargo and our stockholders.

We work with our partners across Wells Fargo to develop creative

financial solutions—such as flexible acquisition, re-hab and

construction loans—to help our customers build communities that

provide people with housing, offices, factories, warehouses, schools,

stores,shopping,recreation, lodging and jobs.”

Larry Chapman, Real Estate

Years in financial services: 32

People First

Team members: 5,000

Customers: 2,300

Includes Foreign Exchange,Treasury

Management,Wells Fargo HSBC Trade Bank

(l to r): Lillie Axelrod, Acordia,

Atlanta,Georgia; Dave Zuercher;

Sara Wardell-Smith,

International Group,

San Francisco,California

Team members: 360

Customers: 485

One of U.S.’s leading lenders

to developers and investors

(l to r): Larry Chapman;

Debora Welsh, Real Estate, Atlanta,

Georgia; Juan Carlos Wallace,

Real Estate,San Francisco, California

21

“Our mission is homeownership. Our team members believe

passionately in that mission.They live it every day.They believe and

know that homeownership provides a rich, stable foundation upon

which to achieve personal and financial success. It’s the primary

source of financial net worth for most American households.They

know that working together, we can help people reach their

personal and financial goals—through homeownership.

We’re privileged to work in a business that helps people build

wealth and provide a safe,secure environment for their families.

Businesses measure success with numbers and so do we—but our

most important measure is how we feel every time we know we’ve

helped someone achieve the dream of homeownership.That’s how

we picture success.It comes from the home and from the heart.”

Cara Heiden and Mike Heid, Mortgage

Years in financial services: 25 and 26

Home and Heart

Team members: 28,000

Customers: 5.7 million

#1 U.S. retail mortgage originator

#2 U.S. mortgage servicer

(l to r): Christiaan Lidstrom, Wells Fargo

Home Mortgage, Des Moines,Iowa;

Cara Heiden; Patrick Carey, Wells Fargo

Home Mortgage, Fort Mill, South

Carolina; Mike Heid

22

“Our success starts with attracting, keeping and growing the

best team of professionals in financial services.We’ve built a high-

performing business model based on many partnerships.This allows

us to deliver our products and services through our banking stores,

mortgage stores,Wells Fargo Financial, wellsfargo.com,direct mail,

telesales,Wells Fargo Phone Bank centers,brokers and correspondents.

We listen to and educate customers.We guide them to the

home equity and personal credit solutions that help them succeed

financially with smart management of their home asset and

personal credit. Our innovative products and solutions sustain our

lead in market share and earning more business from loyal

customers helps grow it.”

Doreen Woo Ho, Consumer Credit, Corporate Trust

Years in financial services: 32

Right Solutions

“Our business model has changed profoundly the last few years.So has

our picture of success.We’ve moved from offering small,unsecured

loans to larger,secured loans, auto loans and first mortgage products

—and we’ve expanded credit card offerings to our best customers.

To be more efficient and give our customers faster service,we’ve

freed up our store team members to spend most of their time

serving and selling to customers—we now score all our loans

electronically and collect all payments centrally. Our goal: common

where possible,custom where it counts.

These fundamental changes in our business model have driven

unprecedented growth for Wells Fargo Financial—19 percent annual

compound growth in receivables for the last six years—but they’ve

also reduced our cost per loan which helps us lower interest rates

for customers.”

Tom Shippee, Wells Fargo Financial

Years in financial services: 32

Serving and Selling

Team members: 21,000

Customers: 6.7 million

Stores: 1,307

One of North America’s premier

consumer finance companies

(l to r): Stephanie D’Itri, Wells Fargo

Financial Canada Corporation,

Mississauga, Ontario; Susan Hack,

Auto Finance, Chester,

Pennsylvania; Tom Shippee

Team members: 6,000

Households: 2.4 million

#1 home equity lender, personal

credit provider in U.S.

