National Aeronautics and

Space

Administration

NASA Shared Services Center

Stennis Space Center, MS

39529-6000

www.nssc.nasa.gov

NASA Shared Services Center Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Effective Date: February 11, 2021

Expiration Date: February 11, 2022

TRAVEL CARD AGENCY PROGRAM

COORDINATOR (APC) ROLES AND

RESPONSIBILITIES

Responsible Office: Accounting and Travel Services Branch

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 2 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Approved by

________________________________

Alison Butsch

Chief, Financial Management Services Division, Acting

_________________________

Date

ALISON

BUTSCH

Digitally signed by

ALISON BUTSCH

Date: 2022.02.11

11:27:40 -06'00'

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 3 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

DOCUMENT HISTORY LOG

Status

(Basic/Revision

Cancelled)

Document

Version

Effective

Date

Description of Change

Basic 1.0 05/03/2011 Basic Release

Revision

2.0

07/31/2012

Center Agency Program Updates

Revision 3.0 06/15/2014

Document originated under NSWI-

9710-0001 and was renumbered

on 06/13/2014 to align with the

NSSC Document Management

Program Procedural Instruction

(NSNPI-1410-0001).

Updated Annual Use Review

process to reflect Semi-Annual

Use Review Process (p. 24-25);

Appendix C Updated from

PaymentNet to IntelliLink (p.71);

Appendix D – Create Reports in

CGE deleted

Revision 4.0 11/01/2014

Updated Chapter 4 PROGRAM

MONITORING REPORTS to show

transfer of roles to Service

Providers in accordance with the

CSC Change Order 76; to update

references to FedTraveler.com to

Concur Government Edition

(CGE).

Revision

5.0

08/01/2015

Added Appendix G to include the

link to NSPWI-9000-0002 (Process

for the External Audit

Documentation Pull and Request

for Extension).

Updating formatting to new

template and created a separate

Service Provider Support section.

Revision 6.0 12/16/2015

Update due to new work

management system and to add

DRD information

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 4 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Revision 7.0 1/5/2017

Added NPD 5104.1 Government

Charge Card to Authority

Revision 8.0 04/7/2017

Update to add overall APC roles

and Responsibilities to include

preparation of the OMB quarterly

and the Agency Delinquency

Report; remove FMOP; update

Frequent Traveler review; remove

processes specific to NSSC only

Revision 9.0 04/12/2018

Updated the procedures for salary

offset and setting credit limits

Remove Annual Use Review

(Infrequent & Frequent Travelers

Review) and moved to Center APC

Work Instructions (NSPWI 9710-

0001)

Revision 10.0 12/21/2018

Updated to include U.S. Bank

instructions

Revision 11.0 06/28/2019

Updated to remove all JP Morgan

Chase processes and procedures

Revision

12.0

11/22/2019

Update to due date of monthly

delinquency reports to Travel Lead

APC

Revision

13.0

4/22/2020

Added notes to monthly assurance

review process, updated salary

offset procedures to include DOI

POC; added verbiage for misuse

and abuse, and the travel card

usage review (Appendix G)

Revision 14.0 02/24/2021

Added steps and requirements to

salary offset appeal process

Revision 15.0 02/11/2022

Added standards/guidelines for

delinquencies on SATERN travel

card training

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 5 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

TABLE OF CONTENTS

1.0 Introduction ........................................................................................................ 7

2.0 Objective ............................................................................................................ 7

3.0 Scope ................................................................................................................. 7

4.0 Authority ............................................................................................................. 7

HOW TO APPLY FOR A NEW TRAVEL CARD ACCOUNT .......................................... 8

HOW TO REGISTER IN US BANK’S ACCESS ONLINE ............................................... 9

TRANSFERRING AND SEPERATING EMPLOYEES ................................................. 10

Transferring Employees ............................................................................................ 10

Separating Employees .............................................................................................. 12

MONITOR FOR TRAINING, DELINQUENCY AND NEED FOR CARD ....................... 14

Monitoring of SATERN Training ................................................................................ 14

Monitor for Delinquency Monthly .............................................................................. 15

PROGRAM MONITORING REPORTS ........................................................................ 16

U.S. Bank Program Monitoring Reports (U.S. Bank Access Online) ......................... 17

Concur Government Edition (CGE) Report ............................................................... 22

Monthly Overall Agency Program Coordinator Review ............................................. 24

Monthly APC Delinquency Report ......................................................................... 24

Agency Quarterly APC Travel and Fleet Card OMB Report (NSSC Lead APC) ...... 41

APPENDIX A – How to Create Reports ........................................................................ 50

APPENDIX B – Sample E-mail Notifications ................................................................ 68

Sample Reminder Notification of 30-day past due to employee ................................ 68

Sample 61-day Suspended Delinquency Notice* ..................................................... 70

Sample Validation of Travel Card Charge ................................................................. 71

APPENDIX C – Acronyms............................................................................................ 72

APPENDIX D –Travel Charge Card Chart ................................................................... 73

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 6 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

APPENDIX E – Monthly Travel Card Assurance Review ............................................. 78

APPENDIX F – Procedures for Salary Offset ............................................................... 81

Salary Offset References .......................................................................................... 81

Purpose .................................................................................................................... 81

Salary Offset ............................................................................................................. 81

Salary Offset Process ............................................................................................... 81

Attachment A: Sample Due Process e-mail Notice for Salary Offset Procedures ..... 84

Attachment C: Summary of Process Time Line ........................................................ 90

APPENDIX G – Quarterly Travel Card Usage Report (Center Action) ......................... 91

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 7 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

1.0 Introduction

In relation to the NASA Travel Charge Card Program, the NASA Office of the Chief

Financial Officer (OCFO) develops and implements travel card policy, regulations, and

procedures. The NASA Shared Services Center (NSSC) Lead Agency Program

Coordinator (APC) performs program oversight and internal control reviews. Center

Agency Program Coordinators (CAPCs) issue charge cards, monitor Center charge

card activity, and handle Center charge card issues. Links to referenced authority

documents for detailed roles and responsibilities are located on the NSSC Customer

Service Web site.

2.0 Objective

The objective is to identify reports for the Center APCs to run as a part of the

management of their Center Travel Charge Card Programs. These reports will provide

information to Center Managers and Supervisors of employees with delinquent

balances or inappropriate transactions and allow CAPCs to verify compliance with

Center, Agency, and Federal policies and procedures.

3.0 Scope

The scope includes reports that should be run for all Center travel charge card activity.

4.0 Authority

• NASA Travel Charge Card Management Plan

• Office of Management and Budget (OMB) Circular A-123 Appendix B.

Improving the Management of Government Charge Card Program

• 41 Code of Federal Regulations (CFR), Federal Travel Regulations

(FTR), Chapters 300-304

• NASA Policy Directive (NPD) 1200.1E, NASA Internal Control

• NPD 5104.1 Government Charge Cards

• NPR 9730.1 Travel Cards

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 8 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

HOW TO APPLY FOR A NEW TRAVEL CARD ACCOUNT

When you are notified of a new hire (civil servant) at your Center and determine that

he/she needs a travel card, the Center Agency Program Coordinator (CAPC) needs to

reach out to the NSSC SATERN team so they can add the new Agency travel card

curriculum to his/her SATERN profile. In order to do that, please send an email to nssc-

[email protected] and enter the following in the subject line: SATERN Request

– Add Agency Travel Card Curriculum for New Employee. In the body of the email,

please use this as a template:

SATERN Course needed to be added to profile: AG-CD-TRAVELCARD

New Employee Name: John Doe (example)

NASA Center: Marshall (example)

NSSC Contact Center,

Please assign a ServiceNow case, include the information above and assign as follows:

Category: HRIS-SATERN SYSTEM ADMIN

Subcategory: ADD COURSE

Assignment Group: HR-HRIS L2

Prior to initiating a travel card application with US Bank, the employee must provide

proof of training completion in SATERN to the CAPC either hard or soft copy.

