2023

© Florida Realtors®, All rights reserved.

Profile of International Residential

Transactions in Florida

Who Is an International Client?

The term international client refers to two types of clients:

- Non-resident internationals (Type A): Non-U.S. citizens with

permanent residences outside the United States. These clients

typically purchase property as an investment and/or for vacation, or

visits of less than six months to the United States.

- Resident internationals (Type B): Non-U.S. citizens who are

recent immigrants (in the country less than two years at the time of the

transaction) or visa holders residing for more than six months in the

United States for professional, educational, or other reasons.

Survey Methodology

In August 2023, online survey invitations were sent to about 238,000

Realtors across the state of Florida. A total of 5,275 Realtors

completed the survey from August 9 through September 25, of which

1,104 reported a closed international buyer transaction during the

reference period. Respondents were asked about their real estate

activity over the period of August 2022–July 2023, and were asked

detailed questions about the characteristics of the most recent

transaction.

To correct for over- or under-response from Realtor members in each

metropolitan area, the sample distribution of respondents was

reweighted by a factor that aligns the sample distribution to the Florida

Realtors membership distribution across the state’s 22 metropolitan

areas.

Questions and Citation Guidelines

If you have questions about this report, please contact the Florida

Realtors Research Department at research@floridarealtors.org

.

The contents of this report should be cited with proper attribution

given to Florida Realtors.

About the Report

2023 Profile of International Residential Transactions in Florida

Objective of the Report

From 2005 to 2021, Florida Realtors

®

and the National Association of

Realtors

®

collaborated on an annual surveys to assess international

investment trends in Florida residential real estate, including sales

volume, characteristics of international buyers, and challenges and

opportunities inherent in cross-border transactions.

Beginning last year in 2022, the Florida Realtors Research

Department assumed full authorship of this annual report. We

continue to collaborate closely, however, with our partners at the

National Association of Realtors Research Group on survey design

and data collection, and we are grateful for their continued

contributions in producing this vital source of information about

international investment in Florida residential real estate.

This year’s 2023 Profile of International Residential Transactions in

Florida report presents information from Florida Realtors

members

regarding residential transactions with international clients closed

during the 12-month period of August 2022 to July 2023. For the

survey results presented in this report, the year 2023 refers to this 12-

month period, and the year 2022 refers to the period of August 2021-

July 2022.

© FloridaRealtors®, all rights reserved.

€ 250,000

€ 300,000

€ 350,000

€ 400,000

€ 450,000

2022 2023

Euro

-15%

-10%

-5%

0%

5%

10%

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

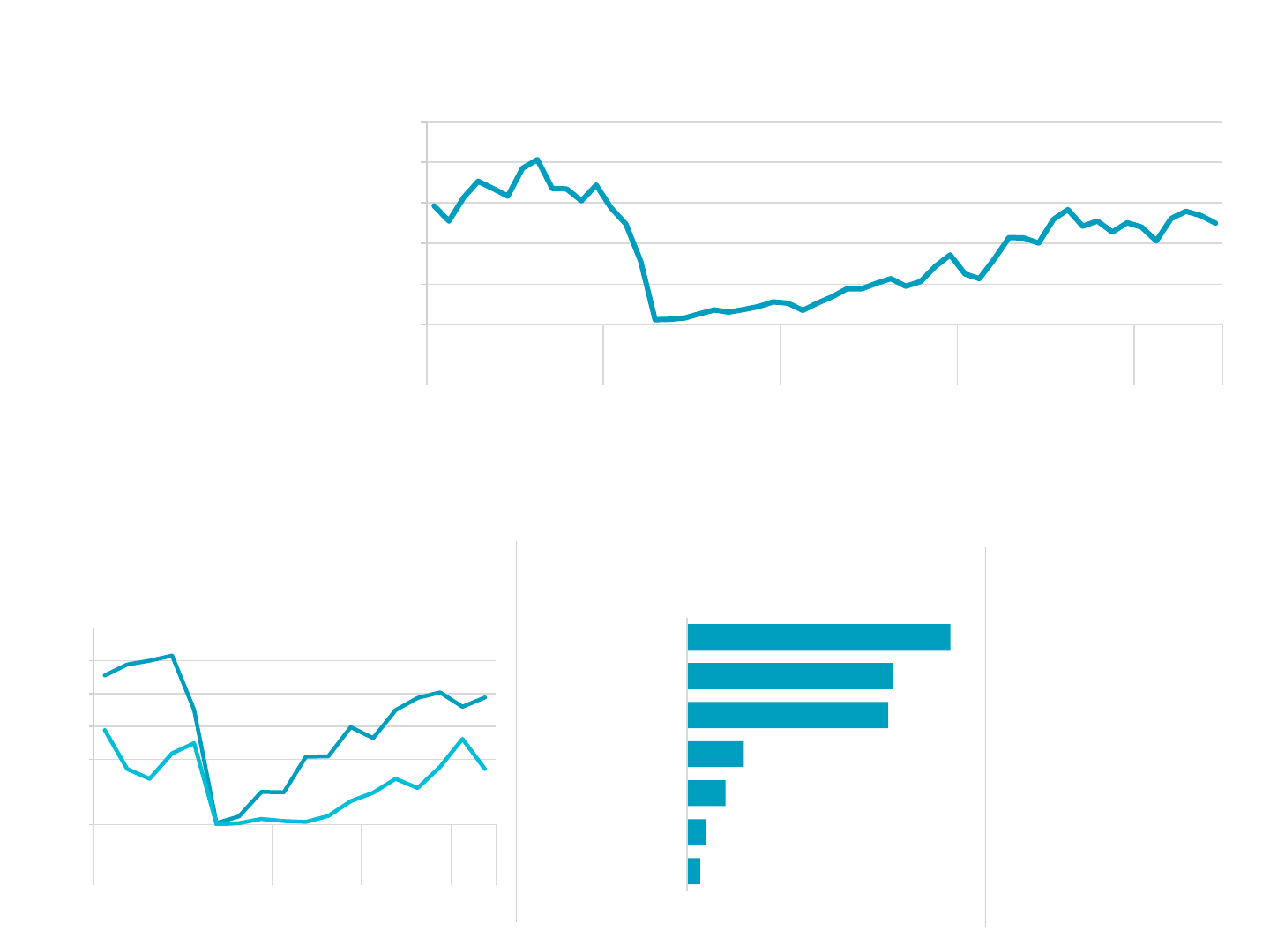

World GDP Growth Is Moderating

Annual Real GDP Growth, World and Selected Areas

Source: International Monetary Fund (IMF)

World

China

Latin America and the Caribbean

Canada

United Kingdom

Euro Area

Japan

Economic Environment

The Global Landscape

Economic recovery from the pandemic has been steady, but global activity

still falls short of pre-pandemic levels. Multiple headwinds causing sustained

drag stem from both long-term issues including the war in Ukraine and more

acute issues like central bank monetary policy to combat inflation.