(l to r): Doreen Woo Ho; Jody Bhagat,

Consumer Credit,San Francisco,

California;Tracy Schaefbauer,

Home and Consumer Finance,

Minneapolis,Minnesota

23

“We’ve partnered with entrepreneurs for 45 years to build great

technology businesses.We pride ourselves on doing whatever

it takes to help them build leading companies—facilitating

customer and partner relationships for these companies,helping

entrepreneurs evolve their business strategies, or working with

CEOs to drive their recruiting processes. If our portfolio companies

are successful, then we’re successful.What characterizes this

success? Extreme dedication to these entrepreneurs.Deep

operating experience.High integrity. And,a strong network of

domestic and international relationships.”

John Lindahl, Norwest Equity Partners

Years in financial services: 39

Resourceful, Approachable

“Our success is built on strong partnerships. Strong partnerships

with our portfolio companies. Strong partnerships with experienced

management teams to acquire leading middle-market companies.

To these relationships our investment professionals bring significant

resources to help management grow their business—including

adequate capital to grow organically and by acquisition.We can

supplement the company’s management team, provide operating

expertise, and,when we exit the investment,guidance to maximize

shareholder value. Our success,built on our 45-year history, requires

skill, ability and integrity — the skill to recognize great companies,

the ability to offer valuable expertise,the integrity to be resourceful,

resilient and reliable partners.We succeed when,during our time as

owners,the investors and our management partners create an even

better company.”

Promod Haque, Norwest Venture Partners

Years in financial services: 15

Dedicated Partners

Early stage investments in information

technology including semiconductor

and components, systems, software,

services and consumer/internet

technologies.

Invests in management buyouts,

recapitalizations, and growth financing

for middle-market companies; one of

oldest private equity firms in U.S.

24

Picturing the Next Stage of Success

for Our Communities

Our picture of success for our communities begins with our team

members.They know their cities,towns and neighborhoods

better than anyone else because they live and work there—so

they’re the major voice in deciding how Wells Fargo responds to

the distinct needs of their own community.We want them to care

as much about their community’s quality of life as they do about

their business’s bottom-line because the two are related. A report

on our achievements in corporate citizenship for 2005 is available

at www.wellsfargo.com/about/csr.

St. Paul, Minnesota

Once a polluted industrial site,

these 200 acres now are home to

indigenous plants and animals.

Duane Ostlund,

Business Banking Manager

25

Eleven years ago, the Phalen Corridor was an environmental mess—

11 contaminated industrial sites covering 200 acres in a distressed

community on the east side of St. Paul, Minnesota.Wells Fargo and

60 other public and private organizations came together to restore

Phalen Corridor.The result: today it’s a thriving neighborhood with

parks,wetlands, new homes, retailers and jobs.

Wells Fargo team members Duane Ostlund (opposite page) and

Judy Chapman serve on the Phalen Corridor Steering Committee.

Thanks to their leadership, hundreds of hours volunteered by more

than 30 other team members,and thousands of dollars in corporate

contributions,the Phalen Corridor is now a revitalized community

with 19 new businesses,2,100 new jobs and 1,100 new homes.

“This is a great example of tremendous results that can be achieved

through a public,private and community partnership,”said Ostlund.

As part of the extensive environmental cleanup,Wells Fargo

helped restore Ames Lake wetlands, once filled-in with asphalt and

used as a parking lot.Today Ames Lake is a habitat for hundreds of

indigenous plants and animals.

Other examples of Wells Fargo’s commitment to the environ-

ment include:

• A 10-point commitment to more effectively integrate

environmental responsibility into our business practices.

• A $1 billion lending, investment and other financial commitment

target for environmentally-beneficial businesses.

• Reducing in paper, energy and water consumption through

services such as online statements and e-bills.

• Promoting environmental responsibility for team members

through an awareness campaign called “everyday actions.”