Note:In accordance with OMB Circular A-123 Appendix B, all Government Charge card

travelers are required to take training prior to being issued a government charge card

and, at a minimum, refresher training every 3 years thereafter. Standard agency-wide

training is available via SATERN. The training lasts about 1/2 hour and includes self-

assessments. The entire course must be completed in order to receive a Government

Charge card.

There are (2) ways to apply for a US Bank SP3 travel card: cardholder initiated and

Agency Program Coordinator (APC) initiated. This decision of who starts the process

(employee/cardholder or APC) may differ by Center. The instructions for each process

are listed below.

Click on the following for CARDHOLDER INITIATED APPLICATION PROCESS

Click on the following for APC INITIATED APPLICATION PROCESS

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 9 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NOTE: Please be aware that NASA is utilizing the “Without Workflow” option for the

APC initiated application process. This removes the requirement to direct the process

to the supervisor and creates a more efficient and more expedited process.

US Bank maintains two addresses for the cardholder – the account address and the

legal address. The cardholder account address can be an address with a PO Box; the

legal address should be a physical address on the account (not a PO Box).

Additionally, if the card needs to be expedited OR if the card needs to be delivered to an

address that is different from the normal mailing address, the Center APC will need to

call US Bank customer service number. If a card does need to be expedited, a physical

address is required as well (no PO Box).

HOW TO REGISTER IN US BANK’S ACCESS ONLINE

Once an employee has received their new US Bank SP3 travel card, they should follow

the instructions for activating found on the sticker on the front of the card by calling 1-

888-994-6722. Additionally, the employee needs to register in US Bank’s financial

transaction system, Access Online at the earliest convenience. Access Online will allow

cardholders to view/modify their account information, pull up transaction information

associated with government travel, pull up statements, file a dispute, etc. Follow the

instructions in the link below to register in Access Online.

Additionally, Access Online will be the tool that APCs use to manage account profiles,

view transactional and delinquency activity for their Center and access statements.

Access Online website: https://www.access.usbank.com

Click on the following link on how to > Register in Access Online

NOTE: In Access Online, the Organization Short Name is NASA

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 10 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

TRANSFERRING AND SEPERATING EMPLOYEES

Transferring Employees

NOTE: When an employee transfer is needed, the Center APC (from the departing

Center) should validate the NASA employee is transferring to another Center and

inform the NASA employee that he/she is to keep their travel card and that you will be

updating their profile to reflect their new Center.

Then, email the Lead APC team (TravelCard_LeadAPCs@nasa.onmicrosoft.com), the

NSSC Contact Center (nssc-contactcenter@nasa.gov) and include the employee’s full

name as it appears in Access Online, the Center that the employee needs to be

transferred to, any outstanding (current) balance on the account and include the Center

APCs for the gaining Center in the email for their awareness and approval.

(Lead APC steps)

1. Log into Access Online.

2. Select Account Administration on the Home Page

3. Select Maintain Cardholder Account

4. Find the applicable cardholder/NASA employee who is transferring (i.e. search

by last name) and then go to the Account Profile

5. Click on the pencil icon to edit the Processing Hierarchy for that cardholder

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 11 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

6. The “Bank” field should show as “8201” and the “Agent” field should show as

“0034”. The “Company” field needs to be changed to reflect where the

cardholder is being reassigned to:

NASA AFRC – 26524 NASA LARC - 26523

NASA ARC – 26521 NASA MSFC - 26562

NASA GRC – 26522 NASA NSSC - 26511

NASA GSFC – 26551 NASA SSC - 26564

NASA HQ – 26510

NASA JSC – 26572

NASA KSC – 26576

7. Press confirm after you have populated the correct applicable Center.

8. Press next

9. Review all cardholder information and if correct, click submit. If there are no

errors, there will be a confirmation screen appear with a green check

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 12 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Separating Employees

Any employee that leaves in a manner (other than termination) should follow the steps

listed below:

1. Collect Individually Billed Account (IBA) travel card and destroy/shred

2. Validate NASA employee is separating from NASA and has no outstanding

balances. If there is a remaining/outstanding balance:

a. Remind the cardholder that he/she is still responsible for the payment

b. Look in CGE to see if there are any outstanding vouchers for the

cardholder; if so, they should be structured to ensure the travel card

balance is paid off (or as much as possible).

c. Email the US Bank Account Coordinator team and let them know the

cardholder in question (provide name and Account ID) has left NASA and

to please pursue normal collection efforts per US Bank’s policy

d. Include the Lead APC and backups for both awareness and to include on

list maintained that will exclude this cardholder from future delinquency

reports

3. Log into Access Online

4. Select Account Administration on the Home Page

5. Select Maintain Cardholder Account

6. Find the applicable cardholder/NASA employee who is transferring (i.e. search by

last name) and then go to the Account Profile

7. Under the section “Account Overview”, click on the pencil icon next to “Open” by

Account Status

8. Click on “Show Optional Settings”

9. Click on the dropdown box under “New” and change from “Open” to either:

V9 – Voluntarily Closed (anything other than termination) or

T9 – Terminated

10. Select today’s date as the Start Date and ensure the “Don’t End” radial button is

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 13 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

selected.

11. Scroll down to the bottom of the page and select Next

12. Confirm changes are correct and click Submit

13. If there are no errors, there will be a confirmation screen appear with a green

check

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 14 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

MONITOR FOR TRAINING, DELINQUENCY AND NEED FOR CARD

Monitoring of SATERN Training

During 2021, the Lead APC had confirmed that all Centers either have the ability to

obtain their own SATERN reports from their SATERN Administrator Lead (SAL) or

have worked with the NSSC SATERN team to have reports scheduled and

automatically sent via email to the designated POCs at the Center.

In addition, the Lead APCs receive a scheduled report from the NSSC SATERN

team on a biweekly basis for all active Civil Servants.

Center APCs are to perform the following upon receipt of the report:

1. The CAPC will identify the cardholders and travel approvers who are past due

and coming due within the next 30 and 60 days.

2. All Centers, upon learning that any of their cardholders are delinquent for their

SATERN card training the Center IBA APC should:

• Email the cardholder to let them know that their training is delinquent

and that the traveler will be unable to use their travel card until he/she

provides evidence of completion to the Center APC team (unless the

cardholder is currently on travel or scheduled to go on travel within 10

days).

• Either go into the cardholder account within US Bank’s Access Online

and set the account status of the individual to V9 – Voluntarily Closed

and Select “No End Date” (if the cardholder is not on or scheduled to

travel within 10 days) or remove the cardholder’s credit card information

from their traveler profile in CGE (assuming there is no outstanding

authorizations or vouchers or currently on travel) or go into the

cardholder’s account and set the credit limit to $1.00

3. If a week has gone by since the first notification to the cardholder has gone

without any action, a follow up email to the cardholder should be sent. This

second email should include the supervisor. Centers should do this at a

minimum – if Centers wish to continue to elevate weekly emails to include

higher supervision (i.e. Branch and/or Division Chiefs, HR, etc.) on their emails,

that would be up to the individual Center. These emails should continue weekly

until the cardholder can provide evidence of completion.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 15 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Centers can establish additional disciplinary action for extended delinquencies

as they deem appropriate.

