NEW ISSUE RATING: Moody's Aa2

BOOK-ENTRY ONLY

In the opinion of Bond Counsel, under existing law, assuming compliance with certain covenants described herein, (i)

interest on the Bonds is excluded from gross income for federal income tax purposes, (ii) interest on the Bonds is exempt from

State of Arkansas income tax and (iii) the Bonds are exempt from property taxes in the State of Arkansas.

OFFICIAL STATEMENT

$117,630,000 Fayetteville School District No. 1 of

Washington County, Arkansas Construction Bonds

Dated: July 11, 2024

Due: February 1

The Bonds are limited, general obligations of Fayetteville School District No. 1 of Washington County, Arkansas.

Interest on the Bonds is payable on February 1 and August 1, commencing February 1, 2025, and the Bonds mature (on February 1

of each year), bear interest and are priced as follows:

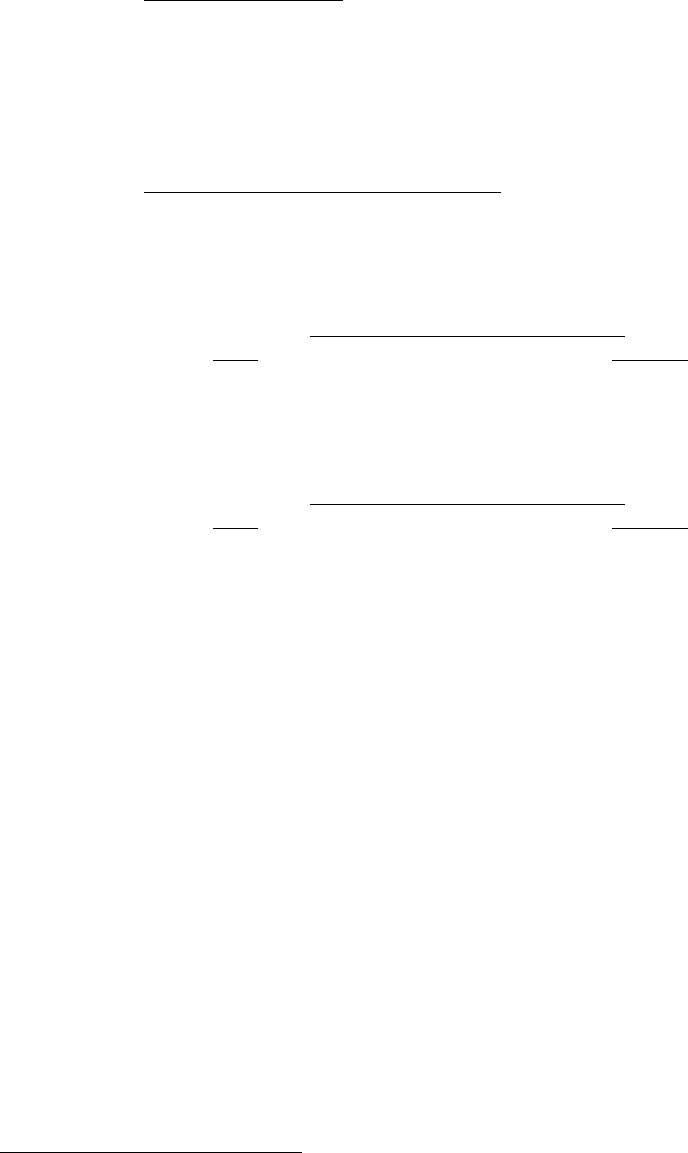

$57,390,000 SERIAL BONDS

Maturity

Amount

Rate

(%)

Price or

Yield (%)

Maturity

Amount

Rate

(%)

Price or

Yield (%)

2026

$ 225,000

5.000

3.500

2035

$3,795,000

5.000

3.380*

2027

235,000

5.000

3.400

2036

4,830,000

5.000

3.400*

2028

250,000

5.000

3.350

2037

5,070,000

5.000

3.450*

2029

260,000

5.000

3.350

2038

5,325,000

5.000

3.550*

2030

385,000

5.000

3.350*

2039

5,585,000

4.000

4.000

2031

3,115,000

5.000

3.350*

2040

5,810,000

4.000

4.100

2032

3,275,000

3.500

3.700

2041

6,045,000

4.000

4.150

2033

3,390,000

3.500

3.800

2042

6,285,000

4.000

4.200

2034

3,510,000

3.500

3.850

$27,760,000 4.000% TERM BONDS due February 1, 2046; Yield: 4.300%

$32,480,000 4.000% TERM BONDS due February 1, 2050; Yield: 4.400%

The Bonds of each maturity will be initially issued as a single registered Bond registered in the name of Cede & Co., the

nominee of The Depository Trust Company ("DTC"), New York, New York. The Bonds will be available for purchase in book-

entry form only, in denominations of $5,000 or any integral multiple thereof. Except in limited circumstances described herein,

purchasers of the Bonds will not receive physical delivery of Bonds. Payments of principal of and interest on the Bonds will be

made by U.S. Bank Trust Company, National Association, as the Trustee, directly to Cede & Co., as nominee for DTC, as registered

owner of the Bonds, to be subsequently disbursed to DTC Participants and thereafter to the Beneficial Owners of the Bonds, all as

further described herein. The Bonds are subject to optional redemption on and after August 1, 2029.

This cover page contains certain information for quick reference only. It is not a summary of this issue. Investors must

read the entire Official Statement to obtain information essential to the making of an informed decision.

The Bonds are offered, subject to prior sale, when, as and if issued and accepted by the Underwriter named below, subject

to the approval of legality by Bond Counsel and certain other conditions.

BofA Securities, Inc.

Official Statement dated: June 11, 2024

_______________

* Priced to first optional redemption date, August 1, 2029.

No dealer, broker, salesman or other person has been authorized by the District or the Underwriter to

give any information or to make any representations other than contained in this Official Statement,

and, if given or made, such other information or representations must not be relied upon as having been

authorized by any of the foregoing. This Official Statement does not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any offer, solicitation or sale of the Bonds by or to any

person in any jurisdiction in which it is unlawful to make such offer, solicitation or sale. Neither the

delivery of this Official Statement nor the sale of any of the Bonds implies that there has been no

change in the matters described herein since the date hereof or that the information herein is correct as

of any time subsequent to its date.

TABLE OF CONTENTS

INTRODUCTION TO THE OFFICIAL STATEMENT 1

BONDS BEING OFFERED 2

Book-Entry Only System 2

Generally 4

Authority 4

Purpose 5

Sources and Uses of Funds 5

Security and Source of Payment 6

Developments 6

Redemption 6

Redemption of Prior Tax Bonds 7

Additional Parity Bonds 8

Priority Among Successive Bond Issues 8

DESCRIPTION OF THE SCHOOL DISTRICT 8

Area 8

Governmental Organization 8

Executive Officials 8

Services Provided 8

School Buildings 9

School Enrollment and Population 9

Accreditation 9

Assessed Valuation 10

Financial Institution Deposits 10

Major Employers 10

Employees 10

DEBT STRUCTURE 10

Outstanding Indebtedness 10

Parity Debt 11

Debt Ratio 11

Computation of Dollar Amount of Debt

Service Tax Levied 11

Debt Service Schedule and Coverage 12

Pledge of State Aid 13

Uniform Rate of Tax 13

Defaults 13

Infectious Disease Outbreak 13

THE RESOLUTION 13

Bond Fund 13

Deposit of Sale Proceeds 13

Investments 14

Trustee 14

Modification of Terms of Bonds 14

Defeasance 14

Defaults and Remedies 15

FINANCIAL INFORMATION 16

Sources and Uses of Funds 16

Collection of Taxes 17

Overlapping Ad Valorem Taxes 17

Assessment of Property and Collection of

Property Taxes 17

Constitutional Amendment Affecting

Personal Property Taxes 19

Constitutional Amendment Nos. 59 and 79 19

Major Taxpayers 21

LEGAL MATTERS 21

Litigation Over State Funding for Schools 21

Legal Proceedings 21

Legal Opinion 22

Tax Exemption - Opinion of Bond Counsel 22

Tax Exemption - Original Issue Premium 23

Tax Exemption - Original Issue Discount 23

Non-Litigation Certificate 23

Official Statement Certificate 23

CONTINUING DISCLOSURE CERTIFICATE 24

CONTINUING DISCLOSURE PAST COMPLIANCE 27

MISCELLANEOUS 28

Bond Rating 28

Underwriting 28

Interest of Certain Persons 28

INTRODUCTION TO THE OFFICIAL STATEMENT

This introduction to the Official Statement is only a brief description and is subject in all respects

to the more complete information contained in the Official Statement. The offering of the Bonds to

potential investors is made only by means of the entire Official Statement, including the cover page.