Cleaning Up Polluted Land

26

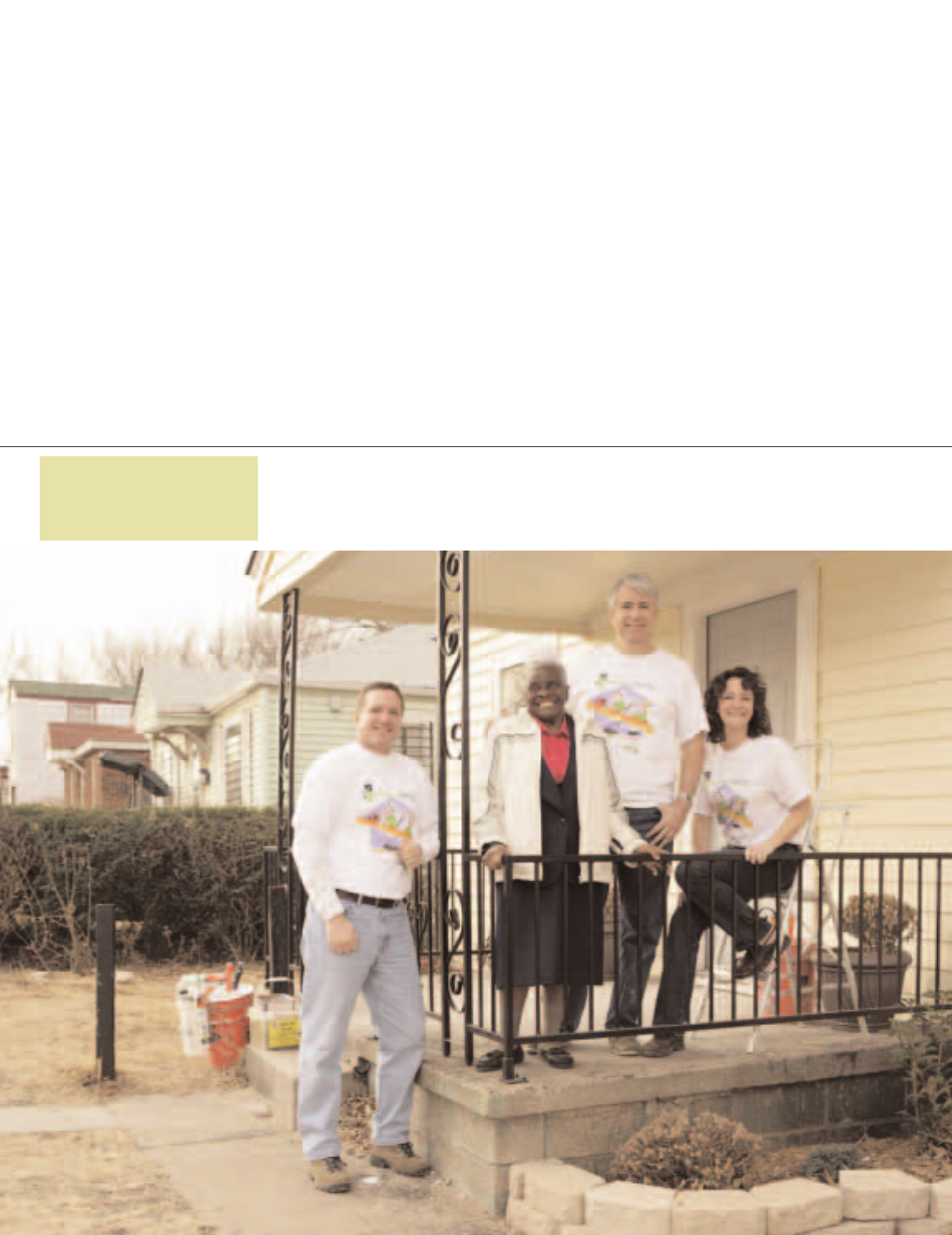

Oklahoma City, Oklahoma

As the nation’s #1 retail mortgage

originator, we work with non-profits

to help build and renovate homes

for low-income families.

