March 23, 2015

The Federal Reserve in the 21

st

Century

Monetary Policy Decision Making

Paolo Pesenti, SVP – Office of the Director, Research and Statistics Group

The views expressed in this presentation are those

of the presenter and not necessarily those of the

Federal Reserve Bank of New York or

the Federal Reserve System

2

Monetary policy refers to the actions undertaken by a central

bank to influence availability and cost of money and credit to

help promote national economic goals

In what follows we will review:

the institutional framework and organization of the Federal

Reserve System, the central bank of the U.S.

its goals and objectives (the so-called dual mandate)

We will focus on how the Fed chooses its actions to achieve

the dual mandate

And close with an assessment of issues and concerns in the

current policy debate

Outline

3

The Federal Reserve System includes:

12 Federal Reserve Banks (FRBs)

▫ part private, part government institutions

▫ each with a Board of Directors (9 in number)

▫ who appoint the president and officers of the FRB subject to approval by BOG

Board of Governors of the Federal Reserve System (BOG)

▫ headquartered in Washington DC

▫ up to seven members appointed by POTUS and confirmed by the Senate

▫ currently (March 2015) five members, two vacancies

Federal Open Market Committee (FOMC)

Around 2900 member commercial banks

Depending on the context, the shorthand “Fed” can refer to the whole system, or the

Washington Board, or the FOMC…

The Fed in a nutshell (get used to the acronyms…)

4

Federal Open Market Committee:

the (up to) seven members of the BOG in Washington DC

▫ (BOG Chair = FOMC Chair)

the president of the Federal Reserve Bank of New York

▫ (FOMC Vice Chair)

four of the remaining eleven FRB presidents, serve one-year terms on a rotating

basis

The FOMC holds eight regularly scheduled meetings per year

at these meetings, the Committee reviews economic and financial conditions,

assesses the risks to its long-run goals, and votes on actions that influence the

money supply and interest rates

nonvoting FRB presidents attend the meetings of the Committee, participate in the

discussions, and contribute to the Committee's assessment of the economy and

policy options

the policy actions are explained in a public statement released shortly after each

meeting

The FOMwhat?

5

How do FOMC meetings look like (March 2014)

6

In very general terms, central bank’s goals are to foster economic prosperity and

promote social welfare

More specific objectives are established by the government

Federal Reserve Act: provides statutory basis for monetary policy

Goals of monetary policy: Original language from 1913

“. . . to furnish an elastic currency, to afford means of rediscounting commercial paper,

to establish more effective supervision of banking in the United States, and for other

purposes.”

Goals of monetary policy: Amendment in 1977

“The Board of Governors of the Federal Reserve System and the Federal Open

Market Committee shall maintain long run growth of the monetary and credit

aggregates commensurate with the economy's long run potential to increase

production, so as to promote effectively the goals of maximum employment, stable

prices, and moderate long-term interest rates”

“maximum employment and stable prices” = Fed’s dual mandate

What are the Fed’s ultimate objectives?

7

Statement on ‘Longer-Run Goals and Monetary Policy Strategy’ (adopted in 2012, most

recently amended in Jan 2015) contains an interpretation of the dual mandate

Price stability longer-run goal for inflation

▫ inflation at the rate of 2 percent is most consistent over the longer run with the

FED’s statutory mandate

▫ measured by the annual change in the price index for personal consumption

expenditures (PCE), a comprehensive measure of prices faced by US households

Maximum employment no fixed goal

▫ policy decisions must be informed by assessments of the maximum level of

employment, based on a wide range of indicators

▫ assessments are uncertain and subject to revision

▫ estimates of the longer-run normal rates of output growth and unemployment are

published four times per year in the FOMC’s Summary of Economic Projections

(SEP).

