I, THEMBELANI WALTERMADE NXESI, Minister of Employment and Labour,

hereby, in terms of section 32(6)(a)(ii) of the Labour Relations Act, 1995, renew the

period fixed in Government Notice No. R. 324 of 20 March 2020, by a further period

ending 30 April 2023.

NXESI, MP

MINISTER OF EMPLOYMENT AND LABOUR

DATE:

This gazette is also available free online at www.gpwonline.co.za

36 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

General notices • alGemene kennisGewinGs

Employment and Labour, Department of/ Indiensneming en Arbeid, Departement van

DEPARTMENT OF EMPLOYMENT AND LABOUR

NOTICE 333 OF 2020

333

Labour R

elations Act, 1995: Furniture Bargaining Council - Renewal of Period & Extension to Non-Parties Main Agreement

43447

LABOUR RELATIONS ACT, 1995

FURNITURE BARGAINING COUNCIL: EXTENSION TO

NON -PARTIES OF

THE MAIN COLLECTIVE AMENDING AGREEMENT

I,

THEMBELANI WALTERMADE NXESI,

Minister of Employment and

Labour, hereby in terms of section 32(2) of the Labour

Relations Act, 1995,

declare that the Collective Agreement which

appears in the Schedule hereto,

which was concluded in the Furniture Bargaining Council,

and is binding in

terms of section 31 of the Labour Relations Act, 1995,

on the parties which

concluded the Agreement, shall be binding

on the other employers and

employees in that Industry with effect from the second Monday

after the date

of publication of this Notice and for the period ending 30

April 2023.

ESI, MP

MINISTER OF EMPLOYMENT AND LABOUR

DATE:

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 37

In accordance with the provisions of the Labour Relations Act 1995 (Act No 66 of 1995)(as

amended), made and entered into by and between the

Chemical, Energy, Paper, Printing, Wood and Allied Workers Union (CEPPWAWU)

(hereinafter referred to as the "employees" or the "trade unions "), of the other part

being parties to the Furniture Bargaining Council

hereby agree to amend extend the Main Collective Agreement published under Government Notice No.

R.324 of 20 March 2020.

1. TABLE OF CONTENTS

CHAPTER 1

Substitute the Table of Contents with the following:

"1.

SCOPE OF APPLICATION

2.

PERIOD OF OPERATION OF AGREEMENT

3.

INDUSTRIAL ACTION

4. DEFINITIONS

5.

PROHIBITION OF TWO -TIER BARGAINING AND THRESHOLD - TRADE

UNION ORGANISATIONAL RIGHTS

6.

REGISTRATION OF EMPLOYERS

Furniture, Bedding & Upholstery Manufacturers' Association for the Greater Northern Region

(hereinafter referred to as the "employers" or the "employers' organisations "), of the one part,

This gazette is also available free online at www.gpwonline.co.za

38 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

7.

NEWLY ESTABLISHED SMALL EMPLOYER

CONCESSION

8.

NEWLY EMPLOYED EMPLOYEE CONCESSION

9.

TERMS OF EMPLOYMENT

9.1

Ordinary hours of work

9.2

Intervals

9.3

Overtime

9.4

Shift work

9.5

Public Holidays

9.6

Annual closure

9.7

Paid sick leave and proof of incapacity

9.8

Termination of employment

9.8.1

Notice periods

9.9

Absenteeism.

9.10

Short time, dismissals based on operation requirements

and severance pay

9.10.1

Short time

9.10.2 Dismissals based on operational requirements

9.10.3 Standard severance pay and additional severance pay

9.11

Trade union representative leave

9.12

Maternity leave

9.13

Family responsibility leave

9.14

Parental leave

9.15

Adoption leave

9.16

Commissioning parental leave

9.17

Study leave

9.18

Fixed term contract of employment

9.19

Indefinite-period contract of employment

9.20

Certificate of service

10.

GENERAL.

10.1

Work under an incentive scheme

10.2

Temporary employment services and/or labour

brokers

10.3

Outwork

10.4

Provision of tools

10.5

Employment of children and forced labour

10.6

Working employers

10.7

Prohibited employment

10.8

Employment of trade union members

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 39

3

10.9

Trade union representatives on the Council and committees of

a national character in the Industry

10.10 Subscriptions to trade unions

10.11 Council levies

10.12 Exhibition of Agreement and notices

10.13 Administration and enforcement of Agreement

10.14 Provisions declared ultra vires

10.15 Protective clothing

10.16 Compulsory retirement age

10.17 Late /nonpayment and allocation of fees, levies and

contributions

10.18 Interest payable on outstanding /unpaid fees, levies and

contributions

10.19 Audit and accounting

11.

EXEMPTIONS

11.1

Exemptions Body and Independent Appeal Body

11.2

Administration

12.

LEAVE PAY FUND

13.

HOLIDAY BONUS FUND

14.

REMUNERATION

14.1

Wages

14.2

Set -off of wages

14.3

Hourly rates of pay

14.4

Basis of payment

14.5

Employees engaged in more than one occupation skills level

14.6 Wage payment procedure

14.7

Remuneration for overtime and work on a Sunday

14.8

Remuneration for work on public holidays

14.9

Remuneration for time worked in ..

14.10 Payment of night shift allowance

14A 1 Set -off against annual wage increases

14.12 Subsistence allowance

CHAPTER 2

COUNCIL BENEFIT FUNDS

1.

ESTABLISHMENT AND CONTINUATION OF COUNCIL BENEFIT FUNDS

/SCHEMES.

2.

OBJECTIVES OF THE COUNCIL BENEFIT FUNDS /SCHEMES

This gazette is also available free online at www.gpwonline.co.za

40 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

ADDENDUM 'I

FEES, LEVIES AND CONTRIBUTIONS PAYABLE TO THE COUNCIL

CHAPTER 4

OCCUPATION SKILLS LEVELS FURNITURE, BEDDING AND UPHOLSTERY

SECTOR

1

General worker

2.

Semi -skilled employee

3.

Skilled employee

4.

Chargehand

5.

Foreman /Supervisor

3.

MEMBERSHIP OF THE COUNCIL BENEFIT FUNDS /SCHEMES

4.

CONTRIBUTIONS AND EXISTING LOAN REPAYMENTS TO THE COUNCIL

BENEFIT FUNDS /SCHEMES.

5.

ADMINISTRATION OF THE COUNCIL BENEFIT FUNDS /SCHEMES.....

6.

OPERATION OF THE COUNCIL BENEFIT FUNDS /SCHEMES

7.

AUDITING OF THE COUNCIL BENEFIT FUNDS /SCHEMES

8.

EXPIRY OF THE COLLECTIVE AGREEMENT

9.

LIQUIDATION OF THE COUNCIL BENEFIT FUNDS /SCHEMES

10.

BENEFITS INALIENABLE

11.

WITHHOLDING OF BENEFITS

12.

PAYMENT OF FEES, LEVIES AND CONTRIBUTIONS

13. AMENDMENT TO THE RULES.

CHAPTER 3

NEGOTIATING PROCEDURES AND DISPUTE SETTLEMENT PROCEDURES

1.

Preamble

2.

Procedure for the negotiation of collective agreements

3.

Disputes between parties to the bargaining council

4.

All other disputes

5.

General

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 41

1

LEAVE PAY FUND CONTRIBUTIONS

2.

HOLIDAY BONUS FUND CONTRIBUTIONS

3.

PROVIDENT FUND CONTRIBUTIONS

4.

SICK BENEFIT SOCIETIES

5.

COUNCIL LEVIES..

6.

REGISTRATION FEE

7.

DEATH AND DISABILITY SCHEME (D.D.S.) CONTRIBUTIONS AND PROVIDENT

FUND CONTRIBUTIONS IN RESPECT OF THE NEWLY EMPLOYED EMPLOYEE

CONCESSION

8.

STANDARD DEATH AND DISABILITY SCHEME (STANDARD D.D.S.)

CONTRIBUTIONS

9.

DEATH AND DISABILITY SCHEME (D.D.S.) CONTRIBUTIONS IN RESPECT

OF THE NEWLY ESTABLISHED SMALL EMPLOYER CONCESSION

10.

DISPUTE RESOLUTION LEVY

ADDENDUM 2

PRESCRIBED ACROSS THE BOARD INCREASES OF ACTUAL HOURLY RATES OF PAY,

MINIMUM HOURLY RATES OF PAY AND SUBSISTENCE ALLOWANCE

(for all areas

excluding the Free State Province)

1

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties from the first full pay week in MAY 2020 and non -parties on such date as may

be determined by the Minister of Employment and Labour (for all areas excluding the Free

State Province)

2.