(l to r): Wells Fargo Home

Mortgage team members

Chris Hunter,John Snodgrass and

Shelley Pruitt with homeowner

Clara Myers (second from left)

The dream of living in a clean, warm, safe home can be a challenge

for homeowners who are low-income,elderly or who have

disabilities.Who do they turn to if the roof leaks or a handrail

breaks? Over the past nine years,thanks in part to Wells Fargo’s

partnership with Rebuilding Together, many seniors and families are

now living independently and comfortably in their own homes.

Wells Fargo has contributed over $650,000 and hundreds of team

member volunteer hours to Rebuilding Together in 27 cities.

Last April, a platoon of more than 20 Wells Fargo team members

in Oklahoma City, Oklahoma, descended upon 10 houses on

National Rebuilding Day for a hands-on renovation project.They

helped install windows,fix porches,paint, and add grab-bars and

railings.“Everyone deserves to live in their own home,”said

Wells Fargo team member Shelley Pruitt, board member for the

local chapter of Rebuilding Together.“We’re fortunate to help

improve the quality of life for residents in our community.”

Since 1993, the Wells Fargo Housing

Foundation has teamed up with

hundreds of local housing non-profits

such as Rebuilding Together and Habitat

for Humanity to help make the dream of

homeownership a reality for low-income

families.The Foundation, through grants

and the volunteerism of Wells Fargo team

members,has helped build or renovate

more than 1,900 homes.

Who Do You Turn to When the Roof Leaks?

27

Santa Ana, California

Seeking to increase student academic

performance by encouraging

parents to be active participants

in their child's education.

Wells Fargo team member and

mentor Gabriela Cachua

and student

Colorado Springs, Colorado

Educating and inspiring young

people to become learners

and leaders.

Fifth grader Lucia (below),who attends Willard Intermediate School in

Santa Ana, California, probably wouldn’t be reading the American

classic “Tom Sawyer”if it weren’t for Wells Fargo team member

Gabriela Cachua, Regional Banking,Orange County, California.

She’s just one of the eight volunteer mentors who visited the school

every week for a 10-week Reading Club.

Two years ago,Wells Fargo connected with the Santa Ana

Foundation to help out with Avanzando Familias Program,which

engages parents in their child’s education to improve student

academic performance. Mentors also teach students and their parents

about budgeting,the importance of saving, bank accounts,and credit

through Wells Fargo’s financial literacy curriculum,Hands on Banking®.

More than 5,000 team members have been trained to teach the

Hands on Banking curriculum, available in both English and Spanish,

in schools and community groups (handsonbanking.com).

“It is never too early, or too late,to learn—whether it’s about

enjoying a new book, or the basics of banking,”said Cachua.

Engaging Parents in Education

“Stay in school and you’ll be more successful on the job.” That’s been

the message to eighth grade students for the past several years

during Junior Achievement’s Job Shadow Day. Students interested

in learning more about careers in banking visit a Wells Fargo store in

Colorado Springs,Colorado to see a typical day in the banking world

up close.More importantly, they learn about teamwork and how

math, problem solving and communication skills are used each day

on the job.

Wells Fargo has partnered with Junior Achievement for more

than 11 years and is one of the top three largest providers of

volunteers to Junior Achievement in the nation.In 2005, over 1,500

team members volunteered in 1,630 classrooms nationwide to

teach financial literacy, leadership skills,and life lessons such as

self confidence and the importance of staying in school. First

grader Sierra (below),Whittier Elementary School, participated in

Junior Achievement workshops with Wells Fargo team member

Doug Brewer last year.

The Economics of Life

28

Portland, Oregon

Helping satisfy the basic needs of

the homeless as they transition

to housing.

Why spend time helping others? Just ask any of the several

thousand team members at Wells Fargo who volunteer in their

communities.They’ll say that every smile, hug and “thank you”

they receive makes it more than worthwhile. Every day, hundreds

of team members across the country give their time,talent and

resources to improve the quality of life in their communities.

In 2005,Wells Fargo created a company-wide process

to better manage and measure the company’s volunteer efforts.