Purpose of Official Statement. This Official Statement is provided to furnish certain information in

connection with the issuance by Fayetteville School District No. 1 of Washington County, Arkansas

(the "District"), of its Construction Bonds, dated July 11, 2024, in the aggregate principal amount of

$117,630,000 (the "Bonds").

Book-Entry Only System. The Bonds will be initially issued in book-entry form and purchasers of

Bonds will not receive certificates representing their interests in the Bonds purchased. See BONDS

BEING OFFERED, Book-Entry Only System. The Bonds will contain such other terms and

provisions as described herein. See BONDS BEING OFFERED, Generally.

The District. The District is a school district duly established and existing under the Constitution and

laws of the State of Arkansas for the purpose of providing public school education for persons residing

within the geographic boundaries of the District. See DESCRIPTION OF THE SCHOOL

DISTRICT.

Security and Source of Payment. The Bonds will be limited, general obligations of the District. No

specific tax has been voted for payment of these Bonds, but the Bonds are secured by a pledge of surplus

revenues (being revenues in excess of the amounts necessary to insure the payment when due of

principal of, interest on and trustee’s and paying agent’s fees in connection with the bonds for which

voted), derived from debt service taxes heretofore or hereafter voted for payment of other bond issues

of the District (subject to prior pledges of such surplus revenues). See BONDS BEING OFFERED,

Security and Source of Payment.

Litigation Over State Funding for Schools. In an Order issued November 9, 1994, the Honorable

Annabelle C. Imber held that the existing state funding system for public education violated the equal

protection provision of the Arkansas Constitution and violated Article 14, § 1 of the Arkansas

Constitution by "failing to provide a general, suitable and efficient system of free public education."

Lake View School Dist. No. 25 of Phillips County, Arkansas v. Jim Guy Tucker, Case No. 92-5318

(1994). After years of litigation and legislation, the Arkansas Supreme Court concluded (on

May 31, 2007) that the system of public school financing was now in constitutional compliance.

At the 1996 general election, a Constitutional Amendment was passed ("Amendment No. 74")

which establishes a statewide 25-mill property tax minimum for maintenance and operation of the

public schools (the "Uniform Rate of Tax"). The Uniform Rate of Tax replaces that portion of local

school district ad valorem taxes available for maintenance and operation. The Uniform Rate of Tax is

to be collected in the same manner as other school property taxes, but the revenues generated from the

Uniform Rate of Tax are remitted to the State Treasurer for distribution to the school districts.

Purpose. The Bonds are being issued to finance capital improvements for the public schools of the

District. See BONDS BEING OFFERED, Purpose.

Redemption. The Bonds are subject to optional redemption on and after August 1, 2029. The Bonds

are also subject to redemption from proceeds of the Bonds not needed for the purposes intended. The

Bonds maturing February 1, 2046 and February 1, 2050 (the "Term Bonds") are subject to mandatory

sinking fund redemption as described herein. The Trustee shall give at least thirty (30) days’ notice of

redemption. If fewer than all of the Bonds are called for redemption, the particular maturities to be

redeemed shall be selected by the District in its discretion. If fewer than all of the Bonds of any maturity

shall be called for redemption, the particular Bonds or portion thereof to be redeemed from such

maturity shall be selected by lot by the Trustee. See BONDS BEING OFFERED, Redemption.

2

Denominations and Registration. The Bonds are issuable only as fully registered bonds, without

coupons, in the denomination of $5,000 or an integral multiple thereof. Interest is payable February 1,

2025, and semiannually thereafter on each August 1 and February 1. Unless the Bonds are in book-

entry form, payment of principal of the Bonds will be made to the owners of the Bonds at the principal

office of U.S. Bank Trust Company, National Association (the "Trustee"). Interest is payable by the

Trustee to the registered owners as of the Record Date (herein defined) for each interest payment date.

A bond may be transferred, in whole or in part (in integral multiples of $5,000), but only upon delivery

of the bond, together with a written instrument of transfer, to the Trustee. See BONDS BEING

OFFERED, Generally and Book-Entry Only System.

Tax Exemption. In the opinion of Bond Counsel, Friday, Eldredge & Clark, LLP, under existing law,

assuming compliance with certain covenants described herein, (i) interest on the Bonds is excluded

from gross income for federal income tax purposes, (ii) interest on the Bonds is not an item of tax

preference for purposes of the federal alternative minimum tax imposed on individuals and

corporations, (iii) with respect to certain corporations, for the taxable years beginning after

December 31, 2022, interest on the Bonds will be taken into account in determining adjusted financial

statement income for the purpose of computing the federal alternative minimum tax, (iv) interest on

the Bonds is exempt from State of Arkansas income tax and (v) the Bonds are exempt from property

taxes in the State of Arkansas. (see LEGAL MATTERS, Tax Exemption).

Municipal Advisor. The District has employed Stephens Inc. as municipal advisor to assist the District

in the sale and issuance of the Bonds ("Municipal Advisor"). See MISCELLANEOUS, Interest of

Certain Persons.

Authority. The Bonds are being issued under the authority of the Constitution and laws of the State of

Arkansas, including particularly Amendments No. 40 and No. 74 to the Arkansas Constitution and

A.C.A. §§ 6-20-1201 et. seq., and a resolution of the Board of Directors of the District (the "Resolution")

and approval by the Commissioner, Division of Elementary and Secondary Education. See BONDS

BEING OFFERED, Authority, and THE RESOLUTION.

Delivery of Bonds. It is expected that the Bonds will be available for delivery on or about July 11, 2024.

This Official Statement speaks only as of its date, and the information contained herein is subject

to change.

BONDS BEING OFFERED

Book-Entry Only System. DTC, or its successor, will act as securities depository for the Bonds. The

Bonds will each be issued as fully-registered securities registered in the name of Cede & Co. (DTC’s

partnership nominee) or such other name as may be requested by an authorized representative of DTC.

One fully-registered Bond certificate for each maturity will be issued in the principal amount of the

maturity and will be deposited with DTC.

DTC is a limited-purpose trust company organized under the New York Banking Law, a

"banking organization" within the meaning of the New York Banking Law, a member of the Federal

Reserve System, a "clearing corporation" within the meaning of the New York Uniform Commercial

Code, and a "clearing agency" registered pursuant to the provisions of Section 17A of the Securities

Exchange Act of 1934. DTC holds securities that its participants ("Direct Participants") deposit with

DTC. DTC also facilitates the post-trade settlement among Direct Participants of sales and other

securities transactions in deposited securities, through electronic computerized book-entry transfers and

pledges between Direct Participants’ accounts. This eliminates the need for physical movement of

securities certificates. Direct Participants include both U.S. and non-U.S. securities brokers and dealers,

banks, trust companies, clearing corporations, and certain other organizations. DTC is a wholly-owned

3

subsidiary of The Depository Trust & Closing Corporation ("DTCC"). DTCC is the holding company

for DTC, National Securities Clearing Corporation and Fixed Income Clearing Corporation, all of

which are registered clearing agencies. DTCC is owned by the users of its regulated subsidiaries.

Access to the DTC system is also available to others such as both U.S. and non-U.S. securities brokers

and dealers, banks, trust companies and clearing corporations that clear through or maintain a custodial

relationship with a Direct Participant, either directly or indirectly ("Indirect Participants"). The DTC

Rules applicable to its Participants are on file with the Securities and Exchange Commission. More

information about DTC can be found at www.dtcc.com.

Purchases of Bonds under the DTC system must be made by or through Direct Participants,

which will receive a credit for the Bonds on DTC’s records. The ownership interest of each actual

purchaser of each Bond (referred to herein as "Beneficial Owner") is in turn to be recorded on the Direct

and Indirect Participants’ records. Beneficial Owners will not receive written confirmation from DTC

of their purchase. Beneficial Owners are, however, expected to receive written confirmations providing

details of the transaction, as well as periodic statements of their holdings, from the Direct or Indirect

Participant through which the Beneficial Owner entered into the transaction. Transfers of ownership

interests in the Bonds are to be accomplished by entries made on the books of Participants acting on

behalf of Beneficial Owners. Beneficial Owners will not receive certificates representing their

ownership interest in Bonds, except in the event that use of the book-entry system for the Bonds is

discontinued.