Prescribed minimum hourly rates of pay effective for 52 weeks for parties from the first full

pay week in MAY 2020 and non -parties on such date as may

be determined by the

Minister of Employment and Labour (for all areas excluding the Free State Province)

3.

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties and non -parties from the first full pay week in MAY 2021

- subject to

Addendum

4

(for all areas excluding the Free State Province)

4.

Prescribed minimum hourly rates of pay effective for 52 weeks for parties and non-parties

from the first full pay week in MAY 2021 (for all areas excluding the Free State Province)

5.

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties and non- parties from the first full pay week in MAY 2022

- subject to

Addendum 4 (for all areas excluding the Free State Province)

This gazette is also available free online at www.gpwonline.co.za

42 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

b

6.

Prescribed minimum hourly rates of pay effective for 52 weeks

for parties and non- parties

from the first full pay week in MAY 2022 (for all areas

excluding the Free State Province)

7.

Subsistence allowance (for all areas excluding the Free State

Province)

ADDENDUM 3

PRESCRIBED ACROSS THE BOARD INCREASES OF

ACTUAL HOURLY RATES OF PAY,

MINIMUM HOURLY RATES OF PAY AND SUBSISTENCE

ALLOWANCE (for the Free State

Province ONLY)

1.

Prescribed across the board increases of actual hourly rates

of pay effective for 52 weeks

for parties from the first full pay week in MAY 2020

and non -parties on such date as may

be determined by the Minister of Employment and

Labour (for the Free State Province

ONLY)

2.

Prescribed minimum hourly rates of pay effective for 52 weeks

for parties from the first full

pay week in MAY 2020 and non-

parties on such date as may be determined by the

Minister of Employment and Labour (for the Free State

Province ONLY)

3.

Prescribed across the board increases of actual hourly rates

of pay effective for 52 weeks

for parties and non -parties from the first full pay week in

MAY 2021 - subject to Addendum

4 (for the Free State Province ONLY)

4.

Prescribed minimum hourly rates of pay effective for 52 weeks

for parties and non- parties

from the first full pay week in MAY 2021 (for the Free

State Province ONLY)

5.

Prescribed across the board increases of actual hourly rates

of pay effective for 52 weeks

for parties and non- parties from the first full pay week in

MAY 2022 - subject to Addendum

4 (for the Free State Province ONLY)

6.

Prescribed minimum hourly rates of pay effective for 52

weeks for parties and non- parties

from the first full pay week in MAY 2022 (for the Free State

Province ONLY)

7.

Subsistence allowance (for the Free State Province ONLY)

ADDENDUM 4

1.

INFLATION PARAMETERS ACROSS THE BOARD WAGE

INCREASES OF ACTUAL

HOURLY RATES OF PAY EFFECTIVE FROM THE FIRST

FULL PAY WEEK IN MAY 2021

AND MAY 2022 IN RESPECT OF ADDENDUMS 2 AND

3

ANNEXURE A

AGREEMENT ON PICKETING

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 43

1. SCOPE OF APPLICATION

I

1

The terms of this Agreement shall be observed by employers and employees in the Furniture,

Bedding and Upholstery Manufacturing Industry as defined hereunder in the Provinces of

Gauteng, North West, Mpumalanga, Limpopo and Free State.

"Furniture, Bedding and Upholstery Manufacturing industry" or "Industry" means,

without in any way limiting the ordinary meaning of the expression, the industry in which

employers and their employees are associated for the manufacture, either in whole or as a

complete unit or in part as a component or components, of all types of furniture and bedding

as well as upholstery and /or re- upholstery and will, inter alia include the following:

1

Furniture

Repairing, staining, spraying, polishing, re- polishing, making loose covers and /or

cushions, wood machining, veneering, woodturning, carving, assembling, painting,

wood bending and

laminating.

Furniture manufacturing

will also include

the

manufacturing, installation, repairing, polishing,

re- polishing, staining, spraying of

pianos, organs, movable room /office partitions, kitchen cupboards, kitchen cupboard

tops, kitchen cupboard components (irrespective of materials used), attached wall

cupboards, built -in cupboards, built -in cupboard components, free standing bars or

built -in bar counters, cane, wicker or grass furniture, cabinets including cabinets for

musical instruments and radios, wireless or television cabinets, bathroom cupboards,

any other cupboard tops and furniture for tea -rooms, restaurants, offices,

churches,

schools, libraries, other educational institutions, conference centres, theatres, shop

fitting, office fitting and bank fitting, which includes the manufacture and /or fixing of

shop fronts, window enclosures, showcases, counters, including point of sales

counters, screens, interior fittings and fixtures and any form of shelving, irrespective

of the materials used.

2,

Bedding

The manufacturing, repairing, covering, re- covering of mattress bases, mattresses,

spring mattresses, overlays, bolsters, pillows, cushions for studio couches, spring

This gazette is also available free online at www.gpwonline.co.za

44 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

8

units, box -spring mattresses and studio couches,

but excluding the manufacturing of

bedding made mainly of metal and /or plastic materials.

"Studio Couch" means an article of furniture, which is

designed for seating and for

conversion into a double bed or two or more beds

and of which the frames are

constructed mainly of metal and the seating and/or

sleeping surfaces consist of

mattresses and /or cushions.

3.

Upholstery

The upholstering or re- upholstering of any furniture, or

item of furniture, bedding,

pelmets and mattress bases.

1.2

Notwithstanding the provisions of clause 1.1 the provisions

of this Agreement -

1.21

apply only to employees for whom wages are

prescribed in this Agreement and to the

employers of such employees; and

1.2.2

apply to learners under the Skills Development

Act, 1998, or any contracts entered into or

any conditions fixed thereunder.

2. PERIOD OF OPERATION OF AGREEMENT

2.1

This

Agreement shall, in terms of section 31 of the Act, become

binding on the above parties on

first full pay week in May 2020 until 30 April 2023.

2.2

This Agreement shall be binding on non -party employers

and employees on the date as may be

determined by the Minister of Employment and Labour in

terms of section 32 of the Act and shall

remain in force for the period ending 30 April 2023.

3. CLAUSE 6: REGISTRATION OF EMPLOYERS

AND EMPLOYEES

Substitute clause 6.1.4 with the following:

"6.1.4

Any employer in the Industry shall, when

required to do so by the Council, within seven

days of that request, lodge with the Council a

cash amount or guarantee

acceptable to the Council, to cover the payment

in respect of his employees as

follows:

6.1.4.1

One week's wages;

6.1.4.2

13 weeks' levies, contributions and /or monies in

respect of-

6.1.4.2.1

6.1.4.2.2

Leave pay monies;

Holiday bonus monies;

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 45

6.1.4.2.3

Council Levies;

6.1.4.2.4

Provident Fund contributions;

Provided that the minimum guarantee shall be for an amount of R500."

(1)

Substitute the first paragraph of the Phase One clause with the following:

"PHASE ONE:

First year of registration until the end of the first September following

registration

During this period the employer shall be exempted from prescribed minimum hourly rates of pay,

subject to no employee being paid less than the national minimum hourly rate of pay, Leave

Pay

Fund contributions, Holiday Bonus Fund contributions or Provident Fund contributions and

either

of the Sick Benefit Societies contributions, if applicable, as prescribed in Addendum 1."

(2)

Substitute the first paragraph of the Phase Four clause with the following:

(1)

"PHASE FOUR: As from October of the fourth year of registration

All the provisions of the prevailing Main Agreement administered by this Council

shall become

applicable, including the payment of 100% of the minimum hourly rates of pay, subject to no

employee being paid less than the national minimum hourly rate of pay, as prescribed

in

Addendum 2 or Addendum 3 and the payment of either of the Sick Benefit Societies

contributions, if applicable, as prescribed in Addendum 1. ".

5. CLAUSE 8: NEWLY EMPLOYED EMPLOYEE CONCESSION

Substitute clause 8.1 with the following:

"8.1

The employer may elect to apply the calculations below to determine the wages, levies,

contributions and fees payable to any newly employed employee who commences

employment with an employer for the first time, subject to clauses 8.2 and 8.3 below,

provided that the establishment concerned is not in Phase 1, Phase 2 or Phase 3 of a

Newly Established Small Employer Concession as reflected in clause 7 above. ",

(2)

Substitute clause 8.2 with the following

This gazette is also available free online at www.gpwonline.co.za

46 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

8

(8)

Insert new clause (g) under YEAR THREE of employment

with the following:

(9)

"(g)

100% of NEEC Provident Fund contributions (refer to clause

.3.2 of Addendum 1.)"

Substitute clauses (a) to (g) of YEAR FOUR of employment

with the following:

"100% of at least the minimum prescribed hourly rates

of pay for all the Occupation Skills Levels

of employees, subject to no employee being paid

less than the national minimum hourly rate of

pay as well as 100% of all

prescribed fees, levies and contributions shall be payable to

the

Council by all employers and all employees.TM.