VolunteerWellsFargo! is an internet-based tool that helps connect

team members with volunteer activities that match their interests

and time.They use it to find projects and recruit colleagues for

beach clean ups,Habitat for Humanity house builds, fun runs, and

tutoring projects, and to record their volunteer hours or board

membership activities.

Team members in Portland,Oregon use VolunteerWellsFargo!

to organize groups of volunteers to prepare and serve hot meals to

90 homeless individuals at Transition Projects Inc.,a non-profit that

provides shelter and helps the homeless get back on their feet.

Team members (below, from left) Kellie Pearse, Mary Hills,

Denise Sandefur, Robin Thomas,Fe Dolor, Charlie Jones,

Michelle Trofitter and Karen Schmidt are among over 30 team

members who take turns volunteering every month to plan,

provide, prepare and serve meals at the shelter.

So far, over 20 percent of our team members have logged

onto the VolunteerWellsFargo! website and over nine percent

have recorded their hours.“This new tool will give us a better

understanding of how we make our communities even better

places to live and work,”said Tim Schreck, community support

manager.“It will also show us for the first time the incredible

quantity and quality of all our volunteer efforts, which we believe

are just as important if not more important than the $95 million

our company contributed to non-profits this year.We can now

track our progress toward becoming one of the top contributors

in team member volunteerism in all of corporate America.”

VolunteerWellsFargo!

29

Wells Fargo Receives Highest Possible

Rating for Community Reinvestment

Wells Fargo Bank, N.A. received an “Outstanding”rating—the highest

rating possible,earned by less than one of every five national banks

—in its most recent Community Reinvestment Act examination by

the Office of the Comptroller of the Currency (OCC).The Bank met

or exceeded community needs in areas such as affordable housing,

financial education and small business lending.For Wells Fargo,

community reinvestment is not just about meeting the requirements

of a law, it’s about helping our communities grow and prosper. It’s

just good business.We’d do it even if there was no CRA!

Here are just some of the more than

15,000 non-profits we supported in 2005:

Arts

Santa Rosa, California – $3.75 million in financial support over

10 years. Wells Fargo provided a grant to the Luther Burbank Center

for the Arts to help renovate and operate the 140,000 square foot

art and performance venue.Greg Morgan, community banking

president, serves on the board.

Des Moines,Iowa – $1.2 million in financial support and 56 prints

by American artists to the Des Moines Art Center.The project

is one reason Wells Fargo was recognized as one of the “Ten Best

Companies Supporting the Arts in America”by the New York-based

Business Committee for the Arts.

Billings,Montana – 33 years as lead sponsor of Symphony in the

Park,a free cultural event for the community showcasing the Billings

Symphony and other local musicians. Last year 55 team members

helped staff the event.

Lincoln, Nebraska – For the second year in a row, Wells Fargo

sponsored Celebrate Lincoln, an outdoor cultural event featuring

live music,dancing,arts and crafts,and food from around the globe.

Over 40 Wells Fargo team members volunteered at the event.

Hurricane Katrina:

The “Next Stage”

Hurricane Katrina caused unprecedented devastation in the

Gulf States.Our response to help our affected customers also

was unprecedented:

• We allowed them to defer mortgage payments for an initial

90 days,through November 2005.

• We then extended that mortgage deferral period another

90 days,through February 2006.

• During those deferral periods,we suspended all late fees,

negative credit reports and collection calls for them.

• Using dedicated toll-free phone numbers,we helped

affected customers with personal financial counseling to

determine the most reasonable payment solution after

the deferral period ended.

• Residents of Alabama, Louisiana and Mississippi could make

free withdrawals from any Wells Fargo ATM, nationwide through

year-end 2005, whether or not they had a Wells Fargo account.

• We increased the daily spending limit for our ATM and Check

Card customers in affected areas of those states.

• Our affected small business customers could get emergency

increases in their credit lines,bridge loans, term loans, credit

protection, deferred loan payments and fee waivers.