As such, global growth is forecast to slow from the 3.5 percent observed in

calendar year 2022 to 3.0 percent in CY2023 and 2.9 percent in CY2024,

according to the International Monetary Fund (IMF).

Domestically, the current higher interest rate environment has created a

disincentive for existing homeowners with lower rates to sell. Limited

inventory is keeping prices high, resulting in more challenging monthly

payments facing would-be borrowers.

3

Exchange Rates

The U.S. dollar strengthened significantly relative to most other major world currencies in CY2022. This trend peaked near year’s end, however, and the

dollar has been generally been weaker so far in CY2023. Still, over the broader period of August 2022-July 2023, international buyers who purchased

Florida residential real estate needed to dig deeper into their pockets much more so than the prior period of August 2021-July 2022. Florida home prices

have appreciated considerably, but compared to other global cities are comparatively inexpensive. U.S. real estate remains a safe haven which

encourages investment during times of economic concern. Ranges of what the median Florida home would have cost an international buyer using the

currency lows and highs during the survey timeframes for each respective 12-month period are presented below.

Amount of Local Currency Needed to Purchase a Florida Median-Priced Home

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

$400,000

$450,000

$500,000

$550,000

2022 2023

Canadian Dollar

R$ 1.4M

R$ 1.6M

R$ 1.8M

R$ 2.0M

R$ 2.2M

R$ 2.4M

2022 2023

Brazilian Real

$ 1.0B

$ 1.2B

$ 1.4B

$ 1.6B

$ 1.8B

$ 2.0B

$ 2.2B

2022 2023

Colombian Peso

¥2.0M

¥2.1M

¥2.2M

¥2.3M

¥2.4M

¥2.5M

¥2.6M

¥2.7M

¥2.8M

¥2.9M

2022 2023

Chinese Yuan

0.0 M

0.5 M

1.0 M

1.5 M

2.0 M

2.5 M

3.0 M

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2019 2020 2021 2022 2023

Tourism Strong Again, but Growth Is Slowing

Quarterly International Visitors to Florida

Source: Visit Florida

Overseas

Canada

0M

2M

4M

6M

8M

10M

J F M A M J J A S O N D J F MA M J J A S O N D J F MA M J J A S O N D J F MA M J J A S O N D J F MA M J

2019 2020 2021 2022 2023

International Tourism in the U.S. Remains Below Pre-Pandemic Levels

Monthly Tourist Arrivals to the United States

Source: National Travel and Tourism Office

U.S. Tourism

International tourism in the U.S. has

rebounded since reopening began in

earnest in calendar year 2022, but

remains below the pre-pandemic

levels last observed in CY2019.

Economic challenges facing other

countries and less international

business travel contribute to muted

travel overall.

Despite the World Health Organization

declaring an end to the pandemic in

May 2023, demand remains low

despite the decline in health concerns.

Florida Tourism

The first two quarters of CY2023 saw the strongest international visitation numbers in Florida since CY2019 with a 22% increase in overseas and 81%

in Canadian visitors compared to the same time CY2022. Florida is leading the nation in recovering the number of overseas travelers that visit Florida

post-pandemic with an 80% recovery rate compared to 2019, while New York follows behind at 75% and California at 68%. The national rate for

overseas arrival also trails Florida at 73%.

Source: Visit Florida

4

Where From?

Top Origin Countries of

International Visitors (CY2022)

1. Canada

2. United

Kingdom

3. Brazil

4. Colombia

5. Mexico

Source: Visit Florida

0.070 M

0.093 M

0.489 M

0.504 M

0.529 M

0.974 M

1.985 M

Middle East/Africa

Asia/Oceania

Central America

Caribbean

Europe

North America

South America

2 of 5 Visitors from South America in 2021

Visitation by World Region (2021)

Source: Visit Florida

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

0.163 M

0.236 M

0.477 M

0.698 M

2.471 M

2.534 M

3.233 M

Middle East/Africa

Asia/Oceania

Central America

Caribbean

Europe

South America

North America

Canadians Overtook So. Americans in 2022

International Visitors to Florida by World Region (CY2022)

Source: Visit Florida

Annual Rate of Price Growth in Most Florida Metros Back to Single-Digits

Metropolitan Statistical Area Single-Family Median Sale Price Pct. Change

Source: Florida Realtors Research produced with data provided by Florida’s multiple listing services

$362K

$375K

$295K

$240K

$357K

$365K

$379K

$315K

$337K

$340K

$400K

$265K

$465K

$735K

$530K

$317K

$365K

$265K

$325K

$335K

$410K

$411K

$370K

$400K

$320K

$260K

$384K

$383K

$401K

$325K

$368K

$359K

$428K

$283K

$515K

$790K

$575K

$335K

$387K

$275K

$349K

$353K

$413K

$425K

The Villages, FL

Tampa-St. Petersburg-Clearwater, FL

Tallahassee, FL

Sebring, FL

Sebastian-Vero Beach, FL

Punta Gorda, FL

Port St. Lucie, FL

Pensacola-Ferry Pass-Brent, FL

Panama City, FL

Palm Bay-Melbourne-Titusville, FL

Orlando-Kissimmee-Sanford, FL

Ocala, FL

North Port-Sarasota-Bradenton, FL

Naples-Immokalee-Marco Island, FL

Miami-Fort Lauderdale-West Palm Beach, FL

Lakeland-Winter Haven, FL

Jacksonville, FL

Homosassa Springs, FL

Gainesville, FL

Deltona-Daytona Beach-Ormond Beach, FL

Crestview-Fort Walton Beach-Destin, FL

Cape Coral-Fort Myers, FL

2%

7%

8%

8%

8%

5%

6%

3%

9%

6%

7%

7%

11%

7%

8%

6%

6%

4%

7%

5%

1%

3%

Aug. 2021 -

Jul.2022

Aug. 2022 -

Jul.2023

Florida Residential

Market Trends

Low interest rates locked in during

in the years leading up to CY2022

have disincentivized current

owners from selling. A higher

interest rate environment today

makes the prospect of financing a

more difficult consideration.

