Integrated Award Environment | For People Who Make, Receive, and Manage Federal AwardsIntegrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

May 2022

Entity Validation Documentation Checklist

A guide and checklist for deciding which documents to attach to your SAM.gov

entity validation incident.

1

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

When you create the incident to validate your entity information, if

requested, you must attach acceptable documents that prove your entity's

legal business name, physical address, date of incorporation, and state of

incorporation (U.S. entities) or national identifier (non-U.S. entities).

What documentation should I attach?

What is an acceptable document?

It’s a document that an authoritative source has used as evidence

that your entity is what you say it is. See links to acceptable

documents here

.

How many attachments should I provide?

Use as many attachments as needed to verify your information. If

you have one acceptable document that includes all the requested

information, you can attach just that document.

What file types are accepted?

Recommended file types are PDF, PNG, JPG/JPEG, BMP.

What if my proof of state or date of incorporation (or

founding) is very old or the name or address has

changed since the entity originally was established?

If you are providing original documentation that is not current (e.g., a

name change has occurred or the entity address has changed), or if

the documentation you are providing is older than five years, you

must also submit additional, recent documentation that proves

that the change happened (e.g., transfer of business) along with your

original paperwork. Provide details in the incident text box

on

SAM.gov for why there is a discrepancy between the documents you

provided and indicate which information is current.

Do I have to include my address on every document?

Proof of state or date of incorporation documents may include only

your current legal business name (without the address),

but you

must always submit with it at least one document, less than

five years old, with your correct and current name and

address.

IMPORTANT: At least one document you submit must show, at

a minimum, your entity’s current legal business name and

correct, current physical address together in the same

document that is no older than 5 years. All documents must

be in English or have a certified translation.

2

The address on the document must include what you put in your

validation search (your current, correct address). Do not include

documents with old addresses unless you are also including a

document with evidence of your current name and current, correct

physical address.

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Your Checklist:

Category/categories to validate (choose those

that need to be updated or verified)

Document(s) must included at least this minimum

information

Legal Business Name and Physical Address

❏ Current Legal Business Name

❏ Current Physical Address

State and Date of Incorporation

❏ Current Legal Business Name

❏ State (or country) and Date of Incorporation

(Month, Day, Year)

❏ Evidence (stamp/receipt, etc.) showing that it was

filed or registered

National Identifier

(non-U.S. entities only)

❏ Current Legal Business Name

❏ National Identifier

● This optional checklist is to help you organize your documentation. Do not upload it to SAM.gov.

● Choose documents for each category on the following pages (see category links, below).

● Use one document to show all of the categories, or use as many as needed as long as at least one document contains both the co

rr

ect legal business

name and current, correct physical address.

● View next steps

for how to create an incident, provide details, and attach documents.

❏Does at least one of your documents show your entity’s correct business name and current, correct physical address in the same doc

ument (no older than 5

years)?

Tip: submitting the correct documents

is the best way to expedite review of

your validation incident!

3

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Documents to Validate Legal Business Name and Physical Address

Entity Type Attach These Acceptable Documents

(examples)

Unacceptable Documents -

Do Not Attach

All Entities

● Certified copies of the following:

● Share certificates

● Articles of organization/incorporation

● Tax returns/filings*

● Certificate of formation

● Articles of formation

● Certificate of organization

● Utility bills

● Bank statements*

● “Doing business as” documentation

● Stock ownership

● Employer Identification Number documentation from IRS

● Tax ID confirmation documents from IRS

● Company bylaws

● Operating agreements

● Non-expired driver’s license (does not need to be a REAL ID)—sole

proprietors and individuals doing-business-as only

● Applications you submitted without evidence of

receipt or approval from an authority

● Your own documents that have not been stamped

or verified by an authority

● Screenshots from SAM.gov, dla.CAGE.mil, or any

other government system that stores your name

and address

● Federal contract or grant award documents

● DUNS profiles

● Notarized entity administrator letters

● IRS form W-9 (request for Taxpayer Identification

Number) and IRS form SS4 (application for an

Employer Identification Number)

● Leases

● Passports, unless they include the current physical

address

This is a list of examples. We accept documentation from state or federal verifiers (or a city/county in rare cases of at-home businesses that would involve an address

validation), or a utility that requires a credit verification. We do not accept documentation that does not have proof that it was certified or validated by an authority.