• We deferred credit card payments for affected customers

through year-end 2005, waived over-limit,late,or non-sufficient

funds fees,and suspended collection calls and negative

credit bureau reporting.

• Our Company and team members contributed a total

of $1.5 million to the American Red Cross and United Way

Hurricane Katrina Relief Funds.

$66

01

82

02

83

03

93

04

95

05

Wells Fargo Contributions – 2005

(millions, cash basis)

Corporate America’s 10 Largest Givers–2004

(dollars in millions)

1. Wal-Mart Stores $188.0

2. Johnson & Johnson 121.8

3. Altria Group 113.4

4. Citigroup 111.3

5. Ford Motor 109.8

6. Bank of America 108.0

7. Target 107.8

8. Exxon Mobil 106.5

9. Wells Fargo 93.0

10. Wachovia 81.7

Source: BusinessWeek 11/28/05

30

Community Development

Anchorage,Alaska – $100,000 grant for affordable housing

through the Wells Fargo Housing Foundation’s seventh annual

Focus Communities Initiative.Wells Fargo team members raised

an additional $1,400 for Cook Inlet Housing Authority.

Oakland,California – $6 million investment in the East Bay Asian

Local Development Corporation for Preservation Park,a renovated

Victorian-style business park that provides affordable office space

to non-profits facing eviction.

Pueblo, Colorado – 35 home improvement projects. Wells Fargo

partnered with NeighborWorks, a non-profit that provides affordable

housing,education and down payment assistance.Team member

Brad Ahl led a group of co-workers to help paint the trims and

garages of 35 homes during their annual Operation Paintbrush event.

Mission, South Dakota – $125,000 to help families of the Rosebud

Sioux Tribe.Wells Fargo team members are working with Habitat for

Humanity to build five homes on the Rosebud Indian Reservation.

Team member Samantha Keller used the company’s new online

tool, VolunteerWellsFargo!,to recruit over 75 volunteers.

Austin,Texas – $20,000 so far to help 10 families buy first homes.

Wells Fargo supports the Austin Area Urban League’s new down

payment assistance program.Low-income individuals who complete

a free,monthly workshop receive $2,000 in down payment assistance.

Brigham City, Utah – $17,500 grant and eight new homes. Wells Fargo

provided a grant to the Neighborhood Nonprofit Housing Agency

for affordable housing.Wells Fargo team members volunteered

every Saturday for seven weeks to help build homes.

Richmond,Virginia – 700 African American adults attended a free

workshop on practical approaches to financial management,

including homeownership and saving for retirement.This was one

of 23 wealth-building seminars held around the country in 2005.

Education

Phoenix, Arizona – Every week, two dozen Wells Fargo team members

visit students at Lowell Elementary School as part of the Big Brothers

and Big Sisters “Lunch Buddy” mentoring program.Team members

also raised $15,000 to renovate the school’s playground.

Fort Wayne,Indiana – For the tenth year in a row, Wells Fargo

sponsored the YMCA Celebration of Youth event. Every year eight

students receive a $700 college scholarship from Wells Fargo in

honor of their community involvement activities.

Las Vegas, Nevada – $50,000 to teachers in 17 schools. Wells Fargo’s

“Grant a Wish for Your School” program awarded up to $3,000 each

to teachers across the state for special classroom projects focused

on financial literacy, math, technology and careers.

Chester, Pennsylvania – 720 backpacks and $5,000 grant. Team

members from Wells Fargo Auto Finance partnered with the Junior

League to kick off the school year in style.Team members visited

Columbus Elementary School and gave each student a backpack

filled with school supplies.

Milwaukee,Wisconsin – A decade of support. Wells Fargo worked

with the Greater Milwaukee Committee and other business leaders

to create the School Partnership Program.The program helps

prepare young people for their future by teaching them healthy

financial habits and other life-skills. During the past 10 years, over

100 team members have volunteered.

Environment

San Francisco, California – Energy consumption reduced by