4. If the cardholder is currently on or scheduled for an upcoming official travel

assignment, action on the card should take place upon 10 days of returning from

the travel

5. Verify completion certificate.

6. Notify the Center HR SAL or the NSSC SATERN team of any employee that

no longer needs a card and request the HR SAL remove the training from

their learning plan. The CAPC should close the travel card account

immediately..

7. Record the entry on the quarterly section (Mandatory Training Verificiation –

Cardholders) of the Monthly Assurance Report submitted to the Agency Lead

APC (Refer to Appendix E).

Monitor for Delinquency Monthly

Summary - Delinquent Travel Card Account Process

U.S. Bank Access Online Delinquency Reports

Report

Name

Frequency When to run Source System

Action required by

Past due Report Monthly

11th of the month

month month

U.S. Bank Access Online CAPC

1. 61 Days Delinquent

a. Run the Past due Report that will show the Delinquencies with Current

Balance monthly on the 11th.

b. Identify suspended accounts.

c. Notify traveler of account suspension and suggest that the traveler

process a payment as soon as possible in order for the bank to un-

suspend the account. Include (CC) the supervisor in the email

notification to the delinquent traveler.

d. If the delinquent account exceeds 91 days, notify the cardholder again,

CC the supervisor to discuss getting delinquent amount resolved and the

upcoming risk of salary offset at the 126 day mark. CC the Center HR

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 16 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

and the Lead APC (and backups).

e. Results of delinquency accounts should be submitted to the Lead APC

by the 1st of each month using Appendix E Monthly Travel Card

Assurance Review.

PROGRAM MONITORING REPORTS

NPR 9730.1 (Section 5.4) states that NASA is obligated under OMB Circular A-123,

Appendix B, to initiate administrative and/or disciplinary actions against cardholders

who (a) fail to meet their responsibilities with respect to appropriate use and timely

payment of the charge card or (b) who engage in charge card misuse.

OMB defines misuse and abuse as referenced below:

Misuse: Unintentional use of the purchase, travel, fleet and/or integrated charge card

in violation of the FAR, DFARs, FTR, Agency Supplements, or Agency

Policies/Procedures. These actions are the result of ignorance and/or carelessness,

lacking intent, to include honest mistakes

Abuse: Intentional use of the purchase, travel, fleet and/or integrated charge card in

violation of the FAR, DF ARS, Agency Supplements, or activity Government Purchase

Card (GPC) policies/procedures. Evidence of intentionality shall be inferred from repeat

offenses of the same violation, following administrative and/or disciplinary action taken

for this violation

Conduct monthly monitoring of travel card transactions and balances to identify

delinquencies and incidents of potential misuse or abuse.

NOTE: To ensure adherence with current policy, administrative and/or disciplinary

action for misuse can be an email or phone call to the individual if it is determined that

the misuse was accidental in nature.

CAPCs should coordinate with supervisors to notify employees of any questionable or

inappropriate charges and/or delinquencies. When requests for clarification are sent to

cardholders, the CAPC should provide the cardholder with one week to respond before

notifying the cardholder’s supervisor.

Abuse/misuse has occurred if transactions were attempted or posted that are contrary

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 17 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

to/do not comply with rules, regulations and guidelines. All reports and subsequent

correspondence, including e-mails and documentation of phone calls, should be

retained by the Center APC for six years.

U.S. Bank Program Monitoring Reports (U.S. Bank Access Online)

Report Name Frequency When to Run Source System

Action Required

by

Financial Management:

Transaction Detail Report -Local

Use

Monthly 11th of the month U.S. Bank Access Online Center APC

Transaction Detail Summary

Report

Monthly 11th of the month U.S. Bank Access Online Center APC

Accounts List Report (sorted by

expiration date)

Monthly 11th of the month U.S. Bank Access Online Center APC

Program Management Report (

Run by closed Status)

Monthly 11th of the month U.S. Bank Access Online Center APC

Cash Advance Report Monthly 11th of the month U.S. Bank Access Online Center APC

Declined Transactions

Authorizations Report

Monthly 11th of the month U.S. Bank Access Online Center APC

Past Due Report- Delinquencies

with Current Balance

Monthly 11th of the month U.S. Bank Access Online Center APC

Full Transaction and Order Detail

Report

Monthly 11th of the month U.S. Bank Access Online Center APC

Past due Report – U.S. Bank

(Note: Reference Section titled U.S. Bank Past due report.) - This report lets you

quickly identify problem accounts and review program policy adherence rates.

You can leverage this information to manage policy guidelines. The report lists:

Name, Account Number, Current Balance, Last Payment Amount, Last Payment Date,

Status Description, Total Past Due, 30 Days amount due, Times Past Due 1–30, 60

Days amount due, Times Past Due 31–60 Days, 90 Days amount past due, Times Past

Due 61–90, 120 Days amount due, Times Past Due 91–120 Days, 150 Days amount

due, Times Past Due 121-150 Days, 180 Days amount due, Times Past Due 151-180

Days, Charge Off Status, Charge Off Description, Charge Off Date, Default Accounting

Code.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 18 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

U.S. Bank

Account List Report (sorted by expiration date)- Accounts Renewing Within Three

Months - U.S. Bank

The Account List Report will provide a comprehensive list of all accounts. The report will

show Name, Open Date, Activated, Last Transaction Date, Last Maintenance Date,

Expiration Date, Single Purchase Limit, Credit Limit, Last Limit Change Date, Cash

Percentage, Status Code, Status Description, Plastic, Account Number,

1. This report can be run to monitor the activation of new cards.

2. Review the report to identify the issuance of new cards awaiting

activation.

3. An e-mail will be sent to the cardholder to notify him/her of the new card

issuance.

U.S. Bank Process

Financial Management: Transaction Detail - Account Activity with Hierarchies – Local

Use (include account details)

(100% Review) - Transaction Detail Summary Report (include account details) shows

transactional information for all transaction types with the information such as: Post

Date, Transaction Date, Purchase ID, Merchant Name, Merchant TIN Number,

Transaction ID, and Transaction Status. The report shall be optimized for Excel.

1. This report can be run to show transactional activity for the state and/or

surrounding areas where the Center employees live. For example, for Stennis it

may be appropriate to run reports for both Mississippi and Louisiana. This report

may show charges for baggage or airport parking which are valid local charges.

However, it will also pick up any local purchases that may not be authorized.

2. The CAPC will review the report and identify transactions that occurred that have

no associated travel authorization, or were not in compliance with rules and

regulations.

3. Make sure your profile in U.S. Bank Access Online is set to mask account

numbers and not output the full account number for the employees.

4. If the employee has a difference in how their name is entered in the two systems

(Concur Government Edition (CGE) and bank system), the database will be

unable to match a travel Authorization (TA) to their transaction.

5. Also, if a transaction occurred more than one day before the approved travel date

or any time after the approved travel date, the database will be unable to match a

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 19 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

TA to the transaction (i.e., an employee takes out a cash advance three days

prior to the first day of travel).

6. An e-mail will be sent to the cardholder to obtain clarification of the charge. If

abuse/misuse is suspected, send an e-mail to the cardholder and supervisor

stating the government charge card may have been used inappropriately. See

Appendix B for a sample e-mail. Disciplinary action may be taken based upon

HR/supervisor discussions.

Transaction Detail Summary

Review for accuracy, validated User ID, etc. - The Transaction Detail Summary report

shows the card and account hierarchies for all individuals. The report displays all

employees – both cardholders and non-cardholders. It groups by User ID and displays

the individuals' names and roles, as well as card account numbers where appropriate.