To facilitate subsequent transfers, all Bonds deposited by Direct Participants with DTC are

registered in the name of DTC’s partnership nominee, Cede & Co., or such other name as may be

requested by an authorized representative of DTC. The deposit of Bonds with DTC and their

registration in the name of Cede & Co. or such other DTC nominee do not effect any change in

beneficial ownership. DTC has no knowledge of the actual Beneficial Owners of the Bonds; DTC’s

records reflect only the identity of the Direct Participants to whose accounts such Bonds are credited,

which may or may not be the Beneficial Owners. Direct and Indirect Participants will remain

responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by DTC to Direct Participants, by Direct

Participants to Indirect Participants and by Direct Participants and Indirect Participants to Beneficial

Owners will be governed by arrangements among them, subject to any statutory or regulatory

requirements as may be in effect from time to time.

Redemption notices will be sent only to Cede & Co. If fewer than all of the Bonds are being

redeemed, DTC’s practice is to determine by lot the amount of the interest of each Direct Participant to

be redeemed.

Neither DTC nor Cede & Co. (nor any other DTC nominee) will consent or vote with respect

to the Bonds unless authorized by a Direct Participant in accordance with DTC’s MMI Procedures.

Under its usual procedures, DTC mails an Omnibus Proxy to the District as soon as possible after the

record date. The Omnibus Proxy assigns Cede & Co.’s consenting or voting rights to those Direct

Participants to whose accounts the Bonds are credited on the record date (identified in a listing attached

to the Omnibus Proxy).

Principal, interest and premium, if any, payments on the Bonds will be made to Cede & Co., or

such other nominee as may be requested by an authorized representative of DTC. DTC’s practice is to

credit Direct Participants’ accounts upon DTC’s receipt of funds and corresponding detail information

from the District or Trustee, on the payable date in accordance with their respective holdings shown on

DTC’s records. Payments by Participants to Beneficial Owners will be governed by standing

instructions and customary practices, as is the case with securities held for the accounts of customers in

bearer form or registered in "street name," and will be the responsibility of such Participant and not of

DTC, the Trustee, or the District, subject to any statutory or regulatory requirements as may be in effect

4

from time to time. Payment of principal, interest and premium, if any, to Cede & Co. (or such other

nominee as may be requested by an authorized representative of DTC) is the responsibility of the

Trustee, disbursement of such payments to Direct Participants will be the responsibility of DTC, and

disbursement of such payments to the Beneficial Owners shall be the responsibility of Direct and

Indirect Participants.

DTC may discontinue providing its services as securities depository with respect to the Bonds

at any time by giving reasonable notice to the District or the Trustee. Under such circumstances, in

the event that a successor securities depository is not obtained, Bonds are required to be printed and

delivered. The District may decide to discontinue use of the system of book-entry transfers through

DTC (or a successor securities depository). In that event, Bonds will be printed and delivered.

The information concerning DTC and DTC’s book-entry system set forth above has been

obtained from DTC. Neither the Underwriter nor the District make any representation or warranty

regarding the accuracy or completeness thereof.

So long as the Bonds are in book-entry only form, Cede & Co., as nominee for DTC, will

be treated as the sole owner of the Bonds for all purposes under the Resolution including receipt

of all principal of and interest on the Bonds, receipt of notices, voting and requesting or directing

the Trustee to take or not to take, or consenting to, certain actions under the Resolution. The

District and the Trustee have no responsibility or obligation to the Participants or the Beneficial

Owners with respect to (a) the accuracy of any records maintained by DTC or any Participant;

(b) the payment by any Participant of any amount due to any Beneficial Owner in respect of the

principal of and interest on the Bonds; (c) the delivery or timeliness of delivery by any Participant

of any notice to any Beneficial Owner which is required or permitted under the terms of the

Resolution to be given to owners of Bonds; or (d) other action taken by DTC or Cede & Co. as

owner of the Bonds.

Generally. The Bonds are issuable in the form and denominations and are in the total principal amount

shown on the cover page, and will be dated, mature and bear interest as set out on the cover page. The

Trustee will maintain books for the registration and transfer of ownership of the Bonds. Interest due on

a bond on each interest payment date will be paid to the person in whose name the bond was registered

at the close of business on the fifteenth day of the month (whether or not a business day) next preceding

the interest payment date (the "Record Date"), irrespective of any transfer of the bond subsequent to the

Record Date and prior to the interest payment date. Payment of interest shall be made by the Trustee to

such registered owner.

A bond may be transferred, in whole or in part (in integral multiples of $5,000), but only upon

delivery of the bond, together with a written instrument of transfer, to the Trustee. The transfer

instrument must be signed by the registered owner or his attorney-in-fact or legal representative and the

signature must be guaranteed by a guarantor acceptable to the Trustee. The transfer instrument shall

state the name, mailing address and social security number or federal employer identification number

of the transferee. Upon such transfer, the Trustee shall enter the transfer of ownership in the registration

books and authenticate and deliver in the name or names of the new registered owner or owners a new

fully registered bond or bonds of authorized denomination of the same maturity and interest rate for the

aggregate principal amount of the bond transferred.

Authority. The Bonds are being issued under the authority of the Constitution and laws of the State of

Arkansas, including particularly Amendments No. 40 and No. 74 to the Arkansas Constitution and Ark.

Code Ann. §§ 6-20-1201 et. seq., a resolution of the Board of Directors of the District (the "Resolution")

and approval by the Commissioner, Division of Elementary and Secondary Education. For a summary

of the Resolution, see THE RESOLUTION.

5

Amendments No. 40 and No. 74 to the Arkansas Constitution require the Board of Directors of

each school district to prepare and make public not less than sixty days in advance of the annual school

election a proposed budget of expenditures for the support of the public schools in the District, together

with a rate of tax levy sufficient to provide the funds therefor. The tax rate is divided into (1)

maintenance and operation millage, (2) current expenditure millage, (3) continuing debt service millage

previously voted for the retirement of existing indebtedness and (4) any additional debt service millage

for proposed new bonded indebtedness. If the proposed rate of tax levy is approved at the school

election it becomes the rate of tax levy to be collected for the District in the next ensuing calendar year

for use in the school fiscal year commencing July 1 of the calendar year in which collected. Debt service

millage, once approved, is a continuing levy until retirement of the indebtedness for which voted.

Maintenance and operation millage is voted for one year only, except that if the overall rate of tax levy

is disapproved in the school election the millage rate for maintenance and operation remains at the rate

last approved.

The issuance of bonds by a school district is subject to the approval of the Commissioner,

Division of Elementary and Secondary Education, governing body of the Arkansas State Department

of Education. The bonds must be offered for public sale, and the offering is subject to the approval of

the Commissioner, Division of Elementary and Secondary Education. The State Board of Education

has approved the issuance of these Bonds and the Commissioner, Division of Elementary and

Secondary Education has approved the offering of the Bonds for sale. The sale and issuance of the

Bonds have been, or will be, authorized by resolution of the Board of Directors of the District, the

governing body of the District.

School district bonds may be issued for the purposes of acquiring sites for, building and

equipping new school buildings, making additions and repairs to and equipping existing school

buildings, purchasing and refurbishing school buses and for the purpose of refunding outstanding

indebtedness.

Arkansas law authorizes the State Board of Education to set a maximum rate of interest for

school bonds (the "Maximum Lawful Rate"). Bonds may be sold at a discount, but in no event shall

the District be required to pay more than the Maximum Lawful Rate of interest on the amount received.

Purpose. The Bonds are being issued to finance a Project described as follows: constructing, renovating

and equipping new and existing facilities. The expected completion date of the Project is July 11, 2027.

Sources and Uses of Funds. The estimated sources and uses of funds for the Project are as follows:

Sources

Proceeds from Sale of Bonds

$115,324,379.25

Estimated Investments Earnings*

8,625,000.00

Total

$123,949,379.25

Uses

Constructing and Equipping Project

$123,625,000.00

Bond Issuance Costs

324,379.25

Total

$123,949,379.25

*Assuming an interest rate of 2.50% per annum.

For a description of how the Bond proceeds are to be invested pending use, the provisions

governing those investments, and the conditions that must be satisfied before the proceeds may be

applied to their intended use, see THE RESOLUTION, Investments.

6

Security and Source of Payment. The Bonds will be limited, general obligations of the District. No

specific tax has been voted for payment of these Bonds, but the Bonds are secured by a pledge of surplus

revenues (being revenues in excess of the amounts necessary to insure the payment when due of

principal of, interest on and trustee’s and paying agent’s fees in connection with the bonds for which

voted) derived from debt service taxes heretofore or hereafter voted for payment of other bond issues

of the District (subject to prior pledges of such surplus revenues) that may legally be used for the purpose

of paying the principal of and interest on the Bonds.