– For example, according to the latest SEP, longer-run normal rate of

unemployment is between 4.9 and 5.8 percent (central tendency: 5.0 to 5.2)

More detail, please

8

Prices act as the key mechanism for allocating resources

efficiently throughout the economy

If inflation is high, lenders are harmed because they can buy

fewer goods and services with their payments than they

expected. If inflation is low, borrowers are harmed

If inflation is high, demand for goods and services is pushing

hard on available resources. If inflation is low there is not

enough demand to fully use the available resources in

society.

When inflation is stable and not too high nor too low over time,

it does not materially enter into the decisions of households and

firms

Why price stability

9

Goldilocks inflation = 2 percent!

π = 2

10

Inflation is influenced by several factors:

Transitory shocks (e.g. food and energy prices)

Supply shocks (e.g. productivity) and external factors (e.g. import prices,

exchange rates) affecting business costs

Either excess demand or slack in resource utilization

Inflation expectations

Inertial components (e.g. indexation)

The central bank has primary influence over the long-run

behavior of the general price level

Importance of “well-anchored” inflation expectations around levels

consistent with objectives of price stability

Over the short-run, appropriate policy reduces risk of inflation

persistently too high or too low

Does not focus on transitory volatility (e.g. in energy prices) or changes in

relative prices

Focuses on underlying (“core”) inflation

What causes inflation and what can the Fed do?

