Version_2022/07

Page 1 / 8

INVOICING GUIDELINES INCL. INVOICE SAMPLE

1 Ensuring the provision of all necessary invoicing details

Kindly note that under relevant legislation, especially the laws on turnover tax and VAT (hereinafter

referred to as ‘VAT legislation’) as well as sales tax and goods and services tax (hereinafter referred

to as ‘GST legislation’) it is possible that other details might be required on invoices apart from

those set out below. Supplier must ensure that all invoicing details required by law are shown on

their invoices to the respective Hilti companies. Please find an Invoice Sample at the end of this

Guideline.

2 Layout of invoices / Correction invoices (credit notes)

2.1 The invoice layout must always be identical.

2.2 The invoice and corresponding correction invoice (credit note) layout must always be identical.

3 Structure of invoices / correction invoices (credit notes)

3.1 The invoice structure must always be identical.

3.2 The invoice and corresponding correction invoice (credit note) structure must always be identical.

3.3 No gridlines must be shown on invoices or corresponding credit notes. If any gridlines should be

shown on an invoice despite this instruction no invoice details must be written over these gridlines.

3.4 The line structure for order-related data must always be identical.

3.5 The number of lines per order pad must always be identical.

3.6 Invoices must always be written in the same language.

3.7 The appropriate designation must always be shown for each individual invoice detail required by

law or by Hilti.

3.8 An appropriate gap must be left between the designation and the amount.

3.9 When showing figures in thousands (e.g. prices, amounts or quantities) a full stop must always be

used (for example: EUR 2.000).

3.10 Commas must be used instead of decimal points (for example: EUR 2.000,95).

3.11 The tariff number (minimum 6-digits) and the country of origin must be indicated. The country of

origin must be reflected in accordance with standard ISO 3166-1 alpha 2 (for example: DE for

Germany). The indication of the actual country of origin is mandatory; a regional indication like EU

is NOT permissible.