Please note that if the report is run using Hierarchy ID as a criterion, that criterion will

apply to the employee and not the accounts that belong to the employee. However,

the user should not be allowed to enter a criteria or view employees/accounts outside

his/her scope of view.

Program Management - Cardholder Status with Hierarchy and Closed Date (100%

Review)

The Program Management - Cardholder Status with Hierarchy and Closed Date report

can be used to identify account limits and account statuses. The report, which is sub-

totaled by Account Status, lists the following: Account Name, Hierarchy, Account

Number, Open Date, Credit Limit, Individual Cycle Amount Limit, Individual Monthly

Amount Limit, Individual Other Amount Limit, Individual Single Amount Limit, Available

Limit, Status, and Closed Date.

1. The Center APCs will monitor this report monthly to ensure the accounts of

employees who transferred to another Center or separated from NASA show

up as closed or were successfully transferred and verify cardholders’

activation of new charge cards.

2. Send a follow up e-mail to gov.service@usbank.com the transferred

employee is not on the report.

3. E-mail cardholders whose card has been suspended or closed because of

suspicious activity to make sure they are aware of the status, and then assist

in reissuing a new charge card, if applicable.

4. E-mail cardholders of new charge cards to inform the employee to activate the

card with 60 days of receipt. If the cardholder has not activated the card within

60 days, send a reminder e-mail to the employee and supervisor that the card

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 20 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

will be closed in 30 days if not activated.

Program Management: Cash Advance Report (100% Review)

The Cash Advance report can be used to identify account limits and account statuses.

The report, which is sub-totaled by Account Status, lists the following: Account Name,

Account Number, Open Date, Credit Limit, Individual Cycle Amount Limit, Individual

Monthly Amount Limit, Individual Other Amount Limit, Individual Single Amount Limit,

Available Limit, and Status.

1. This report is used to monitor Automated Teller Machine (ATM) activity and

compare it to the CGE Valid Travel Authorization Report to validate cash

advances obtained were in conjunction with an approved TA. Run the report

on the 11

th

of the month as part of the monthly monitoring.

2. Compare dates of cash advances to make sure they are within three

calendar days before official travel begins, and not after the official travel

ends when compared to the approved travel authorization.

3. The results of cash advance monitoring will be reported to the Lead APC with

the other monitoring results by the first of the month following the cycle end.

4. Make sure your profile in U.S. Bank Access Online is set to mask account

numbers and not output the full account number for the employees.

5. If there is a difference in how the employee’s name is entered in the two

systems (CGE and bank system), the database will be unable to match a TA

to their transaction.

6. Also, if a transaction occurred more than one day before the approved travel

date, or any time after the approved travel date, the database will be unable to

match a TA to the transaction (i.e., an employee takes out a cash advance

three days prior to first day of travel).

Program Management: Declined Transaction Authorizations Report (100%

Review)

The Declined Transaction Authorization report can be used to monitor the occurrences

and reasons why cardholders have been declined. The report lists: Decline Code and

Reason, Account Name, Account Number, Amount, MCC, MCC Description, Merchant

Name, Merchant City, Merchant State/Province, Merchant Country, Date and Time of

Decline.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 21 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

1. This report will be used to review all declined transactions for the period and

compare it to the CGE Approved Travel Plan Report to validate the

transactions are related to an approved travel authorization. Run the report

on the 11

th

of the month as part of the monthly monitoring.

2. Send an e-mail to any employee who has declines for unauthorized purchases

or for transactions that occurred without a valid travel authorization. The e-mail

should be sent to obtain clarification on the attempted charges.

3. If abuse/misuse is suspected, send an e-mail to the cardholder and supervisor

stating the government charge card may have been used inappropriately. See

Appendix B for a sample e-mail. Disciplinary action may be taken based upon

HR/supervisor discussions.

4. The results of declines monitoring will be reported to the Lead APC with the

other monitoring results by the first of the month following the cycle end.

Financial Management: Full Transaction Detail Report (Statistical Sample)

The Financial Management - Full Transaction Detail report summarizes the number of

transactions and total dollar amount for each account and Hierarchy level.

Transactions as well as line items are included and payments are excluded from this

report. Subtotals are provided for each Hierarchy, as well as Grand Totals for the

entire report. The report lists: Transaction ID, Tran Date, Post Date, Purchase Method,

Merchant, City, State, MCC, Debit Amount, Credit Amount, Tax and Transaction Type.

1. Utilize this report for statistical sampling.

2. This report will be used to validate the transactions charged by cardholders

are appropriate and comply with regulations. For example, if the employee

had an approved TA, but put a haircut on his/her travel charge card while on

travel, the charge would not be appropriate.

3. This report will also be used to monitor activity with no associated TA, as well

as any cardholder that needs additional review. For example, a cardholder

should not be using his/her travel charge card to pay for gasoline to commute

back and forth to work if not in a travel status.

a. Statistical sampling criteria

b. Expected error rate equal to 5%

c. Confidence level equal to 95%

d. Total population equal to total IBA transactions for the month

e. E-mail the cardholder if abuse/misuse is suspected and obtain

clarification on the charge. If abuse/misuse is still suspected based on

the response, send an e-mail to the cardholder and supervisor stating

the government charge card appears to have been used

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 22 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

inappropriately. See Appendix B for a sample e-mail. Disciplinary action

may be taken based upon HR/supervisor discussions.

f. The results of abuse/misuse monitoring will be reported to the Lead

APC with the other monitoring results by the first of the month

following the cycle end.

Concur Government Edition (CGE) Report

Report Name

Frequency

When to run

Source System

Action

required by

Travel Authorization Info (CGE)

Monthly

11th of the month

CGE

CAPC

TA Info (100% Review)

This report lists the following for all authorized travel within a specific time period:

Employee’s Name, TA Number, Amendment Number, Destination, Purpose, Trip

Departure Date, Trip Return Date, # of Days, Amount, Travel Arranger, and Current

Status.

1. This report is used to monitor travel card activity by validating that travel card

transactions were in conjunction with an approved TA. Run the report on the

11

th

of the month as part of the monthly monitoring.

2. Compare dates of cash advances to make sure they are within three

calendar days before official travel begins, and not after the official travel

ends when compared to the approved travel authorization.

3. This report is used to run the three Travel Card Reconciliation reports.

4. If there is a difference in how the employee’s name is entered in the two

systems (CGE and bank system), the database will be unable to match a TA

to their transaction.

5. Also, if a transaction occurred more than one day before the approved travel

date, or any time after the approved travel date, the database will be unable to

match a TA to the transaction (i.e., an employee takes out a cash advance

three days prior to first day of travel).

CGE Search/Audit Tool

This tool is an aid in the search, research and analysis of transactions for authorized

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 23 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

travel.

1. Log into CGE

2. The following are steps to utilize the document search function in CGE to

verify that a valid TA exists for a travel card transaction.

3. Click on the Profile drop down box and click on the radio button, “Book Travel

for any user (self-assign)

4. Search for traveler by last name and then click Start Session

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 24 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

5. Click the TA number of the

corresponding TA. [Hint: View the TA to retrieve travel dates. Verify that

the location the transaction occurred matches the location of the TA or

the local area.]