*Tax returns or filings and bank statements should be redacted or limited; they only need to show relevant data to prove the information you are validating is true.

4

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

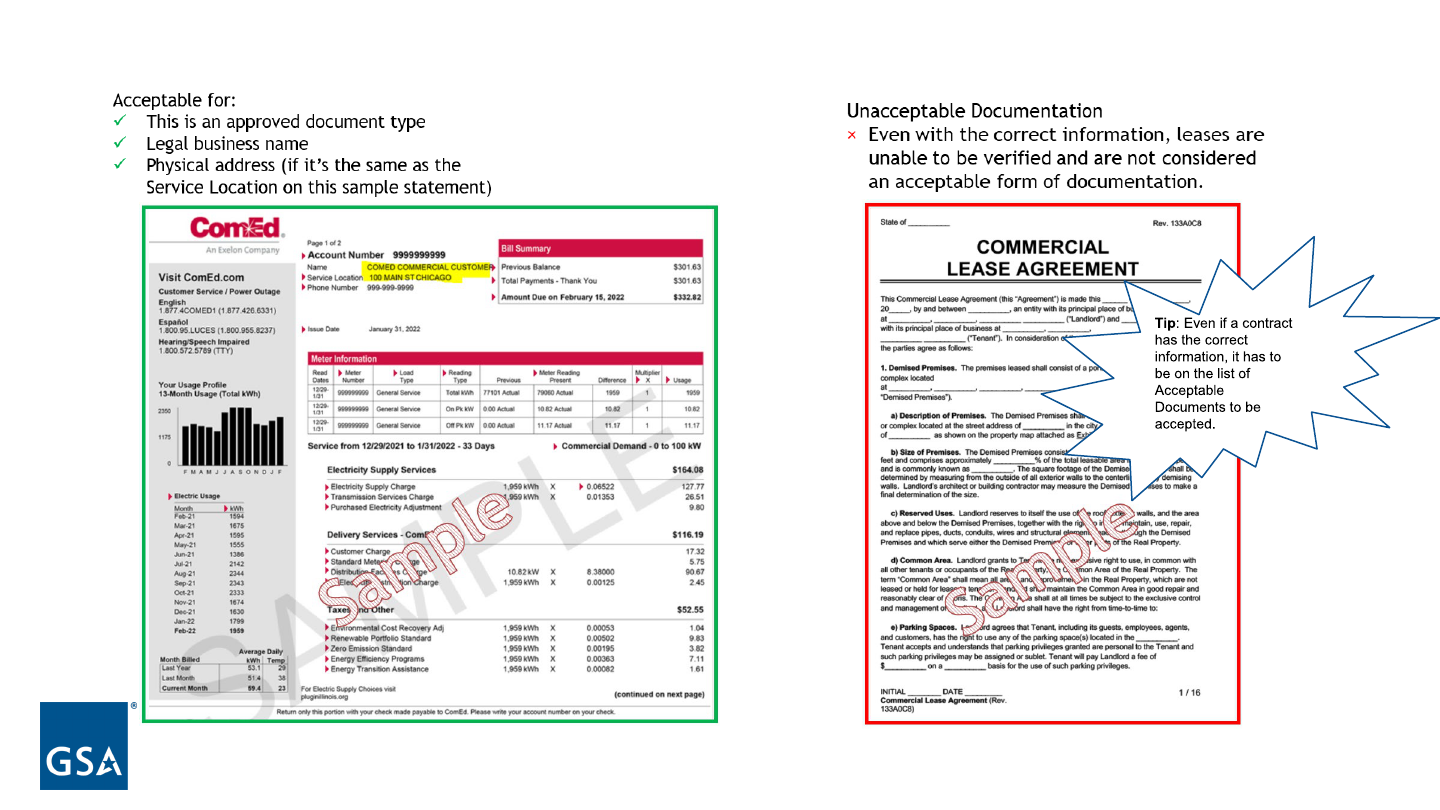

Sample Documents for Legal Business Name and Physical Address

5

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Sample Documents for Legal Business Name & Physical Address

6

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Documents to Validate State and Date of Incorporation

Entity Type Attach These Acceptable

Documents (examples)

Unacceptable Documents -

Do Not Attach

● All Entities Located in the

U.S.