(10) Delete YEAR FIVE of employment.

10

"8.2

As from the first full pay week in May 2020 for parties or

at a later date as determined for

non -parties and for non -parties from the

date as determined by the Minister all changes

relating to the Newly Employed Employee Concession

contributions and year changes,

will be applicable to the corresponding year of the new

Newly Employed Employee's

Concession provisions."

3)

Substitute clause 8.3 with the following:

"8.3

Accumulation of Credits - Upon service termination of the

employee, irrespective of

the reason, the employer shall grant credit to the employee

for time employed under the

newly employed employee concession when reemployed

by any employer ".

(4)

Insert new clause (g) under YEAR ONE of employment

with the following

"(g)

100% of NEEC Provident Fund contributions (refer to

clause 8.3.1 of Addendum 1.) ".

(5)

Substitute clause (e) under YEAR TWO of employment

with the following:

"(e)

100% of either of the Sick Benefit Society contributions,

if applicable, as prescribed in

Addendum 1; ".

(6)

insert new clause (h) under YEAR TWO of employment

with the following:

"(h)

100% of NEEC Provident Fund contributions (refer to clause

8.3.2 of Addendum 1)."

(7)

Substitute clause (d) under YEAR THREE of employment

with the following:

"(d)

100% of either of the Sick Benefit Society contributions,

if applicable, as prescribed in

Addendum 1;) ".

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 47

(1)

6. CLAUSE 9: TERMS OF EMPLOYMENT

Substitute clause 9.5.4 with the following:

"9.5.4

In the event that an official paid public holiday falls during a period in which the

employer is already working short time, employees shall be paid their normal ordinary

hours of work for that day, irrespective of the short time so implemented."

(2)

Substitute clause 9.10.1.1 with the following:

"9.10.1.1

When, by reason of slackness of trade, shortage of raw materials or a general

breakdown of plant or machinery caused by accident or other unforeseen

emergency, an employer is unable to employ his employees for

the number of

ordinary hours of work per week usually worked in his establishment, the employer

may, subject to the provisions of this clause, employ

his employees on short time

during, but not exceeding, the period of such slackness of trade, shortage of raw

materials or general breakdown of plant or machinery: Provided that the employer:

9.10.1.1.1

has consulted with the employees concerned; and /or

9.10.1.1.2

has consulted with any shop stewards or employee representatives

in the workplace concerned; and

9.10.1.1.3

has extended an invitation to the trade union office and trade union

official to attend on the date and time as determined by the employer,

to allow the trade union official to attend the consultation, if a trade

union is active in the workplace concerned, unless short time is

implemented on a specific day for that day only; and

9.10.1 1 4

shall, when short time

is worked, distribute the available work

amongst the employees in any section. ".

(3)

Insert the following new clause 9.10.1.3:

"9.10.1 3

No short time may be called for and implemented, for Mondays and Fridays,

where official paid public holidays fall on Tuesdays and /or Thursdays, unless

the

employer has been working short time prior to such paid public holidays."

7. CLAUSE 10: GENERAL

Substitute clause 10.6 with the following:

"10.6

All working employers shall observe the provisions of this Agreement in respect

of hours of

work, payment of Leave Pay Fund contributions and payment of Holiday

Bonus Fund

This gazette is also available free online at www.gpwonline.co.za

48 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

12

contributions

at the prescribed foremen's rate of pay,

payment of Provident Fund

contributions, payment of Council levies and payment

of wages for public holidays."

CHAPTER 2

(1)

8. CLAUSE 2: OBJECTIVES OF THE COUNCIL

BENEFIT FUNDS /SCHEMES

Substitute clause 2.4 with the following:

"2.4

The objective of the Home Ownership Scheme

(H.O.S.), is to provide for home loan

facilities for qualifying members of the furniture,

bedding and upholstery industry, to

purchase, improve, renovate, repair and /or maintain

existing or new housing. No new

loan applications will be considered and existing

loans will be serviced until expiry;"

(2)

Substitute clause 2.5 with the following:

"2.5

The objective of the Emergency, Trauma,

Disaster and Education Fund (E.T.D.E.

Fund), is to provide for loan facilities for qualifying

members of the furniture, bedding and

upholstery industry, to assist members with loans

for emergencies, trauma, disasters

and /or education. No new loan applications will

be considered and existing loans will be

serviced until expiry; ".

S. CLAUSE 3: MEMBERSHIP OF THE COUNCIL

BENEFIT FUNDS /SCHEMES

(1)

Substitute clause 3.1 with the following:

"3.1

Membership of the Council benefit funds /schemes shall

be compulsory for all party employees

who are employed by party employers and for all non

-party employees who are employed by

non -party employers when

this agreement is

extended to non -party employees and

employers in terms of section 32 of the LRA by the

Minister of Employment and Labour.

To obtain membership of the Council benefit

funds/schemes, these employees and employers

must fall within the registered scope of this Council

and this Collective Agreement must

prescribe their wages.

Membership of either the Furnmed Sick Benefit

Society or the NUFAWSA Sick Benefit

Society may be obtained by qualifying in terms of

the applicable Fund's rules and by electing

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 49

to become a member. Contributions payable to either of these Funds, if

applicable, are as

prescribed in ADDENDUM 1. ".

"3.3 Membership of Furnmed Sick Benefit Society and NUFAWSA Sick Benefit

Society:

3.3.1 Existing membership

An employee who has been a member of either of the Sick Benefit Societies

prior to 1 May

2020, is regarded as an existing member and shall from the first full pay week in May

2020,

be paid a prescribed medical allowance per week by the employer and the

employee shall

pay the weekly contributions to the relevant

Society, as prescribed in Addendum 1.

3.3.2

New membership

From the first full pay week in May 2020 for parties and for non parties from the

date

determined by the Minister, any employee employed by an employer within the registered

scope of this Council, for whom wages are

prescribed in the Collective Agreement, may

apply to become a voluntary member of either the Furnmed Sick Benefit Society or

the

NUFAWSA Sick Benefit Society, subject to the employee qualifying in terms of

the

applicable fund rules and the employee concerned, paying the prescribed employee

only

contributions as reflected in Addendum 1, to the relevant Society.

If successful, the rules

of the Fund concerned shall apply to the member.

3.3.3

Ordinary membership

Any employee employed by an employer within the registered scope of this

Council, for

whom wages are prescribed in the Collective Agreement, may apply to become a member

of either the Furnmed Sick Benefit Society or the NUFAWSA Sick Benefit

Society, subject

to the employee qualifying and both the employer and employee concerned,

paying the

prescribed contributions which are applicable to the relevant Society.

If successful, the

rules of the Fund concerned shall apply to the member.

3.3.4

Voluntary membership

Employees who are employed in the Industry for whom wages are not prescribed

in this

Agreement may be admitted as voluntary members of the Furnmed Sick

Benefit Society

or NUFAWSA Sick Benefit Society in terms of

the relevant Society's rules.

This gazette is also available free online at www.gpwonline.co.za

50 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

3 3.5

Continuation membership

Employees who were existing or voluntary members

of the Furnmed Sick Benefit Society

or NUFAWSA Sick Benefit

Society immediately prior to permanent

retirement from the

Industry owing to old age (65 years or more) or

to permanent disability as substantiated

by a medical certificate(s), or dependant

widows /widowers of deceased continuation

members may be admitted as continuation

members of the Furnmed Sick Benefit Society

or NUFAWSA Sick Benefit

Society depending on the original Society's

membership.

3.3.6

Termination of membership

Membership of both the Societies shall terminate

within one month of a member leaving

the Industry.

3.3.5

Reserves of the Furnmed Sick Benefit Society

and NUFAWSA Sick Benefit Society

If at any time the reserves of the Furnmed Sick

Benefit Society or NUFAWSA Sick Benefit

Society drop below the average of one month's

contributions, the payment of benefits

shall cease and shall not be resumed until

the reserves of the Societies exceed the

aggregate of two months' contributions.

3.3.6

Right of recourse

If it is established that a member has ceased

to be a member of the Furnmed Sick Benefit

Society or NUFAWSA Sick Benefit Society,

and the Society has in. error or contractually

paid for any medical expenses incurred

by such member and/or his

registered

dependants, the Fund trustees shall have the

right to deduct the amount(s) from the

member's Provident Fund contributions and

transfer the amount(s) due to the relevant

Society. ".

10. CLAUSE 4: CONTRIBUTIONS AND

LOAN REPAYMENTS TO THE COUNCIL

BENEFIT

FUNDS /SCHEMES AND ADDITIONAL PROVIDENT

FUND

(1)

Substitute the heading of clause 4 with the following:

"4.