Buyers are facing a dearth of

existing home inventory and as

such, prices are holding steady at

or near their high-water mark.

Along with higher interest rates,

buyers are facing higher monthly

payments than in years past.

Florida has undergone a

particularly stark increase in home

prices since 2021, among the

highest in the country.

Domestic demand slowed in 2022,

rebalancing the market somewhat,

but supply remained tight into 2023.

At the end of July 2023, Florida’s

single-family home inventory was

still 24% lower than February 2020,

before the pandemic began.

Statewide, the median sale price

for a single-family home reached

$420,000. All Florida metros saw

continue to see growth in the

median sale price comparing the

current survey period (August

2022-July 2023) to the prior year,

but no longer the double-digit

growth seen in the previous year.

5

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

6%

5%

0%

10%

20%

30%

40%

50%

60%

International Share of Homebuyers Holding Steady

International Buyer Share of Florida Existing Home Sales and Dollar Volume

$22.9

$16.0

$15.6

$12.3

$15.3

$12.6

2018 2019 2020 2021 2022 2023

...and Fewer Sales Means Less Dollar Volume

Dollar Volume of International Sales in Florida (Billions)

52.0

36.4

33.9

22.5

23.7

19.5

2018 2019 2020 2021 2022 2023

Sales Decline in 2023 As Buyers Face Market Headwinds…

Number of International Sales in Florida (Thousands)

International Buyers

Transactions Detail

International buyer purchases of Florida residential properties (i.e., single-

family homes, townhouses, condos, and co-ops) between August 2022 and

July 2023 declined 18% compared to the prior 12-month period, in terms of

sales counts. Pent-up demand may have burned off in 2022, resulting in a

stunted 2023. Challenges in the global economy continue to weigh on

buyers as sales levels have not yet returned to pre-pandemic norms.

While sales prices are higher, the decline in transactions have pulled

international buyer dollar volume back in line with 2021 levels at $12.6

billion. Dollar volume in 2023 was 18% less than last year’s $15.3 billion.

Domestic demand for Florida homes remained strong, and international

buyers only had a 5% share of existing home purchases across the state. In

terms of dollar volume, international buyers spent 6% of this total since they

spend more than the typical Florida homebuyer. The trend in share of both

existing home sales and dollar volume has remained steady.

International buyers whose primary residence is in another country (Type A)

made up 65% of Florida’s international buyers. This is in line with the past

two years with Type A representing 73% of Florida’s international buyers in

2022 and 71% in 2021. The U.S. on whole has a smaller share of Type A

buyers purchasing real estate across the country. In 2023, it was 49%.

6

Florida

65%

More Common in Florida for Buyers to Live Outside U.S.

Non-Resident Buyers (Type A) as a Share of All International Buyers

U.S.