Monthly Overall Agency Program Coordinator Review

On a monthly basis, the NSSC APC generates charts to record the current state of

delinquencies at all Centers. The source reports and the charts are generated as

follows:

Monthly APC Delinquency Report

1. Set Access Online to run the following reports on the 11

th

of the month utilizing the

screen shots below to establish the initial reports which will then run automatically

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 25 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

each month. Keep in mind that the reports are available on the 11

th

however, if the

11

th

falls on a holiday or weekend you must wait to run your reports. If not you will

not have the correct information for that month. The below screenshots show the

parameters for the reports. In Access Online, once the parameters have been

created, an option at the bottom to schedule reports will be shown. After creating

the reports to match the screen shots, click “save” so that the report will then be

saved to run every month. If you do not hit “save” it will only run once. Save all

reports to N:\Financial Accounting Branch\Travel Card\Agency Delinquency

Reports\ US Bank Access Online Reports\Monthly Reports\new folder with date of

reports.

A. Flex Data: Delinquencies with Current Balance CBA - US Bank

1) Login to Access Online – https://www.access.usbank.com

- Enter login information

2) Click on Reporting on left side of screen

3) Click on Flex Data Reporting

4) Click on “Create a New Template” tab at the top

5) Click on the radial button next to “Account”; scroll down and click “Create”

6) Give a Report Name (i.e. Current Balance Report All Centers CBA)

7) Ensure Output Type is “Excel”

8) On the Select Report Data Tab, click on the following boxes:

a. HIERARCHY - Account Hierarchy Position – Select All

b. HIERARCHY – Reporting Hierarchy – Select the following

i. Reporting Hierarchy Bank Name

ii. Level 1 Name

iii. Level 2 Name

iv. Level 3 Name

v. Level 4 Name

vi. Level 5 Name

c. ACCOUNT – Account Name

d. ACCOUNT – Account Status

e. ACCOUNT INFORMATION – Current Balance

f. ACCOUNT SUSPENSION – Select the following

i. 120 Days

ii. 150 Days

iii. 180 Days

iv. 181+ Days

v. 30 Days

vi. 60 Days

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 26 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

vii. 90 Days

viii. Days Currently Past Due

ix. Past Due Balance

9) Scroll to the top of the screen and click on the “Filter for Content” tab

10) Ensure the “Account Type” field is selected as “Managing Account” and Account

Status is “All”

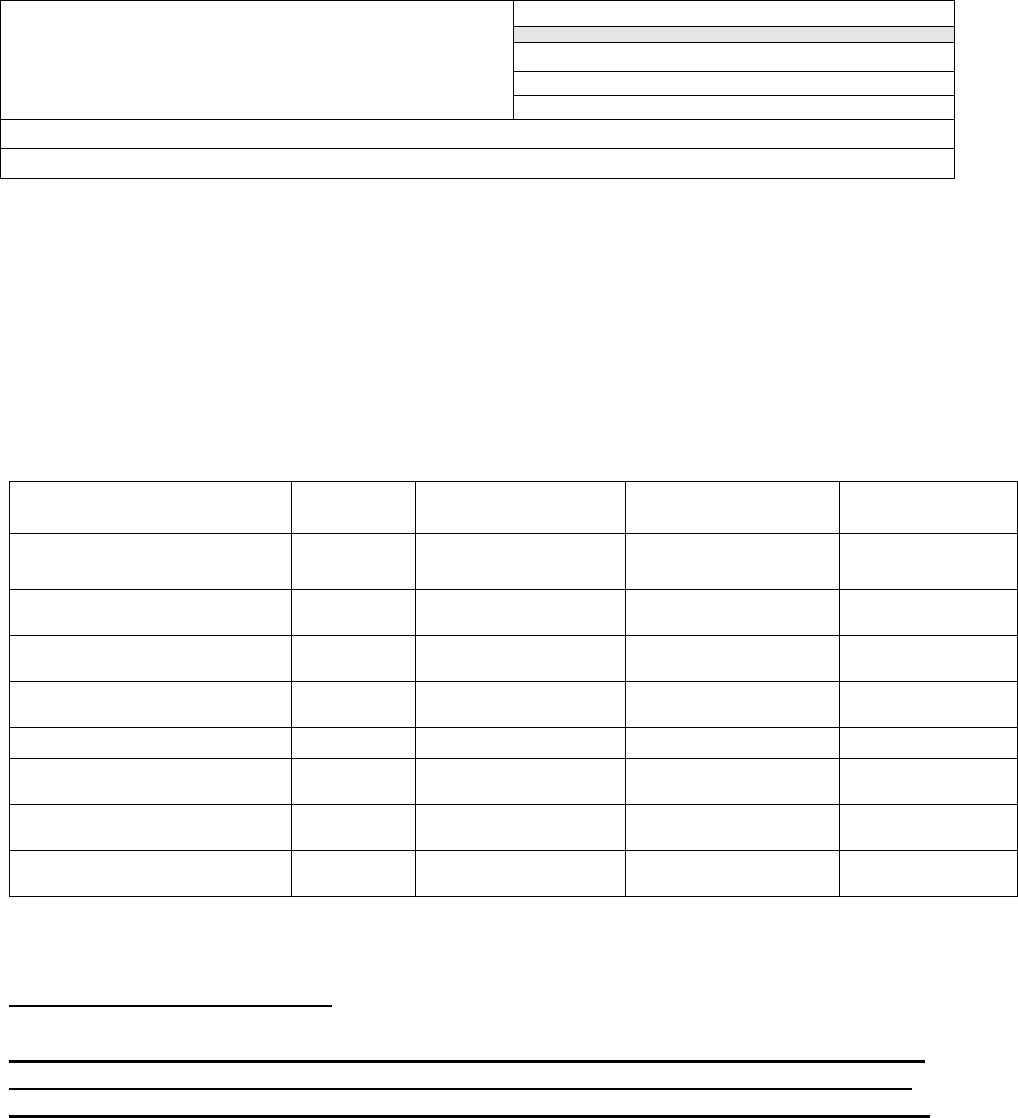

11) In the “Account Hierarchy Position” field, click on “Search for Position or Add

Multiple” (hyperlink)

12) Ensure Hierarchy Level is set to “Company”

13) Click Search

14) Scroll down to see all of the available company numbers; click on all of the

rows where the company number begins with “266”; ensure all boxes where the

company number begins with “265” are unchecked

15) Once confirmed, scroll a little to the right of the screen and click on the “Select

Position >” box

16) Scroll right to ensure that all checked boxes are now to the right of the “Select

Position >” box

17) Scroll down and click on the “Accept Hierarchy box”

18) Click on the “Set Report Layout” tab; change order of the report column to the

following (move the fields up and down by clicking and using the up/down

buttons on the right side of the screen)

a. Account Hierarchy Position

b. Account Name

c. Account Status

d. Agent Name

e. Company Name

f. Current Balance

g. Days Currently Past Due

h. Past Due Balance

i. 30 Days (Amount)

j. 60 Days (Amount)

k. 90 Days (Amount)

l. 120 Days (Amount)

m. 150 Days (Amount)

n. 180 Days (Amount)

o. 181 Days (Amount)

p. Department Name

q. Division Name

r. Last Payment Amount

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 27 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

s. Last Payment Date

t. Level 1 Name

u. Level 2 Name

v. Level 3 Name

w. Level 4 Name

x. Processing Hierarchy Bank Name

y. Reporting Hierarchy Bank Name

19) If you are setting up this report for the first time, click on the (blue) “Save

Template” button. This will allow you to save this layout to quickly run this

report in the future, instead of having to reestablish the parameters

20) Click on the (blue) “Run Report” button to run report and then save in the

applicable folder

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 28 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 29 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 30 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