See DEBT STRUCTURE, Outstanding Indebtedness, for a description of other debt and debt

service taxes pledged.

In addition to the pledged revenues, the District will also covenant to use for payment of

principal of and interest on the Bonds, as and to the extent necessary, all other revenues of the District

that may legally be used for the purpose. The District may not legally pay debt service from revenues

derived from the tax voted for maintenance and operation of schools.

Any surplus of the pledged revenues over and above the amount necessary to insure the payment

as due of principal of, interest on and trustee fees in connection with the Bonds of this issue will be

released from the pledge in favor of the Bonds and may be used for other school purposes.

The Bonds are not secured by any lien on or security interest in any physical properties of the

District.

Developments. Various elected officials, public interest groups and individuals have indicated publicly

that they consider ad valorem property taxation reform to be of significant public interest. At the 2000

general election, the electors of the State voted in favor of a new constitutional amendment

("Amendment No. 79") which does the following:

1. Limits the amount of assessment increases following reappraisal;

2. Limits assessment increases for people who are disabled or who are 65 years of age;

3. Provides for an annual state credit against ad valorem property tax on a homestead;

4. Equalizes real and personal millage rates;

5. Provides that reassessment must occur at least once every five years; and

6. Provides that rollback adjustments under Amendment No. 59 shall be determined after

the adjustments are made to assessed value under Amendment No. 79.

The annual state credit began for taxes due in calendar year 2001. The tax reduction is reflected

on the tax bill sent to the property owner by the county collector. The taxing units within the county

are entitled to reimbursement of the reduction. See DEBT STRUCTURE, Computation of Dollar

Amount of Debt Service Tax Levied.

Redemption. The Bonds are subject to extraordinary, optional and mandatory sinking fund redemption

prior to maturity, as follows:

(1) Extraordinary Redemption. The Bonds must be redeemed from proceeds of the Bonds

not needed for the purposes intended, on any interest payment date, in whole or in part, at a price equal

to the principal amount being redeemed plus accrued interest to the redemption date, in inverse order of

maturity (and by lot within a maturity in such manner as the Trustee may determine).

7

(2) Optional Redemption. The Bonds are subject to redemption prior to maturity, at the

option of the District, in whole, or in part, at any time on or after August 1, 2029, at a redemption price

equal to 100% of the principal amount redeemed plus accrued interest to the redemption date. If fewer

than all of the Bonds are called for redemption, the particular maturities to be redeemed shall be

selected by the District in its discretion. If fewer than all of the of any maturity shall be called for

redemption, the particular Bonds or portion thereof to be redeemed from such maturity shall be selected

by lot by the Trustee.

(3) Mandatory Sinking Fund Redemption. To the extent not previously redeemed, the

Bonds maturing on February 1, 2046 and February 1, 2050, are subject to mandatory sinking fund

redemption in such manner as the Trustee may determine, on the dates and in the amounts set forth

below, at a redemption price equal to the principal amount thereof plus accrued interest to date of

redemption:

Bonds Maturing February 1, 2046

Year

Amount

February 1, 2043

$6,535,000

February 1, 2044

6,800,000

February 1, 2045

7,075,000

February 1, 2046 (maturity)

7,350,000

Bonds Maturing February 1, 2050

Year

Amount

February 1, 2047

$7,650,000

February 1, 2048

7,955,000

February 1, 2049

8,270,000

February 1, 2050 (maturity)

8,605,000

The District shall be entitled to reduce any mandatory sinking fund redemption obligation in

any year with respect to the Term Bonds of any maturity by the principal amount of any such Term

Bond previously redeemed or acquired by the District and surrendered to the Trustee.

Notice of early redemption identifying the bonds or portions thereof (which must be $5,000 or

an integral multiple thereof) to be redeemed and the date fixed for redemption shall be sent by the

Trustee by mail or by other standard means, including electronic or facsimile communications, not less

than 30 nor more than 60 days prior to the redemption date, to all registered owners of bonds to be

redeemed. Failure to send an appropriate notice or any such notice to one or more registered owners

of bonds to be redeemed shall not affect the validity of the proceedings for redemption of other bonds

as to which notice of redemption is duly given and in proper and timely fashion. All such bonds or

portions thereof thus called for redemption shall cease to bear interest on and after the date fixed for

redemption, provided funds for redemption are on deposit with the Trustee at that time.

Notwithstanding the above, so long as the Bonds are issued in book-entry only form, if fewer

than all the Bonds of an issue are called for redemption, the particular Bonds to be redeemed will be

selected pursuant to the procedures established by DTC. So long as the Bonds are issued in book-entry

only form, notice of redemption will be given only to Cede & Co., as nominee for DTC. The Trustee

will not give any notice of redemption to the Beneficial Owners of the Bonds.

Redemption of Prior Tax Bonds. The District will covenant that it will not, so long as any of these

Bonds remain outstanding, redeem, prior to their maturity, any bonds of another issue for the payment

of which a specific debt service tax was voted prior to issuance of these Bonds (all such bonds being

hereafter referred to as "Prior Tax Bonds") unless, after such redemption, a continuing annual tax of

not less than the same number of mills and of not less than the same duration as was pledged to the

redeemed bonds remains pledged to these Bonds or other bonds of the District.

8

Additional Parity Bonds. No additional bonds may be issued on a parity of security with these Bonds.

Priority Among Successive Bond Issues. Other additional bonds may be issued by the District from

time to time in accordance with law for the purpose of financing additional capital improvements. If

the District, prior to issuance of these Bonds, has reserved the right to issue additional bonds on a parity

of security with previously issued bonds, such additional bonds will have a prior claim and pledge over

these Bonds as to all revenues pledged to such additional bonds. See DEBT STRUCTURE, Parity

Debt, for a description of any authorized and unissued parity debt. Otherwise, any additional bonds

shall be subordinate to these Bonds and the pledge of revenues to these Bonds.

DESCRIPTION OF THE SCHOOL DISTRICT

Area. The area of the District is approximately 118 square miles, all located in Washington County.

The incorporated municipalities located, in whole or in part, within the boundaries of the District are

the Cities of Fayetteville, Farmington, Goshen, Elkins, Johnson, and Tontitown.

Governmental Organization. The governing body of the District is a Board of Directors, elected for

staggered terms at the annual school election. The term of each Director ends at an annual school

election, but the Director continues to serve until a successor has been elected and qualified. The present

members of the Board of Directors of the District are as follows:

Name

Term Expires

Ivone Hudson

2025

Justin Eichmann

2025

Tracey Pomeroy

2025

Nika Waitsman

2026

Katrina Osborne

2027

Keaton Smith

2028

Tim Hudson

2029

At the first regular meeting following the annual school election, the Board of Directors elects

one of their number President, one of their number Vice President, and also elects a Secretary who may,

but need not be, a member of the Board. These officers serve terms of one year. The current officers

are: President, Nika Waitsman, Vice President, Tim Hudson, and Secretary, Tracey Pomeroy.

The Board of Directors has authority to do all things necessary for the conduct of an efficient

public school system in the District.

Executive Officials. All employees of the District are employed by the Board of Directors. The chief

executive employee is the Superintendent of Schools. The present Superintendent is Dr. John Mulford,

who has been employed by contract for a term ending June 30, 2027.

Services Provided. The District operates a public school system, consisting of pre-kindergarten,

kindergarten and grades 1 through 12, for the purpose of educating the children residing within the

District. The principal funding sources for the District are: (1) funds received from the State of

Arkansas, (2) ad valorem taxes on the real and tangible personal property located within the boundaries

of the District (see BONDS BEING OFFERED, Developments), and (3) funds received from the

United States of America.

There have been no recent major changes or interruptions in the educational services provided

by the District.