49%

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

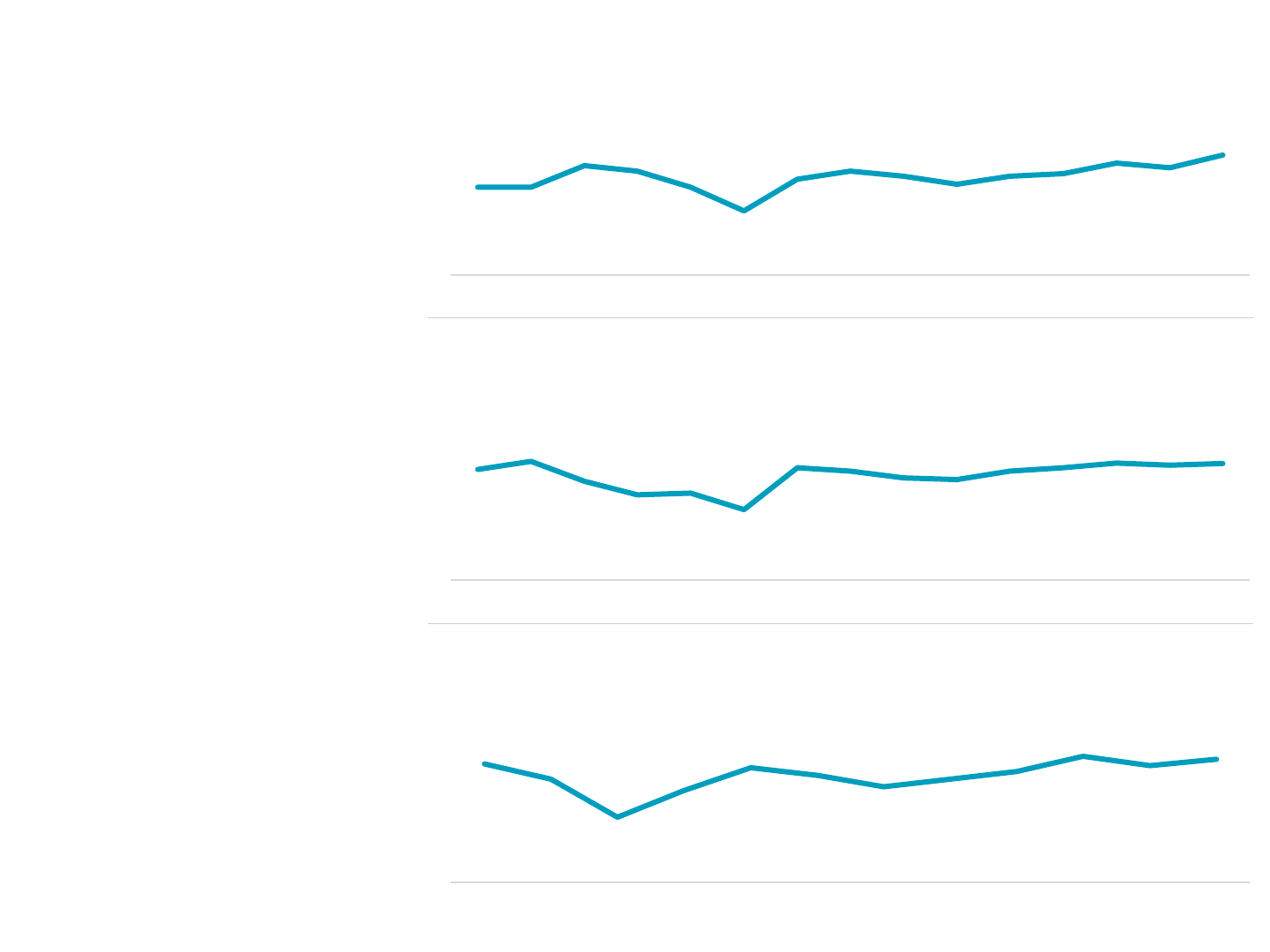

0%

10%

20%

30%

40%

50%

2018 2019 2020 2021 2022 2023

Africa: 1%

0%

10%

20%

30%

40%

50%

2018 2019 2020 2021 2022 2023

Asia and Oceania: 9%

0%

10%

20%

30%

40%

50%

2018 2019 2020 2021 2022 2023

Europe: 17%

0%

10%

20%

30%

40%

50%

2018 2019 2020 2021 2022 2023

Latin America and the Caribbean: 46%

0%

10%

20%

30%

40%

50%

2018 2019 2020 2021 2022 2023

Northern America: 18%

0%

10%

20%

30%

40%

50%

2018 2019 2020 2021 2022 2023

Unknown/Not Specified: 10%

Regional Origin of International Buyers

International buyers are attracted to Florida from across the globe. The appeal of the Sunshine State for some could be its weather and beaches, while

others view it as a bright investment opportunity.

Latin American and Caribbean buyers continue to hold the largest fraction of international buyers in Florida, at 46% in 2023. The share of international

buyers from the Northern American region (virtually all of whom are Canadian) has been shrinking very slightly but still took the second spot at 18%.

Rounding out the lineup were buyers from Europe (17%), Asia and Oceania (9%), and Africa (1%). The regional origin of the international buyer was not

identified by 10% of respondents.

7

Nearly Half of International Buyers from Latin America and the Caribbean

Regional Origin of International Buyers (All Other Regions in Gray for Context)

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

12%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Unknown/Not Specified

National Origin of International Buyers

By number of purchases, the top five countries of origin were Canada (18%), Colombia (10%),

Brazil (7%), Argentina (7%), and the United Kingdom (4%), while 12% of respondents did not

identify a specific country of origin.

8

Most Buyers from Canada, Though Many Come from Across the Globe

Share of Florida’s International Sales by National Origin (Top 12)

Africa

Asia and Oceania

Europe

Latin America and

the Caribbean

Northern America

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

18%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Canada

10%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Colombia

7%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Brazil

7%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Argentina

4%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

United Kingdom

2%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

China

3%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Venezuela

3%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Peru

2%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Mexico

2%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

Germany

2%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023

France

$524 M

$539 M

$982 M

$1.451 B

$2.133 B

Mexico

Peru

Colombia

Brazil

Canada

2023 Dollar Volume: Top 5

$0B

$1B

$2B

$3B

$4B

2020 2021 2022 2023

Canadian Buyers: $2.1 Billion

$0B

$1B

$2B

$3B

$4B

2020 2021 2022 2023

Brazilian Buyers: $1.5 Billion

$0B

$1B

$2B

$3B

$4B

2020 2021 2022 2023

Colombian Buyers: $982 Million

$0B

$1B

$2B

$3B

$4B

2020 2021 2022 2023

Peruvian Buyers: $539 Million

$0B

$1B

$2B

$3B

$4B

2020 2021 2022 2023

Mexican Buyers: $524 Million

86%

83%

80%

76%

72%

FL 65%U.S. 49%

United Kingdom

Canada

Argentina

Colombia

Brazil

UK Buyers Mostly Non-Residents

Non-Resident Buyers (Type A) as a Share of All International

Buyers in Top 5 Buyer Countries

9

Despite Decline Over the Years, Canadians Still Spend the Most

Dollar Volume of International Buyer Purchases of Existing Homes in Florida

Among Major Buyer Countries

Dollar Volume of International Buyers

Among those from the countries with the most dollar

volume in 2023, Canadians purchased the most in dollar

terms by a significant margin. In total, Canadian dollar

volume in 2023 was $2.1 billion.

Brazilian buyer dollar volume rose significantly from the

previous year to $1.5 billion. Dollar volume decreased for

Colombian, Peruvian and Mexican buyers.

The stronger dollar and sales declines were likely two of

the most important factors in bringing about these

declines.

Primary Residence of International Buyers

Non-resident (Type A) buyers tend to make all-cash

purchases. They also gravitate toward using the homes

for vacation or as rentals for investment income.

While overall 65% of Florida’s international buyers were

Type A, it varies by country. About 86% of U.K. buyers

and 83% of Canadian buyers resided abroad.

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

6%

10%

15%

9%

6%

22%

42%

13%

20%

8%

14%

7%

14%

32%

60%

62%

56%

34%

57%

20%

11%

11%

11%

16%

6%

8%

11%

6%

Naples-Immokalee-Marco Island MSA

North Port-Sarasota-Bradenton MSA

Cape Coral-Fort Myers MSA

Tampa-St. Petersburg-Clearwater MSA

Orlando-Kissimmee-Sanford MSA

Miami-Fort Lauderdale-West Palm Beach MSA

Over Horeign Purchases Were in South Florida

Composition by Region of Origin

4%

4%

6%

8%

14%

47%

Naples-Immokalee-Marco Island MSA

North Port-Sarasota-Bradenton MSA

Cape Coral-Fort Myers MSA

Tampa-St. Petersburg-Clearwater MSA

Orlando-Kissimmee-Sanford MSA

Miami-Fort Lauderdale-West Palm

Beach MSA

Nearly Half of International Purchases Are in South Florida

Metro Area Share of Florida's International Buyers in 2023

Destination of International Buyers

The number of residential purchases by international buyers in Florida between August 2022 and July 2023 declined 18% compared to the prior 12-month

period. Reopening economies and fewer restrictions spurred international sales, though purchases were still below their pre-pandemic levels. While sales

prices are higher, fewer transactions have pulled dollar volume back in line with 2021 levels at $12.6 billion. Dollar volume in 2023 was 18% less than last

year’s $15.3 billion.