● Tribal Governments

● U.S. Territories

● Anything from the Legal Business Name list

that also

includes the state and date of incorporation

● Entities that are not incorporated may be able to submit

other documentation

.

● Applications you submitted without evidence of

receipt/approval from an authority

● Your own documents that have not been

stamped/verified by an authority

● Screenshots from SAM.gov, dla.CAGE.mil, or any other

government system that stores your name and

address

● DUNS profiles

● Federal contract or grant award documents

● Notarized entity administrator letters

● IRS form W-9 (request for Taxpayer Identification

Number) and IRS form SS4 (application for an

Employer Identification Number)

● Leases

International Entities

● Anything from the Legal Business Name list

that also

includes the country and date of incorporation

● Entities that are not incorporated may be able to submit

other documentation

.

This is a list of examples. We accept documentation from state or federal verifiers (or a city/county in rare cases of at-home businesses that would involve an address

validation), or a utility that requires a credit verification. We do not accept documentation that does not have proof that it was certified or validated by an authority.

7

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

What if my entity is not incorporated?

If it is requested of you during entity validation, you must provide documents that match and support the date you entered into the Date

of Incorporation field in SAM.gov. If your entity is not incorporated, provide documentation of the date that your entity legally began doing

business, was founded, or was established.

For example:

● The date a university department was founded.

● The date a sole proprietorship provides received their EIN.

● The date a township or city office was established.

In addition to entering this on the validation screen in SAM.gov, the documentation you submit (if requested) must display this date.

If you looked at the guidance on the State and Date of Incorporation document list

and did not see any documentation that fits for your

entity, check the next page for examples of documents

that have been accepted or rejected for validation of entities without a date of

incorporation.

Note: it is not typical for entities that are individual people (i.e. sole proprietors and those doing-business-as) to be asked for date of

incorporation documentation. You do not need to include evidence for state and date of incorporation unless it’s requested of you during

entity validation.

8

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

This is a list of examples. We accept documentation from state or federal verifiers (or a city/county in rare cases of at-home businesses that would involve an

address validation), or a utility that requires a credit verification. We do not accept documentation that does not have proof that it was certified or validated by an

authority.

*Tax returns or filings and bank statements should be redacted or limited; they only need to show relevant data to prove the information you are validating is true.

Entity Type Attach These Acceptable Documents

(examples)

Unacceptable Documents -

Do Not Attach

Sole Proprietors, DBA

If nothing on the State and Date of Incorporation lis

t fits for you, instead

you could provide:

● Schedule C from the year you started doing business with evidence

that it was filed, such as a preparer’s name, e-filing software receipt

If you are an individual who is part of a partnership, the year the

partnership was formed might be the correct information and

documentation.

● Passports

● Driver’s licenses

Partnerships

If nothing on the State and Date of Incorporation list

fits for you, instead

you could provide:

● Formation documents, partnership agreements

● Partnership Tax Return* showing when the partnership was initiated

● Unfiled partnership agreements

● State/Local Government

Entities (e.g., a town,

state office or

department)

● U.S. Territory Entities

● Tribal Government

Entities

If nothing on the State and Date of Incorporation list

fits for you, instead

you could provide:

● Town charter

● Documentation from state governments for town existence

● Governor’s declarations

● Formal resolution from town council establishing office

● Photos of your town’s sign

● Documentation from your own government (must

be certified outside of your governing body)

Non-Incorporated Entities: Additional Documents for Date and State of Incorporation

9

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Sample Documents for State and Date of Incorporation

DBA example

LLC example

10

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Entity Type Attach These Acceptable

Documents (examples)

Unacceptable Documents -

Do Not Attach

● All Entities Located in the U.S.

● Tribal Governments

● U.S. Territories

● Not Required ● N/A

International Entities

● Employer Identification Number Documentation

● Tax Identification Documents*

● Tax Returns/Filings*

All documents must be translated into the English language

following these guidelines

.