B. Delinquencies with current balance IBA – U.S. Bank

1. Login to Access Online – https://www.access.usbank.com

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 31 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

- Enter login information

2. Click on Reporting on left side of screen

3. Click on Flex Data Reporting

4. Click on “Create a New Template” tab at the top

5. Click on the radial button next to “Account”; scroll down and click “Create”

6. Give a Report Name (i.e. Current Balance Report All Centers IBA)

7. Ensure Output Type is “Excel”

8. On the Select Report Data Tab, click on the following boxes:

a. HIERARCHY - Account Hierarchy Position – Select All

b. HIERARCHY – Reporting Hierarchy – Select the following

i. Reporting Hierarchy Bank Name

ii. Level 1 Name

iii. Level 2 Name

iv. Level 3 Name

v. Level 4 Name

vi. Level 5 Name

c. ACCOUNT – Account Name

d. ACCOUNT – Account Status

e. ACCOUNT INFORMATION – Current Balance

f. ACCOUNT SUSPENSION – Select the following

i. 120 Days

ii. 150 Days

iii. 180 Days

iv. 181+ Days

v. 30 Days

vi. 60 Days

vii. 90 Days

viii. Days Currently Past Due

ix. Past Due Balance

9. Scroll to the top of the screen and click on the “Filter for Content” tab

10. Ensure the “Account Type” field is selected as “Cardholder” and Account

Status is “All”

11. In the “Account Hierarchy Position” field, click on “Search for Position or

Add Multiple” (hyperlink)

12. Ensure Hierarchy Level is set to “Company”

13. Click Search

14. Scroll down to see all of the available company numbers; click on all of the

rows where the company number begins with “265”; ensure all boxes

where the company number begins with “266” are unchecked

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 32 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

15. Once confirmed, scroll a little to the right of the screen and click on the

“Select Position >” box

16. Scroll right to ensure that all checked boxes are now to the right of the

“Select Position >” box

17. Scroll down and click on the “Accept Hierarchy box”

18. Click on the “Set Report Layout” tab; change order of the report column to

the following (move the fields up and down by clicking and using the

up/down buttons on the right side of the screen)

a. Account Hierarchy Position

b. Account Name

c. Account Status

d. Agent Name

e. Company Name

f. Current Balance

g. Days Currently Past Due

h. Past Due Balance

i. 30 Days (Amount)

j. 60 Days (Amount)

k. 90 Days (Amount)

l. 120 Days (Amount)

m. 150 Days (Amount)

n. 180 Days (Amount)

o. 181+ Days (Amount)

p. Department Name

q. Division Name

r. Last Payment Amount

s. Last Payment Date

t. Level 1 Name

u. Level 2 Name

v. Level 3 Name

w. Level 4 Name

x. Processing Hierarchy Bank Name

y. Reporting Hierarchy Bank Name

19. If you are setting up this report for the first time, click on the (blue) “Save

Template” button. This will allow you to save this layout to quickly run this report

in the future, instead of having to reestablish the parameters

20. Click on the (blue) “Run Report” button to run report and then save in the

applicable folder

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 33 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 34 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 35 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 36 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 37 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

c. Delinquencies with current balance FLEET-

Log into Fleet Commander :

https://www.fleetcommanderonline.com/app/auth/userLogin.do

d. Transaction Summary by Hierarchy FLEET

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 38 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

After creating the reports, you can choose the menu item “reports”, and the submenu

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 39 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

item “download” to obtain the generated reports which will be available on the 12

th

of the

month.

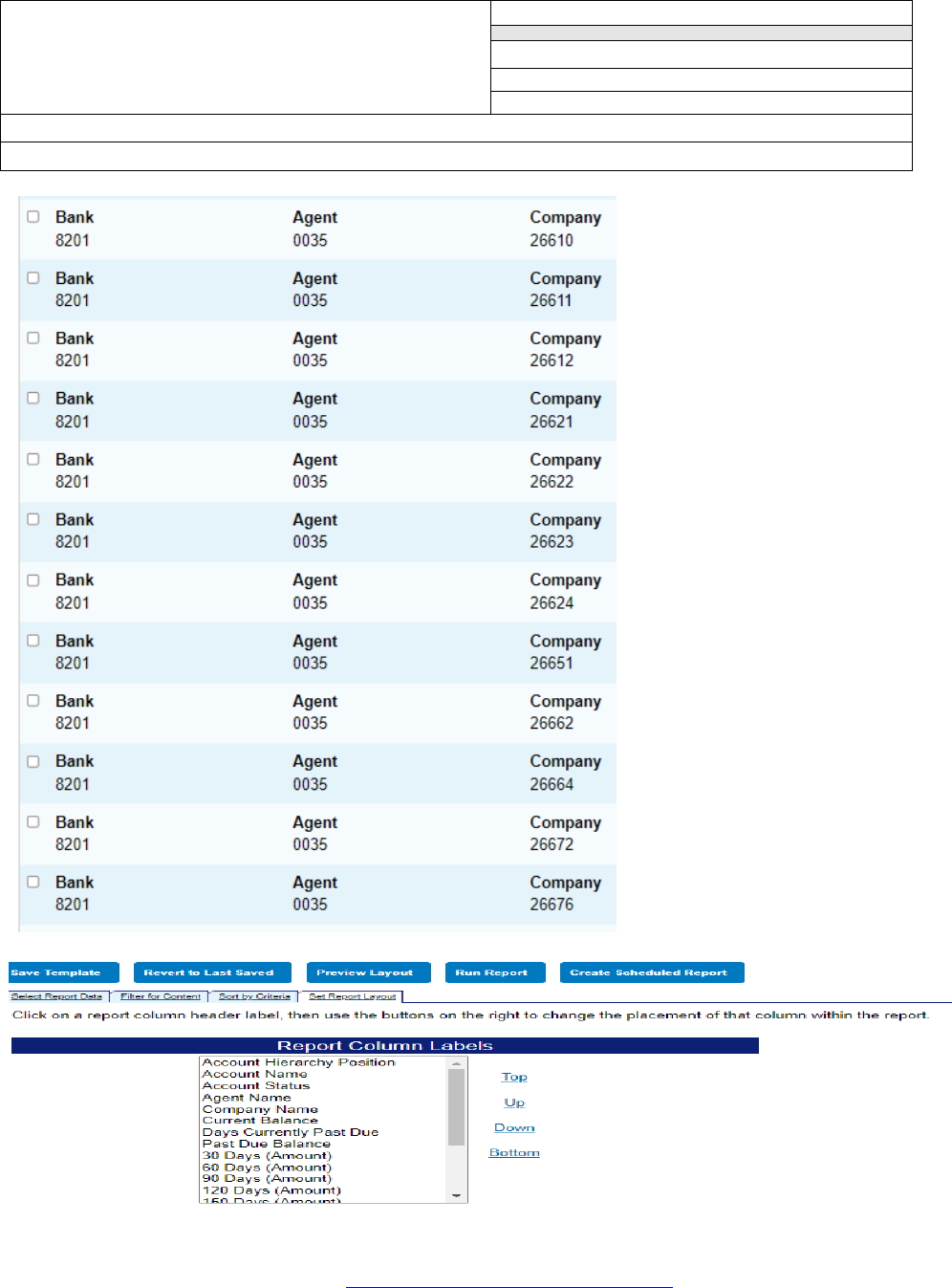

By the 12

th

of the month, the SP will use the results of those reports to fill out the

following charts. (Only fill in clear areas as there are formulas to fill out the grey areas.)