Purchases by international buyers were heavily concentrated in South Florida, with 47% of purchases occurring in the Miami-Fort Lauderdale-West Palm

Beach MSA. In South Florida, 62% of purchases were by buyers from Latin America and the Caribbean, followed by 14% from Europe. The Orlando-

Kissimmee-Sanford MSA also saw a heavy concentration from Latin America and the Caribbean, accounting for 60% of international purchases. The

Tampa Bay area and Southwest Florida destinations were more popular with Canadian and European buyers. While only 4% of Florida’s international

purchases in 2023 were in the Naples-Immokalee-Marco Island MSA, 56% of those buyers were identified as Canadian.

10

Africa

Asia and Oceania

Europe

Latin America and the Caribbean

Northern America

Unknown/Not Specified

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

4%

4%

5%

11%

13%

20%

x

x

Venezuela

China

United Kingdom

Canada

Colombia

Brazil

Orlando-Kissimmee-Sanford

4%

6%

11%

57%

x

x

x

x

Brazil

Israel

Germany

Canada

Cape Coral-Fort Myers

5%

6%

9%

34%

x

x

Ukraine

United Kingdom

France

Canada

North Port-Sarasota-Bradenton

4%

5%

7%

11%

13%

14%

x

x

Peru

Venezuela

Brazil

Canada

Argentina

Colombia

Miami-Fort Lauderdale-West Palm Beach

5%

8%

20%

x

x

x

x

x

China

Colombia

Canada

Tampa-St. Petersburg-Clearwater

7%

56%

x

x

Italy

Canada

Naples-Immokalee-Marco Island

Major Buyer Countries by Metro Area

Countries with At Least a 4% Share of International Sales

in Each Metro Area

11

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

10%

6%

17%

66%

x

x

x

x

x

Other Metros/Non-Metro (<4% each)

Tampa-St. Petersburg-Clearwater

Orlando-Kissimmee-Sanford

Miami-Fort Lauderdale-West Palm Beach

Colombian Buyers

10%

4%

6%

6%

8%

10%

14%

14%

28%

Other Metros/Non-Metro (<4% each)

Ocala

Tampa-St. Petersburg-Clearwater

Naples-Immokalee-Marco Island

Deltona-Daytona Beach-Ormond Beach

Jacksonville

Port St. Lucie

Miami-Fort Lauderdale-West Palm Beach

Cape Coral-Fort Myers

Mexican Buyers

20%

4%

9%

67%

x

x

x

x

x

Other Metros/Non-Metro (<4% each)

Tampa-St. Petersburg-Clearwater

Orlando-Kissimmee-Sanford

Miami-Fort Lauderdale-West Palm Beach

Peruvian Buyers

4%

7%

17%

72%

x

x

Other Metros/Non-Metro (<4% each)

Palm Bay-Melbourne-Titusville

Orlando-Kissimmee-Sanford

Miami-Fort Lauderdale-West Palm Beach

Venezuelan Buyers

15%

85%

x

x

x

x

x

x

x

Other Metros/Non-Metro (<4% each)

Miami-Fort Lauderdale-West Palm Beach

Argentine Buyers

18%

5%

36%

41%

x

x

x

x

x

Other Metros/Non-Metro (<4% each)

Jacksonville

Orlando-Kissimmee-Sanford

Miami-Fort Lauderdale-West Palm Beach

Brazilian Buyers

8%

4%

5%

5%

7%

7%

18%

18%

29%

Other Metros/Non-Metro (<4% each)

Port St. Lucie

Palm Bay-Melbourne-Titusville

Ocala

Tampa-St. Petersburg-Clearwater

North Port-Sarasota-Bradenton

Lakeland-Winter Haven

Orlando-Kissimmee-Sanford

Miami-Fort Lauderdale-West Palm Beach

British Buyers

18%

8%

8%

8%

11%

19%

27%

x

x

Other Metros/Non-Metro (<4% each)

North Port-Sarasota-Bradenton

Orlando-Kissimmee-Sanford

Tampa-St. Petersburg-Clearwater

Naples-Immokalee-Marco Island

Cape Coral-Fort Myers

Miami-Fort Lauderdale-West Palm Beach

Canadian Buyers

Major Destination Metros by Buyer Country

12

© FloridaRealtors®, all rights reserved.

2023 Profile of International Residential Transactions in Florida

International Buyer Purchase Prices

Florida’s median sale price declined slightly 2023 but remains elevated

relative to pre-pandemic years.

The median sale price among Florida international buyers was $416,000 in

2023, decreasing $41,000 from 2022’s median price of $457,000. This is still

$68,700 more than the median sale price in 2021. The median price among

international buyers was 9% more than the median of all properties sold in

Florida between August 2022 and July 2023, which is significantly smaller

more than the 22% spread from the prior year.

The distribution of international buyer purchase prices has shifted somewhat

over the past year. The largest share of purchases were in the $250K-$500K

range, rising to 41% from 2022’s 37%. The range with the largest decline in

2023 was the $500K-$750K price bracket, with a share of 16% compared to to

22% in 2022.

Among buyers from the five countries with the most purchases, Brazilians typically purchased the most expensive properties. The reason for their higher

price point of $489,519 was a combination of a preference for detached single-family homes and their focus in more expensive metros such as the Miami-

Fort Lauderdale-West Palm Beach MSA. Argentine buyers also flocked to South Florida, but tended to purchase condominiums, which generally have

lower prices than their detached counterparts. The median purchase price for Argentine buyers was $318,470 in 2023.