11

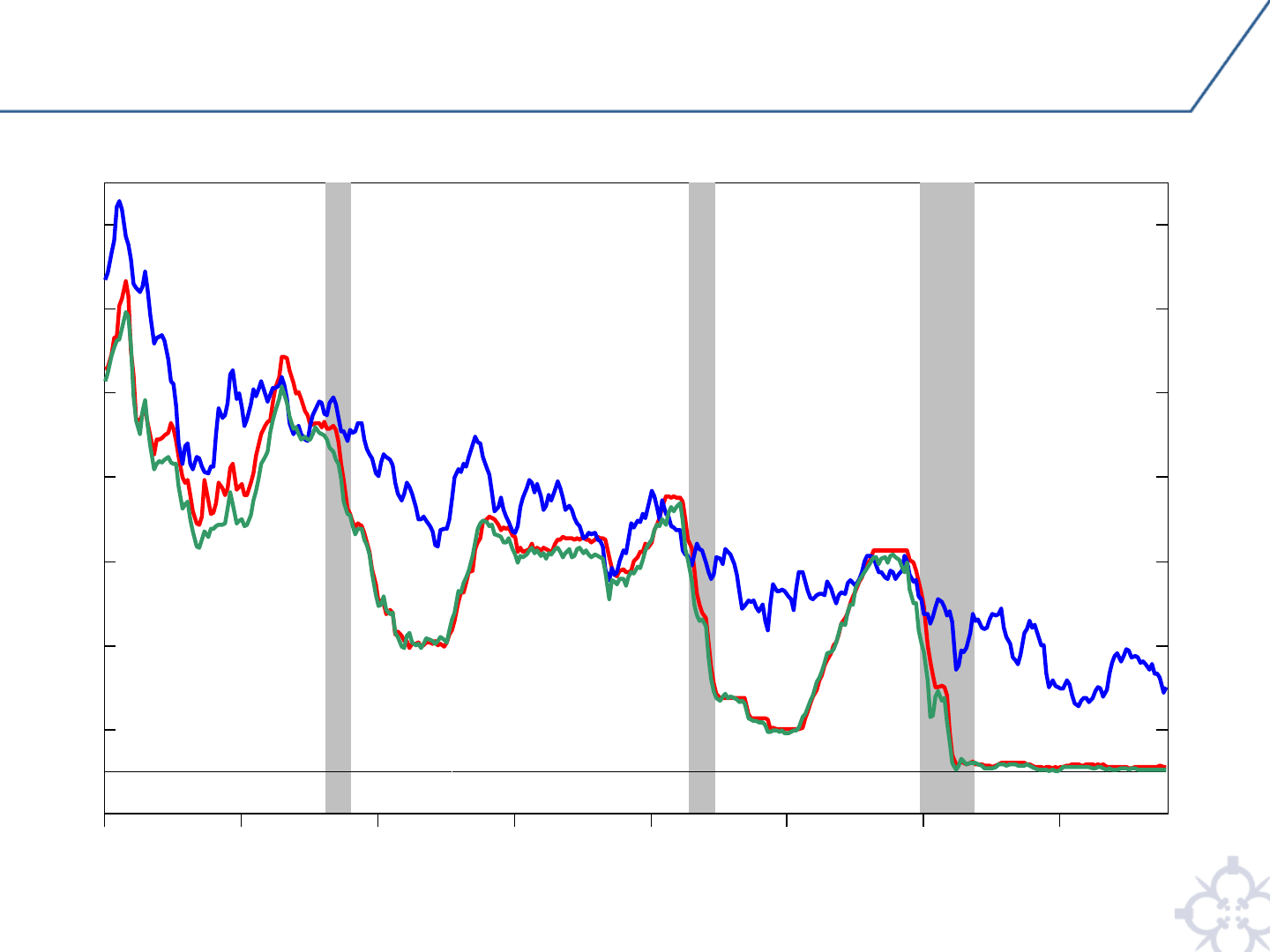

Note: Grey shading shows NBER recessions

Total and core PCE inflation in recent years

-2

-1

0

1

2

3

4

5

6

7

-2

-1

0

1

2

3

4

5

6

7

2000 2002 2004 2006 2008 2010 2012 2014

% Change – Year to Year

Total PCE

Core PCE

% Change – Year to Year

Source: Bureau of Economic Analysis Note: Grey shading shows NBER recessions

12

Obviously social welfare improves as human resources are

utilized more fully and efficiently

Long-run employment and output are determined by:

Population growth, technological progress, preferences for

saving, risk and work effort

Not by monetary policy

In the short-run, the economy goes through business cycles

Output and employment fluctuate above or below long-run

levels (changes in demand relative to supply)

Monetary policy can help ‘smooth’ these fluctuations, and

thus stabilize employment and incomes

Why maximum employment and what can the Fed do?

13

Note: Grey shading shows NBER recessions

Recent history of the US labor market

56

58

60

62

64

66

68

0

2

4

6

8

10

12

2000 2002 2004 2006 2008 2010 2012 2014

Percent

Unemployment Rate

Labor Force

Participation Rate

Percent

Source: Bureau of Labor Statistics Note: Grey shading shows NBER recessions

(Left Axis)

(Right Axis)

Employment to

Population Ratio

(Right Axis)

14

Assessments of maximum employment by FOMC participants

may differ depending on their views about what is structural or

frictional (independent of policy) and what is cyclical

(dependent on policy)

Frictional causes: Turnover unemployment:

▫ Economy is dynamic

▫ Jobs are continually created and destroyed

▫ Workers are continually entering and exiting the labor market

Structural causes: Mismatch unemployment:

▫ Current skills of some workers may not match opportunities for long-

term employment

▫ Re-allocation of labor from shrinking industries/depressed regions to

expanding industries/booming regions

Why is it difficult to assess employment objectives?

15

The FOMC has fallen short on both objectives since the Great

Recession

Inflation has been running below the 2% longer-run

objective of the Committee

Unemployment remains above estimates of its longer-run

normal level, although the gap is currently narrow

FOMC participants’ forecasts from the SEP for unemployment

and inflation generally indicate that both objectives are

expected to be met over the medium term

So, are we achieving our objectives?

16

Projections vs goals: from the latest SEP

Source: Summary of Economic Projections, March 18

th

2015

17

What’s in FOMC participants’ crystal ball?

From the latest FOMC statement (March 2015):

The Committee expects that, with appropriate

policy accommodation, economic activity will

expand at a moderate pace, with labor market indicators

continuing to move toward levels the Committee judges

consistent with its dual mandate.

Inflation is anticipated to remain near its recent low level in

the near term, but the Committee expects inflation to rise

gradually toward 2 percent over the medium term as the

labor market improves further and the transitory effects of

energy price declines and other factors dissipate.