9

School Buildings. The school buildings presently operated by the District are as follows:

Name of School

Grades

Housed

Year in Which

Construction

Or Most Recent

Renovation Completed

Present

Condition

(Good, Fair

or Poor)

Owl Creek Elementary

Pre K-6

2006

Good

Asbell Elementary

K-4

1986

Good

Butterfield Trail Elementary

K-4

2008

Good

Happy Hollow Elementary

K-4

2011

Good

Leverett Elementary

K-4

1986

Good

Root Elementary

K-4

2007

Good

Washington Elementary

K-4

2000

Good

Holcomb Elementary

K-4

1995

Good

Vandergriff Elementary

K-4

1995

Good

McNair Middle School

5-6

2000

Good

Holt Middle School

5-6

2000

Good

Ramey Junior High

7-8

1991

Good

Woodland Junior High

7-8

1991

Good

High School Campus

9-12

2013

Good

School Enrollment and Population. The average daily membership (enrollment) of the District and

estimated population of the District for each of the last five years is as follows:

Fiscal Year

Ending June 30

Average Daily

Membership

Estimated

Population

2019

10,487

41,948

2020

10,151

40,604

2021

10,349

41,396

2022

10,357

41,428

2023

10,164

40,656

Accreditation. In accordance with the requirements of The Quality Education Act of 2003

(Subchapter 2 of Chapter 15, Title 6, Ark. Code Ann.), the State Board of Education adopted standards

that all public elementary and secondary schools in the State must meet to be accredited. The Act

provides that any school not meeting these standards will be eliminated, and that any school district

operating one or more of such schools is to be dissolved and its territory annexed to another district or

districts which operate all schools therein in compliance with the minimum standards. The Division of

Elementary and Secondary Education of the Arkansas Department of Education (the " Division ")

reviews annual reports to determine whether the school district is in compliance with the standards.

Under the Division regulations and guidelines, schools may be classified as accredited,

accredited-cited or probationary. Schools which meet all policies and standards promulgated by the

Division are classified as accredited. For those schools classified as accredited-cited or accredited-

probationary, the Division has promulgated maximum times allowable for correction of particular

violations of standards. A school that has been classified as accredited-cited and does not correct the

violation in the allowable time will be placed on probation. If a school in probationary status fails to

comply within the allotted time frame, the school will be recommended to the State Board of Education

for loss of accreditation status. For a district that falls into probationary status, the State Board of

Education may take any number of actions listed in Division’s Rules Governing Standards For

Accreditation of Arkansas Public Schools and School Districts, including dissolution and annexation.

The District currently meets all standards and policies of the Division and is fully accredited.

10

Assessed Valuation. Taxable property is valued for tax purposes as of January 1 of each year. However,

the assessment process is not completed until November of the year of assessment. See FINANCIAL

INFORMATION, Assessment of Property and Collection of Property Taxes. The assessed valuation

of taxable property located within the boundaries of the District (as of January 1) has been as follows:

Year

Real

Estate

Personal

Property

Utilities and

Regulated Carriers

Total

Assessed Value

2019

$1,449,402,375

$246,950,192

$86,104,191

$1,782,456,758

2020

1,627,328,238

266,885,358

89,309,530

1,983,523,126

2021

1,755,944,308

289,656,608

92,669,658

2,138,270,574

2022

1,895,422,595

323,847,143

109,971,822

2,329,241,560

2023

2,167,180,545

350,888,183

114,781,030

2,632,849,758

Financial Institution Deposits. The total deposits of banks with principal offices within the boundaries

of the District as of the end of each year have been as follows:

Year

Bank Deposits

2019

$16,800,730,000

2020

17,797,063,000

2021

23,416,001,000

2022

24,270,836,000

2023

22,575,497,000

Major Employers. The principal industries, commercial or governmental entities, and other major

employers within the boundaries of the District are as follows:

Company

Business or Product

Number of

Employees

University of Arkansas

Higher Education

5,000

Washington Regional System

Healthcare

3,300

Fayetteville Public Schools

K-12 Education

1,565

VA Hospital

Healthcare

1,500

City of Fayetteville

Municipality

900

Tyson's of Fayetteville

Food Manufacturing

750

Washington County + Sheriff Department

Public

650

Twin Rivers Foods, Inc.

Poultry Industry Corporate Office

600

ConAgra formerly Pinnacle Foods

Food Manufacturing

500

Rausch Coleman Dev Group

Homebuilding

500

Employees. The number of persons presently employed by the District are as follows:

Number

Superintendent and Central District Staff

29

Principals

16

Assistant Principals

28

Classroom Teachers

853

Other Non-Teaching Personnel

639

TOTAL

1,565

DEBT STRUCTURE

Outstanding Indebtedness. The principal categories of indebtedness which the District is authorized to

incur are commercial bonds (offered at public sale on competitive bids), revolving loan bonds and

certificates of indebtedness (representing loans from the State Department of Education), installment

contracts (payable in subsequent fiscal years) and postdated warrants (warrants drawn in one fiscal year

for payment in a subsequent fiscal year). In addition, the District is authorized to lease property from

the owner under lease agreements giving the District the option to purchase the property leased.

Commercial bonds and revolving loan indebtedness are payable from debt service tax revenues.

Installment contracts, postdated warrants and lease-purchase obligations are payable from maintenance

and operation tax revenues.

11

The present outstanding debt of the District is as follows:

Date of Obligations

Amount

Outstanding

Immediately After

Issuance of

These Bonds

Final

Maturity

Tax Rate (in mills per dollar)

Voted for Payment as Rolled

Back After Reassessment

(applicable to real estate)

COMMERCIAL BONDS

02/09/10 (QSCB)

$ 52,305,000

02/09/27

None

11/10/10 (QSCB)

31,460,000

11/01/29

20.0

09/29/11 (QSCB)

1,114,000

09/01/28

None

08/08/12 (QZAB)

1,920,000

06/01/34

None

11/01/12 (QZAB)

930,000

06/01/35

None

09/08/16

4,860,000

06/01/30

None

06/04/19

7,220,000

06/01/35

None

06/11/20

169,645,000

06/01/50

Continuation of existing 20.0

07/11/24

117,630,000

02/01/50

None

REVOLVING LOAN BONDS AND/OR CERTIFICATES OF INDEBTEDNESS

None

POST-DATED WARRANTS

None

INSTALLMENT CONTRACTS

None

LEASE-PURCHASE OBLIGATIONS

None

Parity Debt. The District has not reserved the right to issue additional bonds on a parity with the

outstanding debt listed above.

Debt Ratio. The ratio of outstanding debt after issuance of these Bonds ($387,084,000) to current

assessed valuation ($2,632,849,758) will be 14.7%.

Computation of Dollar Amount of Debt Service Tax Levied. The most recent county-wide

reassessment of taxable property was completed in Washington County in 2023. The next county-

wide reassessment is scheduled for completion in Washington County in 2027. For purposes of

Amendment 59, the year in which the reassessment is completed is known as the "Base Year." For a

general discussion of the reassessment requirement and its effect on assessed value and tax rate, see

FINANCIAL INFORMATION, Constitutional Amendment No. 59 and 79, infra.

Constitutional Amendment No. 79 provides for an annual state credit against ad valorem

property tax on a homestead in an amount not less than $300. Effective with the assessment year

beginning on or after January 1, 2023, the amount of the credit was increased to $425. The tax

reduction is reflected on the tax bill sent to the property owner by the county collector. Amendment

No. 79 provides that the credit shall be applied in a manner that would not impair a bondholder’s interest

in ad valorem debt service revenue. In addition, Amendment No. 79 provides that the "General

Assembly shall, by law, provide for procedures to be followed with respect to adjusting ad valorem

taxes or millage pledged for bonded indebted purposes, to assure that the tax or millage levied for

bonded indebtedness purposes will, at all times, provide a level of income sufficient to meet the current

requirements of all principal, interest, paying agent fees, reserves, and other requirements of the bond

indenture."

12

The taxing units within the county are entitled to reimbursement of the reduction from the

annual state credit. Pursuant to legislation, the state sales tax was increased by 0.5%. The purpose of

the legislation is to raise revenues that the State sends back to school districts to replace the money lost

as a result of the state credit. Therefore, for purposes of calculating projected revenues available for

debt service discussed below, the District has assumed that it will receive debt service revenues equal

to the debt service revenues it would have received prior to the adoption of Amendment No. 79.

The debt service tax levied for collection in 2024 for use in the 2024-2025 school year, and

thereafter, has been computed by multiplying the 2023 assessment ($2,632,849,758) by the total number

of debt service mills (20.0 mills).

For purposes of calculating revenues available for debt service, it has also been assumed that

the assessed value of all property in the District will remain the same, without increase or decrease. On

this basis, the total debt service tax levied in each year will be as shown under Debt Service Schedule

and Coverage, below.