● Applications you submitted without evidence of

receipt/approval from an authority

● Screenshots from SAM.gov, dla.CAGE.mil, or any

other government system that stores your name and

address

● Federal contract or grant award documents

● DUNS profiles

● Notarized entity administrator letters

● Documents in languages other than English without

translation

Documents to Validate National Identifier

This is a list of examples. We accept documentation from state or federal verifiers (or a city/county in rare cases of at-home businesses that would involve an address validation),

or a utility that requires a credit verification. We do not accept documentation that does not have proof that it was certified or validated by an authority.

*Tax returns or filings and bank statements should be redacted or limited; they only need to show relevant data to prove the information you are validating is true.

**Your national identifier is issued by the government of your country and could be your passport number, driver’s license number, or other national or tax identification number.

If you use a Tax Identification Number (TIN), you can only use one that has all numeric values (no letters or special characters).

11

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

English Translation Guidance

If you submit a document containing foreign language to SAM.gov, you must also include a full English language translation of that document

with certification. You will attach a copy of both the original document and the full English translation.

The translator must certify the translation as complete and accurate, and by the translator’s certification, assert that he or she is competent to

translate from the foreign language into English. We suggest using this format which includes the translator’s name, signature, address, and

certification date on the translated document.

Certification by Translator

I [insert typed name], certify that I am fluent (conversant) in the English and [insert foreign language] languages, and that the

above/attached document is an accurate translation of the document attached entitled [insert translated document name].

[Signature]

[Typed Name]

[Address]

[Certification Date]

12

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Sample Documents for National Identifier

13

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Example Scenario

An entity administrator for ACME, LLC entered the following current

information on the entity validation screen*:

Entity Legal Business Name: ACME, LLC

Physical Address: 123 Main St. Anytown, HI 96701

Date/State of Incorporation: January 1, 1957

Because the entity changed physical addresses recently, the

potential entity matches offered in SAM.gov didn’t show the correct,

current address.

The date of incorporation—or founding—could also not be

validated.

The administrator was requested to provide documentation to

support both of these pieces of entity information.

Fortunately, they have a copy of their originally approved articles of

organization. But because the information is older than 5 years, and

because the address is not current the administrator must also

include another document. The administrator chooses a recent

utility bill that displays both the correct legal business name and

the correct, current physical address.

Together, these documents show adequate evidence of the

information that needs to be updated in SAM.gov for this entity.

TIP: If the entity had been organized more recently (less than 5 years) the articles of

organization could have been used alone if the address was current and correct.

Also, if just the physical address had been out of date, and there was no a need to validate

the date of incorporation, the administrator could have included just the utility bill, which

has the correct, current physical address along with the legal business name.

*For Illustrative Purposes Only

14

Integrated Award Environment | For People Who Make, Receive, and Manage Federal Awards

Creating an Incident: Attach Documents and Complete the Text Box

Read this article about how to create an incident and attach your documents.

Note: When you create an incident, there is a text box on the screen. Please clearly state what is not correct about the matches presented or state that no

matches were presented. Clearly state the correct name, address, or other data for which you are providing documentation. Provide the name (electric bill,

articles of incorporation. etc.) of the document(s) you are including and what each should be used to validate. Providing as much detail as possible will help

the validation agents reviewing your incident resolve the issue.

For example:

Learn more about what you can expect after submitting your validation incident, including how to check

the status of your validation request.

Browse our collection of help FAQs here to learn more about entity validation.

Did the entity validation team request additional documentation? Did you forget to add a document or find a better document to evidence your

entity information after submitting your incident? Follow these instructions

to update your attachments.

“My entity physical address does not show

in any of the matches I was presented. My

correct name and address is _____. I

included a recent utility bill with my

correct legal business name and physical

address for evidence.”

“There were no matches for my entity. I have

included my tax return and receipt to show

my legal business name, physical address,

and the date and state my business was

established.”

“My date of incorporation was not accepted. My

correct date of incorporation is MM/DD/YYYY. I

have included my original articles of

organization from MM/DD/YYYY which shows

this, but since it’s older than 5 years, I also

included a recent utility bill that confirms our

current legal business name and current,

correct physical address.”

15