Note: FOMC expectations are based on the presumption that

there will be appropriate policy accommodation. What does it

mean?

18

Monetary policy cannot directly affect employment or inflation

(ultimate objectives)

What monetary policy can do is to affect the flow of credit to

the economy by influencing financial conditions

The flow of credit in turn affects aggregate demand and

economic activity

Accommodation: Higher availability and lower cost of credit

provides economic stimulus, boosts demand and spending, and

puts upward pressure on prices

Tightening: Lower availability and higher cost of credit reduces

economic stimulus, contracts demand and spending, and

contains risk of inflation

What does accommodation mean?

19

Fed eases or tightens the stance of policy by choosing the

appropriate levels of its intermediate (or operating) targets

A good target is a variable that

is effective in influencing the flow of credit

can be controlled reasonably well by the Fed

Possible examples of intermediate targets: short-term interest

rates; money aggregates; exchange rate…

(vary across countries, change through time)

Policy stance and operating targets

20

The federal funds rate (FFR)

The FFR is the rate at which banks borrow and lend reserves in

the federal funds market

Reserves are deposits that banks hold in their accounts at the Federal Reserve (these deposits are

assets for the banks, but liabilities for the Fed)

The federal funds market is an overnight market

Loans in this market do not require collateral

FFR is a good operating target

It is controlled fairly well by the Fed

The FFR influences other interest rates and borrowing costs

▫ It is strongly linked to short-term rates such as Treasury bills

▫ Short-term rates in turn affect long-term rates such as mortgage rates

To increase (reduce) accommodation, FOMC lowers (hikes) FFR

Interest rates affect credit flows, foreign exchange rates, and ultimately a range of

economic variables, including employment, output, and prices of goods and services

(transmission mechanism)

Monetary policy affects economy with “long and variable lags” (Milton Friedman)

21

-1

1

3

5

7

9

11

13

1984 1988 1992 1996 2000 2004 2008 2012

-1

1

3

5

7

9

11

13

%

%

Source: Federal Reserve Board

FFR

10Y TR

3M TR

Fed funds rate, 3-month and 10-year Treasuries

22

Once again, see Statement on ‘Longer-Run Goals and Monetary Policy Strategy’

In setting monetary policy, the Committee seeks to mitigate deviations

(or gaps) of inflation from its longer-run goal and deviations of

employment from the Committee’s assessments of its maximum level.

These objectives are generally complementary.

This means that generally a stance of policy that helps closing the inflation gap also

helps closing the employment gap

But sometime there may be policy trade-offs: a policy that helps closing the inflation

gap may worsen the employment gap, and vice versa

Under circumstances in which the Committee judges that the objectives

are not complementary, it follows a balanced approach in promoting

them, taking into account the magnitude of the deviations and the

potentially different time horizons over which employment and inflation

are projected to return to levels judged consistent with its mandate

How does the Fed set its targets?

23

Let’s play with the FFR: the Fed Chairman Game

This is an interactive game on the SF Fed page.

http://sffed-education.org/chairman/

24

How to decide whether to hike, reduce, or keep constant the FFR?

At each meeting, the Committee:

▫ assesses how current and projected economic conditions stand relative

to its long-run goals

– Summarized in the first and second paragraphs of the FOMC statement

▫ accounts for the potential trade-offs in closing projected inflation and

employment/unemployment gaps

– This is based on participants’ views on how he economy operates, i.e. the mechanism of

transmission and its ‘long and variable lags’

– Research staff plays a key role in affecting these views through data analysis, historical case

studies, evaluation of policy alternatives, model-based simulations…

▫ debates extensively pros and cons of alternative choices

– Based on participants’ views of costs and efficacy of alternative options

– A summary of these debates, without attributions, appears in the minutes of the meetings,

published three weeks after the meetings

– More comprehensive transcripts are released five years later

▫ votes on a specific action

– Voters in favor and against are identified in the FOMC statement

That was fun. Now, about making policy in practice…

25

FOMC decisions can sometime surprise market participants

Policymakers like flexibility and do not usually like to “telegraph” their

actions, leading to some uncertainty about the outcome of a meeting

But FOMC considers it valuable to be transparent about its

reaction function: how policy will respond to shocks and

unexpected contingencies

Market participants set expectations (about inflation, interest rates, etc.)