Debt Service Schedule and Coverage. For purposes of the following table, it is assumed that the

assumptions made in Computation of Dollar Amount of Debt Service Tax Levied are accurate and that

the annual rate of tax collections in each year will be 100%. See FINANCIAL INFORMATION,

Collection of Taxes, for the actual historical rate of collection. On this basis, the annual debt service

requirements for previously issued bonds and these Bonds, the revenues available for debt service and

coverage are as follows:

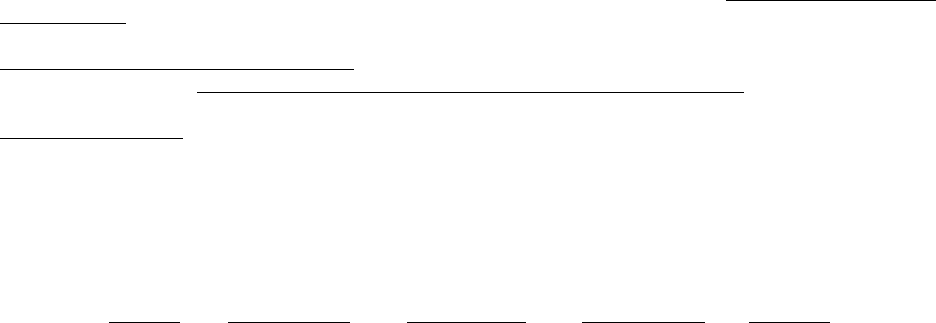

Fiscal

Year

Ending

June 30

Total

Principal and

Interest of

Previously

Issued Bonds

Total

Principal&

Interest of

These Bonds

Total

Revenues

From Debt

Service Mills

Coverage

2025

$14,905,690

$2,716,236.11

$52,656,995

2.99

2026

14,908,225

5,114,225.00

52,656,995

2.63

2027

14,907,957

5,112,975.00

52,656,995

2.63

2028

14,903,714

5,116,225.00

52,656,995

2.63

2029

14,905,486

5,113,725.00

52,656,995

2.63

2030

14,294,800

5,225,725.00

52,656,995

2.70

2031

10,986,149

7,936,475.00

52,656,995

2.78

2032

10,981,299

7,940,725.00

52,656,995

2.78

2033

10,980,981

7,941,100.00

52,656,995

2.78

2034

10,981,594

7,942,450.00

52,656,995

2.78

2035

10,818,564

8,104,600.00

52,656,995

2.78

2036

9,976,563

8,949,850.00

52,656,995

2.78

2037

9,977,938

8,948,350.00

52,656,995

2.78

2038

9,975,188

8,949,850.00

52,656,995

2.78

2039

9,978,313

8,943,600.00

52,656,995

2.78

2040

9,976,813

8,945,200.00

52,656,995

2.78

2041

9,979,013

8,947,800.00

52,656,995

2.78

2042

9,979,613

8,946,000.00

52,656,995

2.78

2043

9,978,463

8,944,600.00

52,656,995

2.78

2044

9,975,413

8,948,200.00

52,656,995

2.78

2045

9,975,738

8,951,200.00

52,656,995

2.78

2046

9,979,875

8,943,200.00

52,656,995

2.78

2047

9,977,550

8,949,200.00

52,656,995

2.78

2048

9,976,600

8,948,200.00

52,656,995

2.78

2049

9,977,700

8,945,000.00

52,656,995

2.78

2050

9,975,550

8,949,200.00

52,656,995

2.78

13

Pledge of State Aid. A.C.A. §6-20-1204 provides that if the Trustee does not receive the bond payment

from the District at least five (5) calendar days before the principal or interest is due under the

Resolution, the Division of Elementary and Secondary Education immediately shall cure any deficiency

in payment by making payment in the full amount of the deficiency to the Trustee. If the Division

makes the bond payment, and the District fails to remit the full amount to the Division, the Division will

withhold from the District the next distribution of state funding.

Uniform Rate of Tax. Amendment No. 74 establishes a statewide 25-mill property tax minimum for

maintenance and operation of the public schools (the "Uniform Rate of Tax"). The Uniform Rate of

Tax replaces that portion of local school district ad valorem taxes available for maintenance and

operation of schools.

Defaults. No debt obligations of the District have been in default as to principal or interest payments or

in any other material respect at any time in the last 25 years.

Infectious Disease Outbreak. The World Health Organization declared a pandemic following

the global outbreak of COVID-19, a respiratory disease caused by a new strain of coronavirus. On

March 13, 2020, a national emergency was declared. The Governor of the State of Arkansas (the

"State") declared a state of emergency due to the outbreak of COVID-19, which spread to the State

and to many counties, and also instituted mandatory measurers via various executive orders to

contain the spread of the virus. These measures, which altered the behavior of businesses and

people, had a negative impact on regional, state and local economies and caused volatility in the

financial markets in the United States.

Developments with respect to COVID-19 may continue to occur. The continued spread of

COVID-19 or the declaration of another pandemic could have a material adverse effect on the

District, its student enrollment and collections of the debt service taxes pledged to the Bonds.

It is the goal of the State to have all students physically present for each school year.

However, the State has instructed all Districts to be prepared to shift to other delivery methods

should the need arise.

THE RESOLUTION

Set forth below is a summary of certain provisions of the Resolution. This summary does not

purport to be comprehensive and reference is made to the full text of the Resolution for a complete

description of its provisions.

Bond Fund. The pledged revenues will be deposited into a Bond Fund which will be held by, or under

the direction of, the District. Moneys in the Bond Fund will be used solely for the payment of principal

of, interest on and Trustee’s fees in connection with the Bonds, except as otherwise specifically provided

in the Resolution. Any surplus of the pledged revenues over and above the amount necessary to insure

the payment as due of principal of, interest on and Trustee’s fees in connection with the Bonds will be

released from the pledge and may be withdrawn from the Bond Fund and used for other school purposes.

The Treasurer of the District will withdraw from the Bond Fund and deposit with the Trustee, not later

than fifteen (15) calendar days before each interest payment date and not later than fifteen (15) calendar

days before the due date of any Trustee fees, moneys in an amount equal to the amount of such Bonds

or interest, or Trustee’s fees, for the sole purpose of paying the same, and the Trustee shall apply such

moneys for such purpose.

Deposit of Sale Proceeds. The Bonds will be delivered to the Trustee upon payment by the purchaser

of the Bonds in cash of the purchase price. The amount, if any, necessary to pay interest on the Bonds

until revenues from tax collections are available in sufficient amount therefor will be deposited in the

Bond Fund. The balance of the total sale proceeds will be deposited in the Construction Fund created

14

by the Resolution (the "Construction Fund"). Amounts in the Construction Fund will be disbursed for

costs and expenses of the Project (including interest on the Bonds during the construction period) upon

filing in the official records pertaining to said Fund of a certificate of the District setting forth the

information provided for in the Resolution.

Investments. (a) The District may, from time to time invest moneys held for the credit of the

Construction Fund in Authorized Investments or in bank certificates of deposit.

(b) The District may, from time to time, invest moneys held for the credit of the Bond Fund in

Authorized Investments or in bank certificates of deposit the principal of and interest on which are fully

insured by the Federal Deposit Insurance Corporation.

(c) Investments shall remain a part of the Fund from which the investment was made. All

earnings and profits from investments shall be credited to and all losses charged against, the Fund from

which the investment was made.

(d) The term "Authorized Investments" means direct obligations of the United States of America

or obligations the principal of and interest on which are fully guaranteed by the United States of

America.

Trustee. The Trustee was designated by the Underwriter.

The Trustee shall only be responsible for the exercise of good faith and reasonable prudence in

the execution of its trust. The Trustee is not required to take any action for the protection of Bondholders

unless it has been requested to do so in writing by the holders of not less than 10% in principal amount

of the Bonds then outstanding and offered reasonable security and indemnity against the cost, expenses

and liabilities to be incurred therein or thereby.

The Trustee may resign by giving notice in writing to the Secretary of the Board of Directors.

Such resignation shall be effective upon the appointment of a successor Trustee by the District and

acceptance of appointment by the successor. If the District fails to appoint a successor Trustee within

30 days of receiving notice of resignation, the Trustee may apply to a court of competent jurisdiction

for appointment of a successor. The holders of a majority in principal amount of outstanding Bonds, or

the Board of Directors of the District, may at any time, with or without cause, remove the Trustee and

appoint a successor Trustee.

Modification of Terms of Bonds. The terms of the Bonds and the Resolution will constitute a contract

between the District and the registered owners of the Bonds. The owners of not less than 75% in

aggregate principal amount of the Bonds then outstanding have the right, from time to time, to consent

to the adoption by the District of resolutions modifying any of the terms or provisions contained in the

bonds or the Resolution; provided, however, there shall not be permitted (a) any extension of the

maturity of the principal of or interest on any bond, or (b) a reduction in the principal amount of any

bond or the rate of interest thereon, or (c) the creation of any additional pledge on the revenues pledged

to the Bonds other than as authorized in the Resolution, or (d) a privilege or priority of any bond or

bonds over any other bond or bonds, or (e) a reduction in the aggregate principal amount of the Bonds

required for such consent.