CONTRIBUTIONS AND EXISTING LOAN

REPAYMENTS TO THE COUNCIL BENEFIT

FUNDSISCHEMES ".

(2)

Substitute clause 4.1 with the following:

"4.1

Prescribed contributions for the Provident

Fund, Furnmed Sick Benefit Society and the

NUFAWSA Sick Benefit Society, if applicable,

shall be deducted weekly from the employee's

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 51

15

wages and a prescribed contribution from the employer

shall together be paid to the Council or

any other prescribed organisation or body, as per the values

stipulated in Addendum 1 "

(3)

Substitute clause 4.2 with the following:

"Existing stipulated loan repayments towards the H.O.S. and the E.T.D.E fund shall be

made to the

Council in accordance with individual signed loan agreement.

".

l t CLAUSE 6; OPERATION OF THE COUNCIL BENEFIT FUNDS /SCHEMES

FEES, LEVIES AND CONTRIBUTIONS PAYABLE TO THE COUNCIL

12. CLAUSE 3: PROVIDENT FUND CONTRIBUTIONS

Substitute clause 3.2 with the following:

"3.2 The Provident Fund contributions payable to the Council shall be as

follows for parties from the

first full pay week in May 2020 or at a later date as determined for non

-parties and for non -parties

from the date as determined by the Minister, from the first full pay week in May

2021 and from the

first full pay week in May 2022 for all Occupation Skills Levels:

3.2.1

Employees in the Industry:

3.2.2

Working employers:

6% of normal weekly wages from the employee per

week, calculated on the establishment's normal

ordinary hours of work per week, plus an equal

amount from the employer.

12% of a foreman's prescribed weekly wage.".

(1)

Substitute clause 6.1.1 with the following:

"6.1.1

all the Funds /Schemes contributions;"

(2)

Delete clause 6.7

This gazette is also available free online at www.gpwonline.co.za

52 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

14. CLAUSE 11: DISPUTE RESOLUTION LEVY

Renumber clause 11:

Dispute Resolution Levy as clause number 4 to replace

the deleted

Additional Provident Fund Contribution clause.

15. CLAUSE 5: SICK BENEFIT SOCIETIES

(1)

Substitute clause 5 with the following:

"5.

SICK BENEFIT SOCIETIES

The current status quo for

existing employee Sick

Benefit Society employee

contributions will apply unless it is decided differently at

the respective Sick Benefit

Societies. The following Sick Benefit Society contributions are

payable for parties from

the first full pay week in May 2020 or at a later date as

determined for non -parties and

for non -parties from the date as determined by the

Minister:

5.1

EXISTING MEMBERSHIP PRIOR TO 1 MAY 2020 FOR

PARTIES AND

NON -PARTIES FROM THE DATE AS DETERMINED

BY THE MINISTER -

FURNMED SICK BENEFIT SOCIETY CONTRIBUTIONS

(for all areas

excluding the Free

State Province

5 1.1

Furnmed Sick Benefit Society contributions shall be payable to

the Council at

the prescribed rates by the employer and employee when more

than 20

hours' wages per week are payable to an employee.

To determine the

number of hours worked by the employee, the calculation

must include the

ordinary hours worked by the employee as well as the

hours which would

ordinarily have been worked by the employee on:

5.1.1.1

paid public holidays;

5.1.1.2

trade union representative leave days;

5.1.1.3

the first 3 days per annum of paid sick leave days on

condition that

an acceptable medical certificate is

presented by the employee to his

employer and that such sick leave days do not fall on a

Monday or a

Friday or on the day before or after a public holiday; and

5.1.1.4

family responsibility leave days for the first 2 days only

which are

related

to

the death

of

an

employee's spouse,

life partner,

employee's parent, adoptive parent, grandparent, child,

adopted

child, grandchild or sibling and upon submission of the relevant

death

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 53

5.1.2 Member

certificate by the employee to his employer.

R57 -50 per week payable by the employee and

R30 -50 per week per employee, payable by the

employer as a medical allowance.

R45 -00 per week payable, per adult dependant,

payable by the employee only.

R45 -00 per week, per minor dependant, payable

by the employee only.

R103 -00 per week, per extraordinary dependant,

payable by the employee only.

5.1.3

Adult dependants:

5.1.4

Minor dependants:

5.1.5

Extraordinary dependants:

17

5.2

EXISTING MEMBERSHIP PRIOR TO 1 MAY 2020 FOR PARTIES AND NON

PARTIES FROM THE DATE AS DETERMINED BY THE MINISTER - FURNMED SICK

BENEFIT SOCIETY CONTRIBUTIONS (for the Free State Province ONLY)

5.2.1

Furnmed Sick Benefit Society contributions shall be payable to the Council at

the prescribed rates by the employer and employee when more than 20

hours' wages per week are payable to an employee.

To determine the

number of hours worked by the employee, the calculation must include the

ordinary hours worked by the employee as well as the hours which would

ordinarily have been worked by the employee on:

5.2.1.1

5.2.1.2

5.2.1.3

5.2.1.4

5.2.3

Member:

paid public holidays;

trade union representative leave days;

the first 3 days per annum of paid sick leave days on condition that

an acceptable medical certificate is presented by the employee to

his employer and that such sick leave days do not fall on a Monday

or a Friday or on the day before or after a public holiday; and

family responsibility leave days for the first 2 days only which are

related

to the death of an employee's spouse,

life

partner,

employee's parent, adoptive parent, grandparent, child, adopted

child, grandchild or sibling and upon submission of the relevant

death certificate by the employee to his employer.

R40 -00 per week payable by the employee and

R30 -50 per week per employee, payable by the

employer as a medical allowance.

R45 -00 per week payable, per adult dependant,

payable by the employee only.

5.2.4

Adult dependants:

This gazette is also available free online at www.gpwonline.co.za

54 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

5.2.5

Minor dependants:

5.2.6

Extraordinary dependants:

18

R45 -00 per week, per minor dependant, payable

by the employee only.

R96 -00 per week, per extraordinary dependant,

payable by the employee only.

5.3

EXISTING MEMBERSHIP PRIOR TO 1 MAY 2020

FOR PARTIES AND NON

PARTIES FROM THE DATE AS DETERMINED BY THE

MINISTER - NUFAWSA SICK

BENEFIT SOCIETY (for all areas excluding the Free

State Province)

5.3.1

NUFAWSA Sick Benefit Society contributions shall be payable to

the National

Union of Furniture and Allied Workers of South Africa or

their nominated

administrator at the prescribed rates by the employer and

employee when

more than 20 hours' wages per week are

payable to an employee.

To

determine the number of hours worked by the employee,

the calculation must

include the ordinary hours worked by the employee as well as

the hours which

would ordinarily have been worked by the employee on:

5.3.1.1

paid public holidays;

5.3.1.2

trade union representative leave days;

5.3.1.3

the first 3 days per annum of paid sick leave days on

condition that

an acceptable medical certificate is

presented by the employee to his

employer and that such sick leave days do not fall on a Monday or a

Friday or on the day before or after a public holiday; and

5.3.1 4

family responsibility leave days for the first 2 days only which are

related

to

the death

of

an employee's spouse,

life

partner,

employee's parent, adoptive parent, grandparent,

child, adopted

child, grandchild or sibling and upon submission of the relevant

death

certificate by the employee to his employer.

5.3.2

Member plus 1 to 3 dependants: R62 -50 per week payable

by the employee

and R30 -50 per week per employee payable

by the employer as a medical allowance.

5.3.3

41h and more dependants:

R12-50 per week, per dependant, payable by

the employee only.

5.3.4

Extraordinary dependants:

R92.00 per week, per extraordinary

dependant, payable by the employee only.

5 4

EXISTING MEMBERSHIP PRIOR TO I MAY 2020

FOR PARTIES AND NON

PARTIES FROM THE DATE AS DETERMINED BY THE

MINISTER - NUFAWSA

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 55

19

SICK BENEFIT SOCIETY (FOR the Free State Province ONLY)

5.4.1

NUFAWSA Sick Benefit Society contributions shall be payable to the National

Union of Furniture and Allied Workers of South Africa or their nominated

administrator at the prescribed rates by the employer and employee when

more than 20 hours' wages per week are payable

to an employee.

To

determine the number of hours worked by the employee, the calculation must

include the ordinary hours worked by the employee as well as the hours

which

would ordinarily have been worked by the employee on

5.4.1.1

paid public holidays;

5.4.1.2

trade union representative leave days;

5.4.1.3

the first 3 days per annum of paid sick leave days on condition that

an acceptable medical certificate is presented by

the employee to his

employer and that such sick leave days do not fall on a Monday or a

Friday or on the day before or after a public holiday; and

5.4.1.4

family responsibility leave days for the first 2 days only which are

related

to

the death

of an employee's spouse,

life partner,

employee's parent, adoptive parent, grandparent,

child, adopted

child, grandchild or sibling and upon submission of the relevant death

certificate by the employee to his employer.