A. “Total Current Balance” amounts come from the report, “Flex Data Report –

Delinquencies with Current Balance IBA” and are identified by Center

B. All of the Past Due categories come from the report, “Delinquencies with Current

Balance IBA” and are identified by Center

1. Go to N:\Financial Accounting Branch\Travel Card\Smartpay 3\Cardholders who

left NASA with balances – IBA to pull up the document which shows the listing of

cardholders identified as having left NASA with a balance on their card

2. Identify these personnel on the Flex Data Report for IBA and delete the rows to

exclude these individuals; therefore, not penalizing the Center metrics for that

month

3. Additionally, each Center’s Total Outstanding Balance should be reduced by the

credit balance on the account

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 40 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

A. “Total Current Balance” amounts comes from the report, “Flex Data Report –

Delinquencies with Current Balance CBA” and are identified by Center

B. All of the Past Due categories come from the report, “Delinquencies with Current

Balance CBA” and are identified by Center

A. “Total Current Balance” amounts comes from the report, “Transaction Summary by

Hierarchy Fleet” and are identified by Center

B. All of the Past Due categories come from the report, “Delinquencies with Current

Balance Fleet” and are identified by Center

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 41 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NOTE: Manually add the totals for LARC and LARC Aircraft to populate the “Total

Current Balance” for LARC

Once the reports are completed, the SP will save the charts in N:\Financial Accounting

Branch\Travel Card\Agency Delinquency Reports\ US Bank Access Online Reports

\Monthly Reports and create a ServiceNow Case and assign the Task to the Lead

Travel APC and backup to let them know it is complete. The monthly delinquency

reports should be completed and provided to the Lead Travel APC within 2 business

days of when the monthly statements are available in Access Online. If any Center is

above the 2% threshold in “Percent Delinquent” column, the Lead APC will contact the

Center APC(s) and request the Center plan of corrective action within one week. The

charts, along with any statements of corrective action from the Centers, must be

emailed to HQ by the 6

th

day of the following month. A courtesy copy of the charts

without the corrective action plans is sent to all of the Center APCs.

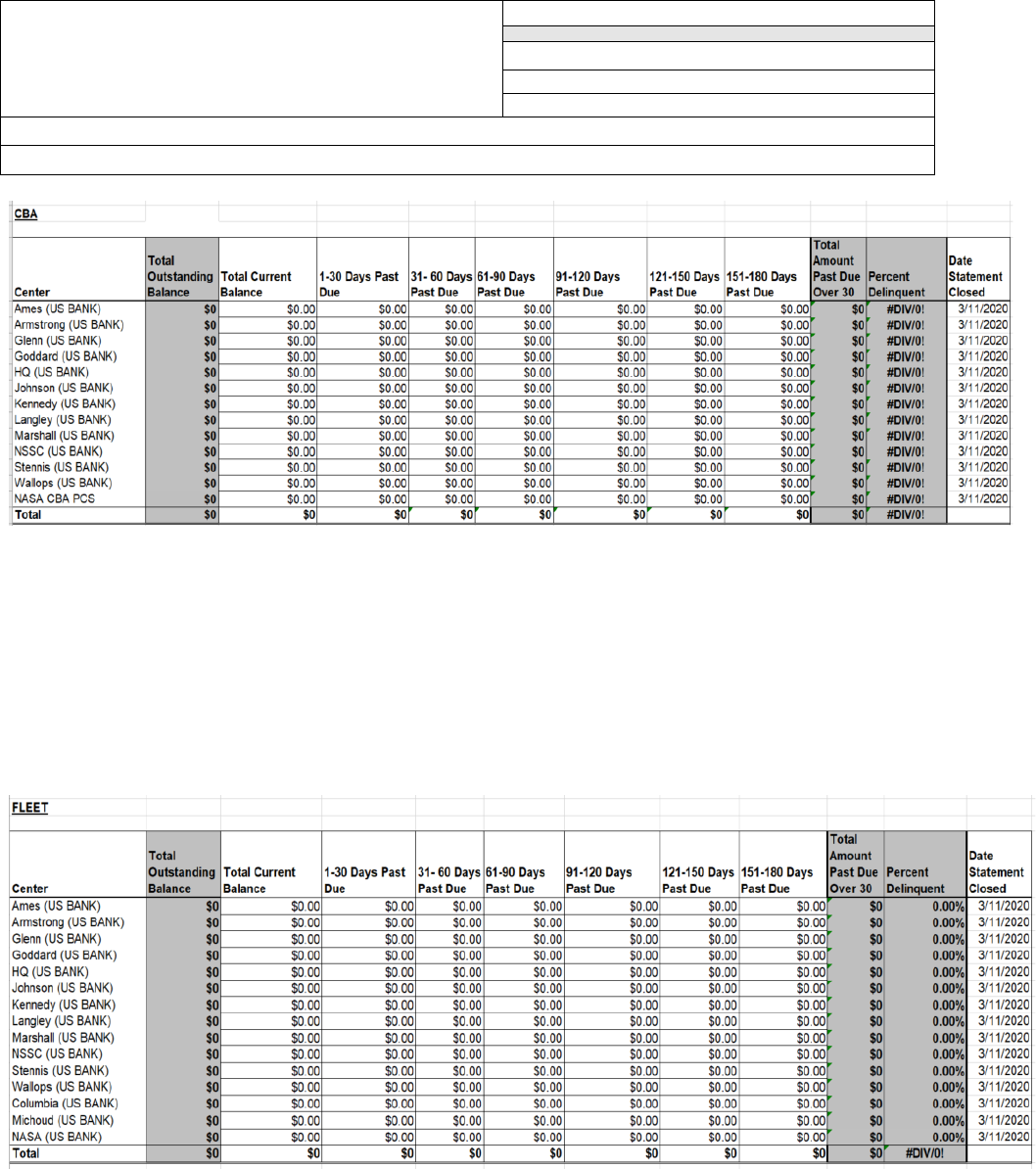

Agency Quarterly APC Travel and Fleet Card OMB Report (NSSC Lead APC)

After the 17

th

of the month following the end of a quarter, run the following reports in

order to generate the information needed for an OMB annual report. Although these

reports can and should be saved, the dates of interest field must be updated every

quarter prior to running the report in order to receive the data from the most recent

quarter. In January, the Lead APC will consolidate all of the quarterly data and work

with NSSC Procurement to submit the document in OMBMAX. Save all reports to

N:\Financial Accounting Branch\Travel Card\OMB Reports - Correspondence\FY

20XX\OMB X QTR FY 20XX

OMB Quarterly Refund –IBA and CBA –

- The NASA Travel Card AOPC should contact the US Bank Relationship Manager,

Scott Kelly (scott.kelly1@usbank.com) to obtain refund information/data.

OMB Full Transaction and Order Detail IBA- Quarter-US Bank

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 42 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 43 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

OMB Transaction Summary By Hierarchy- CBA Quarter-US Bank

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 44 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 45 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

OMB Travel – IBA & CBA Quarter (The report is initially named “OMB Travel”)-US

Bank

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 46 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 47 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

OMB Charge Off Quarter-U.S. Bank

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 48 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

1. Query personnel from the NASA IG and the APCs from each Center to determine

if any cardholders were turned over to the IG for investigation and how many

employees at each Center received administrative or disciplinary action in the last

quarter.

2. Send an email to NSSC FM Accounts Receivable to obtain the “Fedwire” reports

for the quarterly refunds received from the charge card bank. Compare these to

the amounts obtained from US Bank to ensure the totals match.