Version_2022/07

Page 2 / 8

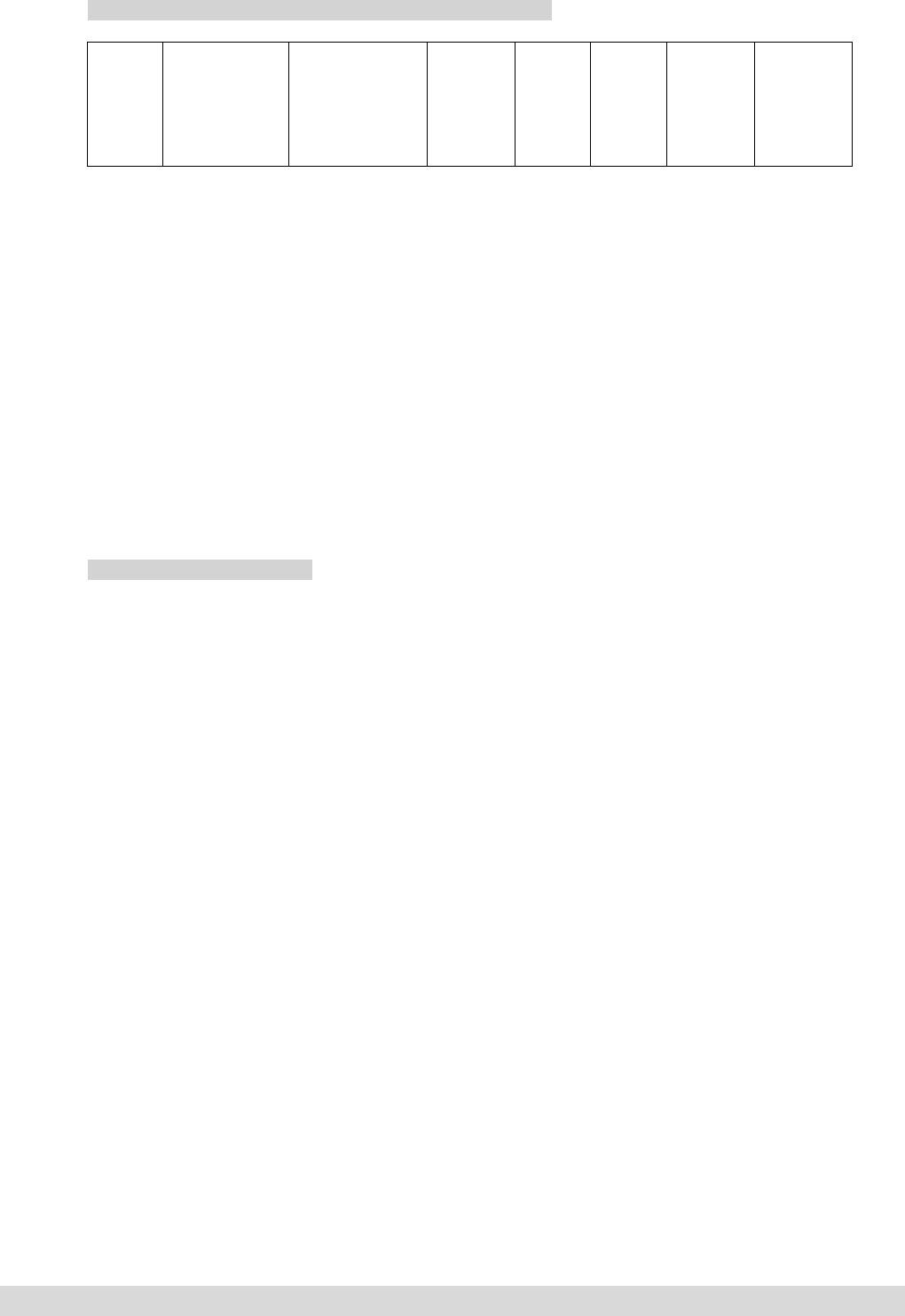

Example: Order-related line structure as per Hilti guidelines

Hilti

order

code

Hilti order

no.

Hilti article

no.

Article

designation

Customs

duty no. /

origin

Quantity

Unit

Quant-

ity unit

Price in

EUR per

quantity

unit

Total

price in

EUR

per code

00010

4501234567

123456

Article ‘ABC’

Customs tariff:

90159000/DE

4800

Items

1

10

48.000,00

00130

4501236589

789101

Article ‘’123’

Customs tariff:

90259000/DE

3600

Items

1

20

72.000,00

00060

4501238791

111213

Article ‘XYZ’

Customs tariff:

90359000/ES

6400

Items

1

30

192.000,00

4 Hilti order nos.

The Hilti order nos. provided by the Hilti company concerned must be shown on the invoice.

For example: 4501234567

5 Correction of invoices

Invoices that do not correspond to a Hilti order, the goods actually supplied or service actually

rendered to the Hilti company must first be corrected by Supplier by way of a corresponding

correction invoice (credit note) issued to the Hilti company. The invoice no. of the invoice that differs

from the Hilti order, the goods actually supplied or service actually rendered to the Hilti company

must be shown on the correction invoice (credit note) as a reference; a new corrected invoice must

then be issued; no handwritten comments or other amendments may be made on invoices to Hilti

companies.

6 Submission of invoices

6.1 If not explicitly agreed otherwise, the original invoice must be submitted to the Hilti company

concerned in the form of a paper invoice. Submission of electronic invoices to Hilti companies in

the form of a pdf file or a structured data record is permissible only based on a written agreement

on electronic invoicing between Supplier and the Hilti company concerned and subject to the

applicable terms and conditions, e.g .Hilti’s terms of use (ToU) for Ariba Network. If the Hilti

company concerned should not accept electronic invoices Supplier will be obliged to submit

invoices in the form of a paper invoice as before despite any changes to framework legal terms

and conditions.

6.2 Only original invoices may be submitted to the Hilti company concerned.

6.3 Invoice pages must never be stapled together.

6.4 No paying-in slips must be attached to invoices.

6.5 No delivery notes or order confirmations must be attached to invoices.

6.6 All necessary bank details must be shown on invoices.

Version_2022/07

Page 3 / 8

7 Invoice issuer

7.1 The full current address of the invoice issuer must be given on invoices.

7.2 The invoice issuer’s company logo must be shown on invoices.

8 Invoice recipient’s address

Invoices must always be addressed to the ‘Zentrale Rechnungskontrolle’ [Central Invoicing Dep’t]

and must never be sent to the Hilti employee having placed an order.

For example: Hilti Aktiengesellschaft

Zentrale Rechnungskontrolle

Feldkircherstrasse 100

LI-9494 Schaan

9 Hilti contact person

In the absence of a Hilti order no. the full name of the contact person at the Hilti company concerned

has to be shown on the invoice.

For example: Franz Muster

10 Delivery date / date of performance / performance period

The figure and corresponding designation must be entered on the same line or directly below each

other.

For example: Delivery date: 25.09.12

Date of performance: 25.09.12

Performance period: 15.09.12 – 25.09.12

11 Delivery note no. (work sheet, where available)

The figure and corresponding designation must be entered on the same line or directly below each

other.

For example: delivery note no.: 80025466

12 Invoice date

The figure and corresponding designation must be entered on the same line or directly below each

other.