$383K

$416K

$0K

$100K

$200K

$300K

$400K

$500K

$600K

2018 2019 2020 2021 2022 2023

Florida’s International Buyers Typically Spend More

Median Price for Florida Existing Home Sales vs. International Buyer Sales

$318,470

$359,437

$383,000

$413,200

$416,000

$489,400

$489,519

Argentina

Colombia

Florida Existing Home Sales

Canada

Florida International Buyers

United Kingdom

Brazil

Brazil & UK Buyers Purchase More Expensive Properties

Median Purchase Price Among Florida's Top 5 International Buyer Countries

3%

10%

9%

16%

41%

13%

8%

0% 10% 20% 30% 40%

Over $3M

$1M to $3M

$750,001 to $1M

$500,001 to $750,000

$250,001 to $500,000

$150,001 to $250,000

Up to $150,000

2022 2023

Mild Pullback in $500K-$750K Price Bracket

Price Distribution of International Buyer Purchases

13

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

70%

91%

55%

57%

81%

62%

26%

9%

40%

39%

16%

32%

4%

3%

3%

United Kingdom

Argentina

Brazil

Colombia

Canada

All Florida

Argentine and Canadian Buyers More Likely to Make All-Cash Purchases

Financing Among Florida's Major International Buyers

All Cash | U.S. Mortgage | Home Country Mortgage | Investors/Other | Don't Know

Florida

62%

U.S.

42%

Financing

Close to two-thirds of Florida’s international buyers purchased a property

entirely with cash. This statistic has been consistent over the past several

years and shows a difference from the national trend, where only 42% of

U.S. international residential purchases were paid in all cash.

Following cash transactions, using a U.S. mortgage is the next most

common option selected by international buyers. The remaining

purchases are financed either through a mortgage from their home

country, investors, or other means.

Not all international buyers are the same. Ninety-one percent of

Argentines and 81% of Canadians made an all-cash purchase. This

correlates with their high share of non-resident (Type A) buyers who are

not eligible for a U.S. mortgage. Brazilian buyers are more evenly split

between purchases in cash and purchases financed through a U.S.

mortgage.

14

Florida’s International Buyers More Likely to Pay in Cash

Cash Sales as a Percentage of International Buyer Purchases

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

35%

43%

0%

10%

20%

30%

40%

50%

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Urban Share Increase Linked to More Latin American Buyers

Share of International Buyers Who Purchased Property in a Central City/Urban Area

U.S.

Florida

28%

68%

33%

42%

38%

58%

14%

44%

24%

41%

8%

15%

18%

10%

10%

7%

6%

6%

9%

8%

United

Kingdom

Argentina

Brazil

Colombia

Canada

Argentine Buyers Heavily Favor Condo Purchases

Residential Property Purchases of Florida's Major International Buyers

Condo or Coop | Detached Single-Family | Townhouse | Residential Land | Other

Florida

53%

U.S.

76%

Type of Property

Fifty-three percent of Florida’s international buyers purchased detached or

attached single-family homes, which is lower than the 76% share among

all U.S. international buyers.

Buyers from Brazil, the U.K. and Canada tended to purchase detached

single-family homes. Argentine buyers tended to purchase condominiums

more so than other international buyers, which is in part a reflection of

their overwhelming preference for buying in condo-heavy South Florida.

15

Condo Popularity in Florida Limits Single-Family Share

Single-Family Home (Attached/Detached) Share of International Purchases

Location Preference

Forty-three percent of Florida’s international buyers

purchased in a central city/urban area, which is

consistent with the prior 12-month period, but up from

34% in 2021. The increase can be explained by the

higher share of buyers from Latin America who tend to

purchase properties in the Miami metro area.

Nationally, 35% of all U.S. international buyers

purchased property in a central city/urban area.

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

43%

8%

32%

13%

52%

8%

66%

23%

47%

17%

22%

6%

8%

12%

11%

14%

13%

29%

15%

12%

7%

6%

6%

8%

5%

6%

4%

3%

United

Kingdom

Argentina

Brazil

Colombia

Canada

Canadian and British Buyers Seek Vacation Nests, While Argentine and Colombian Buyers Seek Rental Income

Intended Use of Property Among Florida's Major International Buyers

Vacation Home | Residential Rental | Both Vacation and Rental | Primary Residence | Student Use | Other | Don't Know

Florida

64%

U.S.

50%

Intended Use of Property

International buyer preferences for the type of property and location are

tied to their intended use of the property. The share of Florida international

buyers planning to use their purchase as an investment rental and/or a

vacation home was 64% in 2023, which is down slightly from the 72%

observed in 2022.

True to their reputation, Canadian buyers are naturally snowbirds, with

nearly one in two (52%) indicating they plan to use their property as

exclusively as a vacation home. U.K. buyers were not far behind, at 43%

Argentines (66%) and Columbians (47%), on the other hand, are among

the nationalities most likely to use their purchases exclusively as rentals.

Among the top five international-buyer countries, Brazilian buyers are

most likely to use their property as a primary residence (29%).

16

Florida’s International Buyers Expect to Rent or Visit

Share of International Buyer Purchases for Income or Vacation Use

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

14%

14%

27%

45%

14%

20%

31%

34%

Don't Know

Decrease

About the Same

Increase

Optimists Decline in Number but Maintain a Plurality

Outlook on International Buyer Client Transactions in the Next 12 Months

21%

41%

37%

29%

37%

34%

Decreased

Stayed About the Same

Increased

International Business Weaker Than 5 Years Ago for Many

Change in International Share of Buyer Clients in the Past 5 Years

27%

49%

24%

34%

46%

21%

Decreased

Stayed About the Same

Increased

Many Added Fewer International Clients in 2023 vs. 2022

Change in International Share of Buyer Clients in the Past Year

23%

20%

19%

15%

17%

16%

41%

39%

37%

34%

34% 34%

2018 2019 2020 2021 2022 2023

Realtors in Florida Work with More International Clients

Share of Respondents with an International Client in the Past Year

U.S.

Florida

Business Trends

International Transaction Change and Outlook

The same share of Florida Realtors

respondents—34%—worked with an

international client in 2023 as in 2022 and 2021. Nationally, the fraction of

Realtors who worked with an international client fell slightly to 16%

(compared to 17% last year).