Defeasance. When all of the Bonds shall have been paid or deemed paid, the pledge in favor of the

Bonds (see BONDS BEING OFFERED, Security and Source of Payment, supra) shall be discharged

and satisfied. A Bond shall be deemed paid when there shall have been deposited in trust with the

Trustee or with another bank or trust company (which other bank or trust company must be a member

of the Federal Reserve System), as escrow agent under an escrow deposit agreement requiring the

escrow agent to apply the proceeds of the deposit to pay the principal of and interest on the Bond as due

at maturity or upon redemption prior to maturity, moneys or Government Securities sufficient to pay

15

when due the principal of and interest on the bond. If the principal of the Bond is to become due by

redemption prior to maturity, notice of such redemption must have been duly given or provided for.

"Government Securities" shall mean direct or fully guaranteed obligations of the United States of

America, noncallable, maturing on or prior to the maturity or redemption date of the bond. In

determining the sufficiency of a deposit there shall be considered the principal amount of such

Government Securities and interest to be earned thereon until their maturity.

Defaults and Remedies. If there is any default in the payment of the principal of or interest on any

Bond, or if the District defaults in the performance of any other covenant in the Resolution, the Trustee

may, and upon the written request of the owners of not less than 10% in principal amount of the Bonds

then outstanding shall, by proper suit compel the performance of the duties of the officials of the District

under the Constitution and laws of the State of Arkansas and under the Resolution and protect and

enforce the rights of the owners by instituting appropriate proceedings at law or in equity or by other

action deemed necessary or desirable by the Trustee. If any default in the payment of principal or

interest continues for 30 days the Trustee may, and upon the request of the owners of not less than 10%

in principal amount of the then outstanding Bonds shall, declare all outstanding Bonds immediately due

and payable together with accrued interest thereon.

No owner of any bond shall have any right to institute any suit, action, mandamus or other

proceeding in equity or at law for the protection or enforcement of any right under the Bonds or the

Resolution or under the Constitution and laws of the State of Arkansas, unless such owner previously

shall have given written notice to the Trustee of the default, and unless the owners of not less than 10%

in principal amount of the then outstanding Bonds shall have made written request of the Trustee to take

action, shall have afforded the Trustee a reasonable opportunity to take such action, and shall have

offered to the Trustee reasonable security and indemnity against the cost, expenses and liabilities to be

incurred and the Trustee shall have refused or neglected to comply with such request within a reasonable

time. No one or more owners of the Bonds shall have any right in any manner by his or their action to

affect, disturb or prejudice the security of the Resolution, or to enforce any right thereunder except in

the manner provided in the Resolution. All proceedings at law or in equity shall be instituted, had and

maintained in the manner provided in the Resolution and for the benefit of all owners of outstanding

Bonds. Any individual rights of action are restricted by the Resolution to the rights and remedies therein

provided. Nothing shall, however, affect or impair the right of any owner to enforce the payment of the

principal of and interest on any bond at and after the maturity thereof.

Action may be taken by the Trustee without possession of any bond, and any such action shall

be brought in the name of the Trustee and for the benefits of all the owners of bonds.

No delay or omission of the Trustee or any owner of a bond to exercise any right or power

accrued upon any default shall impair any such right or power or be construed to be a waiver of any

such default or acquiescence therein, and every power and remedy given to the Trustee and to the

owners of the Bonds may be exercised from time to time and as often as may be deemed expedient.

The Trustee may, and upon the written request of the owners of not less than 10% in principal

amount of the Bonds then outstanding shall, waiver any default which shall have been remedied before

the entry of final judgment or decree in any suit, action or proceeding or before the completion of the

enforcement of any other remedy. No such waiver shall extend to or affect any other existing or

subsequent default or defaults or impair any rights or remedies consequent thereon.

There is no requirement that the District furnish periodic evidence as to the absence of default

or as to the compliance with the terms of the Bonds, the Resolution or law.

16

FINANCIAL INFORMATION

Sources and Uses of Funds. The following combined summary of Revenues, Expenditures and Fund

Balances are taken from the District’s 2023, 2022 and 2021 Audits. For complete information

concerning the District, please review the actual Audits at www.arklegaudit.gov/ and

https://emma.msrb.org/.

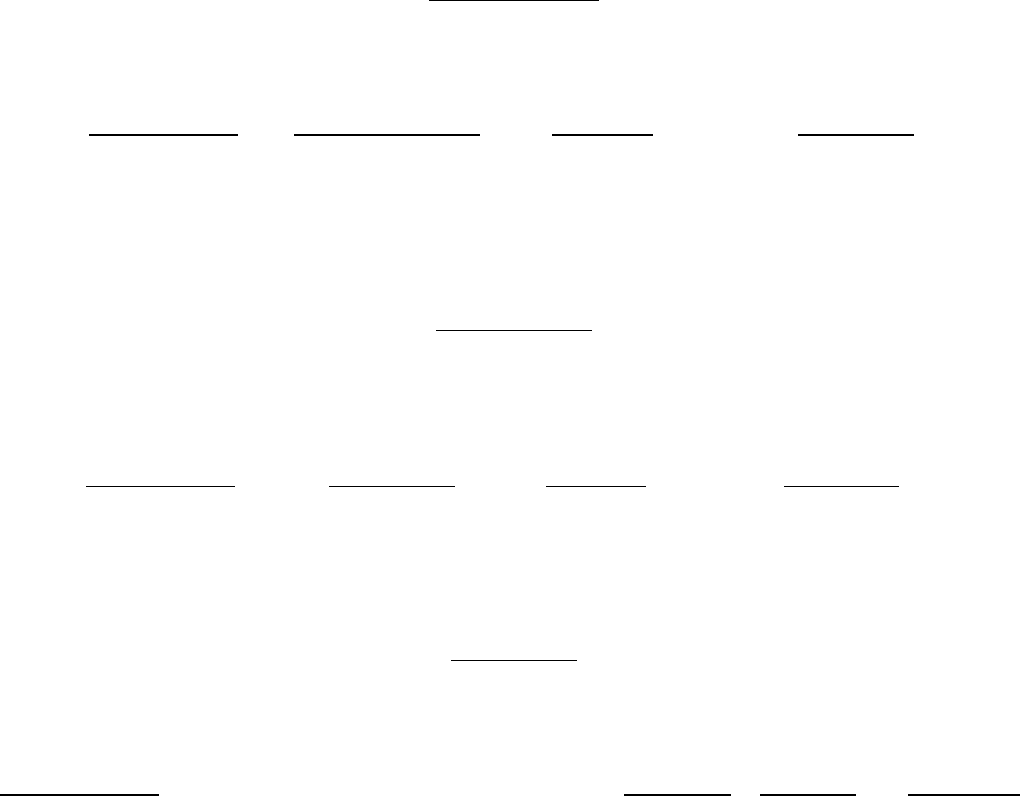

REVENUES

2023

2022

2021

Property taxes

$ 96,037,529

$ 91,287,603

$ 87,661,429

Investment income (loss)

1,888,580

74,444

89,455

Other local revenues

232,157

97,759

635,675

State revenues

32,453,026

32,469,851

39,079,140

Federal revenues

0

0

0

TOTAL REVENUES

$130,611,292

$123,929,657

$127,465,699

EXPENDITURES

Instruction

$ 72,092,228

$ 66,545,424

$ 60,312,893

Support services

43,089,271

38,840,408

34,500,637

Non-instructional services

1,020

378

0

Capital outlay

541,773

609,200

578,376

Debt Service - Principal

0

0

0

Debt Service - Interest

0

0

0

Paying agent fees

0

0

0

TOTAL EXPENDITURES

$115,724,292

$105,995,410

$ 95,391,906

EXCESS OF REVENUES OVER

(UNDER) EXPENDITURES

$ 14,887,000

$ 17,934,247

$ 29,073,793

OTHER FINANCING SOURCES

(USES)

(16,375,732)

(19,333,678)

(16,273,296)

EXCESS OF REV & OTHER

SOURCES OVER (UNDER) EXPND

& OTHER USES

(1,488,732)

(1,399,431)

12,800,497

FUND BAL, BEG OF YEAR

29,931,909

31,331,340

18,530,843

FUND BAL, END OF YEAR

$ 28,443,177

$ 29,931,909

$ 31,331,340

17

Collection of Taxes. Tax collections of the ad valorem tax levied by the District are shown in the

following table. School taxes voted at the school election are collected in the next calendar year and

normally received by and used by the District during the school fiscal year beginning in such calendar

year.