5.4.2

Member plus 1 to 3 dependants:

5.4.3

41" and more dependants:

5.4.4

Extraordinary dependants:

R17 -50 per week payable by the employee

and R30 -50 per week per employee

payable by the employer as a medical

allowance.

R12 -50 per week, per dependant,

payable by the employee only.

R92 -00 per week, per extraordinary

dependant, payable by the employee only

5.5

NEW MEMBERS FROM THE FIRST FULL PAY WEEK IN MAY

2020 AND

NON PARTIES FROM THE DATE AS DETERMINED BY THE

MINISTER -

FURNMED SICK BENEFIT SOCIETY CONTRIBUTIONS

(for all

areas

excluding the Free State Province)

5.5.1

Furnmed Sick Benefit Society contributions shall be payable to the Council at

the prescribed rates by the employee only when more than 20 hours' wages

per week are payable to an employee.

To determine the number of hours

This gazette is also available free online at www.gpwonline.co.za

56 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

20

worked by the employee, the calculation must

include the ordinary hours

worked by the employee as well as the hours

which would ordinarily have

been worked by the employee on:

5.5.1.1

paid public holidays;

5.5.1.2

trade union representative leave days;

5.5.1.3

the first 3 days per annum of paid sick leave days on

condition that

an acceptable medical certificate

Is presented by the employee to his

employer and that such sick leave days do not

fall on a Monday or a

Friday or on the day before or after a public holiday;

and

5.5.1 4

family responsibility leave days for the first 2 days

only which are

related

to

the death

of an employee's spouse,

life

partner,

employee's parent, adoptive parent, grandparent, child,

adopted

child, grandchild or sibling and upon submission of the

relevant death

certificate by the employee to his employer.

5.5.2 Member

R88 -00

per

week

payable

by

the

employee only.

5.5.3 Adult dependants:

R45 -00 per week payable, per adult

dependant, payable by the employee

only.

5.5.4

Minor dependants:

R45 -00 per week, per minor dependant,

payable by the employee only.

5.5.5 Extraordinary dependants:

R103 -00

per week,

per extraordinary

dependant, payable by the employee

only. ".

5.6

NEW MEMBERS FROM THE FIRST FULL. PAY

WEEK IN MAY 2020 AND

NON PARTIES FROM THE DATE AS

DETERMINED BY THE MINISTER -

FURNMED SICK BENEFIT SOCIETY CONTRIBUTIONS

(for the Free State

Province ONLY)

5.6.1

Furnmed Sick Benefit Society contributions shall be

payable to the Council at

the prescribed rates by the employee only when more

than 20 hours' wages

per week are payable to an

employee. To determine the number of hours

worked by the employee, the calculation must include

the ordinary hours

worked by the employee as well as the hours

which would ordinarily have

been worked by the employee on:

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 57

21

5.6.1.1

paid public holidays;

5.6.1.2

trade union representative leave days;

5.6.1.3

the first 3 days per annum of paid sick leave days on condition that

an acceptable medical certificate is presented by

the employee to his

employer and that such sick leave days do not fall on a Monday or a

Friday or on the day before or after a public holiday; and

5.6.1 4

family responsibility leave days for the first 2 days only which are

related

to

the death

of

an

employee's spouse,

life partner,

employee's parent, adoptive parent, grandparent,

child, adopted

child, grandchild or sibling and upon submission of the relevant death

certificate by the employee to his employer.

5.6.2

Member

R70 -50 per week payable by the employee only.

5.6.3

Adult dependants:

R45-00 per week payable, per adult dependant,

payable by the employee only.

R45 -00 per week, per minor dependant, payable

by the employee only.

R96 -00 per week, per extraordinary dependant,

payable by the employee only.

5.6.4

Minor dependants:

5.6.5

Extraordinary dependants:

5.7

NEW MEMBERS FROM THE FIRST FULL PAY WEEK IN MAY 2020 AND NON-

PARTIES FROM THE DATE AS DETERMINED BY THE MINISTER - NUFAWSA

SICK BENEFIT SOCIETY (for all areas excluding the Free State Province)

5.7.1

NUFAWSA Sick Benefit Society contributions shall be payable to the National

Union of Furniture and Allied Workers of South Africa or their nominated

administrator at the prescribed rates by the employee only when more than

20

hours'

wages per week are payable to an employee.

To determine the

number of hours worked by the employee, the calculation must include

the

ordinary hours worked by the employee as well as the hours which would

ordinarily have been worked by the employee on:

5.7.1.1

paid public holidays;

5.7.1.2

trade union representative leave days;

51.1.3

the first 3 days per annum of paid sick leave days on condition that

an acceptable medical certificate is presented by

the employee to his

employer and that such sick leave days do not fall on a Monday or a

Friday or on the day before or after a public holiday; and

This gazette is also available free online at www.gpwonline.co.za

58 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

22

5 7.1 4

family responsibility leave days for the first 2

days only which are

related

to

the death

of an employee's spouse,

life

partner,

employee's parent, adoptive parent, grandparent,

child,

adopted

child, grandchild or sibling and upon submission

of the relevant death

certificate by the employee to his employer.

5.7.2

Member plus 1 to 3 dependants: R93 -00 per

week payable by the employee

only

5.7.3

Oland more dependants:

R12 -50 per week, per dependant, payable by

the employee only.

5.7.4

Extraordinary dependants:

R92 -00 per week, per extraordinary

dependant, payable by the employee only.

5.8

NEW MEMBERS FROM THE FIRST FULL

PAY WEEK IN MAY 2020 AND

NON PARTIES FROM THE DATE AS

DETERMINED BY THE MINISTER

NUFAWSA SICK BENEFIT (FOR the Free

State Province ONLY)

5.8.1

NUFAWSA Sick Benefit Society contributions

shall be payable to the National

Union of Furniture and Allied Workers of

South Africa or their nominated

administrator at the prescribed rates by the employee

only when more than 20

hours' wages per week are payable to an

employee.

To determine the

number of hours worked by the employee,

the calculation must include the

ordinary hours worked by the employee as well as

the hours which would

ordinarily have been worked by the employee on:

5.81.1

paid public holidays;

5.8.1.2

trade union representative leave days;

5.8.1.3

the first 3 days per annum of paid sick leave

days on condition that

an

acceptable

medical

certificate

is

presented

by

the

employee to his employer and that such sick

leave days do

not fall on a Monday or a Friday or on the

day before or after a

public holiday; and

5.8.1.4

family responsibility leave days for the first 2 days

only which

are related to the death of an

employee's spouse, life partner,

employee's

parent,

adoptive

parent,

grandparent,

child,

adopted child, grandchild or sibling and upon

submission of

the relevant death certificate by the employee

to his employer.

5.82

Member plus 1 to 3 dependants: R48 -00 per

week payable by the employee

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 59

5.8.3

4th and more dependants:

5.8.4

Extraordinary dependants:

only.

R12 -50 per week, per dependant, payable by

the employee only.

R92-50 per week, per extraordinary

dependant, payable by the employee only."

16. CLAUSE 6: COUNCIL LEVIES

Substitute clause 6.2 with the following:

"6.2

The Council levies payable to the Council shall amount to:

6.2.1 From the date of coming into operation of this Agreement until 30 April 2021

R12 -46 per week per employee payable by the employer and R12 -46 per week

payable by the employee.

(1)

6.21 From the first full pay week of May 2021 until 30 April 2022

R13 -21 per week per employee payable by the employer and R13 -21 per week

payable by the employee.

6.2.2 From the first full pay week of May 2022 until 30 April 2023

R14 -00 per week per employee payable by the employer and R14 -00 per week

payable by the employee."

17. CLAUSE 8: DEATH AND DISABILITY SCHEME (D.D.S.) CONTRIBUTIONS AND

PROVIDENT FUND CONTRIBUTIONS IN RESPECT OF THE NEWLY

EMPLOYED EMPLOYEE CONCESSION

Substitute clause 8.2 with the following:

"8.2

The D.D.S. contributions for employees employed under the Newly Employed

Employee Concession (NEEC) payable to the Council shall amount to the following:

8.2.1 YEAR ONE to YEAR THREE

of employment

8.2.3

YEAR FOUR of employment

and onwards

R10 -46 per week per

employee,

payable by the

employer

ONLY.

R13 -25 per week payable by

the employee and R13 -25 per week per

employee payable by the employer (refer

This gazette is also available free online at www.gpwonline.co.za

60 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

(2)

to clause 9.3). ".