based on conjectures about policy, and these expectations affect their

behaviors

▫ E.g. if firms think that future accommodative policy will raise wages and

business costs, they set higher prices today to insure against loss of

profitability, driving current inflation up

If policymakers want to stabilize market expectations, they need to be

predictable and transparent about their future intentions, preferences and

judgmental views

▫ Extensive communication is key to effective monetary policymaking!

Surprises vs. transparency

26

Channels of FOMC communication

The statement

▫ Issued at the end of each meeting

▫ Includes the Committee’s view on economic outlook and inflation, the policy

decision and an assessment of risks

The minutes

▫ Published three weeks after the meeting

▫ Summarize the discussion and the rationale of the policy decision

Press conferences

▫ 4 times a year, after every other meeting

▫ Chair discusses statement and answers questions

▫ Public release of FOMC projections for output, inflation and unemployment, as well

as the appropriate pace of policy firming

Other communication (speeches of the Committee members)

▫ Help inform the public on FOMC members’ views between meetings

27

Simple interest rate rules can encapsulate some aspects of the FOMC’s

policy approach

E.g. the so-called “Taylor rule” suggests to move the interest rate predictably in

response to inflation and output gaps

The constant `2’ above represents the long-run equilibrium real interest rate

Formal interest rate rules have some attractive properties

Clear link between adjustment of policy rate and deviations from objectives

Policy setting is data-dependent

Transparent communication

Reasonably good guidepost for US monetary policy, from mid-1980s to 2007

But simplicity is both a virtue and a shortcoming

Policy rules do not capture complex link between FFR and financial conditions

If mechanism of transmission were tight and stable over time, a simple rule would

generate acceptable results

If transmission is uncertain and variable, monetary policy cannot be put on autopilot

Would a formal rule make policymaking easier?

28

In the world of the Fed Chairman Game, FFR is the single instrument

of monetary policy

But monetary policy response to the recession has lowered the FFR:

Down by 325 basis points from Aug 2007 to Sep 2008

Down to 0-1/4 percent range (effectively zero) since Dec 08

Does this situation preclude further accommodation? Not necessarily

▫ Some central banks have recently lowered their policy rate below zero

In fact, there are two unconventional approaches to monetary policy

when FFR is at or near the zero lower bound:

Forward guidance on the future path of the FFR

Quantitative and credit easing policy involving changes in the size

and/or composition of the balance sheet

The mix of instruments to provide accommodation

29

Even when the FFR and short-term rates cannot go further

down, one can still use monetary policy to lower long-term rates

Return on long-term securities depends on two elements:

expectations about future short-term interest rates

uncertainty about future events

▫ risky to get locked into long-term contracts (duration risk)

▫ agents demand compensation (term premium) for taking long-

term positions

If you want to provide more accommodation by lowering long-

term returns, you can

use communication about keeping the FFR low for long

(forward guidance)

purchase long-term securities to drive down the term

premium (quantitative easing)

▫ We explore these issues in detail in the next presentation

Accommodation at the zero bound

30

-1

0

1

2

3

4

5

6

7

2000 2002 2004 2006 2008 2010 2012 2014

-1

0

1

2

3

4

5

6

7

%

%

Source: Federal Reserve Board

FFR

10Y TR

3M TR

LSAP1

LSAP2

LSAP3

MEP

Tapering

The alphabet soup of policy and long-term rates

31

Time to start hiking the FFR after six years (and counting) at the

zero bound?

When is the appropriate timing of the FFR lift-off?

Will the recovery be “sufficiently” strong once we remove accommodation?

What the appropriate pace of FFR renormalization be after lift-off?