Twenty-one percent of those who worked with an international client

reported a decrease in their share of business that is international in the

past year—a decline compared to the 24% reported for the prior survey

period.

Over a 5-year period, a smaller fraction of respondents—29%—reported a

decrease in their international buyer client transactions.

Thirty-four percent of respondents expect their international business

transactions to increase in the next 12 months, a significant decline

compared to the 45% share reported in last year’s 2022 survey.

17

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

67%

62%

65%

64%

62%

68%

2018 2019 2020 2021 2022 2023

Larger Share of Prospective Buyers Getting Cold Feet

Share of Respondents with Any International Client Deciding Not to Purchase

93% 93%

94%

89%

92%

93%

2018 2019 2020 2021 2022 2023

Prospective Buyer Visits Back to Normal

Percent of Respondents Who Reported International Buyers Visited

Florida at Least Once Before Purchasing a Property

6%

14%

2%

5%

9%

11%

12%

15%

17%

24%

24%

32%

47%

Don't know

Other

Loss of home country benefits

U.S. tax laws

Property taxes

Immigration laws

Could not obtain financing

Insurance costs

Cannot move money

Exchange rate

Condo fees

Could not find property to purchase

Cost of property

Rising Prices, Lack of Inventory Prevent Purchases

Reasons Client Did Not Purchase Property (Multiple Selections Allowed)

Reasons Client Did Not Purchase

Higher prices and rising rates prohibited buyers of all kinds from

closing deals over the past year. Roughly 68% of respondents

reported at least one of their international clients ultimately chose

not to buy a Florida property, up from 62% in 2022. Cost of

property was the top reason cited (47%) as the reason buyers did

not close.

Scarcity of available listings—another difficulty affecting both

domestic and international buyers—was the second-most cited

issue among respondents. Thirty-two percent of respondents

whose international buyers did not close on a property cited the

inability to find a property to purchase as a contributing factor.

Other factors preventing purchases were cited less frequently,

ranging from condo fees and exchange rates (both 24%) to a loss

of home-country benefits (2%).

18

Visits to Florida Before a Purchase

Florida has strong appeal and a positive reputation worldwide, yet

most international buyers still want to visit before taking the plunge.

In 2023, 93% of respondents visited Florida at least once before

making a purchase. This compares to 92% the previous year and

89% in 2021 when international buyers were hindered by travel

bans in place during the pandemic.

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

43%

0%

10%

20%

30%

40%

50%

'18 '23

More Expensive

13%

0%

10%

20%

30%

40%

50%

'18 '23

About the Same

20%

0%

10%

20%

30%

40%

50%

'18 '23

Less Expensive

14%

0%

10%

20%

30%

40%

50%

'18 '23

Don't Know

31%

22%

14%

8%

5%

3%

3%

3%

1%

9%

Personal Contacts

Referred by Previous Client

Was a Former Client

Website/Internet (Paid Ad)

Website/Internet Organic Search

Business Contact Outside the U.S.

Walk-in/Open House/Phone Call

U.S. Business Contact

Signs/Ads on Boards or Yard

Other

Best Referrals - Connections and Former Clients

Source of Referrals or Leads on Florida’s International Buyers

6%

0%

10%

20%

30%

40%

50%

'17 '18 '19 '20 '21 '22

Other/Don't Know

25%

0%

10%

20%

30%

40%

50%

'17 '18 '19 '20 '21 '22

Secure Investment

42%

0%

10%

20%

30%

40%

50%

'17 '18 '19 '20 '21 '22

Desirable Location

27%

0%

10%

20%

30%

40%

50%

'17 '18 '19 '20 '21 '22

Profitable Investment

Reasons Client Purchased Property

Desirable location remains the No. 1 factor influencing international buyer

purchases, cited by 45% of respondents. Roughly half bought due to the investment

potential – 24% because they expect it to be profitable, and another 24% because it

is viewed as a secure investment.

19

Location, Location, Location Matters

Most Important Factor Influencing International Buyer Decision to Purchase in Florida

Source of Referrals

Two-thirds of respondents reported that their international

buyers were personal or business contacts, former clients, or

referrals from former clients. Traditional advertising trails

behind personal relationships.

How Clients View Florida Home Prices

Florida’s home prices are becoming more

expensive for international buyers. Forty-three

percent of respondents reported that their clients

viewed Florida home prices to be more expensive

than prices in their home country. While 33% think

prices are about the same or less expensive than

prices in their home country, 14% “don’t know” how

the prices compare.

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

45%

0%

10%

20%

30%

40%

50%

'18 '19 '20 '21 '22 '23

Desirable Location

24%

0%

10%

20%

30%

40%

50%

'18 '19 '20 '21 '22 '23

Secure Investment

24%

0%

10%

20%

30%

40%

50%

'18 '19 '20 '21 '22 '23

Profitable Investment

6%

0%

10%

20%

30%

40%

50%

'18 '19 '20 '21 '22 '23

Other/Don't Know

47%

12%

8%

6%

5%

4%

4%

3%

2%

1%

1%

Miami-Fort Lauderdale-West Palm Beach

Orlando-Kissimmee-Sanford

Tampa-St. Petersburg-Clearwater

Cape Coral-Fort Myers

North Port-Sarasota-Bradenton

Lakeland-Winter Haven

Jacksonville

Naples-Immokalee-Marco Island

Deltona-Daytona Beach-Ormond Beach

Port St. Lucie

Palm Bay-Melbourne-Titusville

Almost Half of International Sellers Sold in South Florida

Metro Area Share of Florida's International Sellers

24%

7%

7%

6%

6%

5%

3%

2%

2%

2%

2%

2%

2%

Canada

United Kingdom

Colombia

Argentina

Brazil

Venezuela

France

Germany

Mexico

Peru

China

Dominican Republic

Ecuador

Canadians Are a Larger Share of Sellers Than of Buyers

National Origin of International Clients Who Sold Florida Property

Africa

Asia and Oceania

Europe

Latin America and

the Caribbean

Northern America

Residential Sellers

Some respondents also worked with international clients who sold U.S. property. The list

of top seller countries of Florida real estate is similar to the list of top buyers. Canada led

the way in 2023, followed by the United Kingdom, Columbia, Argentina and Brazil.