For example: invoice date: 25.05.2011

13 Invoice no.

The figure and corresponding designation must be entered on the same line or directly below each

other.

For example: invoice no.: 921395

Version_2022/07

Page 4 / 8

14 Supplier’s bank details

The following details must be entered directly on the invoice:

Name and address of bank

IBAN or Account no.

Bank Identifier Code (BIC)

Sort code or ABA routing number (if applicable)

15 Supplier’s Local Tax number

15.1 Supplier’s local tax number must be given for domestic transactions if this is a requirement of

national tax legislation.

15.2 The figure and corresponding designation must be entered on the same line or directly below each

other.

For example: Tax no.: 11122233333 or 111/2222/3333

16 Supplier’s VAT Registration number

If required under VAT legislation applicable, the figure and corresponding designation must be

entered on the same line or directly underneath each other.

For example: Our VAT Registration number: ATU 123456789

17 VAT Registration number of Hilti for supplies of goods

If required under VAT legislation applicable, the figure and corresponding designation must be

entered on the same line or directly underneath each other. To determine the correct/applicable

VAT registration number of Hilti Corporation please refer to the enclosed table by selecting place

of dispatch of goods as well as place of destination of goods.

17.1 Additionally, invoices to Hilti Corporation

• for deliveries within Austria and

• a gross amount exceeding EURO 10.000,-- incl. Austrian VAT,

must contain the Austrian VAT Registration number of Hilti Corporation ATU36111300

For example: Your VAT Registration number: ATU 36111300

18 Tax exemption notice

If required under VAT legislation applicable, one of the following notices must be added to invoices

to the Hilti companies concerned:

• tax exempt for intra-Community deliveries

or

• tax exempt for intra-Community triangular transactions

or

• tax exempt for exports

or

• tax exempt service.

Please clarify the exact wording of the tax exemption notice with your tax advisor.

Version_2022/07

Page 5 / 8

19 Hilti order no. (10 digit number)

19.1 If just one Hilti order no. is being charged in an invoice the Hilti order no. (incl. designation) may be

shown in the header data.

19.2 If multiple Hilti order nos. are being charged in an invoice the Hilti order no. must be given for each

individual invoice item (incl. designation).

For example: Your order no. 4505615308

20 Hilti order code (2 or 3 digit number)

The Hilti order code (incl. designation) must be given for each individual invoice item; in 10’s.

For example: 10 / 20 / 60 / 120

21 Goods designation / performance designation

21.1 Goods: the goods designation must be given for each individual invoice item.

21.2 Services: the performance designation and, where available, the contract reference must be given

for each individual invoice item.

For example: Goods: screws

For example: Service: Development costs as per Contract 12345 of 15.08.08

22 Hilti article number

The Hilti article no. must be given for each individual invoice item.

For example: Article number 346589

23 Customs duty place of origin

The customs duty place of origin (incl. designation) must be given for each individual invoice item.

24 Customs tariff no.

The customs tariff no. (incl. designation) must be given for each individual invoice item.

25 Other customs relevant information

Any other relevant information for customs processes must be provided on the invoice as agreed

between Hilti and Supplier, e.g. in the Supply Contract.

26 Hilti cost centre (6 digits)

Where available, the Hilti costs centre (incl. designation) must be given for each individual invoice

item.

For example: cost centre 518127

27 Hilti inventory account (6 digits)

Where available, the Hilti inventory account (incl. designation) must be given for each individual

invoice item.

For example: inventory account 66000

Version_2022/07

Page 6 / 8

28 Hilti in-house contract no. (7-9 digits)

Where available, the Hilti contract no. (incl. designation) must be given for each individual invoice

item.

For example: contract no. 51000000

29 Price per quantity unit / performance unit

The price per quantity unit (incl. designation) must be given for each individual invoice item.

For example: price per 100 items EUR 328,00

For example: price per hour EUR 120,00

30 Code quantity

The code quantity (incl. designation) must be given for each individual invoice item.

For example: quantity: 100 items

For example: no. of hours: 10

31 Code quantity unit

The code quantity unit (incl. designation) must be given for each individual invoice item using

standard abbreviations (as per ISO).

For example: items (STK), kilos (KG), meters (M), hours (H)

32 Amount

The amount per order code (quantity x price per quantity unit) (incl. designation) must be given for

each individual invoice item.

For example: gross amount: EUR 2.000,00

33 Currency

The ISO currency abbreviations must be used when stating currencies.

For example: EUR / CHF / USD / JPY / GBP

34 Net amount

The figure and corresponding designation must be entered on the same line or directly underneath

each other.