What will happen to forward guidance?

To the balance sheet?

Where are we now? (March 2015)

32

Labor market conditions have improved significantly.

The 12-month change in total nonfarm payroll

employment through February 2015 was 3.296 million

(2.4%), the highest since May 2000.

The unemployment rate was 5.5% in February.

The labor force participation rate was fairly stable over

the past year after falling considerably over 2008-13.

The employment-to-population ratio for prime-age

workers was at its highest level since December 2008.

About goal #1: Maximum employment

33

Oil prices have pushed inflation down.

Total PCE inflation fell in 2014H2 due to declines in

energy and goods prices.

While core PCE inflation (which excludes volatile food

and energy prices) has been steadier, it has also fallen

modestly in recent months.

On a 12-month basis, both measures are significantly

below the FOMC’s longer-run objective of 2%.

Movement of inflation toward the FOMC’s longer-run

objective will likely be restrained in the short run by the

stronger dollar and lower energy prices.

About goal #2: Price stability

34

From the March 2015 statement:

To support continued progress toward maximum employment and price

stability, the Committee today reaffirmed its view that the current 0 to 1/4

percent target range for the federal funds rate remains appropriate.

In determining how long to maintain this target range, the Committee will

assess progress--both realized and expected--toward its objectives of

maximum employment and 2 percent inflation. This assessment will take into

account a wide range of information, including measures of labor market

conditions, indicators of inflation pressures and inflation expectations, and

readings on financial and international developments.

The Committee judges that an increase in the target range for the federal

funds rate remains unlikely at the April FOMC meeting.

On the timing of lift-off

35

SEP: Dispersion of views on the timing of lift-off

Source: Summary of Economic Projections, March 18

th

2015

The height of each bar denotes the number of FOMC participants who judge that, under appropriate monetary policy, the first increase

in the target range for the federal funds rate from its current range of 0 to 1/4 percent will occur in the specified calendar year.

36

Are there inflation risks?

Possibly. Fed’s critics long warned about reserve expansion

However, inflation remains below objective despite sizable balance sheet

And inflation expectations remain stable.

Is there risk of financial instability?

Concern about persistently low rates leading to excessive risk taking

▫ Compression of risk premia may abruptly unwind when policy is tightened

▫ Disruption of financial stability may impair the ability to achieve macro objectives

Should monetary policy be used for financial stability purposes?

▫ Jury still out

▫ How to balance need for accommodative policy with safeguard against excessive risk

taking?

▫ Majority view is that short-term interest rates are too blunt a tool to address specific

segments of risk-taking

Are there risks in a prolonged accommodation?

37

Again, from the March 2015 statement

Data-dependent lift-off

The Committee anticipates that it will be appropriate to raise the target

range for the federal funds rate when it has seen further improvement in

the labor market and is reasonably confident that inflation will move back

to its 2 percent objective over the medium term.

Post lift-off pace of normalization

When the Committee decides to begin to remove policy accommodation,

it will take a balanced approach consistent with its longer-run goals of

maximum employment and inflation of 2 percent. The Committee

currently anticipates that, even after employment and inflation are near

mandate-consistent levels, economic conditions may, for some time,

warrant keeping the target federal funds rate below levels the Committee

views as normal in the longer run.

Forward guidance today

38

SEP: Dispersion of views on the pace of normalization

Source: Summary of Economic Projections, March 18

th

2015

Each shaded circle indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant’s judgment of the

midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end

of the specified calendar year or over the longer run.

39

Fed Chair Janet Yellen, February 2015 Semiannual Monetary

Policy Report to the Congress:

In sum, since the July 2014 Monetary Policy Report, there has

been important progress toward the FOMC's objective of

maximum employment.

However, despite this improvement, too many Americans

remain unemployed or underemployed, wage growth is still

sluggish, and inflation remains well below our longer-run

objective.

As always, the Federal Reserve remains committed to

employing its tools to best promote the attainment of its

objectives of maximum employment and price stability.

Conclusion