Slightly less than half of properties sold by international owners were in the Miami-Fort

Lauderdale-West Palm Beach MSA. The other most common metro areas for international

sellers were Orlando-Kissimmee-Sanford (12%), Tampa-St. Petersburg-Clearwater (8%),

Cape Coral-Fort Myers (6%), and North Port-Sarasota-Bradenton (5%). These metros

were also the top destinations of international buyers in 2023.

The estimated median price of properties sold by international owners was $416,437,

which is 1.5% higher than the median sale price in the prior survey period of $410,364.

20

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

76%

7%

5%

8%

5%

No, did not have a client interested in purchasing property abroad

Helped the client directly

No, could not refer the client

Yes, referred to an agent/Realtor in another country

Yes, referred to an agent/Realtor in the U.S.

Most Clients Not Considering a Purchase in Another Country

Referrals of Clients Seeking to Purchase Property Abroad

12%

7%

6%

5%

5%

4%

4%

4%

4%

2%

2%

2%

2%

1%

1%

Colombia

Costa Rica

Spain

Portugal

Italy

Canada

Dominican Republic

Mexico

Panama

Brazil

United Kingdom

Belize

Bahamas

Argentina

France

Buyers Seek Latin American and Mediterranean Properties

Top Countries of Interest to Clients Seeking to Purchase Property Abroad

21

Clients Seeking Property Abroad

Twenty-four percent of respondents reported they had clients–either U.S.

citizens or non-U.S. citizens–who were interested in purchasing property

abroad. Of these respondents, only about one in four were unable to

assist or refer the client to someone who could assist.

Eighty-four percent of these respondents indicated their clients were

interested in purchasing property abroad for use as a vacation home

and/or residential rental.

Clients were interested in purchasing properties in several Latin American

countries such as Colombia and Costa Rica. The European destinations

Portugal, Spain and Italy were also high on the list.

Africa

Asia and Oceania

Europe

Latin America and

the Caribbean

Northern America

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

31%

27%

17%

24%

30%

28%

25%

27%

29%

33%

31%

32%

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Nearly One-Third of Florida Realtors Were Born Abroad

Percent of Respondents Born Abroad

33% 33%

41%

39%

33%

24%

36%

39%

37%

34%

37%

38%

42%

40%

45%

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Non-English Fluency Remains High Among Survey Respondents

Percent of Respondents Who Are Fluent in a Language Other Than English

66%

71%

59%

51%

52%

42%

67%

65%

61%

60%

65%

67%

70%

69%

70%

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

With More Respondents Fluent in Other Languages, Fewer Problems Occur

Percent of Respondents Who Reported No Problems Working with International Clients

22

Cultural and Language Issues

Cultural and language issues faced by

Realtors when working with

international clients have eased

somewhat in recent years. Seventy

percent of respondents reported they

have not had problems when working

with international clients. In past

years, as few as 42% reported no

problems working with international

clients.

The decline in those reporting

problems is associated from the larger

fraction of the respondents who could

speak another language and were

born abroad. Forty-five percent of

respondents reported they are fluent

in a language other than English, the

highest share since this question was

asked in the 2008 survey.

A third of respondents were born

outside the United States.

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

Notes:

Line 1

Source: NAR's 2023 International Transactions in U.S. Residential Real Estate

Line 2

Source: NAR's

2023 International Transactions in U.S. Residential Real Estate

Line 3 Multiply Lines 1 and 2

Line 4 Source: Florida Realtors 2023 Survey of International Residential Transactions in Florida

Line 5 Multiply Lines 3 and 4 (Sales = # of units x mean price)

Line 6

Dollar volume of closed sales for single-family homes, condominiums, and townhomes. Source of data: Florida Realtors®

Line 7

Closed sales for single-family homes, condominiums, and townhomes. Source of data: Florida Realtors®

Line 8 Divide Line 5 by Line 6.

Line 9 Divide Line 3 by Line 7.

Computation of Residential Purchases of International Buyers in Florida for the 12-Month Period August 2022‒July 2023

Line Florida's International Buyer Residential Purchases

1 Total U.S. International Buyer Residential Purchases 84,600

2 Florida's Share to U.S. International Buyer Residential Purchases (units) 23%

3 Number of Florida International Buyer Residential Purchases 19,458

4 Average Price of Florida International Buyer Residential Purchases $648,104

5 Dollar Volume of International Buyer Residential Purchases in Florida $12,610,803,192

Florida's Residential Market for Existing Homes

6 Florida's Residential Dollar Volume (Single-Family, Condo/Townhomes) $196,786,203,999

7 Florida's Closed Sales (Single-Family, Condo/Townhomes) 372,564

8

Share of Dollar Volume of International Buyer Purchases to Florida's Total Dollar Volum

6%

9 Share of International Buyer Purchases to Florida's Closed Sales 5%

Appendix

23

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.

About Florida Realtors

®

Since 1916, Florida Realtors

®

has advanced Florida’s real estate

industry by shaping public policy on real property issues; encouraging,

promoting and teaching consistent standards for ethical practice and

professionalism; and building on the efforts of local Realtor

boards/associations to provide the information and tools members

need to succeed.

Florida Realtors is the largest professional trade association in the

state with more than 238,000 members. Members enjoy business

contacts, networking opportunities, educational offerings, research

and legislative representation, programs, services, and tremendous

camaraderie. The association headquarters is located in Orlando, and

the legislative Office of Public Policy is located in the heart of Florida’s

capital city of Tallahassee.

Florida Realtors’ elected leadership and business management teams

share a common goal. Individually, each brings to the table years of

expertise in the real estate industry and proven business management

skills. As partners, they seek solutions to advance specific public

policy issues and meet the needs of the state's Realtor community.

Florida Realtors

®

Research Department

The goal of the Florida Realtors Research Department is to provide

Florida Realtors members, Florida’s local Realtor associations, and

the general public with the most accurate and comprehensive housing

market statistics and analysis available.

Visit www.floridarealtors.org/research

for the latest statistics and

analysis.

Florida Realtors

®

Research Department

7025 Augusta National Drive

Orlando, FL 32822

407.438.1400

24

2023 Profile of International Residential Transactions in Florida

©

FloridaRealtors®, all rights reserved.