Substitute clause 8.3 with the

following:

"8.3

Provident Fund contributions

for employees employed

under the Newly

Employed Employee Concession

(NEEC) payable to the Council

shall amount to

the following:

8.3.1

YEAR ONE of employment

ALL employees

3% of normal weekly wages

from

the employee per week,

calculated

on

the

establishment's

normal

ordinary hours of work per

week,

plus an equal amount per

week

from the employer.

ALL employees

8.3.3 YEAR THREE of

employment

ALL. employees

8.3.4 YEAR FOUR of

employment

ALL employees

3% of normal weekly wages

from

the employee per week,

calculated

on

the

establishment's

normal

ordinary hours of work per

week,

plus an equal amount per

week

from the employer.

3% of normal weekly wages

from

the employee per week,

calculated

on

the

establishment's

normal

ordinary hours of work per

week,

plus an equal amount per

week

from the employer.

6% of normal weekly wages

from

the employee per week,

calculated

on

the

establishment's

normal

ordinary hours of work per

week,

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 61

18. PRESCRIBED ACROSS THE BOARD INCREASES OF ACTUAL HOURLY RATES OF PAY,

MINIMUM HOURLY RATES OF PAY AND SUBSISTENCE ALLOWANCE (for all areas excluding the

25

plus an equal amount per week

from the employer ".

"PRESCRIBED ACROSS THE BOARD INCREASES OF ACTUAL HOURLY RATES OF PAY,

MINIMUM HOURLY RATES OF PAY AND SUBSISTENCE ALLOWANCE (for all areas excluding the

Free State Province)

1

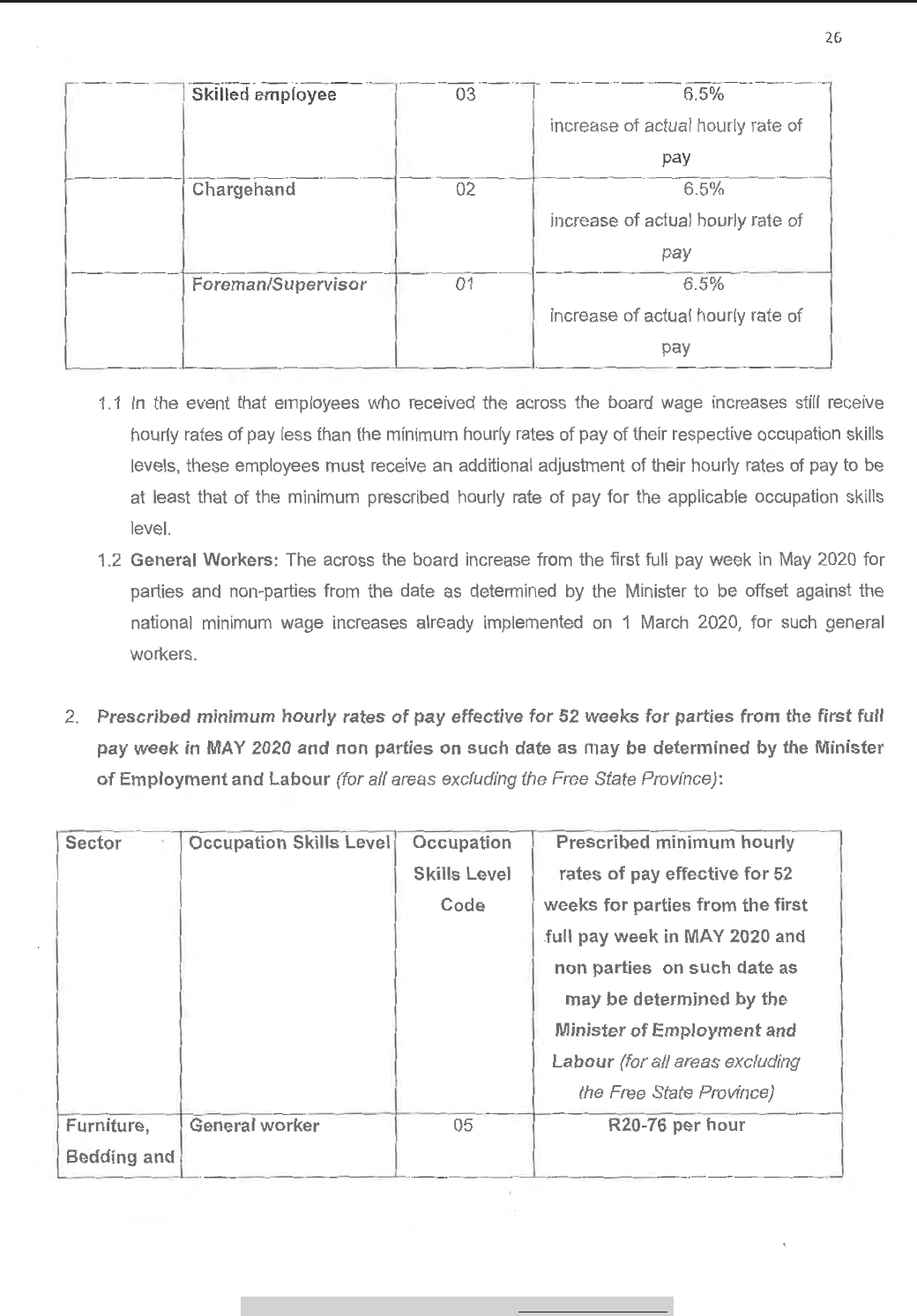

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties from the first full pay week in MAY 2020 and non parties on such date as may

be determined by the Minister of Employment and Labour (for all areas excluding the Free

State Province):

Sector

Occupation Skills Level

Occupation Prescribed across the board

Skills Level

increases of actual hourly

Code

rates of pay effective for 52

weeks for parties from the first

full pay week in MAY 2020 and

non parties on such date as

may be determined by the

Minister of Employment and

Labour (for all areas excluding

the Free State Province)

Furniture, General worker

05

6.5%

Bedding and

increase of actual hourly rate of

Upholstery

pay, subject to the offset in clause

1.2 below.

Semi -skilled employee

04

6.5%

This gazette is also available free online at www.gpwonline.co.za

62 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

--

-

_

-

Chargehand

02

6.5%

increase of actual hourly rate

of

pay

Foreman /Supervisor

01

6.5%

increase of actual hourly rate

of

pay

1.1

In the event that

employees who received the across

the board wage increases

still receive

hourly rates of pay less

than the minimum hourly

rates of pay of their

respective occupation skills

levels, these employees must

receive an additional

adjustment of their hourly rates

of pay to be

at least that of the

minimum prescribed hourly

rate of pay for the

applicable occupation skills

level.

1.2 General Workers:

The across the board

increase from the first full pay

week in May 2020 for

parties and non- parties

from the date as determined

by the Minister to be

offset against the

national minimum wage

increases already implemented on

1 March 2020, for such

general

workers.

2.

Prescribed minimum hourly

rates of pay effective for

62 weeks for parties

from the first full

pay week in MAY

2020 and non parties on

such date as may be

determined by the Minister

of Employment and

Labour (for all areas excluding

the Free State Province):

Sector

Occupation Skills Level

Occupation

Prescribed minimum hourly

Skills Level

rates of pay effective for

52

Code

weeks for parties from the

first

full pay week in MAY 2020

and

non parties on

such date as

may be determined

by the

Minister of Employment

and

Labour (for all areas excluding

the Free State Province)

Furniture,

General worker

05

R20 -76 per hour

Bedding and

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 63

_

-

-

Upholstery

Semi -skilled employee

R23 -59 per hour

Skilled employee

03

R24 -98 per hour

Chargehand

02

R26 -95 per hour

Foreman /Supervisor

01

R26 -95 per hour

27

2.1

In the event that the Government implements any amendments to the national minimum hourly

rate of pay and the hourly rates of pay of the employees above are below the national

minimum hourly rate of pay, such hourly rates of pay shall be adjusted to the national minimum

I

hourly rate of pay in accordance with the implementation date of such.