School

Year

School

Tax Levied

School

Tax Collected

Rate of Collections

(net of collection fees %)

2018-2019

$74,016,562

$75,764,441

102.36

2019-2020

79,468,452

73,160,628

92.06

2020-2021

81,369,151

88,394,228

108.63

2021-2022

90,547,831

92,407,349

102.05

2022-2023

97,612,052

98,851,384

101.27

5-year average rate of collections – 101.32%

Overlapping Ad Valorem Taxes. The ad valorem taxing entities in the State of Arkansas are

municipalities, counties, school districts and community college districts. All taxable property located

within the boundaries of a taxing entity is subject to taxation by that entity. Thus property within the

District is also subject to county ad valorem taxes. Property located within a municipality and/or within

a community college district is also subject to taxation by that entity or entities. The ad valorem taxing

entities whose boundaries overlap the District and their real estate ad valorem tax rates are:

Name of Overlapping Entity

Total Tax Rate

(in mills)

Washington County

6.5

City of Elkins

5.0

City of Farmington

5.0

City of Fayetteville

6.8

City of Johnson

5.0

City of Tontitown

3.5

City of Goshen

3.0

Assessment of Property and Collection of Property Taxes. Under Amendment No. 59 to the Arkansas

Constitution, all property is subject to taxation except for the following exempt categories: (i) public

property used exclusively for public purposes; (ii) churches used as such; (iii) cemeteries used

exclusively as such; (iv) school buildings and apparatus; (v) libraries and grounds used exclusively for

school purposes; (vi) buildings, grounds and materials used exclusively for public charity; and (vii)

intangible personal property to the extent the General Assembly has exempted it from taxation, provided

that it be taxed at a lower rate, or provided for its taxation on a basis other than ad valorem. Amendment

No. 59 also authorizes the General Assembly to exempt from taxation the first $20,000 of value of a

homestead of a taxpayer 65 years of age or older.

Amendment No. 59 provides that, except as otherwise provided therein in connection with the

transition period following a county-wide reassessment (see Constitutional Amendment Nos. 59 and

79, infra), (1) residential property used solely as the principal place of residence of the owner shall be

assessed in accordance with its value as a residence, (2) land (but not improvements thereon) used

primarily for agricultural, pasture, timber, residential and commercial purposes shall be assessed upon

the basis of its value for such use, and (3) all other real and tangible personal property subject to taxation

shall be assessed according to its value (the Arkansas Supreme Court has held that the unqualified word

"value," as used in a prior, substantially identical, constitutional provision, means "current market

value").

(b) Property owned by public utilities and common carriers and "used and/or held for use in the

operation of the company . . ." is assessed for tax purposes by the Tax Division of the Arkansas Public

Service Commission. A.C.A. § 26-26-1605 provides that the Tax Division "shall assess the property at

18

its true and full market or actual value" and that all utility property of a company, whether located within

or without the State of Arkansas, is to be valued as a unit. Annually, the company files a report with

the Tax Division. The Tax Division reviews these reports, along with other reports (such as reports to

shareholders, the Federal Communications Commission, the Federal Energy Regulatory Commission

and the Interstate Commerce Commission), to determine the value of the property. Valuation is

currently made on the basis of a formula, as set forth in A.C.A. § 26-26-1607, with consideration given

to (i) original cost less depreciation, replacement cost less depreciation or reconstruction cost less

depreciation; (ii) market value of capital stock and funded debt; and (iii) capitalization of income. As

provided in A.C.A. § 26-26-1611, once the value of a company’s property as a unit is determined, the

Tax Division removes the value allocable to out-of-state property and assigns the remainder among

Arkansas taxing units on the basis of value within each jurisdiction. The Tax Division certifies the

assessment to the county assessor who enters the assessment as certified on the county assessment roll.

County officials have no authority to change such assessment. See LEGAL MATTERS, Legal

Proceedings.

All other property is assessed by the elected assessor of each Arkansas county (or other official

or officials designated by law). This includes both real and tangible personal property. A.C.A. 26-26-

1902 requires each county to appraise all market value real estate normally assessed by the county

assessor at its full and fair value every four (4) years.

(c) Amendment No. 79 requires the county assessor (or other official or officials designated by

law), after each county-wide reappraisal, to compare the assessed value of each parcel of real property

reappraised or reassessed to the prior year’s assessed value. If the assessed value of the parcel increased,

then the assessed value of that parcel must be adjusted as provided below.

Subject to subsection (e) below, if the parcel is not the homestead and principal place of

residence ("homestead") of a taxpayer, then any increase in the assessed value in the first year after

reappraisal cannot be greater than 10% (or 5% if the parcel is the taxpayer’s homestead) of the assessed

value for the previous year. For each year thereafter, the assessed value shall increase by an additional

10% (or 5% if the parcel is the taxpayer’s homestead) of the assessed value for the year preceding the

first assessment resulting from reappraisal; however, the increase cannot exceed the assessed value

determined by the reappraisal prior to adjustment under Amendment No. 79.

For property owned by public utilities and common carriers, any annual increase in the assessed

value cannot exceed more than 10% of the assessed value for the previous year. The provisions of this

subsection (c) do not apply to newly discovered real property, new construction or substantial

improvements to real property.

(d) If a homestead is purchased or constructed on or after January 1, 2001 by a disabled person

or by a person over age 65, then that parcel will be assessed based on the lower of the assessed value as

of the date of purchase (or construction) or a later assessed value. If a person is disabled or is at least

65 years of age and owns a homestead on January 1, 2001, then the homestead will be assessed based

on the lower of the assessed value on January 1, 2001 or a later assessed value. When a person becomes

disabled or reaches age 65 on or after January 1, 2001, that person’s homestead should thereafter be

assessed based on the lower of the assessed value on the person’s 65th birthday, on the date the person

becomes disabled or a later assessed value. This subsection (d) does not apply to substantial

improvements to real property. For real property subject to subsection (e) below, the applicable date in

this subsection (d), in lieu of January 1, 2001, is January 1 of the year following the completion of the

adjustments to assessed value required in subsection (e).

(e) If, however, there has been no county-wide reappraisal and resulting assessed value of

property between January 1, 1986, and December 31, 2000, then real property in that county is adjusted

differently. In that case, the assessor (or other official or officials designated by law) compares the

assessed value of each parcel to the assessed value of the parcel for the previous year. If the assessed

19

value of the parcel increases, then the assessed value of the parcel for the year in which the parcel is

reappraised or reassessed is adjusted by adding one-third (l/3) of the increase to the assessed value for

the year prior to appraisal or reassessment. An additional one-third (1/3) of the increase is added in each

of the next two (2) years.

The adjustment contemplated by subsection (e) does not apply to the property of public utilities

or common carriers. No adjustment will be made for newly discovered real property, new construction

or substantial improvements to real property.

(f) Property is currently assessed in an amount equal to 20% of its value. The percentage can

be increased or decreased by the General Assembly.

The total of the millage levied by each taxing entity (municipalities, counties, school districts

and community college districts) in which the property is located is applied against the assessed value

to determine the tax owed. The assessed value of taxable property is revised each year and the total

millage levied in that calendar year is applied against the assessed value for the calendar year. Assessed

value for each year is determined as of January 1 of that year. Tangible personal property, including

automobiles, initially acquired after January 1 and before June 1 is required to be assessed in the year

of acquisition. Otherwise, only property owned by a taxpayer on January 1 is assessed for that calendar

year.

The total taxes levied by all taxing authorities are collected together by the county collector of

the county in which the property is located in the calendar year immediately following the year in which

levied. Taxes are due and payable between the first business day in March and October 15, inclusive.

Taxes not paid by October 15 are delinquent and subject to a 10% penalty. Real estate as to which taxes

are delinquent for two successive years is certified to the State Land Commissioner, who offers the

property for sale. The proceeds of such sale are distributed among the taxing authorities. Delinquent

real property may be redeemed by the taxpayer within two years of the delinquency. Delinquent

personal property taxes may be collected by distraint and public sale of the taxpayer’s property.

Constitutional Amendment Affecting Personal Property Taxes. At the 1992 general election, a

Constitutional amendment was approved which exempts from all personal property taxes items of

household furniture and furnishings, clothing, appliances and other personal property used within the