3. Utilize the NASA Workforce Information cubes online at

https://wicn.nssc.nasa.gov/wicn_cubes.html and then click on Workforce Profile

Cube to obtain the Headcount (Final total of All Employees); save print screen in

folder on N drive along with other information needed to populate spreadsheet

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 49 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

4. Utilize the reports to create a quarterly chart that includes the number of active

travel cards at NASA, the number of active accounts, the percentage of

employees that are cardholders, the net number of new accounts for NASA for

the quarter, the dollars spent in the quarter, the refunds earned in the quarter, the

percentage of potential refunds earned, the number of cases reported by the

Agency to the IG, the number of administrative and/or disciplinary actions taken in

the last quarter for card misuse, the breakout and percentage of spending limits,

the number and percentage of cardholders with ATM withdrawal limits, and the

percentage of cardholders who travel less than 5 times annually. Most of the key

information is already in the correct order and format from the report labeled OMB

IBA & CBA (Quarter) Save this report in the following folder: N:\Financial

Accounting Branch\Travel Card\OMB Reports - Correspondence\FY 20XX\OMB

X QTR FY 20XX.

5. US Bank has informed NASA that they will only be providing NASA the detailed

data needed to complete the OMB spreadsheet on an annual basis. NASA

confirmed this change with GSA. The Lead APC will still gather the Center

responses on a quarterly basis and will consolidate into the OMB spreadsheet in

January each year. The US Bank annual data will be included as well at this time.

This chart should be emailed to the Procurement personnel responsible for credit

cards who provides this information to OMB utilizing OMB MAX OCFO Policy

should be cc’d this email for their awareness as well.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 50 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

APPENDIX A – How to Create Reports

Create Access Online Reports

Report Name

Frequency

When to

run

Source

System

Action

required by

Accounts List Report (sorted by

expiration date) - Accounts Renewing

Within

Three Months

Monthly

11th of the

month

Access

Online

CAPC

Financial Management - Transaction

Detail - Account Activity with

Hierarchies

Report-Local Use - LA

Monthly

11th of the

month

Access

Online

CAPC

Financial Management Transaction

Detail - Account Activity with

Hierarchies

Report-Local Use - MS

Monthly

11th of the

month

Access

Online

CAPC

Transaction Detail Summary -Account

and Employee Hierarchy

Monthly

11th of the

month

Access

Online

CAPC

Program Management - Cardholder

Status with Hierarchy

and Closed

Date

Monthly

11th of the

month

Access

Online

CAPC

Cash Advance by Hierarchy

Monthly

11th of the

month

Access

Online

CAPC

Declined Transactions Authorizations

- Declines

Monthly

11th of the

month

Access

Online

CAPC

Flex Data - Delinquencies with

Current

Balance - NSSC

Monthly

11th of the

month

Access

Online

CAPC

Financial Management: Transaction

Detail Report

Monthly

11th of the

month

Access

Online

CAPC

1. Log into https://www.access.usbank.com.

2. In the left hand corner click on Reporting.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 51 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

3. In the Reporting list, Click on the name of the report. Click on Program Management,

then Past Due. Complete the following fields in Past Due then click run report. Similar

steps will be followed to create the remaining Access Online Reports.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 52 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Accounts List Report (formerly Accounts Renewing Within Three Months)

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 53 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 54 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

*** In Level 4 put your center number. For example NSSC will be 26511.***

Transaction Detail Summary Report -Local Use – LA

Note: This report should be created twice, Example: once for LA and a 2

nd

report for

MS. Remember to type or select MS in each area LA is listed in the screen shot below

for the MS report. Centers should select the states activity for their respective area.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 55 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 56 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Transaction Detail Summary Report

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 57 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Make sure to mark include and not exclude below.

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 58 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 59 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Program Management - Account List Report-Cardholder Status with Hierarchy

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 60 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Cash Advance Report – formerly Cash Advance by Hierarchy

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 61 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 62 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Declined Transactions Authorizations Report

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 63 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

Past Due Report- Delinquencies with Current Balance – Flex Data IBA

Steps for setting up Flex Data Report for IBA

1) Login to Access Online – https://www.access.usbank.com

a. Enter login information

2) Click on Reporting on left side of screen

3) Click on Flex Data Reporting

4) Click on “Create a New Template” tab at the top

5) Click on the radial button next to “Account”; scroll down and click “Create”

6) Give a Report Name (i.e. Current Balance Report All Centers IBA)

7) Ensure Output Type is “Excel”

8) On the Select Report Data Tab, click on the following boxes:

a. HIERARCHY - Account Hierarchy Position – Select All

b. HIERARCHY – Reporting Hierarchy – Select the following

i. Reporting Hierarchy Bank Name

ii. Level 1 Name

iii. Level 2 Name

iv. Level 3 Name

v. Level 4 Name

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 64 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

vi. Level 5 Name

c. ACCOUNT – Account Name

d. ACCOUNT – Account Status

e. ACCOUNT INFORMATION – Current Balance

f. ACCOUNT SUSPENSION – Select the following

i. 120 Days

ii. 150 Days

iii. 180 Days

iv. 30 Days

v. 60 Days

vi. 90 Days

vii. Days Currently Past Due

viii. Past Due Balance

9) Scroll to the top of the screen and click on the “Filter for Content” tab

10) Ensure the “Account Type” field is selected as “Cardholder” and Account Status

is “All”

11) In the “Account Hierarchy Position” field, click on “Search for Position or Add

Multiple” (hyperlink)

12) Ensure Hierarchy Level is set to “Company”

13) Click Search

14) Scroll down to see all of the available company numbers; click on all of the rows

where the company number begins with “265”; ensure all boxes where the

company number begins with “266” are unchecked

15) Once confirmed, scroll a little to the right of the screen and click on the “Select

Position >” box

16) Scroll right to ensure that all checked boxes are now to the right of the “Select

Position >” box

17) Scroll down and click on the “Accept Hierarchy box”

18) Click on the “Set Report Layout” tab; change order of the report column to the

following (move the fields up and down by clicking and using the up/down

buttons on the right side of the screen)

a. Account Hierarchy Position

b. Account Name

c. Account Status

d. Agent Name

e. Company Name

f. Current Balance

g. Days Currently Past Due

h. Past Due Balance

NSSC

Process Work Instruction

NSPWI-9710-0001 Revision 15.0

Number

Effective Date: February 11, 2022

Expiration Date: February 11, 2023

Page 65 of 91

Responsible Office: Financial Management Division

SUBJECT: Travel Card APC Roles and Responsibilities

i. 30 Days (Amount)

j. 60 Days (Amount)

k. 90 Days (Amount)

l. 120 Days (Amount)

m. 150 Days (Amount)

n. 180 Days (Amount)

o. Department Name

p. Division Name

q. Last Payment Amount

r. Last Payment Date

s. Level 1 Name

t. Level 2 Name

u. Level 3 Name

v. Level 4 Name

w. Processing Hierarchy Bank Name

x. Reporting Hierarchy Bank Name

19) If you are setting up this report for the first time, click on the (blue) “Save

Template” button. This will allow you to save this layout to quickly run this report

in the future, instead of having to reestablish the parameters

20) Click on the (blue) “Run Report” button to run report and then save in the

applicable folder

Past Due Report- Delinquencies with Current Balance – Flex Data CBA

Steps for setting up Flex Data Report for CBA

1) Login to Access Online – https://www.access.usbank.com

a. Enter login information

2) Click on Reporting on left side of screen

3) Click on Flex Data Reporting

4) Click on “Create a New Template” tab at the top

5) Click on the radial button next to “Account”; scroll down and click “Create”