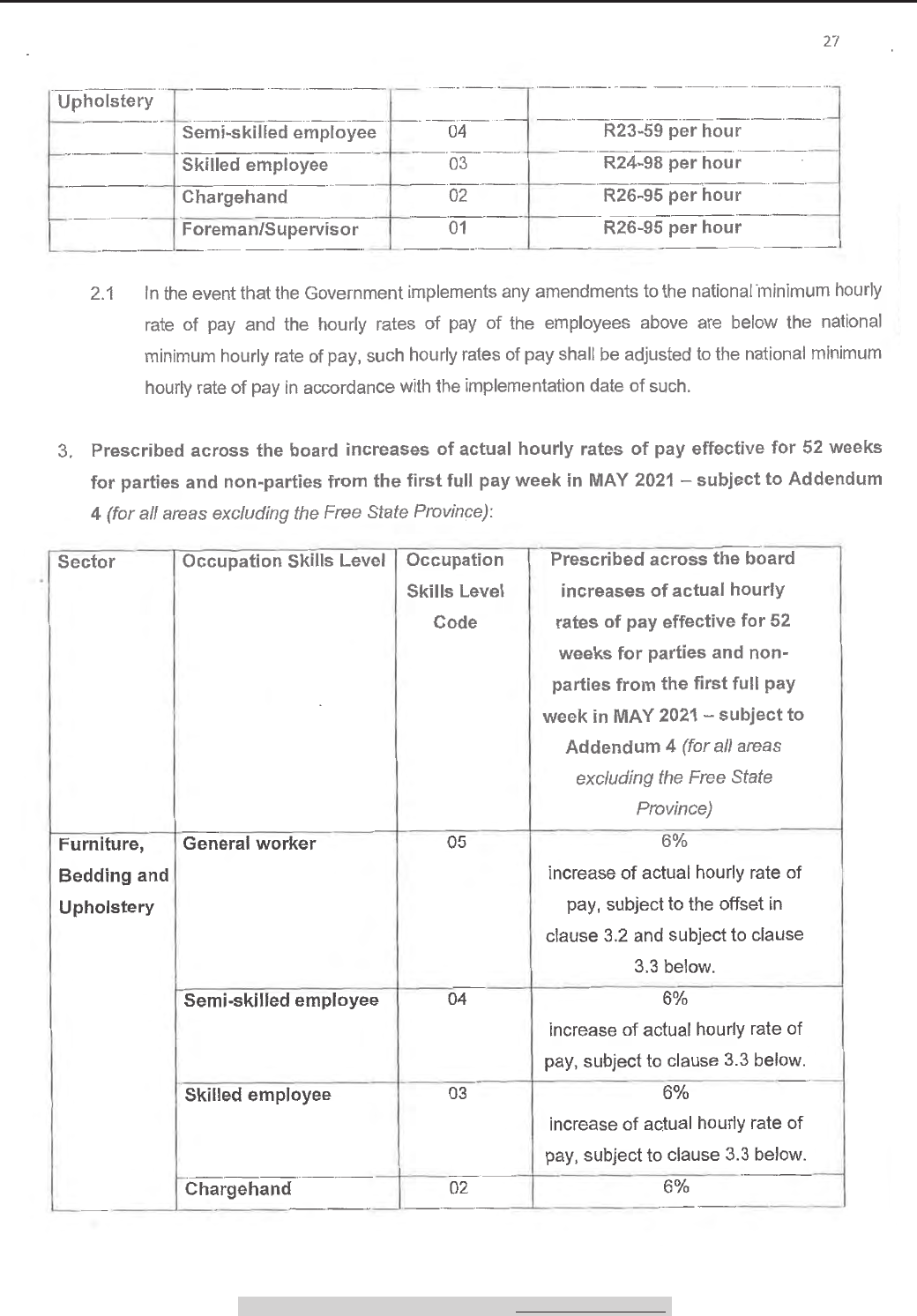

3.

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties and non -parties from the first full pay week in MAY 2021 - subject to Addendum

4 (for all areas excluding the Free State Province):

Sector

Occupation Skills Level

Occupation

Prescribed across the board

Skills Level

increases of actual hourly

Code

rates of pay effective for 52

weeks for parties and non-

parties from the first full pay

week in MAY 2021 -- subject to

Addendum 4 (for all areas

excluding the Free State

Province)

6%

04

Furniture,

General worker

Bedding and

Upholstery

05

increase of actual hourly rate of

pay, subject to the offset in

clause 3.2 and subject to clause

3,3 below.

6%

increase of actual hourly rate of

pay, subject to clause 3.3 below.

increase of actual hourly rate of

pay, subject to clause 3.3 below.

This gazette is also available free online at www.gpwonline.co.za

64 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

ForemanlSupervisor

increase of actual hourly rate

of

pay, subject to clause

3.3 below.

01

6%

increase of actual hourly rate

of

pay, subject to clause

3.3. below.

28

3.1

In the event that employees

who received the across the

board wage increases still receive

hourly rates of pay less than

the minimum hourly rates of pay

of their respective occupation

skills levels, these employees

must receive an additional

adjustment of their hourly rates of

pay to be at least

that of the minimum prescribed

hourly rate of pay for the

applicable

occupation skills level.

3.2

General Workers: The across

the board increase from the

first full pay week in May 2021

to

be offset against the national

minimum wage increases when

implemented earlier in 2021, for

such general workers.

3.3

Increase Threshold

3.3.1

A wage threshold of 40%

above any minimum prescribed

hourly rate of pay is

implemented as from the first full pay

week in May 2021, provided that

the employee

who is already earning a wage

above the threshold will only

receive the across the

board increase minus 1.5 %.

3.3.2

In the event that an employee earns

above the threshold if the full across

the board

increase is to be awarded, such

employee may not be awarded

the full across the

board increase, but shall receive an

increase up to the threshold or

the across the

board increase minus 1.5 %,

whichever is the greater.

4

Prescribed minimum hourly

rates of pay effective for

52 weeks for parties and

nonparties

from the first full pay week

in MAY 2021 (for all areas

excluding the Free State Province):

Sector

Occupation Skills Level

Occupation

Prescribed minimum hourly

Skills Level

rates of pay effective for

52

Code

weeks for parties and non-

parties from the first full pay

week in MAY 2021 (for all

areas excluding the

Free State

Province)

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 65

-

-

-

Furniture,

General worker

Bedding and

Upholstery

05

Skilled employee

increase of actual hourly rate of

pay, subject to the offset in

clause 5.2 and subject to clause

5.3 below.

6%

increase of actual hourly rate of

pay, subject to clause 5.3 below.

03

6%

increase of actual hourly rate of

pay, subject to clause 5.3 below.

05

Furniture,

Bedding and

General worker

As per the national minimum

wage rate increase

Upholstery

Semi -skilled employee

R24 -77 per hour

Skilled employee

03

R25 -98 per hour

Chargehand

02

R28 -03 per hour

Foreman /Supervisor

01

R28 -03 per hour

2.9

4.1.

In the event that the Government implements any amendments to the national minimum

hourly rate of pay and the hourly rates of pay of the employees above are below the

national minimum hourly rate of pay, such hourly rates of pay shall be adjusted to the

national minimum hourly rate of pay in accordance with the implementation date of such.

5.

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties and non -parties from the first full pay week in MAY 2022 - subject to Addendum

4 (for all areas excluding the Free State Province):

Sector

Occupation Skills Level Occupation

Prescribed across the board

Skills Level

increases of actual hourly

Code rates of pay effective for 52

weeks for parties and non-

parties from the first full pay

week in MAY 2022 - subject to

Addendum 4 (for all areas

excluding the Free State

Province)

6%

This gazette is also available free online at www.gpwonline.co.za

66 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

-

-

_

-

Foreman/Supervisor

6%

increase of actual hourly rate of

pay, subject to clause

5.3 below.

01

6%

increase of actual hourly rate

of

pay, subject to

clause 5.3 below.

5.1

In the event that employees

who received the across the

board wage increases still

receive

hourly rates of pay less than

the minimum hourly rates

of pay of their respective

occupation

skills levels, these employees

must receive an additional

adjustment of their hourly rates of

pay to be at least

that of the minimum prescribed

hourly rate of pay for the

applicable

occupation skills level.

5.2

General Workers: The across

the board increase from the

first full pay week in May 2022

to

be offset against the national

minimum wage increases when

implemented, earlier in 2022, for

such general workers.

5.3

Increase Threshold

5.3.1

A wage threshold of 40%

above any minimum prescribed

hourly rate of pay is

implemented as from the first full pay

week in May 2022, provided

that the employee

who is already earning a wage

above the threshold will only

receive the across the

board increase minus 1.5 %.

5.3.2

In the event that an employee earns

above the threshold if the full across

the board

increase is to be awarded, such

employee may not be awarded

the full across the

board increase, but shall receive an

increase up to the threshold or

the across the

board increase minus 1.5 %,

whichever is the greater.

6.

Prescribed minimum hourly

rates of pay effective for

52 weeks for parties and non

-parties

from the first full pay week

in MAY 2022 (for all areas

excluding the Free State Province):

Sector

Occupation Skills Level

Occupation

Prescribed minimum hourly

Skills Level

rates of pay effective for 52

Code

weeks for parties and non-

parties from the first full pay

week in MAY 2022 (for all

areas excluding the Free

State

Province)

Furniture,

General worker

As per the national minimum

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 67

Substitute Addendum 3 with the following:

"PRESCRIBED ACROSS THE BOARD INCREASES OF ACTUAL HOURLY RATES OF PAY,

MIMIMUM HOURLY RATES OF PAY AND SUBSISTENCE ALLOWANCE (for the Free

State Province ONLY)

1.