For example: net amount: EUR 1.000,00

35 Rate / amount of tax as per corresponding VAT legislation / GST legislation

35.1 In the case of a taxable supply of goods or services the rate of tax, relevant designation and amount

of tax must be entered on the same line or directly underneath each other.

For example: VAT 20% amount of VAT EUR 2.000,00

35.2 In the case of a tax-exempt supply of goods or services the rate of tax, relevant designation and

amount of tax must be entered on the same line or directly underneath each other.

For example: VAT 0% amount of VAT EUR 0,00

Version_2022/07

Page 7 / 8

36 Gross amount

The figure and corresponding designation must be entered on the same line or directly underneath

each other.

For example: gross amount EUR 1.200,00

37 Terms of delivery

The terms of delivery according to the Incoterms® standard must be stated on the invoice.

38 Charging of freight costs

These must be entered as a separate invoice item (stating the corresponding designation for the

costs charged); charging by addition to another invoice item is strictly forbidden.

For example: freight EUR 200,00

39 Charging of packaging costs

These must be entered as a separate invoice item (stating the corresponding designation for the

costs charged); charging by addition to another invoice item is strictly forbidden.

For example: packaging EUR 50,00

40 Charging of postages

These must be entered as a separate invoice item (stating the corresponding designation for the

costs charged); charging by addition to another invoice item is strictly forbidden.

For example: postages EUR 50,00

41 Charging of insurance costs

These must be entered as a separate invoice item (stating the corresponding designation for the

costs charged); charging by addition to another invoice item is strictly forbidden.

For example: insurance EUR 100,00

42 Place of dispatch of goods

42.1 These details must be given on all invoices using the appropriate text field.

42.2 The structure of different addresses for places of dispatch must always be identical.

42.3 It is necessary to avoid details such as, e.g. ‘DE-89123 Berlin’ being shown on different lines of the

‘place of dispatch text field’ depending on the length of address (=> ensure uniform invoicing

structure / invoice layout per supplier);

Line 1: Title (mandatory field ‘place of dispatch’)

Line 2: Name of firm (‘Muster AG’)

Line 3: Road name (‘Musterstrasse 1’)

Line 4: ISO country designation, hyphen, post code, town (‘DE-81123 Berlin’)

For example: Place of dispatch

Muster AG

Musterstrasse 1

DE-89123 Berlin

Version_2022/07

Page 8 / 8

43 Place of destination of goods

43.1 These details must be given on all invoices using the appropriate text field.

43.2 The structure of different addresses for places of dispatch must always be identical.

43.3 It is necessary to avoid details such as, e.g. ‘DE-89123 Berlin’ being shown on different lines of the

‘place of dispatch text field’ depending on the length of address (=> ensure uniform invoicing

structure / invoice layout per supplier);

Line 1: Title (mandatory field ‘place of destination’)

Line 2: Name of firm (‘Hilti Aktiengesellschaft’)

Line 3: Road name (‘Feldkircherstrasse 100’)

Line 4: ISO country designation, hyphen, post code, town (‘LI-9494 Schaan’)

For example: Place of destination

Hilti Aktiengesellschaft

Feldkircherstrasse 100

LI-9494 Schaan

Supplier A address line 1

address line 2

VAT number: DE815302903

Bank account XXX | IBAN DE00 0000 0000 0000 0000 00 | BIC DEXXXXXX

Invoice 000000000

Page: 1(1)

Hilti Aktiengesellschaft

Zentrale Rechnungskontrolle

Feldkircherstrasse 100

9494 SCHAAN

LIECHTENSTEIN

Delivery Address:

50000000

Name

Contract No.:

Customer No.:

1051

Delivery note:

Your VAT No.: DE123456789 Contact person:

HILTI Aktiengesellschaft, Feldkircherstrasse 100, LI-9494 Schaan, Liechtenstein

Hilti Order No:

Order date:

Delivery date:

Conditions:

4500000000

01.01.2021

01.01

.2021

Standard delievery

Item No. Description

(product specific information)

Item Value

price

Unit Pcs/

Unit

Qty Unit

2145578

10 pc 100,00 1 1.000,00

1.000,00Net Value

VAT 0% 0,00

1.000,00Invoice Total EUR

'Reference to tax exemption notice'

⑧

⑨

⑩

⑪

⑬

(29-32)

(33-36)

Product A

Customs Tariff No.: 85081900

Country of Origin: AT

(20-25)

⑲

⑰

⑯

⑭

Company logo supplier

SPECIMEN

SPECIMEN

Please pay before 01.03.2021

Incoterms® (2010): DAP (delivered at place), Schaan

200000000

⑫

Invoice date: 01.01.2021

Place of dispatch: 'please mention exact address'

(43)

(37)

(18)

(42)