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties from the first full pay week in MAY 2020 and non parties on such date as may be

determined by the Minister of Employment and Labour (for the Free State Province

ONLY):

Sector

Occupation Skills Level

Occupation

Prescribed across the board

Skills Level

increases of actual hourly

Code

rates of pay effective for 52

weeks for parties from the first

full pay week in MAY 2020 and

non -parties on such date as

19. PRESCRIBED ACROSS THE BOARD INCREASES OF ACTUAL HOURLY RATES OF PAY,

MIMIMUM HOURLY RATES OF PAY AND SUBSISTENCE ALLOWANCE

(for the Free

State Province ONLY)

Bedding

Upholstery

Semi -skilled employee

04

Skilled employee

03

Chargehand

02

Foreman /Supervisor

01

wage rate increase

R26 -01 per hour

31

R27 -02 per hour

R29 -15 per hour

R29 -15 per hour

6.1.

In the event that the Government implements any amendments to the national minimum

hourly rate of pay and the hourly rates of pay of the employees above are below the

national minimum hourly rate of pay, such hourly rates of pay shall be adjusted to the

national minimum hourly rate of pay in accordance with the implementation date of such.

7

Subsistence allowance (for all areas

excluding the Free State Province)

A minimum subsistence allowance of R80 -00 per night is payable."

ADDENDUM 3

This gazette is also available free online at www.gpwonline.co.za

68 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

32

may be determined

by the

Minister of Employment

and

Labour (for the Free State

Province

ONLY)

Furniture,

Bedding and

Upholstery

General worker

05

6.5%

increase of actual hourly

rate of

pay, subject to

the offset in

clause 1.2 below.

Semi -skilled employee

04

6.5%

increase of actual hourly

rate of

pay

increase of actual hourly

rate of

pay

02

6.5%

increase of actual hourly rate

of

pay

ForemanlSupervisor

01

6.5%

increase of actual hourly rate

of

pay

1.1

1.2

In the event that employees

who received the across

the board wage increases

still receive

hourly rates of pay less

than the minimum hourly

rates of pay of their

respective occupation

skills levels, these

employees must receive an

additional adjustment of

their hourly rates of

pay to be at least

that of the minimum

prescribed hourly rate of pay

for the applicable

occupation skills level.

General Workers: The across

the board increase from

the first full pay week in

May 2020 for

parties and non- parties on

the date determined by

the Minister to be offset

against the national

minimum wage increases

already implemented on 1

March 2020.

2.

Prescribed minimum hourly

rates of pay effective

for 52 weeks for parties

from the first full

pay week in

MAY 2020 and non -parties on

such date as may be

determined by the Minister

of Employment and

Labour (for

the Free State Province

ONLY):

Sector

Occupation Skills Level

Occupation

Prescribed minimum hourly

Skills Level

rates of pay effective

for 52

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 69

_

-

05

04

03

Furniture,

General worker

Bedding and Semi -skilled employee

Upholstery

Skilled employee

Chargehand

Foreman/Supervisor

Code

weeks for parties from the first

full pay week in MAY 2020 and

non -parties on such date as

may be determined by the

Minister of Employment and

Labour (for the Free State

Province ONLY)

R20 -76 per hour

R21 -32 per hour

R23 -85 per hour

02

R25 -58 per hour

01

R25 -58 per hour

2.1.

In the event that the Government implements any amendments to the national minimum

hourly rate of pay and the hourly rates of pay of the employees above are below the

national minimum hourly rate of pay, such hourly rates of pay shall be adjusted to the

national minimum hourly rate of pay in accordance with the implementation date of such.

3.

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties and non -parties from the first full pay week in MAY 2021 - subject to Addendum

4 (for the Free State Province ONLY):

Sector

Occupation Skills Level

Occupation

Skills Level

Code

Furniture,

General worker

Bedding and

Upholstery

05

Prescribed across the board

increases of actual hourly

rates of pay effective for 52

weeks for parties and non-

parties from the first full pay

week in MAY 2021 - subject to

Addendum 4 (for the Free State

Province ONLY)

6%

increase of actual hourly rate of

pay, subject to the offset in

clause 3.2 and subject to clause

3.3 below.

6%

This gazette is also available free online at www.gpwonline.co.za

70 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

-

-

_

-

-

-

-

l=oremanlSupervisor

increase of actual hourly wage,

subject to clause 3.3 below.

03

6%

increase of actual hourly rate of

pay, subject to clause

3.3 below.

increase of actual hourly rate of

pay, subject to clause

3.3 below.

01

6%

increase of actual hourly rate of

pay, subject to clause

3.3 below.

3.1

In the event that employees

who received the across the

board wage increases still receive

hourly rates of pay less than the

minimum hourly rates of pay of

their respective occupation

skills levels, these employees

must receive an additional

adjustment of their hourly rates

of

pay to be at least

that of the minimum prescribed

hourly rate of pay for the

applicable

occupation skills level.

3.2

General Workers: The across

the board increase from the

full pay week in May 2021 to

be

offset against the national minimum wage

increases when implemented

earlier in 2021, for

such general workers.

3.3

Increase Threshold

3.3.1

A wage threshold of 40%

above any minimum prescribed

hourly rate of pay is

implemented as from the first full pay

week in May 2021, provided

that the employee

who is already earning a wage

above the threshold will only

receive the across the

board increase minus 1.5 %.

3.3.2

In the event that an employee earns

above the threshold if the full across

the board

increase is to be awarded, such

employee may not be awarded

the full across the

board increase, but shall receive an

increase up to the threshold or

the across the

board increase minus 1.5 %,

whichever is the greater.

4.

Prescribed minimum hourly rates

of pay effective for 52 weeks

for parties and non -parties

from the first full pay week

in MAY 2021 (for the Free

State Province ONLY):

Sector

Occupation Skills Level

Occupation

Prescribed minimum hourly

Skills Level

rates of pay effective for

52

This gazette is also available free online at www.gpwonline.co.za

STAATSKOERANT, 19 JUNIE 2020 No. 43447 71

-

Furniture,

General worker

Bedding and

Upholstery

05

Code

weeks for parties and non-

parties from the first full pay

week in MAY 2021 (for the Free

State Province ONLY)

Furniture,

Bedding and

General worker

05

As per the national minimum

wage rate increase

Upholstery

Semi -skilled employee

04

R22 -39 per hour

Skilled employee

03

R24 -80 per hour

Ch- argehand

02

R26 -60 per hour

Foreman /Supervisor

01

R26 -60 per hour

4.1

In the event that the Government implements any amendments to the national minimum

hourly rate of pay and the hourly rates of pay of the employees above

are below the

national minimum hourly rate of pay, such hourly rates of pay shall be adjusted to the

national minimum hourly rate of pay in accordance with the implementation date of such.

5.

Prescribed across the board increases of actual hourly rates of pay effective for 52 weeks

for parties and non -parties from the first full pay week in MAY 2022

- subject to Addendum

4 (for the Free State Province ONLY):

Sector

Occupation Skills Level

Occupation

Skills Level

Code

Prescribed across the board

increases of actual hourly

rates of pay effective for 52

weeks for parties and non-

parties from the first full pay

week in MAY 2022 - subject to

Addendum 4 (for the Free State

Province ONLY)

6%

increase of actual hourly rate of

pay, subject to the offset in

clause 5.2 and subject to clause

5.3 below.

6%

increase of actual hourly wage,

subject to clause 5.3 below.

This gazette is also available free online at www.gpwonline.co.za

72 No. 43447 GOVERNMENT GAZETTE, 19 JUNE 2020

-

_

01

6%

Skilled employee

03

02

Foreman /Supervisor

increase of actual hourly rate

of

pay, subject to

clause 5.3 below.

increase of actual hourly rate

of

pay, subject to

clause 5.3 below.

increase of actual hourly rate

of

pay, subject to

clause 5.3 below.

5.1

In the event that employees

who received the across the

board wage increases

still receive

hourly rates of pay less than

the mínimum hourly rates

of pay of their respective

occupation

skills levels, these employees

must receive an additional

adjustment of their hourly rates

of

pay to be at least

that of the minimum

prescribed hourly rate of pay

for the applicable

occupation skills level.

5.2

General Workers: The across

the board increase from the

first full pay week in May

2022 to

be offset against the national

minimum wage increases when

implemented earlier in 2022, for

such general workers.

5.3

Increase Threshold

5.3.1

A wage threshold of

40% above any minimum

prescribed hourly rate of pay

is